Jim Cramer’s Crystal Balls

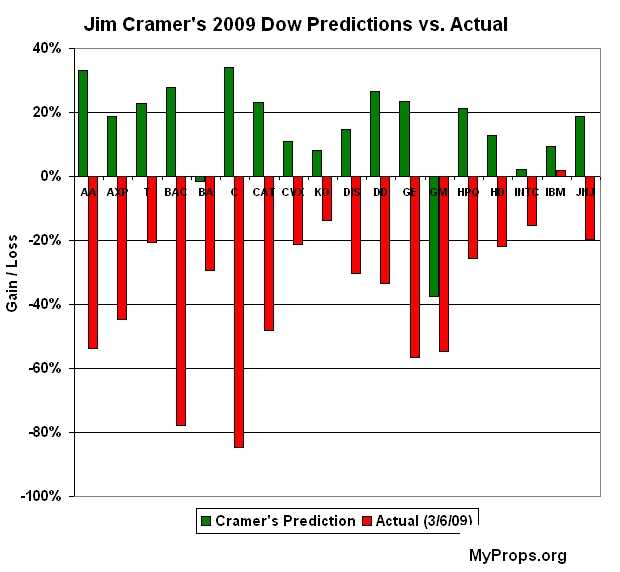

Dylan Matthews, guesting at Ezra’s place, provides this handy dandy chart to track Jim Cramer’s predictions on the Dow:

He concludes,

Actually, I’ll give Cramer some props. With the small exceptions of Boeing, GM, and IBM, the market tends to do the reverse of what he anticipates. Remember that Seinfeld episode where George decides to do the opposite of what his instinct tells him, and his life instantly improves? Cramer’s investment advice is kind of like that. You can make some money with it, provided you short the stocks he likes and buy the ones he tells viewers to sell.

Now, to be fair, these predictions are for a very short period and a particularly volatile one. So, perhaps Cramer has been much better over the long haul.

On the other hand, Cramer isn’t merely a prognosticator, he’s the host of an insanely popular (by the standards of CNBC, anyway) host of an investment show. Presumably, an not insignificant number of people actually go out and buy and sell based on Cramer’s recommendations. So, Cramer’s actual predictive skill for the charted period is inflated by that fact — meaning, his predictions would be even worse if he were writing them down and not influencing events!

Reminds me a little of Tim Taylor’s description of Tool Time: the 3rd highest rated tool show in eastern Michigan on basic cable.

This looks a bit bogus, though the original data is not linked when I click through. If I understand it correctly, this is what the first entry in the bar graph means:

American Airlines traded at $11.26 per share at the close of 2008. Cramer is predicting the shares will hit $15.00 by the end of the 2009. As of 3/6/09, American Airlines is trading at $5.22 per share.

His prediction is well off if 3/6/09 is any gauge. As of 12/31/09, who knows?

There is a very good book called Your Money and Your Brain. Whoever did the subtitle got it wrong. It should be “How a little self-brain-knowledge can keep you from getting poor, fast.”

Cramer, and most daytime financial channels, cater to the wrong impulses, the risks that are more likely to make us poor than rich.

The steady, sane, less emotional stuff of good financial planning doesn’t make as exciting TV.

If I’m remembering correctly, Carmen Ulrich on CNBC is a little steadier and saner … but less exciting, right?

Anyway, I’ve done a fair amount of reading on the boundaries of brains and money (Blank Slate, Winner’s Curse, Descartes’ Error, Fooled by Randomness, Cheating Monkeys Citizen Bees, etc.) and I’ll say take Zweig’s book over Cramer.

The continuing Cramer sage on the Daily Show has been hilarious.

Now I’m far from being Cramer fan but doesn’t this seem unfair? How did the other guys do on their predictions? When did Cramer make these predictions? If these are 2009 predictions why are we measuring them two months into the year?

Looks to me like when Cramer crossed the Obama administration he made some enemies. Lovely. I like to think my president’s supporters are capable of character assassination since it bodes well for all critics and we know such dissent is the highest form of patriotism.

Who cares what the Daily Show is doing, it’s comedy, not news. It’s for kids and slackers who can’t handle adult commentary on real issues.

Steve, the thing all the brain research tells us is that we are prediction junkies, even when we know all the predictions are bad.

I mean, think about all the people to come on TV to give the year’s closing DOW. They are wrong, except for some random SOB, but we keep tuning in, right?

No time to lose, Steve. IIRC James, Dave Schuler and others at OTB have made their predictions for 2009. Time to evaluate whether they were right or insane. In times of bread and circuses, I know it makes me feel better to send in the clowns.

The unedited Stewart interview with Cramer was devastating.