4.9% GDP Growth in Third Quarter

Contrary to some public opinion, the economy is in decent shape.

Via the NYT: U.S. Economic Growth Accelerated in the Third Quarter.

The United States economy surged in the third quarter as a strong job market and falling inflation gave consumers the confidence to spend freely on goods and services.

Gross domestic product, the primary measure of economic output, grew at a 4.9 percent annualized rate from July through September, the Commerce Department reported Thursday. The pace exceeded forecasts and was the strongest showing since late 2021, defying predictions of a slowdown prompted by the Federal Reserve’s interest rate increases.

[…]

Although the growth rate is an initial estimate that may be revised as more data comes in, it’s a far cry from the recession that many had forecast at this time last year, before economists realized that Americans had piled up enough savings to power spending as the Fed moved to make borrowing more expensive.

[…]

But for now, the United States is outperforming other large economies, in part because of its aggressive fiscal response to the pandemic and in part because it has been more insulated from impact of the Ukraine war on energy prices.

“We’re talking about the eurozone and U.K. certainly looking like being on the cusp of recession, if not already in recession,” said Andrew Hunter, deputy U.S. economist for Capital Economics, an analysis firm. “The U.S. is still the global outlier.”

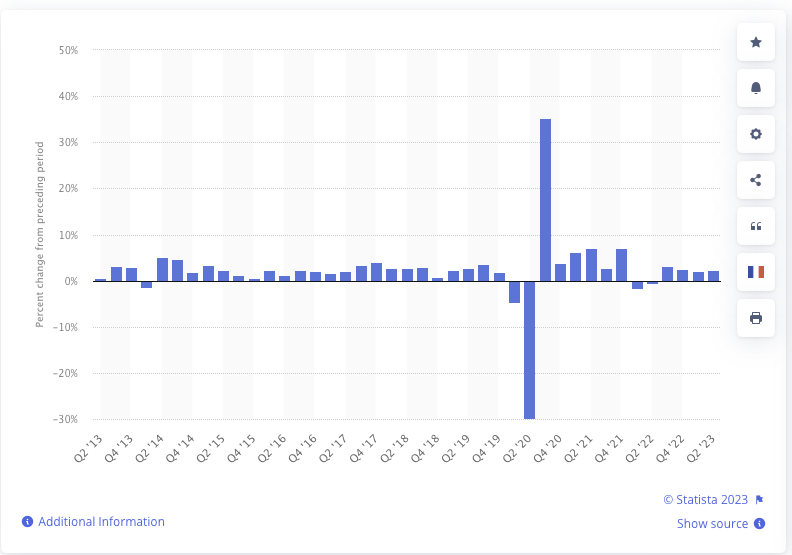

Here are recent quarters for comparison.

I never imagined a wrecked, terrible economy could look so good.

Over at the Fed Jay Powell’s gonna be pissed.

FWIW, Kevin Drum has been wondering why two branches of the Fed had such different forecasts for growth for this 3rd quarter. Since the first prediction the NY Fed has been in the 2% range while the Atlanta has been in the 5% range – and it really hasn’t changed much the whole quarter. It turns out the Atlanta branch has been right. Why was NY so far off and why didn’t they get closer as the quarter ended?

That’s the propaganda, and probably “true” as they manipulate the what they include in the calculations. But what matter is what voters perceive at the grocery store and that is Make Groceries Affordable Again. Gasoline is coming down a bit, so maybe some improvement there. MGAA.

And part of what is being seen on the spending side is Boomers moving into retirement, spending their savings. Savings which is no longer flooding the market to keep interest rates down.

I see two major issues. Debt is becoming a concern. When you have a $1.7 trillion deficit on top of $32+ trillion in debt there is an issue. Even if you take the position that debt doesn’t matter, if the bond and stock markets think it is an issue, then it becomes an issue. Second, a large part of the GDP growth is from personal spending, and that well will start to run dry. And the middle class does not see the benefits of high GDP growth. Thye feel squeezed. People need to remember that for there was a 12 month period where YOY inflation reached 9.1%. Wage growth at that point was not even 5% so people did get squeezed. When you lose 4% of spending power in one year that is serious, and it is forever.

@SenyorDave: All true. But I would rather be facing these difficulties with positive, indeed healthy, growth instead of facing those difficulties with poor or negative growth.

@Steven L. Taylor: But it’s second and third quarter per capita income in the election year that seem to matter. And everyone in Washington seems to know that. Can Biden’s luck and skill hold for another year?

@JKB: That’s your truth-finding principle? If it doesn’t fit, it must be propaganda? No curiosity about how the world might be other than how you think it is?

And the hundreds of people who work on collecting this data, and double-checking it and making sure it’s right. They are all propagandists?

It’s fair to say that what people feel when they go to the grocery store matters in politics. But it’s also the case, and I think you know this, that what you say elsewhere about the economy affects how people feel at the grocery store. And damn, but 4.9% growth is good.

@gVOR10:

I would pay good money to be allowed to shoot Powell in the crotch with one of those tennis ball throwing machines. As far as I’m concerned he’s managed to single handedly destroy the real estate market.

The vast majority of my work is in residential real estate transactions and every lawyer, mortgage broker and realtor I talk to is, to be blunt, fucked. I went from doing about 10 transactions a month to zero. Everyone who could get a 2-3% mortgage did and now that they are at 8% they aren’t moving. Probably until they die.

The mortgage banker I talked to last week doesn’t know how we’re gonna get out of this. There is a huge demand for homes/condos/dwellings but no one wants to sell. No inventory means prices go up and with high interest rates no one can afford them. Add in it’s expensive to build and the builders are not building for first time owners or lower income people, it’s a mess. Also, because of low rates lots of people have enough equity that we won’t have another foreclosure crisis to get us out (not necessarily a bad thing, I mean, bad for me, I work with REOs too). She thinks we’re in for at least another year of messed up housing markets. I hope she’s wrong.

Never said the economy is looking bad at present.

But prices didn’t come down. Rents are up 30-40% or more. That’s a monthly reminder for people who have to rent.

Housing costs have gone through the roof. Most people can see these thing. Less people know what GDP is or what the significance of it is.

All of this don’t trend well for Biden next fall. As James Carville says, its the economy stupid.

@Beth: If you come to accept the fact that God never intended for lower income people to own property, you’ll reach equilibrium faster. You won’t be happier and your business still might not improve, but it will trouble you less.

If the deniers are in denial about this growth being real, could you pass some of the delusion of it our way?

Pretty please?

Current forecasts are for UK 0.4% total growth for 2023.

🙁

@JKB:

The forecasts are for growth not for inflation.

If you are waiting on prices coming down you are either going to waiting a long time, or the US will be entering a deflationary recession.

Repeat after me: “deflationary recession is NOT a good thing.”

See 1930 to 1933.

@Steven L. Taylor: I’d rather have a government that has some idea of what to do about the housing crisis. Both Bill Jempy and Beth point out different parts.

GDP is a weird metric that only tells half the story — it means less when it’s high than when it’s low.

@Gustopher: I feel like you are both trying to pick a fight with me that I am not inviting.

I am not making an electoral argument via the post.

I understand the the problems inherent to inflation, the housing market, etc.

I understand that most people don’t understand GDP and that growth affects citizens unevenly.

None of that changes the factual nature of the post (which really is primarily reportage) nor does it change the fact that 4.9& quarterly growth is good news.

@JohnSF: Deflationary recession is not a good thing. Prices settling back to normal as supply chains get unfucked is a good thing.

I would have expected grocery and manufactured goods prices to drop a bit.

Rents are way up due to (sigh) rent seeking, and a lack of competition on price because there are a few dominant companies that are used by landlords to figure out how much their property should rent for.

Energy is it’s own thing, of course.

@Steven L. Taylor: Not trying to pick a fight, per say, but your subheading, “Contrary to some public opinion, the economy is in decent shape”, is claiming that GDP is the be all and end all of the economy.

@Bill Jempty: Is that 30-40% increase for a specific area? Here’s the rent vs. wage inflation since 2000. Nothing about the past few years is dramatic. Last year rent inflation was quite high, historically, at 4.5%, but wage inflation was also high, at nearly 6%. 2021 also saw higher wage than rent inflation.

@JKB:

Conservatives use the terms ‘propaganda’ and ‘woke’ to describe anything they don’t like. I realize that 4.9% GDP growth is depressing, but …

Admit it, if Trump was president you’d be backlighting you’re new Chairman Mao-sized poster of Fed Chair Jay Powell.

The economy is in decent shape. Not perfect, certainly, but decent. GDP growth, yes, but also nearly full employment, and the lowest inflation rate in the developed world. Against that: mortgages and rents. Still, any decent GOP presidential candidate should be able to exploit the problems and win. Too bad all the GOP has is a rapist, business fraud and traitor.

It’s the economy, stupid, but it’s also abortion and gay rights and respect for law. On the economy all Trump will be able to do is rant generalities (Only I. . .) which he’ll sandwich in between his increasingly deranged objections to the rule of law. It’ll be an IQ test as well as a moral challenge for the American voter. <— A sentence that fills me with trepidation.

@Beth: I liked where you were going until you got to “tennis ball”.

@MarkedMan: Florida rent prices have increased drastically since 2020, analysis shows

@Gustopher:

True some prices may settle back.

But a lot will not.

And it needs to be faced, that de-carbonising, securing supply chains, diverting production into infrastructure, and increasing worker returns on production IS, inevitably, going to drive prices up.

The point may be managing the overall system to change the pattern of return to maximise benefits for the general population.

In other words, market mechanisms may be a a good thing.

Market absolutism and maximized returns for the asset ownership class: not so much.

But then I’m an Old Labour type, so pretty dinosaurid.

“Our time shall come again”

🙂

@Bill Jempty: “Florida’s average rent showed a percentage increase from March 2020 to March 2023 of 45.77%, amounting to a whopping change from $1,459.73 to $2,127.86 per month.”

Wonder how much of that comes from the skyrocketing homeowners’ insurance costs.

@Bill Jempty:

Yikes, rent control for the win (although I think Kevin Drum is not a fan of cities that have enacted rent-control regulations, but maybe I am misunderstanding the point he makes when he wishes that RC was not a thing). I like KD, but I cringe if my interpretation of his anti-rent control comments is accurate, as there is no way in heck I could have stayed in my place without having to turn to roommates (multiple roommates at that) were it not for rent control. As it is, I have been very open that I graciously had help from my parents when it comes to paying my rent, as my mom certainly understands I live in a nice complex, nice city in the East Bay, and with some occasional help I will not need to move out and just up-end my life (well, my Dad was also a big proponent of helping me keep my place, he was a fan having visited a fair amount of times over the years and my hosting his visit).

I have been in my place since 2010 (so going on at least 13 years in just a few months), and I just signed another lease with a small rent increase (one of the smallest increases in all my years at my current place) that still has me paying less than the $2,127.86 per month quoted in your comment. And my place is a one bedroom that is not super large, but the bedroom I am in can easily accommodate at least a CA King size bed (I have a queen size bed).

The problem is that when I read about your rent quotes from states like FL and CO, I unfortunately get why us Liberals/Democrats have such a tall hill to climb to overcome the negativity that oftentimes floods the airwaves by GOP surrogates like Fox News. If you are a brand spanking new renter in FL and CO trying to find a half-way decent place in a low-moderate crime area, you better not only have a well paying job, but one that you are confident will not be laying you off anytime soon.

@SenyorDave: “I see two major issues. Debt is becoming a concern. When you have a $1.7 trillion deficit on top of $32+ trillion in debt there is an issue.”

In other word, a Dem is President, and suddenly deficits matter.

@Michael Reynolds: “It’ll be an IQ test as well as a moral challenge for the American voter. <— A sentence that fills me with trepidation."

Worse – it's a test of our no-so-liberal media, of just how low they can go, to ensure a horserace. My money is on 'all the way down'.

This is just an objectively true statement.

Market values were just reappraised in my county. Market value increased 8.1 percent over the past five years.

OTOH, we have given up on snowbirding to FL. After they “offered” a bargain 30% increase, we swallowed it the first year (2022) but said no thanks when they wanted another 30% for 2023. Won’t be back to FL. anytime soon.

@MarkedMan: I can only give you anecdotes, too, but when I moved back to Longview, WA from Korea (summer, 2015), I decided to share an apartment with a friend. We found one for $650 a month. Two years later, we were paying $800 a month and he decided to move to a low-income seniors apartment the next year (2018). When I left a couple of months later, the rental agency offered the apartment for $975.00 a month. Last time I checked (2022), apartments in that building were being offered for $1575 a month, but 2nd and third floor apartments might be less because rumor has it that the elevator broke down and the owner declined to replace it citing high cost of replacement.

When I moved, I found an studio apartment (my actual preference) in Kelso (across the river) for $625 which over the years had gone up to $700 (with one state enforced rent increase moratorium for Covid) and then was raised to $850 for the next 6 months because I’m choosing to move in the spring rather than wait and try to rent somewhere just as students are starting college in September. New tenants in my building are still paying $900 or more to start (and have been since 2021), though, so I’m not surprised that the owner is trying to catch everyone up. The rest of the market here is keeping pace with the units that I’ve lived in with Longview units $100-15o/month more than in economically depressed Kelso (last year ranked and the 4th poorest city in Washington State).

So yes, some of the statistic is regional or limited to specific areas. But as I look at various cities, large and small, on Zillow, I keep finding that the floor is pretty rigidly fixed. When I was looking in August this past summer, at $800 (my new rent if I’d decided on a year extension) as the cap, I was finding a lot of “there are no apartments in this range” messages. So city/sub/exurban rents seem to be of a type everywhere. I suspect that is where the disconnect comes in the nationwide statistics. If I can move to Union, Oregon, pop. ~1000 (maybe), I can rent an apartment for $495 a month, but that’s a unicorn (and I may need to be a migrant worker to qualify for that rate, I didn’t check).

Surprisingly, to me anyway, I can now afford to move to Portland, Oregon, which was the original plan to begin with because (according to a rental agent I worked with there) after Covid, Portland instituted a statutory cap on how much rent can increase annually. Socialism choking the life out of the rent-seekers seems to have a purpose after all. (But a lot of “afford” comes from my rent going from $375 in the shared unit to $850 since 2015; I’ll leave you to do the math. 😉 )

@JohnSF:

How is THAT fair? I was counting on those maximized returns to redouble the value of my share of the estate that I settled when Mom shuffled off this mortal coil. I’ll grant you that because I’ve no heirs and live simply myself that the money is going to charities, but charities deserve windfalls as much as anyone else–especially the regional (and therefore small) charities that I give to.

@inhumans99: The best explanation I ever read for the unexpected consequences involved in rent controls was in an opinion piece in The New Republic and went something to the effect of Instituting rent controls doesn’t create the problem;needing to remove them is what causes the problem. Over time, the income from a property that suffers wear and tear (usually beyond the extent of a single family house) becomes inadequate to maintain the property’s level of repair/original condition.* Adjusting to allow owners to recover the value of their assets sometimes creates explosive valuation changes.

*On the other hand, the practice of depreciating the property to near zero and dumping it creates similar issues even when there is no rent control, but that’s why the buy property at zero down using other people’s money guys go banko so frequently.

@Just nutha ignint cracker: correction: The statement “I suspect that is where the disconnect…” should have read “I suspect that is where the disconnect comes in the nationwide aggregate statistics, which may blur the effect experienced by specific cohorts of the economy.

@Barry: You should not have a $1.7 trillion deficit in a good economy! Doesn’t matter who is president. And it goes without saying that taxes should be higher, because multiple tax cuts under Republican presidents have caused this deficit. Bottom line is if you have a structural deficit that is 25% of your spending and the economy is doing well you are headed for trouble. Because a percent increase in unemployment is estimated to cost 2% of GDP.

@SenyorDave:

Why not? So long as we’re the hegemon, petroleum is priced in dollars and other countries use us as a bank, it’s a pretty good deal. I mean, good luck trying to repossess the U.S.

@Bill Jempty: So… there are certain areas that see high rent increases? Maybe there are certain areas that have seen lower than average increases?

@JohnSF:

The most charitable interpretation I can think of is that he’s not waiting for prices to come down, he’s waiting for wages to catch up with the recent bout of inflation. Which is a reasonable concern; wages always trail prices, and have been failing to keep pace for quite a while now. The 40% wage hike that the UAW were asking for would pretty much have put them back where they were before the GM bailout, in terms of real wages. The rest of us aren’t getting that.

I got a 6% raise last year, and the company was very proud of how they were indicating how very valued my contributions are. I didn’t bother pointing out to them that, in fact, I had taken a pay cut — just less than everyone else’s pay cut.

@MarkedMan: I’m confident that there are areas with lower than average rent increases. I would guess that they are places where there are small surpluses of properties that no one is renting because there’s no reasons to live there. But that’s just a guess.

@DrDaveT:

Indeed!

@DrDaveT:

Always the problem with serious inflationary episodes: those with less bargaining power on incomes or with “near-cash” assets tend to lose out.

Those with “real property” assets (eg houses) may maintain value.

Those who own productive assets and/or have large fixed interest debts benefit.

That’s why general inflation in the range 1% to 2% is benign, 2% to around 3% tolerable, above 3% damaging.

@just nutha:

States with greatest decreases in rent:

Montana, Oklahoma, Oregon, Washington, Idaho, Nevada, Utah, Florida, Pennsylvania, Virginia.

States with the highest population growth rates:

Florida, Idaho, South Carolina, Texas, South Dakota, Montana, Colorado, Georgia, North Carolina, Tennessee, Arizona, New Mexico, Utah, Nevada, Washington, Oklahoma.

(States with the highest rates of population decrease: California, Oregon, Illinois, Michigan, New York, Louisiana, West Virginia, Michigan, Massachusetts.)