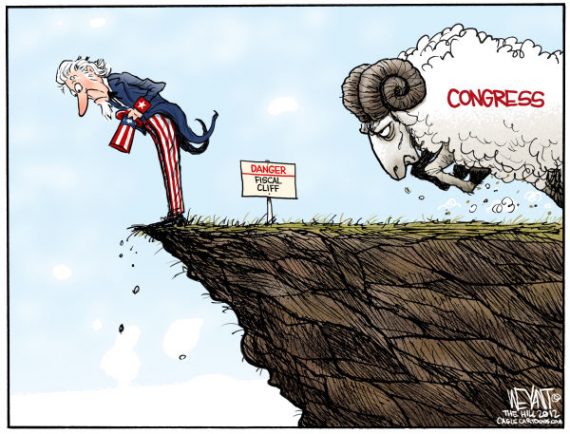

Fiscal Cliff Compromise

A outline of a deal both sides could live with.

Ezra Klein reports that, despite all the public blustering, the two sides are actually quite close on a deal on the so-called fiscal cliff:

Talk to smart folks in Washington, and here’s what they think will happen: The final tax deal will raise rates a bit, giving Democrats a win, but not all the way back to 39.6 percent, giving Republicans a win. That won’t raise enough revenue on its own, so it will be combined with some policy to cap tax deductions, perhaps at $25,000 or $50,000, with a substantial phase-in and an exemption for charitable contributions.

The harder question is what Republicans will get on the spending side of the deal. But even that’s not such a mystery. There will be a variety of nips and tucks to Medicare, including more cost-sharing and decreases in provider payments, and the headline Democratic concession is likely to be that the Medicare eligibility age rises from 65 to 67.

That’s not a policy I like much, but New York magazine’s Jonathan Chait accurately conveys the White House thinking here: They see it as having “weirdly disproportionate symbolic power,” as it’s not a huge (or smart) cut to Medicare benefits, and most of the pain will be blunted by the Affordable Care Act. But Republicans and self-styled deficit hawks see it as a big win. And Democratic House Minority Leader Nancy Pelosi, who staunchlyopposes raising the retirement age, has stopped well short of ruling it out.

Paul Krugman hopes that this isn’t true:

First, raising the Medicare age is terrible policy. It would be terrible policy even if the Affordable Care Act were going to be there in full force for 65 and 66 year olds, because it would cost the public $2 for every dollar in federal funds saved. And in case you haven’t noticed, Republican governors are still fighting the ACA tooth and nail; if they block the Medicaid expansion, as some will, lower-income seniors will just be pitched into the abyss.

Second, why on earth would Obama be selling Medicare away to raise top tax rates when he gets a big rate rise on January 1 just by doing nothing? And no, vague promises about closing loopholes won’t do it: a rate rise is the real deal, no questions, and should not be traded away for who knows what.

Krugman’s right here, at least in terms of the politics. I’m not sure why President Obama would concede so much given that he holds almost all of the cards. The Clinton rates will return automatically and there’s nothing the Republicans can do to prevent that; all they can do is block making the Bush tax cuts permanent for the bottom 98 percent–which would be the biggest gift to the Democrats since nominating Barry Goldwater. And, yes, raising the Medicare age actually increases costs, making the victory symbolic but stupid.

Bargaineering‘s Tim Wang has done the drudge work of putting together the three baseline scenarios together in a concise format, so I’m going to just use his tables outright while cutting some of his analysis for simplicity:

Three Proposals

- Current Law: The current law, in which Bush-Era tax cuts expire, goes into effect.

- Obama Budget: President Obama’s Fiscal Year 2013 Budget Proposal is passed.

- Bush Era Cuts: The current brackets are extended, the Bush-Era tax cuts are extended.

Tax Brackets

Here are the tax brackets under the Current Law scenario:

Tax Bracket Single Married Filing Jointly Head of Household 15% Bracket $0 – $35,500 $0 – $59,300 $0 – $47,600 28% Bracket $35,500 – $86,00 $59,300 – $143,350 $47,600 – $122,860 31% Bracket $86,000 – $179,400 $143,350 – $218,450 $122,840 – $198,900 36% Bracket $179,400 – $390,050 $218,450 – $390,050 $198,900 – $390,050 39.6% Bracket $390,050+ $390,050+ $390,050+ And the brackets under the Obama FY2013 Budget:

Tax Bracket Single Married Filing Jointly Head of Household 10% Bracket $0 – $8,750 $0 – $17,500 $0 – $12,500 15% Bracket $8,750 – $35,500 $17,500 – $71,000 $12,500 – $47,600 25% Bracket $35,500 – $86,000 $71,000 – $143,350 $47,600 – $122,850 28% Bracket $86,000 – $179,400 $143,350 – $218,450 $122,850 – $198,900 33% Bracket $179,400 – $199,350 $218,450 – $241,900 $198,900 – $222,750 36% Bracket $199,350 – $390,050 $241,900 – $390,050 $222,750 – $390,050 39.6% Bracket $390,050+ $390,050+ $390,050+ Finally, here’s what they’d look like if the Bush Era cuts are extended as is:

Tax Bracket Single Married Filing Jointly Head of Household 10% Bracket $0 – $8,750 $0 – $17,500 $0 – $12,500 15% Bracket $8,750 – $35,500 $17,500 – $71,000 $12,500 – $47,600 25% Bracket $35,500 – $86,000 $71,000 – $143,350 $47,600 – $122,850 28% Bracket $86,000 – $179,400 $143,350 – $218,450 $122,850 – $198,900 33% Bracket $179,400 – $390,050 $218,450 – $390,050 $198,900 – $390,050 35% Bracket $390,050+ $390,050+ $390,050+

From the Democrats’ perspective, Current Law is the ideal outcome. It raises rates back to Clinton levels, thus maximizing revenue to the Treasury, while shifting all the blame to the Republicans. But President Obama’s proposal is politically shrewd: It raises the rates on the top bracket but retains the Bush tax cuts for everyone else. Finally, there’s the ideal Republican outcome, which keeps the Bush rates intact for all income levels.

Looking at the tables, several things jump out at me that have escaped the public debate.

- First, all of the discussion has surrounded some mythical $250,000 level that appears nowhere on any of the three scenarios.

- Second, note that the Current Law scenario has only five brackets, compared to six under the Bush Tax Cuts scenario and seven under the Obama scenario. If nothing happens and the Bush tax cuts expire completely, there will be a rather staggering increase on the tax rates for the lowest income groups, not only because the rates go up but because the bracket thresholds go down tremendously. For Married Filing Jointly, we’d go from a 10% rate on the first $17,500 to a 15% rate on the first $59,300!

- Third, the debate has entirely elided the fact that, in addition to rates, there are three filing categories: Single, Married Filing Jointly, and Head of Household. The rates vary widely between those groups.The Current Law scenario is brutal on Heads of Household, i.e., single parents. (With the death of my wife last November, I’m now in that category, although I get to file in the Married Filing Jointly category for one more tax year.)

It strikes me that there’s a deal here that’s smarter than the one Klein’s sources are betting on. One that’s simultaneously better for the country, better for both sides politically, and more compatible with the purported governing philosophy of both parties to boot.

First, the Republicans have argued that, rather than raising rates, we should close loopholes that benefit the rich. But they never seem to tell us which loopholes. So, let me throw some out there:

- Carried interest: Essentially, hedge fund managers and other bigwigs in the financial services industry get to treat their income as capital gains, which are taxed at 15%, rather than ordinary income. For those on the high end of the earnings spectrum, that’s a massive windfall. It’s the reason Mitt Romney and Warren Buffet pay such low rates. And there’s no rationale for this that makes any sense: They’re taking no risk with their money to justify a lower rate; they’re investing other people’s money. Some estimates have this bringing in an additional $17.7 billion over ten years; not a ton by federal government standards but real money.

- State and local taxes: We’re allowed to deduct from our gross earnings monies paid to state and local governments: income taxes, property taxes, and the like. While this makes sense on the macro level–you’d otherwise be taxed on income that you didn’t actually see–it’s a huge boon to those living in high tax states and localities. Seth Hanlon at the liberal Center for American Progress notes that this cost the Treasury $70.2 billion in FY 2011 alone and that the savings is negligible for most Americans; only those making over $100,000 a year net any significant savings while those making over $200,000 a year average a whopping $5166. So, either cap this deduction severely or get rid of it entirely.

- Mortgage interest: While it’s never made any sense to me to subsidize homewners building equity in the property while poor people get nothing for rent that’s just lost money, the deduction is too entrenched and popular to go away. But, surely, we can eliminate it on second homes. For that matter, we should be able to phase in a cap on very high dollar homes.

Second, Democrats insist that rates go up for the highest earners while Republicans say this is a non-starter. Given that rates go up automatically in three weeks, the Democrats are going to score a win on this one. Republicans should counter with a deal that’s a win for both sides:

- More brackets: Current Law has us going to brackets, the Bush extension favored by Republicans has six brackets, and Obama proposes seven. Let’s give him his seven brackets. Or eight. This gives the Democrats a big win over the automatic cuts that they’d get anyway, introducing substantial progressivity over the five bracket scenario, and thus giving the Republicans leverage they otherwise lack.

- Extend Bush rates to more people: Currently, the 33% rate extends to $390,050 for all filing categories. Obama ends it at $241,900 for Married Filing Jointly and it goes away entirely under the automatic resumption of the Clinton rates. Republicans should propose to keep the 33% rate and make up whatever difference isn’t already made up with the loophole closures with a higher rate at the very top levels. At the very least, they should be able to wrangle a number in between $241,900 and $390,050; $315,975 splits the difference. This gives the Republicans a substantial win both philosophically and negotiation-wise–but the president comes out ahead, too, in that this would raise the threshold for hikes beyond a level that anyone could plausibly claim was “middle class.”

- A millionaires tax: Pursuant to both of the above, there would be an additional rate on incomes over $1,000,000. While artificial, it’s a number that still screams “rich” to, well, anybody. I haven’t done the math here to know what rate we’d need to reach the required revenue thresholds. The 39.6% bracket that comes back automatically might be enough; it might not. But, surely, it wouldn’t have to go higher than the 50% rate that was acceptable to Ronald Reagan throughout most of his presidency. For that matter, we could have a bracket in between the 33% rate and the millionaires rate, kicking in at, say, $500,000.

In terms of entitlement reform, there have to be smarter ways to save money on Medicare—which all agree is simply a must, given the trendlines—than raising the eligibility age. Some combination of cost inefficiencies on things like drug purchases and means testing would be a good start, although likely not enough. There are some other sensible reforms along those lines in the Simpson-Bowles plan, which seems to be drawing renewed interest, although quite a few of the suggestions have already been implemented. There’s money to be had, for example, in means testing Social Security and/or taxing it for those above a high income threshold.

Let me reiterate that I haven’t done the math on any of the above; indeed, I’m not even sure how I’d begin. Some tweaks might be necessary to make the numbers add up. But my outline puts real money on the table in terms of loophole closures and does rate hikes in a way that gives both Republicans and Democrats real wins. It’s better than the three scenarios currently on the table in terms of revenue, politics, and basic fairness. And it would get the ball moving in terms of real negotiations.

Anyone who believes that there will be spending cuts outside of defense is incredibly naive. If taxes go up, the money will be spent on new programs and the politicians will depend on economic growth to lower the deficit.

In the long run, the real question for the U.S. is how big can the government be and what percentage of the GDP can the government consume.

Anyone who thinks Obama won’t get rolled in the negotiations (even though he holds the winning hand) hasn’t been paying attention for the last 4 years.

Sounds very reasonable James. There for it will never fly.

On the slightly more serious side:

This needs to end.

If the wonks don’t even pay attention to this, I guess we can dispense with the notion that this budget fight has anything to do with actually developing a realistic budget for the federal government. Who cares about the numbers, it’s who “wins” the politics that matters, right?

Here are some rough numbers, James. Let’s assume in a fantasy world that the Democrats got all the tax increases they wanted and the Republicans got all the spending decreases they wanted. That would “add up” to about $3 trillion dollars over 10 years with is about 1/3 of the expected deficit over that period.

I haven’t been able to find any numbers on this deal Ezra Klein talks about, but it’s likely to fall somewhere between $1-1.5 trillion over ten years – about 10% of the total projected deficit.

So keep that in mind when discussing “required revenue thresholds.”

@Andy: I’m not a budget wonk and don’t have access to much less competency to use the specialized tools that would allow me to run the numbers. For that matter, this is a blog post that I cranked out on a Saturday morning before the kids got out of bed.

Still, I’m pointing to major loopholes that can be closed, yielding tens of billions of dollars, in exchange for some tweaks on the way we tax income at the upper margins. It strikes me as plausible that the numbers would be within spitting distance of balancing out.

Nor do I think that the expected outcome in these negotiations is a balanced budget in the near term. I don’t think that’s even desirable given the state of the economy and the ability to borrow at absurdly low rates of interest. Some restoration of fiscal sanity is the best we can hope for here.

No mention of Social Security anywhere, though. Discussing our various fiscal crises without mentioning Social Security is like having a discussion about classical music while omitting Bach, Chopin and Mozart. Social Security dwarfs Medicare. Dwarfs Medicare + Medicaid. Dwarfs everything.

How exactly will Gen. Y support first the Boomers and then Gen. X? Living at home with mom and dad doesn’t pay all that well.

And along those lines no discussion about growth and job creation. If we don’t grow the economy and create vast numbers of high-paying jobs, across all working age groups and for all key industry groups, this entire dog & pony show about the current debt ceiling and the Bush tax cuts will become academic, both literally and figuratively.

That all aside, a few other points are worth noting:

– The notion that raising the eligibility age for a public money welfare program somehow does not save the government public costs concerning that program only can exist on the Internet and in media-academic circles.

– Not a single word about what federal programs other than Medicare should be cut. Lots of words about which taxes should be hiked up. Quite telling.

We can’t tax our way out of this mess. You could raise the marginal federal rate to 100% on every millionaire in America and we’d still have a long-term, structural deficit, notwithstanding the fact that Social Security and Medicare are off budget items.

Spending has to be cut too. There are hundreds of billions of annual public dollars being spent by the Feds on redundancies, waste, inefficiencies, fraud and rank social engineering. They need to stop spending that money. Otherwise we’re hosed in any event.

– Means testing is governance by class distinction.

The guy who’s paid Medicare taxes for 45-plus years, but who just so happens to have been a self-made success such that he can afford private health insurance, doesn’t deserve the benefits of the very program into which he’s paid those taxes? Really? OK. Then in the next breath, however, to be logically consistent, and not to be hypocrites, we should means test military pension payments, shouldn’t we? After all if someone retires from the military and then goes on to a highly-successful, highly-lucrative 2nd career in the private sector, and doesn’t “need” their military pension, we should save public dollars by means testing and thereby denying those payments. And if not why the distinction?

Klein is blowing smoke. As you rightly point out JJ Obama is holding all the cards so why would he agree to such a cockamamie deal and one that does not appear to address the debt ceiling which a lot of Republican theorising supposes would put them back in the driving seat early next year. I also think you’re missing a key factor here JJ. Namely political symbolism. Obama, the Democratic leadership and Lew (who is a key figure) are not interested in giving Republicans some sweetheart deal they can claim was a philosophical or negotiation victory.This would cause ructions in the Democratic base and caucus and gain Obama very little. It’s quite clear the preponderance of opinion in the administration and amongst congressional democrats let alone activists is let’s go over the cliff and bring an end to the entire Bush supply side tax fandango which has proved a disaster for the country. The symbolism is enormous. There’s also the perception that going over the cliff actually strengthens the admins hand as indeed it does. Some Republicans get this but not much of the house rank and file and the loony commentariat. Any deal is going to have to be overarching and include the debt ceiling issue and there will be no can kicking. I put the chances of it before December 31 as only 50/50 but Boehner understands the dynamics and has to be under a lot of pressure from the business community who have already essentially thrown in the towel and don’t want any idiocy about the debt ceiling. So nice try JJ but it aint going to happen.

@superdestroyer:

Well it’s going to be just over 23% of GDP this year and then down into the 22’s for the next four. Hence the tax take need to rise to about 20% of GDP. This is not wildly different from the 19% it averaged from the mid 60’s until 2000 before Bush drove the bus off the road.

P.S. — With a 2nd glance I just saw the one reference to Social Security. In the last sentence of the penultimate graf. My bad. Of course the reference is to means testing and taxing those benefits. Great. Again, if we’re going to means test Social Security let’s means test military pensions. That way we’re all paying “our fair share.” And FYI Social Security benefits already are taxed under current law.

@James Joyner: James, I’m not a budget wonk either, but it’s not that difficult to get in the ballpark to get an idea how realistic a proposal is. And these proposals are not realistic in terms of actually closing the budget deficit over the next ten years.

And, actually, the easiest way to approach a balanced budget over ten years is to do nothing. All the Bush and Obama tax cuts will expire increasing revenues, especially as the AMT starts to really eat into middle class. On the spending side, medicare spending would be significantly restrained (no more doc fixes) and discretionary spending would be greatly limited thanks to the budge control act and other measures.

My point is that the debates in Washington over the budget are at the margins when it comes to the actual numbers. Nothing either party is proposing will come close to getting our nation’s finances close to balance. Do that will require radical measures (such as those which would happen automatically under current law) that our politicians don’t like to contemplate, much less talk about. The reasons for that are pretty obvious – what politician wants to run on a platform of significantly higher taxes and significantly lower federal spending?

It’s a compromise that makes no practical sense. Andy makes the case that the tax increases and spending cuts are ridiculously small. There’s another case, too: that the economy needs more money in it rather than less.

If that’s one’s position, there shouldn’t be any tax increases or spending cuts at all, indeed, taxes should be cut and there should be more federal spending. There are, after all, an enormous number of people still unemployed and the jobs that have been created are preponderantly temps and part-time ones.

The compromise only makes political sense. I’m enough of a pragmatist to recognize that compromises must make political sense but when they make no practical sense and solely political sense, it’s unhinged.

@Andy:

Here are some rough numbers, James.

I don’t recognise your rough numbers anywhere. The proposal Geithner has tabled produces around 4.5 trillion over 10 years (not that I think these ten year scenarios are remotely serious) but notionally this is an average of 450 billion a year when the deficit for FY 2013 which we’re three months into is projected at around 1 trillion. Btw based on projected 2013 GDP of just over 16 trillion that means the deficit is down to around 6% from 2012’s 7% and the over 10% of three years ago.So things are moving in the right direction.

As a practical matter, Obama’s proposal is very modest, it is the middle ground. He proposes a tax increase to the top 2% of wage earners only, all other tax brackets left unchanged, a continuation of the payroll tax reduction ‘holiday’ for most wage earners, and so forth.

If Obama can’t sell his modest proposal, then …. oh, never mind, he’s probably going to be rolled into accepting cuts that would have been automatic in sequestration.

@Brummagem Joe: Link please? Geitner’s proposal claims to raise $1.6 trillion over 10 years, and includes unspecified cuts of $400 billion over the same time period. I’ve seen no one claim that his proposal would “average” $450 billion a year.

@Dave Schuler:

I think the complicating factor is that the economy has lots of money. It isn’t behaving in ways we’d like it to. A great deal, for instance, goes into the NYSE. Every time more money is pumped into the economy, more goes into the NYSE. Mr. Bernanke’s hope has been that “wealth effects” would drive spending, but that is a weak linkage.

I am starting to think that money can be taxed out of the economy and used to reduce the deficit just because it isn’t accomplishing all that much … especially in the hands of savers like me.

Here is the ultimate compromise that both sides would jump at: Congress goes on a four year overseas junket. The president goes on a four year farewell tour. When they get back, there is a budget surplus, unemployment rate is 2 %, gas prices are $2 a gallon. Finally we have a good use of taxpayer money – we will be glad to help pay for their trips !!

One requirement: they must take Chris Matthews and Sean Hannity with them (on the same plane together) !!

@Andy:

I can’t provide one but my understanding was that essentially he’d regurgitated a previous Obama budget proposal which produced these kind of numbers and it was this that had left Boehner and co so flabbergasted.

@john personna: Except most of that saving is for pensions and retirement. I’ll have to dig up the link, but I read a study recently that estimated that institutional investors account for as much as 70% of the stock market. And really, where else can such money go with Bonds and treasuries paying practically nothing in interest?

@Brummagem Joe:

Do you really think that the federal government spending will decrease as the Democrats become the dominant party? How soon do you think that the U.S. will end up with single payer healthcare? How will adding millions of immigrants of the third world affect governent spending.

The only way that the Democrats can hold their very big tent together is with massive amounts of federal spending. And the only way that the Democrats can maintain higher levels of spending is by deficit spending and more entitlements.

The future of politics in the U.S. is entitlements and how to pay for them. There will be no discussion on reductions in entitlements.

Of course, no one has bother to point out that the Democrats have gone from offering more spending cuts than tax increases to talking about nothing but tax increases with a small amount of decreases in the growth of spending.

@Andy:

Who has the money?

Remember, the top 1% of households hold 34.6% of all private wealth.

@this:

Also of note, “the bottom 90% have 61.5% of their wealth in their homes.”

@Brummagem Joe: Yes, I think the proposal was based on the President’s 2013 budget proposal with called for 1.6 Trillion in revenue increases. I’d have to look it up, but you might be able to get to $4.5 trillion by eliminating almost all the Bush and Obama tax cuts.

@john personna: Yes, I’m aware of the wealth numbers. The fact remains that when it comes to the stock market, institutional investors dwarf the 1%. Therefore, if one wants to develop a policy to tax wealth or “savers” or otherwise get all the money to “behave” in the manner that one wishes, then it needs to be carefully constructed so that the policy only affects those one wants it to effect. That bottom 90% is depending on institutional investors meeting their 7-8% rate of return targets.

@Andy:

I’m not getting that. Are you making some argument that “institutional investors” accumulate nothing but poor people?

Don’t hedge funds fall in the “institutional” category?

@this:

See figure 12, here.

“The percentage of households who owned stocks either directly or indirectly rose from 31.7 % in 1989 to 49.1 % in 2007. However, the growth of ownership was disproportionately geared towards the top wealth classes. About 37% of the rise in overall value of stock holdings was garnered by the top of the top 1%, more than 80% by the top 10% , while as much as 90% went to the top 20%.”

@Andy:

I think I expressed it badly. I think the confusion is between overall anticipated revenues and the specific effect of these changes. Because so many numbers get thrown around I stick to one source the OMB. From 2012 to 2017 they’re projecting an increase in annual revenues of about 350 billion bringing the deficit down to about 3% of GDP. I thought I’d seen some extrapolations earlier in the year that projected this going to 450 billion over ten years which as I said I regard as a joke but I’m quite prepared to admit to a senior moment. That said I don’t agree with your basic premise that this is all marginal stuff. The deficit as % of GDP is going to be around 6 this fiscal which is quite a drop from the 10 of three years ago. Basically revenue needs to get to around 20% of GDP up from this year’s projected 16 % which in itself is better than the 15% of the last three years.

@superdestroyer:

Do you really think that the federal government spending will decrease as the Democrats become the dominant party?

To start with the Democrats aren’t the dominant party and unless you’d noticed the deficit has gone from 10.1% of GDP three years ago to a projected about 6.25% this fiscal year.

@john personna:

Don’t hedge funds fall in the “institutional” category?

They do but much of their money is coming from private and public pension funds

@Dave Schuler: It’s an interesting argument, Dave. Both sides seem convinced that we have to whittle down the deficit and the question is over whether this should be done by modest take hikes, modest spending cuts, or both. I’m trying to come up with a proposal that achieves the targets and that’s less dumb than the compromise proposal that Klein points to as where the insiders think we’re headed.

It may well be that the underlying assumption–that we need to fix this particular problem in the short run—is flawed. Indeed, I’m not sure that austerity makes sense given our ability to borrow money for practically nothing and the fact that most of what we “owe” is to ourselves. There doesn’t seem to be a lot of momentum behind that notion, though.

@Tsar Nicholas: I didn’t address this argument in the post, which is already too long, but I’ve addressed it before: Social Security and Medicare are welfare programs for the elderly paid for out of the general Treasury. We need to stop pretending that they’re insurance programs paid for by the beneficiaries and placed into trust funds.

@john personna: I’m talking about people’s pensions, not stocks that individuals directly own. CALPERS (the pension system for California’s public employees) accounts for $250 billion in assets all by itself. Pension investing alone in the US accounts for $16 trillion dollars in assets. That is working people’s money. The total value of stock market assets is currently about $30 trillion dollars.

So, what I’m saying is that if you want to go after the wealth of the top 10% or 1% or whatever, then you should realize that their money is invested in the same assets pension money is, and much is managed by the same people and institutions that manage rich people’s money. So, whatever your proposal is, I would hope that it doesn’t end up screwing the pensions funds in an attempt to get at the 1%’s wealth, especially considering pensions are already finding it difficult to meet their future obligations. Those obligations are considered “assets” by a lot of the “90%” who are counting on the money they were promised being there when they need it.

@john personna:

That´s an obvious result if you have both a policy of easy money(AKA as Free Money to the banks) combined with a policy of artificially low interest rates.

@Brummagem Joe: No worries, there are a lot of moving parts in the budget and these are iffy predictions dependent on a lot of questionable assumptions. Is it $450 billion a year or is it $450 billion over ten years or over some other time period? That may explain the discrepancy.

I’ve given you guys the numbers.

People outside the top tier have most of their money in houses, not stocks.

Stocks are overwhelmingly held by the wealthy.

I don’t really see why this should be shocking or threatening. We are talking about income tax regimes, and how those affect the wealthy. I’m saying we can tax income on high earners because they have this great wealth which is not driving the economy terribly well.

What I’m suggesting is the logical completion of the “wealth creators” argument.

(I mean, I’ll just let it go by that people think you can’t tax the rich because that automatically taxes the poor. That assumes all kinds of crazy steps in-between.)

I call BS on Ezra Klein’s “Smart People” proposal.

First of all, these “Smart People” sound like the same ones who predicted a down-to-the wire, nail-biter election finish. How did that end up?

Secondly, raising the Medicare age would be a HUGE concession and bad policy, as Ezra Klein noted in this article. Also too, 70% of Americans oppose it-including other Democratic leaders. You don’t offer it unless the Republicans are rolling over on everything else.

Thirdly, there is no good reason for Obama to be giving any concessions at this point. As James points out, he has all the cards. If there is one thing people agree on, Obama is a rational man.

This proposal strikes me as a trial balloon floated by one of the numerous VSPs who think that cutting the deficit should be the number one goal of government, politics be damned. I would ignore it.

@john personna: Except your numbers don’t account for pensions.

No, that’s not what I’m saying, please read what I wrote again. I said that whatever you do, you probably don’t want to hurt pension investing because those are assets that benefit working people even if they don’t directly own the assets.

And now I’m confused because you started out talking about wealth and now you’re talking about income. I had thought you were talking about taxing wealth in the stock market, but perhaps I misunderstood.

@john personna: We are talking about income tax regimes, and how those affect the wealthy.

But you weren’t talking about taxing incomes. You started talking about taxing owned assets. Ot takings. If you demand a portion of the wealthy’s assets, i.e., property, they will have to sell assets to generate the cash to transfer. Such a large sell off will depress stock market prices affecting the pension assets. Plus, that money will now be removed from the investment pool resulting in an across the board lower capital valuation of the market. Not to mention, you start not a income realization shaping scheme but an asset defense scheme which would prompt other assets to be sold off and transferred to non-taxed assets or those easier to move and hide. Resulting in a further decline in the valuation of stocks. Such declines would make borrowing and expansion more difficult for businesses, resulting is less income generation, fewer jobs and less taxes paid.

Then we can discuss that asset “taxation” would destroy the concepts that built the modern world and brought billions out of poverty, namely, secure property rights and the rule of law.

It is a common theme. Socialists having neither the intelligence or skills to build wealth by doing something useful for their fellow man, i.e., providing a product or service others voluntarily purchase, seek to us government, i.e., the force monopoly, to remake the rules so that they can enjoy the fruits of others labors.

As the USSR proved with the Kulaks, as Mugabe proved with the Zimbabwe farmers, you can take the productive assets of your disfavored “wealthy” but that way only leads to starvation for the people. Although, the “elite” socialists do get to live well while the people suffer and die.

@Andy:

Well this is rather the whole point isn’t it? The Federal budget is an enormously complex document (much more so than I or anyone else posting here is likely to have experienced). And then there’s the entire forecasting process. They haven’t yet finally settled the budget for FY 2013 which is 3 months old so those CBO ten year projections with all kinds of iffy assumptions that people love to throw around are complete nonsense. The OMB numbers have a bit of cred for maybe 2-3 years out because they are based on admin policies but that’s about the size of the window. Once you cut through all the fog the explanation for the ballooning deficit in 2008/9 is completely straightforward at the macro level. A federal budget already swollen by off the books wars and unfunded programs stepped into a fiscal crevasse when receipts collapsed to 15% of an economy that itself shrunk by around 3.5% in real terms for a while when for the 35 years between 1965 and 2000 they’d averaged around 19% of GDP. At the same time federal outlays shot up as they always do when a recession hits.Return federal receipts to that 35 year average and you’ve largely solved the problem although they probably have to go a touch higher because of the boomer factor.

@Andy:

I’m talking about people’s pensions, not stocks that individuals directly own. CALPERS (the pension system for California’s public employees) accounts for $250 billion in assets all by itself.

I’m not going to try and disentangle what JP says but broadly you’re correct. In absolute dollar terms it’s the savings oriented institutions that have the most funds to invest and Calpers for example directs many of them to hedge funds. That said there is still an enormous concentration of wealth although you need to spread the net a bit wider than the top 1%. Basically 85-90% of the liquid assets in the country (ie. stocks, bonds, IRA’S, 401k’s, futures, pension rights, etc) are owned by about 10% of the population. This of course excludes real estate but if you throw this in I think the figure is something like 75% is owned by the top 20%. In absolute terms the 15% of liquid assets owned by 90% is still quite a lot of tin of course.

@JKB:

As the USSR proved with the Kulaks, as Mugabe proved with the Zimbabwe farmers,

Really there should be a Godwin’s law that applies to 21st century US comparisons with Soviet Russia and Zimbabwe. You could throw Greece in as well….LOL. Isn’t there a name for this sort of totally asinine fallacy?

If the democrats don’t stop refusing to sacrifice to the GOP’s ideological gods, then the GOP will never learn. That’s what drives me crazy. Tell the GOP no, and tell them to come back with something that actually saves money.

There are many things that both sides could compromise on, but raising the Medicare eligibility age cannot be one of them. Better to go over the cliff at that point.

Since you asked, if Medicare could buy drugs at the same price as the VA, we could save $14 billion a year.

http://theincidentaleconomist.com/wordpress/what-if-medicares-drug-benefit-was-more-like-the-vas/

Steve

It wasn’t that hard.

We were talking about adjusting our current tax system and impacts on the economy. Dave thought the economy needed more money. I observed that money flows go to financial assets, primarily the hands of the rich. Taxing the rich more, by current means, would likely only reduce growth in financial assets.

I frankly have no idea why Andy bent that to talk about non-rich people, and how they own a minority share in the financial markets. That’s important why?

@JKB:

I am talking about how existing patterns of income and tax have shaped the financial markets, and vise-versa.

Now, if your goal is to support the rich, the top 20%, you won’t worry about what increasing concentrations of wealth in the stock market do to bottom 80% outcomes.

You don’t seem to understand some pretty basic concepts

The subsidy is to the credit markets – it lowers the consumer cost of borrowing money allowing them to borrow more. Renters also benefit as consumers of mortgaged property as the owner has lower costs. It actually is a contributing factor to bubbles becaus it incentivizes assuming more debt. It only helps equity in an up market fueled by cheap money or if the borrower pays off more principal with the tax savings. It does have some stimulus benefit in that almost all homeowners turn around and spend the money on consumer goods/services

No – they want to pretend that they are going to reduce the deficit. This is politics.

While this kind of loony horse$hit sold very well when Joe McCarthy was a senator, no one, except those in the crazy 27% (you seem to be a card-carrying member) is buying any of that ridiculous nonsense now…

@john personna:

I didn’t bend anything, here’s the first thing you wrote:

Maybe it was presumptuous of me to assume that you’re not rich, but it doesn’t sound like you’re talking about the rich here. It sounds to me like you’re suggesting that money going into equities and money in the hands of “savers” could be better utilized elsewhere. Like I said though, maybe I misinterpreted you.

As for why it’s important – well, the myth that equities is mostly about the fat cats is pretty persistent and a lot of people don’t seem to realize that pensions, for one, are huge players in the markets.

@Andy:

It was really pretty dumb to assume I was talking about the non-rich.

God in heaven, you KNOW they are not the ones accumulating financial assets.

@Andy:

BTW, get over this innumeracy. When:

That INCLUDES pensions. You go on about CALPERS and billions, when the rich own trillions.

More data here.

There is a headline $18T, but it INCLUDES the 401K’s (DC plans) and IRAs already discussed.

Defined benefit plans are 2.4T total.

And remember, all those include many rich people. Mitt Romney was probably not alone when he stuffed $102 Million into IRA …

@Andy:

As for why it’s important – well, the myth that equities is mostly about the fat cats is pretty persistent and a lot of people don’t seem to realize that pensions, for one, are huge players in the markets.

Although there is undoubted wealth concentration the 10% who own 85-90% of liquid assets including equities through the medium of pension funds, 401k’s, IRA’s etc includes a heck of a lot of people with incomes under 250k who would not be deemed “rich” but do have a have a considerable stake in financial markets.

http://www.data360.org/dsg.aspx?Data_Set_Group_Id=2362

And of course it goes way beyond just equity markets in terms of its impact on ordinary people. These savings orientated vehicles are also big players in the corporate and sovereign bond markets which affects the general level of interest rates, industrial investment, job creation, etc etc.

Basically, I am arguing from 30 years of inequality data. Remember this old story:

Americans Want to Live in a Much More Equal Country (They Just Don’t Realize It)

I think that Andy is arguing from that “expected” profile in chart 1, and I am hitting him with “actual.”

Joe, you should know better.

@john personna:

Well, then I guess me and a couple of other people in this thread who misunderstood you are dumb for not understanding you….

@john personna:

Joe, you should know better.

Better than what?…..where have I made any comment that is either incorrect or indeed substantially at odds with your assertions about wealth concentration. For example my income is under 250k but I have quite a substantial IRA, but I wouldn’t categorise myself as rich. One of these days you’ll learn to control your ego.

@john personna:

No, you are assuming that, something you’ve been doing all thread in your attempts to pick a fight. Here’s the point I originally made:

You never really addressed that, and my point isn’t dependent on how much the wealthy have compared to everyone else, nor is it dependent upon the expectations in the chart you just linked, nor is dependent upon you believe I argued instead of what I actually argued.

Ok, stick a fork in it, I think this thread is done….

@Andy:

When I politely said “I’m not getting that” that was probably the time to slow down and think about what I said.

@Brummagem Joe:

I understand perfectly Joe. You wanted to argue Andy’s side, even though you knew I was right.

@Andy:

I called bullshit on this:

That is not consistent with the inequality data. Stock market returns are not an “every man” problem. They are a problem of the top 20%.

The “bottom 90%” were never under either a DB or DC program:

That fairly healthy 38% enrollment in a DB pension was nice, but it is not our current world.

@john personna:

Well, there’s your problem John, you decided to pick sides, assumed me and Joe were on the wrong side and spent the thread valiantly fighting your strawman. You keep avoiding the point I actually made. As I’ve said a couple of times now, my point isn’t contingent on how much wealthier the rich are than everyone else. Even if you, personally, think the assets (actual and deferred) of the bottom 80/90/99% are minuscule, that doesn’t change the purpose behind what I wrote, which was to suggest that we should probably try to protect the assets of those non-rich people when considering policies. And the reason is that those non-rich people are depending on those assets a lot more than the rich people are. Your only responses to that point were a litany of googled-up statistics in an apparent attempt to prove to me that the non-rich have fewer assets than you think I think they have.

Whatever John, I’m done with this. People can read the thread and make up their own minds.

@Andy:

Look back up the thread. I made a polite comment to Dave.

You made a comment to me that was off in a weir direction and wrong.

Now you want that to be my fault.

Project much?

@Andy:

To demonstrate AGAIN why this comment about the 90% depending on stock market assets is wrong, consider:

Median Net Worth by Age

The median net worth, for all assets, including homes and cars, for 65 YOs was $170,494 in 2009.

If I do you a huge favor and assume that 100% of those assets are in a retirement portfolio (no house, no car), they yield about $13K/year at your 7-8%. That is not a mainstay. That is a supplement to Social Security.

IOW, don’t fall for the Romney trap, that all you need is a strong stock market.

Rather, you need strong Social Security.

Yet more:

@john personna:

I understand perfectly Joe.

You understand nothing.

@Brummagem Joe:

This is where you got cute:

You weren’t going to “disentangle what JP” because that would have been admitting that while Andy “was correct” you were trying to explain to him why, in fact, I had it right.

@john personna:

Look, if people who aren’t in the top 10% have a pension, or if they have 401k money or whatever that they’ve saved for the future, they are, in all likelihood, DEPENDING on those assets for the future. I mean, presumably they saved that money in a retirement vehicle for some purpose. I can’t speak for everyone in America, but I don’t know anyone (including me, BTW) who puts money into those assets, or takes a job with a DB pension as part of the compensation package, with the expectation that they won’t depend on those assets in the future.

Where did I ever suggest that SS wasn’t important or where did I ever say that those assets would represent a “mainstay?” You are, again, making a whole bunch of false assumptions about what you think I think and then attacking those assumptions.

I’m not falling for the Romney Trap. That is yet another wrong assumption on your part.

@john personna:

Correct about what exactly, JP? So far I don’t see substantial disagreement except you have yet to directly comment on what I’ve repeatedly said about protecting the assets of non-rich people when considering policy.- instead you are disagreeing with strawmen and continuing to belabor the obvious point that wealthy people have a lot more assets than less wealthy people.

@Andy:

Dude. Look at your first claim:

I have been explaining that “most of that saving is [NOT] for pensions and retirement” ever since.

You say now that you don’t see substantial disagreement, well YOU HIT ME WITH THAT CLAIM, I did not answer you or make any attack on any of your arguments.

I’m pissed because a fairly simple observation was never addressed, the flow of funds generate by Fed policy to financial wealth and not jobs .. instead we had this stupid digression, that we must protect the stock market because poor people depend on it.

No. Poor people do not have significant stocks, very few have defined benefits programs, and those defined benefits programs depend on much more than simple NYSE capitalization.

@Andy:

Look on the bright side Andy……isn’t it wonderful to have an amanuensis with such powers of invention and the ability to read minds.

@john personna:

I’m pretty sure Joe never said that we must protect the stock market and and I’m positive I never did. I don’t actually recall anyone saying anything about that except you. So who is responsible for this stupid digression?

Well, I don’t really disagree with that, but, again, that’s irrelevant to my point. If you go back and actually review what I actually wrote, you’ll note that I never mentioned poor people, much less ever said that they had significant assets that need protecting. Is this another “debate” where the only participant is you?

There are people, however who aren’t poor but also aren’t rich and a lot of those people have assets or promised pension benefits they will depend on for retirement. Therefore they do have a stake in what happens to those assets whether you choose to admit it or not. What I’ve suggested umpteen times is that you might want to keep them in mind when formulating policy.

@Brummagem Joe:

Thanks for the new word, I had to google it. Pretty cool.

@Andy:

Thanks for the new word,

Well strictly speaking it means someone who writes down what you say but this is sometimes stretched to mean someone who becomes your interpreter as with music for example. One of our friend’s problems is that his meanings are often rather obscure and they become progressively more obscure as he thrashes around so at the end of any conversation one is left rather perplexed. Jefferson said that ideas need to be expressed clearly so that the mind can engage with them and I think he must have had this fellow in mind. Although to be fair this sort of muddying of the waters, loose use of language (for example the other 90% aren’t all “the poor”) and misrepresenting what one said is a not uncommon ploy. If you look at that little chart I put up 4/5 ths of the top 10 percentile of income earners have incomes under 300k, many well under. This is at least 20 million people possibly 25-30 million when you count joint filers and essentially is the entire middle to upper managerial and professional class who the very people who collectively are the client base of financial institutions producing savings orientated products like mutual funds, annuities, IRA’s, life insurance, etc. And not by any stretch of the imagination are they rich in the 1% sense but they have a major stake in financial markets. Our friend is right when he says the direct or indirect holdings of equities starts to fall dramatically once you get beyond the top 10% but this doesn’t mean that equity and other financial markets don’t have an impact on these people in lots of other ways like interest rates, consumer confidence, insurance rates, credit availability, etc etc.