Class Warfare: Framing the Debate

Hilzoy is tired of hearing about “socialism” and “class warfare” just because Barack Obama is raising the top marginal tax rate from 35 percent to 39.6 percent. After all, we had much higher rates under John Kennedy and even Ronald Reagan, two legendary tax cutters. And rates are higher in most of the developed world, too!

Hilzoy is tired of hearing about “socialism” and “class warfare” just because Barack Obama is raising the top marginal tax rate from 35 percent to 39.6 percent. After all, we had much higher rates under John Kennedy and even Ronald Reagan, two legendary tax cutters. And rates are higher in most of the developed world, too!

There’s much truth in that. To many Republicans, tax cutting has become something of a fetish. But there’s a right way and a wrong way to frame the debate.

I came of political age in 1979-80 and Reagan was my first political hero. I’m a firm believer in lower and flatter taxes but, at the same time, I recognize that:

Some progressivity is fiscally necessary and morally justified

– Government would need a lot of money even if it were only to do the things that everyone agrees it must do

– People at the bottom of the wealth scale don’t have any money, so the rich will by definition have to pay more

– Money needed to meet basic human needs is more valuable to the individual than incremental money after that point

Cutting taxes generates more revenue . . . but only up to a point

– The greater percentage of an earned dollar taken by the government, the less incentive there is to earn said dollar

– The lower percentage of all money collected as revenue, the lower the revenue collected

Once those points are conceded, as the old joke goes, we’re just haggling over price.

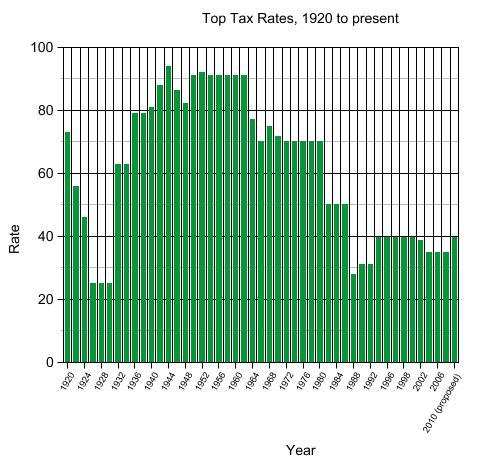

The top tax rate [PDF] has fluctuated wildly since the passage of the 16th amendment in 1913. It began at 7 percent (no, that’s not a typo) on those earning $500,000 — a massive sum in those days. It rose to 15 percent in 1916, 67 percent in 1917, 77 percent in 1918, went down numerous times before settling at 25 percent in 1925, jumped back to 63 percent in 1933, 79 percent in 1936, 81 percent in 1941, 88 percent in 1942, 94 percent in 1944.

It went down to 91 percent after the war and stayed there for years. That’s where it was when John Kennedy took office and where it was when he was murdered. Despite being constantly cited as a tax cutter, he left the top marginal rate alone.

Lyndon Johnson cut it to 77 percent in 1964 and 70 percent in 1965. That’s where it stayed until Reagan cut it to 50 (1982) to 38.5 (1987) to 28 (1988).

It has gone up and down considerably over the two decades since but never back to that low after it went up to 31 percent under George H.W. Bush (1991). Nor has it gone up above the 39.6 percent we reached under Bill Clinton (1993 to 2001).* John Cole has created a graph with this data:

So, no, 39.6 isn’t some magical threshhold that catapults the nation into socialism (indeed, tax rates really have little to do with socialism). Nor is it necessarily a road to financial ruin via the demoralization of the productive class; we’ve had boom and bust times with considerably higher and considerably lower rates.

But here’s the thing: There are different ways of talking about tax rates and some are more useful than others. In addition to the list above, I’d like to add in another thing the debate should recognize:

It’s our money, not the government’s

People earn money by trading in their time, labor, energy, present enjoyment, and so forth. While it’s not universally true, those earning more money tend to work more and have made better choices than those who earn less. One generally doesn’t get rich without getting an education and putting in much more than 40 hours a week. Indeed, few get rich working for someone else; most have taken the enormous risk of going out on their own and starting their own companies.

Recognizing that “the rich” have both earned their money and that they have more ability to pay, let’s debate where the tax rates should be on the needs of society and the logic of the market. This will be an ongoing debate, as there’s no “right” answer that applies regardless of circumstance.

One thing that’s obvious from a glance at the history of the top marginal rate is that it has typically gone up — sometimes skyrocketed — during crises. Especially wars. We went in the opposite direction during the Bush administration (partly out of ideology, partly because we went on a wartime footing during a recession and didn’t want to raise taxes and put a further strain on the economy). So, I’m persuadable that going up to 39.6 percent is necessary.

Here’s how not to persuade me: Using soak the rich rhetoric. The constant, “hey, only the top five percent are having to pay for any of this, so it’s cool” talk. That’s class warfare.

Via Jim Henley, I see that IOZ snarks,

In general I think it safe to say that people who display no outward indications of appreciating the distinction between business income, profit, salary, and taxable income are not, whatever their claims to the contrary, occupying the lofty brackets that Obama proposes we liquidate or nationalize or blast into space or whatever as we make the final transformation into the People’s Republic.

In addition to being untrue (lots of high earners have little knowledge of economics or tax policy) this is entirely beside the point. Whether you’ll personally have to pay more taxes shouldn’t be a major consideration at all.

It’s dangerous for a republic to operate on the basis of the lower classes voting themselves a larger share of the earnings of the upper classes. It’s one thing to appeal to a sense of noblesse oblige and quite another to treat others’ wealth as a piggy bank to be raided at will.

Image: Retirement Council of America

_________

*Yes, I know presidents don’t set tax policy on their own and need Congress to cooperate.

If it were just a matter of this, then why is the Republican Party, for example, so deadset against the Estate Tax? It’s not as if people go out and think “Hmm, I’ll start this small business so my grandchildren can operate it one day.”

Brett,

The death tax and your concept of it ignores the fact that it guts ranches, farms, and small businesses.

It ignores the fact that in many families the children have worked in the business for years and helped maintain and grow it.

The death tax ignores the work the children have done and only looks at how the business is structured. Structure the business wrong and the death tax will destroy it even if the children are the ones who have done the majority of work and added value to it.

The idle rich have extensive planning in place to makes sure they don’t pay the tax. So it tends to hammer the working business owners who don’t consider themselves wealthy and have not done the extensive planning the wealthy have done.

“Cutting taxes generates more revenue . . . but only up to a point”

Agreed, however since revenue increased the last time we cut them there is no evidence that we have reached that point. So in regards to the lefts tax hike fetishes, they must be interrested in doing so for ideological reasons and not any real-world fiscal reasons. Once again, everything the left accused President Bush of being… ideologically blinded, ignorant of facts… was merely projection of their own shortcomings.

Brett, we already taxed all of the money you want double-taxed under an Estate Tax. How, exactly, is it fair, or hell even moral, to steal half of the money someone worked long and hard for all his life while his corpse is still warm?

Brett,

One of the revolting things about the death tax is this.

In the most trying of circumstances, the death of a family member, the rest of the family has to deal with the very real possibility that the death tax may destroy their jobs and livelihood.

In the case of ranches and farms the death tax may also take away the families houses and places where they have lived for years.

Forcing families to deal with death tax issues while their family member is in the ICU or hospice is completely disgusting.

Brett,

One other thing about the death tax. If it did what those who support the tax wanted it to do Ted Kennedy would be flipping burgers.

The fact that he has lots of old family money to live off emphasizes the fact that the death tax generally missing the idle rich.

What it does hit are hardworking small business owners, ranchers, and farmers.

When you tax rich people more, they spend more time in Washington DC forcing more efficient government. We seldom hear this argument, but I speculate there is much to it. Rich people need to be more powerful in government, and they become more powerful as you raise their tax rates, to a limit of course.

This thinking leads me to conclude that taxes should be proportional to wealth and government services should be allocated proportional to wealth, with a slight tilt toward progressivity to ensure the rich manage the dead weight losses properly.

because it’s utter codswallop. They spend more time in DC seeking rents and arranging tax loopholes.

Wow, and it took the issue of taxes for me to completely agree with them about something.

The “cutting taxes” argument strikes me as an unusually broad field of battle. I have found it useful to restrict the argument to the following:

The Amount of government -directed spending we have seen recently has far outstripped the amount of money it would cost if we were to merely stop taking income taxes. Question; would not be simpler, cheaper, and more effective to allow wage earners to decide where they spend the money, rather than government doing it?

The only problem with this, of course, is that doing it that way removes the decision from the government, and does not do a great deal for those who don’t pay income taxes in the first place; the bottom 40% or so of wage earners… who interestingly are one of the the Democrat party’s primary source of votes.

If, as stated, the object is to kick start the economy, what better way than a massive take home pay increase for American workers?

Let’s consider, also, what that pay increase would do to the ability of homeowners struggling to pay mortgages.

Of course, those in power in the white house and in Congress will never go for it; it reduces government.

I should specify that not taking taxes would have a sunset… say in a year or so.

Really? Well, we are the government so I guess I agree in that sense. But whose image and superscription hath it?

I’d agree a lot more if there weren’t tens of thousands of subsidies, mostly given to the rich. A short list

– the Pure Food and Drug Act of 1906 established the over-the-counter/prescription distinction we have in pharmaceuticals today. How many people would go to a doctor for prescriptions if they could just go into a drugstore and get the same thing without one? It’s a subsidy on physicians.

– the home mortgage interest deduction is an enormous subsidy paid to realtors, landowners, builders, mortgage bankers, etc.

– the greater portion of all farm subsidies are paid to people who are rich by anybody’s definition of the term

– the tax break for new car buyers in the recent stimulus package is a subsidy paid to the rich

The list is just too long to enumerate. I don’t deny that there are benefits to each and every one of the above. My point is that there’s a symbiotic relationship between wealth and government. Many of the rich wouldn’t be without the government.

And that doesn’t strike you as a reason for limiting government influence in the marketplace?

Drucomm – your argument would be stronger were it not for the fact that the estate tax specifically exempts working businesses…

Sure it does but that’s irrelevant to the discussion of how indebted the rich are to the government.

My point is that creatures of the government shouldn’t be too outraged when the government makes outrageous demands of them.

I hate to mention this for fear of threadjacking but could someone make a good liberty argument for the abolition of inheritance taxes for me? I don’t see it.

It seems to me that freedom of speech, for example, is different than the right to pass your belongings on to your descendants. The former can only be abridged by the use of force while the latter can only be executed by the use of force.

I think that there are decent pragmatic and incentive arguments in favor of limiting or eliminating the inheritance tax but I don’t see a liberty interest.

If you meant “more tax revenue”, I dare you to show me the math on that.

It should, and in the same context, we should take a look at the social spending our government has undertaken in the last four decades.

If giving money to farmers, new car buyers, pharmaceutical companies, relators, landowners, builders, mortgage bankers, etc..etc.. is to be construed as bad policy…then why is not supporting and promoting bad behavior that the government is more than anxious to pay for, be considered an over-indulgence… buying votes…maybe.

Dave,

Good points… but they fail in comparison to the amount of money spent in other areas.

Both are wrong…I’ll stack up more cases of abuse and the left’s desire to keep people poor and hapless than you can do to degenerate the rich (productive people) of the USA.

Let us just get the government out of our everyday lives, stop paying the rich to get richer, and the poor to get poorer.

OMG, the Estate Tax is so terrible. It’s heartbreaking to think of those families who were destroyed by a tax on the money they inherited above $3.5 million dollars!

(pause)

Okay, I just took my anti-idiot pill. Forget everything I just said.

I’m completely for that. For some reason or other it seems very difficult for our elected representatives to do the former.

Good post James. I’d rephrase the 2nd bullet only slightly:’

It’s about fitting the tool to the problem.

Beyond that … its interesting to think about what sort of country we were when we had those 70% and beyond top-rates. It’s tempting to think that’s “not America” … but it was.

What were we thinking? Is it documented, the internal logic of the thing? Did we think that some amount of yearly income was simply enough? Could we call, say 20 million a year enough today?

That might actually not be such a bad idea, as Wall Street types plunder for short term gain, setting up for long term losses.

Okay from that I take it you didn’t mean tax revenue in the first sentence. So forget my first comment in this thread. I’d mistakenly thought you meant to take the “Tax cuts always pay for themselves” argument. But it looks like you didn’t.

Very short-sighted, Odograph. If you take away Stanley O’Neill’s ability to loot hundreds of millions of dollars from Merrill Lynch, he’ll completely lose the incentive to make them do extremely risky deals involving CDOs. And THEN where would we be.

I notice that nobody has mentioned one of the best arguments against raising taxes too high (whatever too high is). As the total tax burden on an individual rises, compliance falls. That’s been the experience in Italy, for example.

Americans have not historically been law-abiding WRT to taxes and if you raise the rates high enough they’ll just stop paying. BTW that’s another subsidy for the rich: the richer you are the easier it is to hide income.

To the contrary; it’s everything.

See, what you’re missing, is that the solutions of ‘ nail the rich’ currently offered, makes the assumption that all got rich through the government. That’s not even true in the majority of the cases.

Getting government out of the picture eliminates that variable, and with it, that argument.

Bithead,

Can you give me one example from recent times (the last 30 or 40 years) of somebody who became rich without government’s help?

I had a guy in to do some drywall work yesterday. He talked about people he knew who never paid taxes. We agreed that was the trick. If you never pay taxes you might stay hidden. Anyone else is visible in our database nation.

Actually everyone with a credit card should be visible, and I don’t think the rich can really hide (true) income in a database economy.

More likely it’s those data-sharing rules … or perhaps a Bush era lack of interest in finding “aggressive avoiders.” A blast from 2006:

Oh,

There are some good comments here, whether you are left, right, or just foundering in the Moderate range.

You guys are good.

As a person with a tenth grade education, I learn something each and every time I come here.

Thanks a lot,

Nobody is right, nobody is wrong; and everyone desrves their opinion.

Bill Gates, would be one such. Certainly the government got in on the act once the ballw as rolling, but that goes directly to my point.

It also occurs to me that “help” is a fairly wide target. As an example, help may include government performing its basic functions as defined in the constitution, all the way up to direct payments to individuals. Perhaps you’d best give me a definition of what is help, to your mind, within this context.

As Steve Verdon would put it, epic fail.

Without the government Bill Gates would still be programming in his parents’ basement. Without copyrights, a government creation, Microsoft’s first big product, MSBASIC, would have sold a few copies and then been installed by whoever wanted it for free. Without patents Microsoft’s big break, its contract with IBM for MS-DOS, would never have been possible: IBM became IBM by skillfully manipulating the patent laws to take control over computing in the early days. Every large company that Microsoft lists as a customer became a large company through some combination of patents, copyrights, government influence, and government contracts. Indeed, corporations are by definition creatures of the government. And the government itself is one of Microsoft’s biggest customers.

Try again. Somebody who’s never relied on a patent or copyright, never done business with the government, never done business with a corporation, hasn’t inherited any money (that takes government, too), or been dependent on the government in any way.

Thanks for a thoughtful perspective on the issue, James. But this:

Any links to voices in the progressive/Democratic mainstream saying stuff like this? Surely, you’re not taking Hilzoy’s headline seriously? Do you really think she’s calling Reagan and Thatcher soakers of the rich?

The only places I see comments like the one you’re reading “constantly” are conservative sites, where the sentiment is falsely attributed to progressives in a manner reminiscent of the “liberals want America to lose in Iraq” canard of a couple of years ago.

For my part, I agree with most of your bullet points, which leaves us arguing over the price. Considering the complex variables and subjective matters of incentive that are involved, I don’t see how any particular top rate can be chosen other than arbitrarily. For me, 50% is a nice, round number. The government should never take more than half of every dollar earned.* How about we start from that, and work downwards through the brackets?

On the estate tax:

Link

Also:

Link (pdf)

—–

* Not all compensation and income is necessarily “earned.”

Matt,

I think I can help. On Thursday there was a protest in NYC about upcoming budget cuts

Here is a quote from from the CBS report:

Protestors insisted Thursday that there’s a better way. They’re asking for what they call “fair tax reform” — raising state taxes for New Yorkers making $250,000 or more on top of the president’s proposed hikes.

“For those of you who prosper during boom time, we ask them pay a little bit more. Pay a little more so New York can avoid cutting the services that our most vulnerable need,” United Federation of Teachers President Randi Weingarten said.

http://wcbstv.com/topstories/recession.budget.protest.2.951551.html

In short: Obama’s version of sacrifice is that 95% of Americans get tax cuts and 5% get to pay for it (and also get demonized).

As a person who has been in the computer business since the the early 1970’s. Self taught no less, never received a government grant.

You are not only a partial fool, but a complete fool.

If you think he charges too much for his software, go buy something else. There are many versions of of software operating systems that would operate on your computer.

I have a copy of Ubuntu on one of my computers, with Firefox, and Open Office. It’s free, works fine, and I am not obligated to put money in Gates’s pocket

Just stop pissing and whining and go do yourself a favor. Get a grip on reality.

And personally, I think Bill Gates is a person who would be in the top ten as far as wealth goes, but would be shoveling shit out of the sewer if I was his Boss.

He rolls over, kisses his ass every day and thanks the Lord that IBM brought him to prominence.

Sure he can, but he’ll be naming a warlord in Afghanistan or Somalia,..

That is the assumption you make Bit, Dave only states that the rich use gov’t for their own selfish reasons (If we were smart, so would we all)(and the people you are thinking of Bit, have… to their credit). There are many ways the rich get richer because of gov’t (and to some extent, we all benefit from gov’t) and Dave is only speaking of one of those ways (indeed, the most insidious one). But there are other ways Gov’t helps bussiness as well, and if it didn’t, bussiness would collapse (eg: infrastucure) Gov’t should facillitate the creation of wealth…. But that does not necessarily mean “helping the rich get richer”. It is a fine line that needs to be drawn, and will never be perfect.

Hell, even the great cattle barons of the old west would never have made a dime w/o the help of gov’t (it was the US govt who gave the railroads millions of acres of land to subsidize the building of the railroads that allowed the cattlemen to ship their beef to Chicago and KC and then to consumers in NYC etc)(all in all a good deal for the American Economy… but pure hell for the Am. Indian)

That will also eliminate the possibility of any but the very few and powerful to get rich (see Somalia, Afghanistan).

We can argue about the proper balance between “government” and “private enterprise”, and I am more than willing to listen to an honest debate about it, but such a debate has to begin by acknowledging the Golden Rule:

“The man with the gold, makes the rules.”

If you don’t start there, not only are you disingenuous about the interface between Gov’t and business, you are either a liar or a fool about the very essence of human nature.

@JJ:

Ok. But it’s equally dangerous for a republic to continue to concentrate the nation’s wealth in a few percent of the population. Is the following really a predicate for class warfare? Granted, the data is from a few years ago, but is there any reason to think the trend has not been sustained?

I don’t think we’re on the way to a dispossessing socialism if we raise the rates on the upper end so we can lower them for folks in the middle.

Seeing as this debate is about “Class warfare”… I feel the need to make a point: Nobody ever made a dime all by themselves. The great American Ideal is of the lone individualist standing against the forces of nature, of bureaucracy, that are arrayed against him…

Even Warren Buffett and Bill Gates have acknowledged the fact of this fallacy. If it was they, all by themselves, they would still be living in caves. They got where they are (as all “rich” people have since the beginning of time) by having a particular talent for marshalling the resources at hand in the environment they lived in. (this is no knock on them)

I do not recall which Ayn Rand book I read, but it was about an architect struggling against the “status quo” of architecture at the time. I suspect the individual was modeled on Frank Lloyd Wright (who, when it came to building actually functional buildings… was a little bit hit and miss), but I am not in her head and after reading the book I had no further interest in anything she had to say… it was all I could do to get thru that book.

Needless to say, it was a joke. I have never yet met an architect who ever actually built anything. When we get a set of drawings (we call them “funny papers”) we look at them… and then throw them to the side (an exageration) and say, “So how are we really going to build this monstrosity?” I don’t think I have ever built anything strictly according to a set of blueprints. And I cannot count, the # of times I have said to a foreman, “This won’t work!” and he replied, “I know, but we have to build it that way because that is the way it is drawn.” and later on we tore it down.

And yet at the end of the project, whether it was a single story home, or a 40 story tower, the architect got the credit. Why? Because he was at the top of the “totem pole”.

You don’t want “class warfare”? Then you better get a grip on reality, and realize that the guy at the top has not so much to do with on the ground results, to the extent that he almost might as well not be there….

Then you could save yourself the hundreds of millions of $ of compensation you send his way…

I think everyone agrees that there is no absolute “self-made man.” Of course government helps to create the conditions for Warren Buffet’s and Bill Gates’ success. I also think we can agree in the idea of progressive taxation. The disagreement comes from two subsequent questions:

1) How can government create the conditions that allow people to enjoy success (from an good government standpoint the more successful people the broader the tax base)

2) What services are expected from government (defense, social safety net etc.).

The two questions are nearly always in partial conflict but there is a medium between them that allows broad-based prosperity with social services. Class Warfare threatens that balance.

Dave Schuler, smuggling the premise said

Excuse me, how you go from

To the idea that there is no need for government or taxes?

The answer is you don’t.

Unless you are attempting to distract everyone from the original point James Joyner made.

Dave Schuler said,

I can provide lots of examples where established interests and wealth used the government to squash their startup competition.

I’ll Never Let Canada Live This Down: Evil Carpooling Startup Fined

Governments are great at killing new startup companies that would compete with existing industries.

A good argument for limited government.

It also illustrates just how confused your no government stawman argument is.

Dave Schuler,

One other point. Why do you think it took so long for home brewing, craft brewing and the microbrewery / brewpub business to take off in the US?

The answer is it was illegal even after after prohibition was lifted. When the regulations were lifted (I think it was during the Carter administration)home brewing started to take off.

When bewpubs were made legal in the late 80s early 90s that business really took off. This created wealth, jobs, and lots of drinking pleasure.

Multiply this by thousands of regulations and you get a sense of how much of drag big government is on economic and business creativity.

Duracomm: you miss Dave’s point entirely… Mainly that small business is squashed by big business (thru the use of gov’t) because of the fear of competition… ergo, we have the golden rule… (tmwtg,mtr)(as referred to earlier)

Even as you argue against Dave, you prove his point.

Sometimes, I don’t know if I can figure this all out.

The baby’s and children cry,

And the adult’s argue and fight,

The baby’s always smile, after they cry,

And the adult’s find scorn at every turn, never to smile,

I don’t know if I can figure it out,

Never talked to a baby, but I can make them smile.

And I truly don’t think that I have honestly talked to a scornful adult…and,

made one smile..

I figured it out..

Baby’s and children are priceless,

Adults are fools…

No it doesn’t. Not according to the IRS, anyway:

Granted, they’re treated differently, but they are not “exempt”.

@Jim

Actually the quote you provide sounds much more like James’ “appeal to noblesse oblige.”

Eneils, I came here to add one more thing, but then I read this, quoted by you…

As a man who spent the last day and a half with my grandbabygirl, you have left me at all but a loss for words again…

It is all about the children guys, let us remember that. I ain’t sure about the rest of ya, but soon enough I will be dead. I don’t know about you all (and I rarely agree with Eneils), but he he is dead on here:

“I figured it out..

Baby’s and children are priceless,

Adults are fools…”

So what are we going to do, for them?

ps: EB, who wrote that?

Now, let’s discuss a specific example. I used to know a family that owned land outside of Austin, TX. It’s been in the family since they migrated here from Bavaria in 1848. These folks are not wealthy in any sense – except the inflated value of their land, as real estate has become very valuable in their specific locale. Now, let’s assume for the sake of argument that the family patriarch and his spouse both die in 2011 (when the estate tax rates and brackets revert to pre-Bush levels). Their land, according to a Google search that I just did, is worth roughly $5 million on the open market. Assuming that their land is ag exempt, they’ll get a reduction in estate of $800k, leaving $4.2 million in taxable estate. They’ll also receive an exemption equivalent to $600k in estate value, leaving $3.6 million in taxable estate. At that valuation, they will have 9 months to come up with over $1.5 million in estate tax. Any bets as to how they’ll do that?

Now, let’s assume that they’ve done some basic estate planning – not a safe bet in this case – and taken advantage of the Marital Exclusion, doubling the amount of the Estate Tax exclusion. That allows them a $1.2 million exclusion over and above the $800k they got for the family farm, leaving $3 million in taxable estate. Again, well over a million is taxes would be owed 9 months after the second death.

Am I going to shed tears for the surviving heirs who have to split the remainder? Nah. But don’t tell me that family farms are exempt.

tom p

Thank you very much, that is really a nice compliment.

I had been listening to old English and Celtic folk songs all day long after I got home from church. I love the simplicity of the lyrics to say so much.

Then, I decided today is my monthly Merlot Maniac euphoria day. As you know, it aids in digestion, that red wine.

On a bit of whimsy, I just put that together. It’s from my heart, inspired with what I think, and fortified with some cheap Merlot.

Well as I suggested, there is the largish question of what constitutes ‘government help’. We can certainly argue about whether not copyrights are a valid function of government, or indeed the entire idea of intellectual property, but I rather got the idea that we were talking about direct payments to individuals from government.

Of course.It certainly is enough; the right of property. The right to decide where your property goes upon your death. Inheritance taxes usurp that right.

I’ll have to drop Gates a note with this one.

You forget America’s own history.

You see, government being out of the picture can work and often did… but required people of integrity, you see.

I think the topic was general enough that gov’t help means conditions set up by gov’t – even as far as being able to walk down the street without fear of being shot – you only have to travel to some third world countries to realize how essential that aspect of gov’t help is.

Most would agree that its very hard to create wealth either with no gov’t (a few anarchists to the contrary), or with total gov’t control (a few communists to the contrary). The hard part is finding the sweet spot in the middle where gov’t helps set the conditions without stifling citizens.

Please. As some others have generously pointed out, not only does the Estate Tax have a major exemption (up to several million dollars, which is greater than the value of most small businesses and farms), but they don’t have a single example on record of a family losing a farm or small business to it.

That’s an argument for changing the exemptions to minimize this (or to encourage charitable donations), not an argument for getting rid of the Estate Tax.

Find me an actual example (or better yet, a study showing that this is a major problem), and I might be inclined to believe you.

Microsoft, as it stands today, is a specific creation of government. It would never have survived into the 80’s unless the Carter administration Justus department had not filed anti-trust legislation against IBM in the late 70’s.

IMB was going to acquire Intel and the Carter administration said no and filed suit. Had IBM been allowed to acquire Intel then Microsoft would have had no other choice then to sell out to IBM as well given the fact that there would have been no Intel clone market. By the time Reagan came along the in ’81 and dropped the suit it was too late, the clone market had been established and Microsoft was allowed to become what it is today.

Microsoft, as a sand alone company, was a creation of government in the best tradition of government trust busting (with many thanks to TR).

So, you can’t point to a single example where the family farm actually had to be sold to pay the estate tax, either.

Also re this:

What I think is really disgusting is forcing families under these stresses to argue with for-profit insurance companies trying to cancel coverage when it’s most needed, and to make decisions about whether to pay for Dad’s pills or for junior’s tuition, or the mortgage, or the grocery bill. But I’m guessing you’d file all that under “personal responsibility.”

I find it hard to believe that people are missing this rather obvious point that ggr makes. To me, the difference is night and day between an entrepreneur who builds wealth (including personal wealth) by leveraging the system that was set up and enabled by government (leveraging in a way that then provides benefits to the society as a whole), and a situation where an entrepreneur is given unfair advantages by government in order to build wealth. It’s as clear as the distinction between consensual sex and rape in terms of how power is yielded in each situation.

The government obviously creates certain circumstances to allow fair competition to flourish (that’s the whole point.) Copyrights and patents exist to protect against theft of intellectual property. Those circumstances in my opinion would generally be the conditions for fair competition which most in society would agree upon.

It’s when government puts its finger on the scales that the citizens should object, because that’s giving power to certain individuals to profit at the expense of others, without those individuals having done anything to earn the advantage (other than of course, making corrupt deals with the politicians.)

Perhaps it is a subsidy on physicians, but only an overreaching libertarian would ignore the immense societal cost from people taking pharmaceuticals without knowledge of what they’re doing. To take just one obvious example, we’d have long ago lost the effectiveness of every antibiotic available if people could access them every time they had a cold or flu and mistakenly thought they could treat themselves with antibiotics.

James (author) wrote: So, I’m persuadable that going up to 39.6 percent is necessary.

Including the PDF to tax rates over time was very useful in providing insight into how our tax rates have changed and we’re seemingly back to the middle ’90’s period and, as you imply, it didn’t kill us or make us poor.

However, when the tax code changed in 1993, taking the tax rate for the highest earners to 39.6%, that rate was based on income of $250,000 or more….today’s proposed increase is looking to use the same number, $250,000, as its benchmark for when the new rate kicks in – it is not being adjusted for inflation!

In the government’s own CPI calculator, that is available online, $250,000 in 1993 is the same as $365,299 in 2009 dollars….yet we’re going to increase taxes on those who today earn more than $250,000 at that rate? The buying power of $250,000 in 2009 dollars is similar to the buying power of $171,093 in 1993.

And I see that you can’t actually address the argument. Besides, is being “forced” to sell the farm really the only relevant consideration? It isn’t enough that anyone in that situation has to come up with 7 figures in cash in order to keep the farm or business? Sure, if they’re foresighted they’ve purchased a (costly) life insurance policy years earlier, and can come up with the cash that way; or they have other assets to sell that they can raise the cash; or they take out a mortgage against the farm to pay the taxes. But they still have to come up with the cash.

The studies you linked above were deceptive in what they left out. The second one in particular completely elides the fact that the tax thresholds are going back down in 2011. That is a HUGE lie by omission.

But if it makes you feel better, my cousins had to sell the family farm when my aunt and uncle died. So there’s your example.

Everyone agrees? OK, that is the absolute minimum, least common denomenator government after conservatives and libertarians get finished with paring down the government to its bare essentials.

That would mean a lot less money required to run the government show, and, along with reducing fraud, waste and mismanagement, earmarks, pork, and payoffs, we just might not need more than a flat tax that earners contribute to on an equal percentage basis.

The progressive tax is theft of our earnings by the government for redistribution to the needy. It should be called what it is–charity, not “welfare”. So let us tithe for charity to meet the needs of the unfortunate, as good Christians do.

Let us do away with the progressive tax, lower the substantial government overhead involved, and reduce the dependence mindset created by welfare, instead of charity.