Strong Q4 Growth

Plus an observation on news coverage.

Via Yahoo! News: GDP: US economy grows at 3.3% annual pace in fourth quarter, faster than expected.

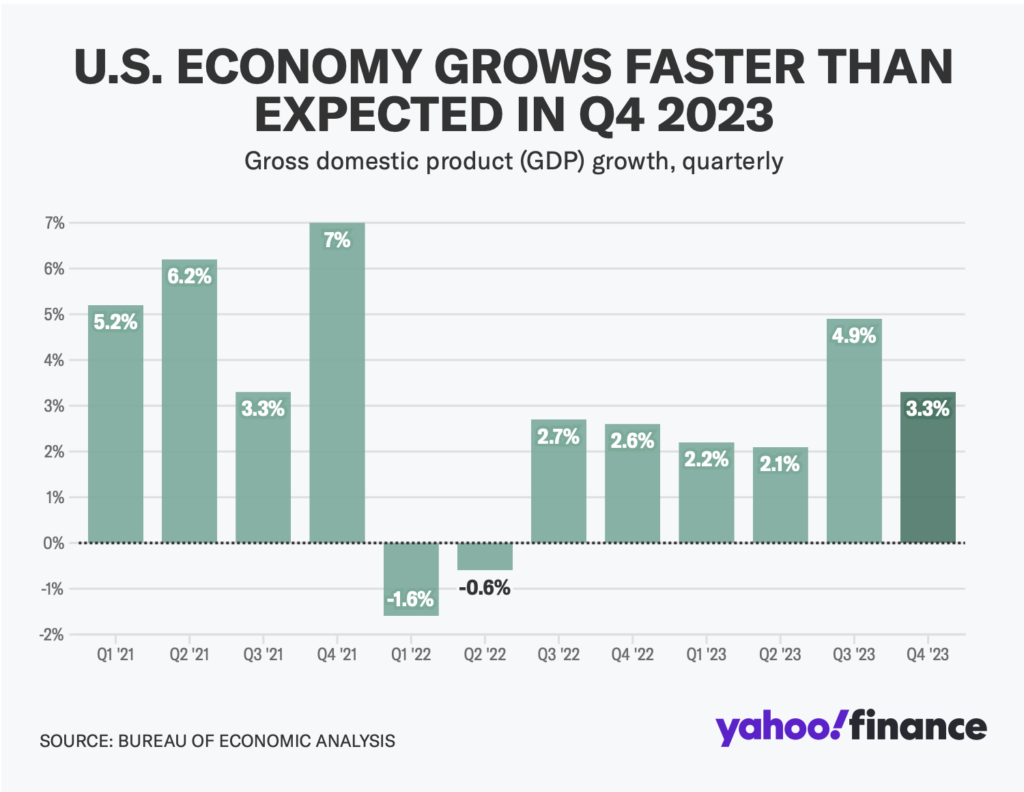

The Bureau of Economic Analysis’s advance estimate of fourth quarter US gross domestic product (GDP) showed the economy grew at an annualized pace of 3.3% during the period, faster than consensus forecasts. Economists surveyed by Bloomberg estimated the US economy grew at an annualized pace of 2% during the period.

The reading came in lower than third quarter GDP, which was revised down to 4.9%. For the year, the US economy grew at an annualized rate of 2.5%, up from 1.9% in 2022.

In handy chart form:

This is simply good news and, really, given the economic headwinds that the country has faced since the pandemic, somewhat surprising. I know it is fashionable to dismiss good macro-level indicators, but growth is good, even if it is not all you need to know about the economy. As has been noted before, the US has out-performed most other OECD counties in weathering the post-pandemic economic era.

Indeed, it is worth noting that there was long talk of a recession, and yet, here we are. Indeed, Investopedia noted back in December:

Last January, the Wall Street Journal asked a panel of 70 economists to rate the chances of a recession in the next year. The average answer was 63%.1 Unless something drastic happens in the next few days, most of them got it wrong—2023 came and went with no recession in sight.

A side note on media coverage. I knew that the GDP figures were going to be released yesterday, but I had a very busy day and did not look at the news until late in the evening. I surfed to CNN and the NYT both, as I expected this to be a front-page story, but even when I looked at “US” as a specific category, I saw nothing. I finally broke down and Googled “GDP growth” and found the stories.

While the GDP figures are hardly the most important story of the day, it is odd (to me, at least) that I couldn’t find the story on the landing page of two major news outlets. While I do not expect news of Q4 growth to radically affect public opinion on the economy, it can have no effect if news consumers are unaware of it entirely. Further, I expect that if the number had been worse than expected, the stories about impending doom would have been far more prominent, as the question, “How Will This Affect Biden?” would have been ubiquitous.

Update: Meanwhile, via HuffPo: ‘Whoa!’: Trump’s Top Economic Adviser Shocks Fox News Host With Biden Economy Admission.

So there’s that. The lead-in, where the anchor makes sure to counter-balance the good news with (vague) bad news is telling and Kudlow’s response on air is a bit more muted than the write-up suggest.

And I’m sure these economists accurately represented the field as a whole and were not cherry picked for their sympathy with the WSJ’s political agenda. /sarc

I think it’s entirely likely economists two centuries from now will view economists from the XIX, XX, and XXI centuries the way we view alchemists and natural philosophers.

Sure, they made a few valid discoveries, and some intriguing finds, but overall they had no idea what they were talking about.

Waiting now for our trumper commenters to admit they were wrong in their “Biden is bringing us to disaster” predictions…

I kid! We all know that they are predominantly driven by racism and, at least in one case, misogyny and Trump is their golden boy for that. Everything else they ever said is just word confetti they toss up to distract.

“No one can predict the future, least of all economists.” There’s a guy on YouTube, an Aussie economist who includes that disclaimer in each show. So why do we keep listening to them? They aren’t prophets, they’re archeologists. They only know what has happened, past tense.

In the space of what, two years or so, we’ve gone from China’s gonna rule the world! to China’s flat on its ass and it’s moment in history is over! Add that to the great, Japan is gonna take over the world! and, The oil states are gonna. . ., and even, back at the dawn of time, The EU is gonna. . . Then of course there are the perennial predictions that Brazil or Indonesia or no doubt Burkina Faso is going to become an economic powerhouse. Now, it’s India. India’s gonna take over the whatever!

Meanwhile, Trump keeps talking about “The worst economy of our lifetime”, “The US is failing.”, “Country is going to hell.” etc. etc.

Keep talking, Donald. Keep talking.

@EddieInCA: Haley is saying that, too. As are most Republicans, I imagine. They can’t win on reality, so they run on fantasy.

After what CNN and the New York Slimes did to Hillary Clinton in 2016 when she was warning the nation about Trumpism, I’m no longer surprised by these outlets’ editorial miscues.

This tracks.

@EddieInCA:

He’s referring to the Trump economy that resulted from him worsening COVID outcomes with dishonesty and incompetence, no?

Meanwhile, down where the proletariat eat, you have these stories trending.

Not to mention, the layoffs in the news media always provokes “journalists” to start writing negatively about the economy. After all, they are in a Depression with massive job losses. And the rest of the people just don’t matter to them.

MGAA – Make Groceries Affordable Again

@JKB: meanwhile, on my McDonald’s app, there is a 6 buck meal deal, points that can be used for free food and the store itself has buy one get 1 for a buck on all their popular items. Sorry these whiners can’t clip electronic coupons or take advantage of the no app needed deals. Hell, I literally, a half hour ago, just got 2 big macs, a quarter pounder with cheese and a mcdouble for less than 10 bux before sales tax. Maybe they shouldn’t expect the hand of government to set prices and instead take advantage of all the possibilities that our great capitalist system affords them, amirite?

@JKB:

I almost quipped that we should all brace ourselves for JKB to show up an drop this in the chat.

@Steven L. Taylor:

Giving credit, MGAA doesn’t work for gasoline much anymore. Well, outside California, but where I live gas ain’t half bad if you’ve got a job.

@Thomm:

The point was not the price but that they were making the youth news of Tik Tok and X. Cite all the CNN, NYT, WaPo you want over the economic growth but the 20-something vote gets their info from the CCP heated Tik Tok

@JKB:

Yes, and pretty much everyone who wants a job, has one. Right? So, you’d agree that when Trump rants about American carnage and the worst economy ever, he’s lying. Right? Can you say that? Can you admit Trump is a liar?

@JKB:

as translated from the original MAGA scriptures: LTECA – Let Them Eat Cake Again

@JKB: is that why you linked to a YouTube and not a tick tok? Keep spinning in circles…I swear, my shih Tzu catches his own tail more than you do.

@JKB: also,no didn’t cite any of those sources, but instead what is available in the real world along with a pertinent, real world, extremely recent experience. Maybe if you were such a man of the people as you like to claim, you would have known about those things and seen that video for the whining it is.

It appears that Biden’s plan, for growing the economy from the bottom up and from the middle out, is working.

Which, in a normal world would put an end to the trickle-down nonsense. But the rapist is still clamoring for more tax cuts for the wealthy.

The two sides are not the same.

@JKB: So you’re colluding with the CCP to tear down America again? Good to know where your loyalties lie. But you’re cheering for a recession too.

Economists have always had a terrible track record when it comes to forecasting.

That said, just based on historical patterns, it did seem likely that Fed rate increases were likely to cause a recession.

But it does make me wonder what is happening. We had a very long period that required near-zero interest rates just to sustain modest growth. And now we have excellent growth with much higher interest rates. Will interest rates eventually slow that growth or is this the new normal?

I have no idea and would not trust the aggregate opinion of any group of economists.

But politically, if the current trends continue, it’s obviously good for Biden. The effects of inflation will recede in people’s minds and combined with full employment and good growth, it’s hard to see how Biden would lose.

But a lot can change in 10 months. The lack of skill in economic forecasting works both ways.

@Andy: What happened is that there was a massive stimulus, where the government borrowed money at those crazy low rates, and then spent it on stuff. The people who got it from the stuff the government bought turned around and spent it, and more people got some of that money. We did this basically twice, the second one was bigger and was done as Covid was receding.

Now, this is not a perpetual motion machine. The stimulus money gets spent maybe 2 times over, and this shows up in GDP and growth numbers.

This is an empirical fact. Republicans and conservatives tend to hate this pattern because it’s Big Government. Milton Friedman did not deny this is what happens, he argued that putting things in the hands of politicians will mess things up and they will overdo it and we will get massive runaway inflation. This is a thing that happened in the late 70’s.

We really haven’t done much of this since then, though Republicans have loved to send out “stimulus checks” during downturns. These probably help a little, but they aren’t as big as the thing we just did.

Now, we got inflation along with the growth. This is also a predictable event. The debate among economists – when they are talking to each other, not on media – is whether it was a “transient” or a “durable” effect. In short, how long would it last? It lasted probably longer than the rosiest predictions of Team Transient, but still not very long. And the Fed seems to have got it about right with their intervention, despite a lot of nervousness. Inflation is down, but there’s still good growth.

And yes, this is Bidenomics. That big stimulus, along with the management of inflation by the Fed, is what did this. We did have some inflation, but that’s a much better thing to have than massive unemployment. Inflation is kind of a First World problem, really.

@JKB: In major college towns in New Hampshire, Joe Biden’s percentage of the Democratic vote was consistently higher than his statewide average. For example, in Hanover—home to Dartmouth—Biden captured 79% of the Democratic vote, compared to his statewide average of 64%.

Trump underperformed in college towns in New Hampshire and Iowa. In those towns, Trump averaged 30% of the vote, compared to 55% statewide.

Youth voters are woke, know climate change is real, support LGBT rights, support multiculturalism and diversity, know tax cuts for billionaires don’t help the economy, want student debt cancellation, support gun control, want abortion to be legal, and despise Trump.

Cite TikTok all you want, but youth voters are still disgusted by liable-rapist sore loser Trump and uninterested in his Republican Party of insurrectionist, climate change denying, gay bashing, trans-hating, anti-black, anti-woke, book banning, tax-cuts-for-the-rich forced birthers who oppose student debt cancellation, healthcare reform, and gun control.

Let me preface this by saying that I am not intending to defend economists. Or to make any other kind of point.

I am saying that it’s a pet peeve when people cite probability data and then go on to talk about “right” and “wrong” predictions. That is all.

@EddieInCA:

Going down the stretch in the last election, I seem to remember Trump assuring us that “your 401K will be worthless” and “the suburbs will be in flames” shortly after a Biden victory.

@Jay L Gischer:

The difference prominent members of Team Transient — like, say, Paul Krugman and Alan Blinder — have admitted what parts they got wrong and publicly grappled with why, how, and lessons learned for their future theorizing.

Wheras the experts who’ve spent the past three years loudly insisting with too little hedging, humilty, or hesitation that there was too much stimulus and promising a recession — “ok, not this year, but next year… no really this time!” — are *crickets*. Jamie Dimon? Larry Summers? Megan McArdle? Whereforeart thou?

Same as with the talking heads who pushed the Big Giant Red Wave 2022 narrative, they just get to memory-hole how loud and wrong they were. And yet the legacy media still goes running back to them for more overly-bold prognostication.

Sen. Warren accused the Fed of killing the economy and last March said Powell had failed. What say you now, Liz? Bueller?

@DK:

I was literally just going ask what Larry Summers had said anything about this latest incident of him being completely wrong, once again in the direction of advocating for millions of people to be laid off. As for the others, Dimon is on the Fed Reserve because he’s a banker and knows how banks worth, not because he knows anything useful about economics. McCardle is a typical and lifelong Libertarian, meaning she thinks any half formed thought she pulls out of ass is worth more than actual facts. Listening to her can only make somebody stupider.

@JKB:

And just how do you propose to reduce the price of groceries?

Price controls?

Rationing?

More broadly, the US is by far the best performing Western economy, on a balanced inflation reduction/growth/employment basis.

Trust me, the UK would LOVE to swap your problems for ours.

Granted, this is hardly all due to administration policies; but than, neither were the prior problems either.

The point is, the administration has avoided screwing the recovery, and put in place the basis for medium- to long-term economic reconstruction.

It might have done more, if Congress were not a dysfunctional clown-car pile up.

As for reducing prices, this is unlikely, unless you want to initiate a deflationary episode?

Trust me when I advise that such rarely end well.

Call the 1930’s and ask them.

@Jay L Gischer:

I agree with a lot of that, but the story isn’t over yet. The effects of various actions have not fully played out. One particular area is interest rates and housing.

And, of course, there are always the normal vagaries of the business cycle and international trade.

Quite the opposite, actually.

@DK:

Several members of Team Transient loudly criticized the Fed for increasing interest rates. The argument was that increasing rates was unnecessary since, they thought, inflation was entirely short-term due to supply issues and that raising rates would overcorrect and create a recession unnecessarily. Well, the Fed raised rates, and no recession. We are left to wonder what the counterfactual would be if the Fed had done nothing.

I think it’s been a case where both Teams have been wrong in important ways and are now trying to retcon their arguments to be mostly correct in hindsight. Again, I find it weird that people have this instinct to pick a side in a debate where the stakes don’t really matter.

Anyway, lots of very smart people on both Teams thought that a big increase in rates from the Fed combined with normalizing supply chains and people spending down the stimulus payments and the end of massive government stimulus spending would at least create some recessionary pressure if not a full-blown recession. The Fed certainly seemed to make it clear they intended to defeat inflation even if that carried a cost. And the logic of the argument makes perfect sense. But we haven’t seen it. Both Teams were wrong about this. Or maybe the shoe hasn’t dropped yet.

My view is one of epistemological humility. There is still a lot of unusual things going on to add to the normal difficulty of economic forecasting.

Is there a reason you failed to note that every dollar of GDP growth was accompanied by about $2.5 in new debt? That’s the cost. That a byproduct of this growth is that all the related jobs (net) are accounted for by low wage foreign workers? Last time I looked that ratio of financed debt to output created dramatic inflation.

I understand rank partisanship. But what of rank dishonesty and some sense of even handed perspective?

Do you have no economic understanding, or shame?

It’s gratifying to see some on the right finally acknowledge that taxes on corporations and high earners are too low.

@Jack:

Except the debt growth does not relate directly to GDP growth.

If it did, countries that have increased debt more than the US might be expected to show more growth than the US.

They have not.

If all the related jobs were those of “low wage foreign workers” that might be expected to show up in overall employment statistics.

What percentage of the US workforce is actually “low wage foreign workers”?

If you mean “illegal workers” would they show up in the statistics at all?

Debt does not necessarily cause inflation; unbounded monetary increase does, but this is obviously not occurring in the US, or else inflation rates would not be down and trending down.

If your primary concern is the level of deficit, and the overall debt trend, the solution is obvious: either cut the main spending programs (social security, health care, defense, medicare) and/or increase taxation.

Most “western” economies have functioned quite happily, from 1945 to date, with tax levels that if applied in the US would end the deficit problem without further ado.

@JohnSF

Ask those miracle makers in China about deflation. They are bleeding investment from every pore.

@JohnMc: Can you explain in more detail? I didn’t understand your comment.

@Jack:

I would note that GDP is a standard measure. So, deciding to accept it or to reject it based on who is in the White House is, well, the very definition of “rank partisanship.”

@Jack:

Lashing out here won’t make voters not notice that the economy generally performs better than Democratic than Republicans, or that the right’s trickle-down tax cuts never trickle down.

Fewer now take seriously conservative complaints about dishonesty, because partisan Republicans are the biggest fabulists in politics — which is saying something, because everyone lies. But modern conservatives take it to a new level. Lies about Jan. 6. Lies about slavery. Lies about education. Lies about the 2nd Amendment. Lies about Trump’s criminality. Lies about climate change. Lies about abortion. Lies about the border. I mean, really. Rank dishonesty? Lolol

Tell you what, bro. When Republicans stop lying on Trump’s behalf, we’ll stop telling the truth about the rate of growth under Obama and Biden outpacing that of Trump even before COVID, about Trump being an unlikeable and treasonous bastard, and about Republicans refusing to solve the border issues they pretend to care about.

Well, 50% of the problem is that non-economists think of economists as like TV Weather forecasters, which is not really the actual focus of professional work – although it is what Journalists treat economists like for quotes. Macro-economics is rather closer in analogy to climate science than weather forecasting – which is to say about large macro effects, structures, rather than monthly, quarterly micro evolutions. Economic data, even for developed economies with robust data, is simply too incomplete, too poor, too laggy, too messy, and generally too inaccurate to be able to be like (modern) weather forecasts. (there is quite a bit of abstraction and virtual magical thinking about economic data, the ugly reality is that it’s oft quite estimative due to pure collection/generation limits).

@Kathy: In 200 years with artificial intelligence and improved data collection in time and quality the data available may change the ability to better apprehend, although broad principals are clear enough – however human behaviour and understanding of it in really more rigorous scientific terms, of which biological, is likely to be important.

@Jay L Gischer:

No, no it is not. Inflation is generally much more serious (as in elevated – as e.g. double digits, and problematic in instability and unpredictability) in developing economies than First World.

@Andy:

As it happens one can look to UK as a comparable as well as Turkey for a more extreme case, to see reasonable counter-factual references.

UK as BoE started reaction on interest rates rather later than either of Fed or ECB and rather more timidly. Although there are confounding factors (always are) and has experienced higher sustained inflation and delayed come-down as compared to either of Euro and Dollar zones. Turkey is the unique case where until very late there was no response – for arguments rather like the US Left although infused with Erdoganism bizarités – and saw severe escalation until finally a new CB governor was allowed to institute more normal policy.

Overall the US ‘progressive Left’ inflation denialism was foolish and misplaced partisan reaction, Biden was quite lucky to have a sage response from Fed to avoid acceleration and have a price cycle that should by election time have cooled such that the perception of pain.

For anything political as like policy has this tribal team reaction tendency – inflation became a comment on their political preferences (more government action) rather than a technical adjustment of policy.

@Jack:

Debt has no necessary relationship at all to inflation. Expansion of net money supply does. Significant net new money creation running ahead of money demand generates inflation – which of course debt issuance binges can generate, but is not a necessary result.

@DK: As 2 of 3 of your anti-examples are not economists at all (a banker and a non-economist journo whose primary degree is in English lit) comparing apples to bananas is not much more than party political posturing and not particularly relevatory of either “team” (although characterisation via team itself is …. party political deformations). Intra-economist dicussion in any case not being something political partisans typically follow.

You know … the funny thing? Despite demonstrable things like corporate profitability and economic growth, corporate America continues to insist we are in a recession, and is making savage job cuts. Particularly in the tech industry. Due to pressure from Wall Street and private equity investors.

America’s business leaders like to claim that they are practical and data-driven and clear eyed. But here, clearly, a combination of ideology and groupthink is coupling up with some rank opportunism to boost revenues numbers and rake back some salary growth from workers … and it is producing a jobs recession at the time the rest of the economy is growing.

@Bokonon: What a bizarre Leftist bizarro world distortion into a bizarrely distorted Just So Story rooted in a priori prejudice and innumeracy.

Given job gains (net) it is more than evident that private hiring has remained strong, not “savage job cuts”

CNN 4 Jan 24

Evidently unable to distinguish between some cuts by some companies in certain sectors notably tech that over-expanded in Covid and individual statements, this is extrapolated into overgeneralisation about “corporate america”.

Wall Street and Private Equity are rather irrelevant to the vast majority of the private jobs market.

Actual US stock market performance (however unrepresentative of the broader economy) of late does not indicate “Wall Street” sentiment about recession or particular negativity, rather the contrary.

Not that this is particularly relevant to anything other than how partisan Just So Stories, be they Left or Right (as see the Republicans opinions expressed in re economic performance ex-personal), are more rooted in selection bias and tribalism