Student Debt and the For-Profit Connection

The loaners, the dreamers, and schemes.

James Joyner’s post on student debt forgiveness leads me to want to note a couple of things, especially given that my day job is being a university administrator (and my long-term career as a university professor).

Let me state up-front that I am positively inclined towards some level of debt forgiveness, but have no strong opinion about specifics and I agree that there are real problems with how we fund higher education in this country. (At a minimum, I think student debt should be dischargeable via bankruptcy).

I do think, and the empirical evidence backs me up, that getting a college degree is generally advantageous:

On average, an associate degree or a bachelor’s degree pays off handsomely in the job market; borrowing to earn a degree can make economic sense. Over the course of a career, the typical worker with a bachelor’s degree earns nearly $1 million more than an otherwise similar worker with just a high school diploma if both work fulltime, year-round from age 25. A similar worker with an associate degree earns $360,000 more than a high school grad. And individuals with college degrees experience lower unemployment rates and increased odds of moving up the economic ladder.

Source: Brookings, Who owes all that student debt? And who’d benefit if it were forgiven?

However, saying that does not mean that I think everyone should get one. Indeed, it is clearly the case that many people shouldn’t. I would also note that going into debt and not getting a degree is a major problem, as it creates an economic burden with no tangible benefits.

This leads me to a key aspect of this discussion that often gets glossed over in press accounts that have a bad habit of lumping different types of schools in the same conversation. The reality is that in broad brushstrokes we need to parse out 2-year v. 4-year schools and from there public schools, non-profit private schools, and for-profit schools. (Finer brush strokes would also distinguish between different levels of public schools and the different kinds of students they serve). An ongoing pet-peeve of mine is that most conversations about higher education seem to assume that all schools are like Harvard, or at least UCLA. This creates a lot of false impressions.

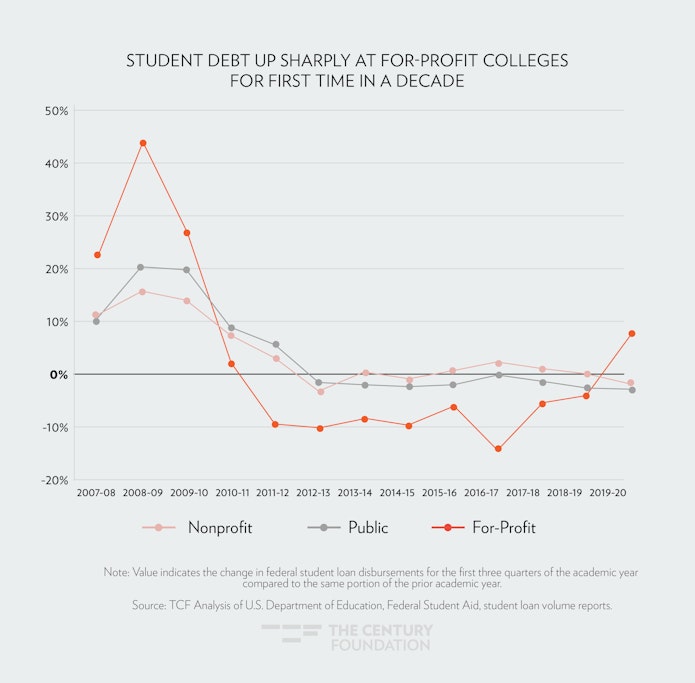

Let’s talk specifically about for-profit schools and their linkage to student debt, which is a bigger part of the story than is sometimes understood. Note the following from the Century Foundation (Student Debt Is Surging at For-Profit Colleges):

What I would point to is first the peak at the left. We see the end of the Bush administration and the peak of the Great Recession into the early Obama administration. A lot of people went to school in that period, as is typical during a recession, to try and increase their odds of good employment when the economy rebounded. And a lot of those students paid for school via loans.

The problem is a large percentage of those loans were for for-profit schools–schools that cost more and graduate fewer students than most options. Most of those schools had open admissions and made promises to their customers (I choose that word deliberately) that they would get good-paying jobs once they finished their degrees. But, of course, when you take in students who are unprepared for college, a lot of them will not earn their degrees, and therefore you get a lot of students with debt and nothing to show for it.

See, for example, this NPR story from 2010: Promise Of Jobs Lures Many To For-Profit Schools and then this 2015 piece in The Atlantic: The Empty Promises of For-Profit Colleges.

The Brookings analysis linked above notes:

Where one goes to school makes a big difference. Among public four-year schools, 12% of bachelor’s degree graduates owe more than $40,000. Among private non-profit four-year schools, it’s 20%. But among those who went to for-profit schools, nearly half have loans exceeding $40,000.

A lot of these for-profits also tapped into federal financial aid which helped the schools’ bottom lines, but the students did not get degrees. Of Pell recipients, one study found that for-profits graduated only 20% (while publics graduated 49%).

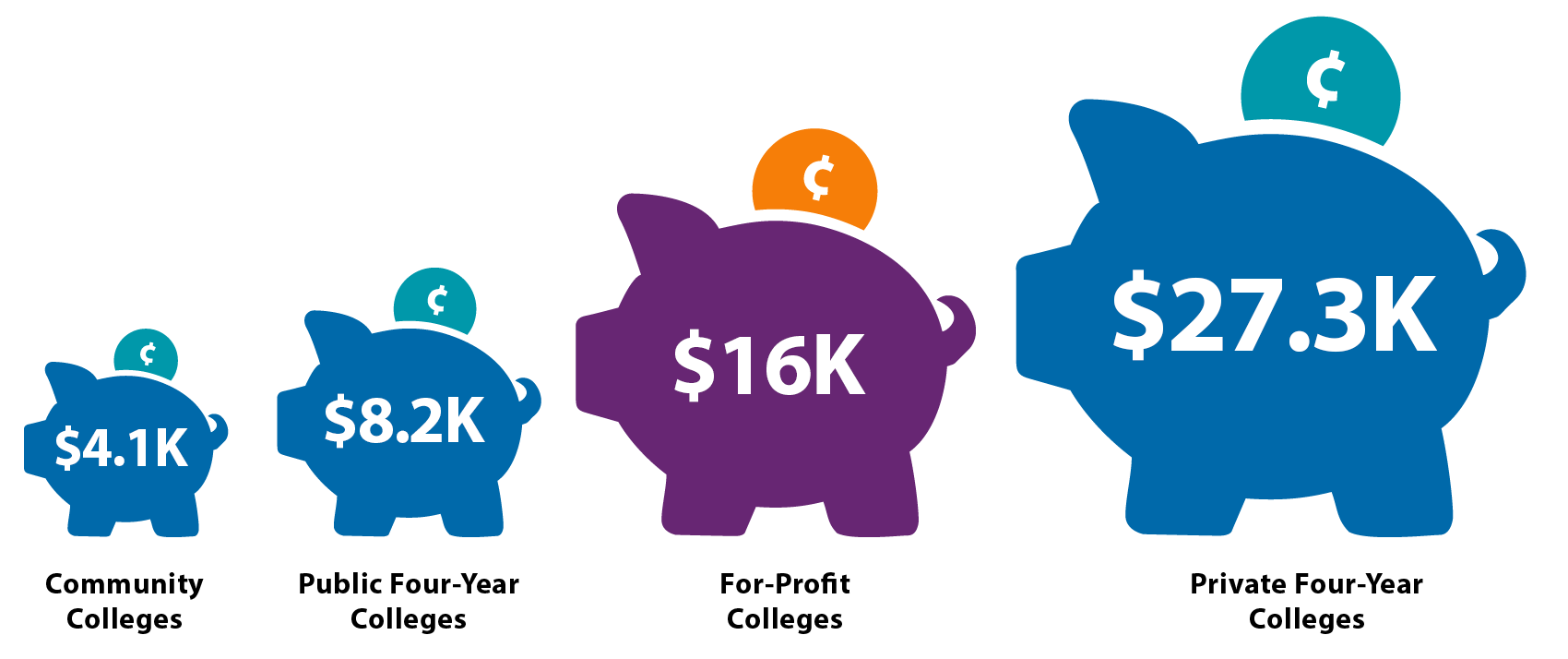

Note the relative expense of for-profit schools:

Many, many students who took the for-profit route would have been far, far better off, both educationally and financially to have attended community college or a regional comprehensive public four-year school.

It should be noted that many for-profit schools (but not all) are not regionally accredited, which in simple terms could mean that classes taken at a given school could not be transferred to another or that a degree would not be recognized for graduate admissions. In some cases, it could also affect employment.

It should also be noted that the Obama administration increased regulations on for-profits, and that is part of the reason for the decline in debt linked to those institutions in the graph above (the fact that a lot of such schools went out of business would also be a factor). The surge in debt linked to for-profits on that chart is the direct result of policies in the Trump administration/DeVos Department of Education that were far more friendly to for-profits.

Examples of for-profits that went out of business include Argosy and ITT Technical Institute.

Note that I am not saying all student debt is the fault of for-profits, but their role needs to be understood.

I will conclude by stating that I support some level of debt forgiveness because we, as a society, have created the context in which a lot of citizens have felt forced into the debt they have accumulated (and often at a young age wherein they do not fully understand the implications of their choices).

Government (state and federal) could better subsidizing higher education and the federal government, in particular, could do a much better job of regulating for-profit schools.

One idea I saw that I think needs more examination: make student loan debt dischargable in bankruptcy again and then create some sort of clawback mechanism for universities that create an above average share of such discharges

The point that we need to discriminate among types of schools is an excellent one.

The problem with the for profit schools is that too many of them are Trump Univ. type mills. For those phony diploma factories the student loan debt should be forgiven. And I’ll second @Stormy Dragon: point about claw back.

There was a headline that I saw the other day, but didn’t read the article, that asked the question, does anyone pay retail for a college education? Now I wished I had read it.

Once, back in the 1990s, I found myself listed as a member of the faculty at a for-profit “university.” I have absolutely no idea how they got my name, nor the list of my degrees at the institutions that awarded them. I phoned them in a fury and demanded they remove my name from their faculty. The “dean” who took my call laughed at me, and demanded to know if I was “gonna sue” them, and good luck with that.

These places are total rip-offs.

@Sleeping Dog: FWIW, Trump “University” was even worse than the schools to which I am referring as it was really more a self-help seminar provider than even pretending to provides college credit and degree.

Nearly 20 years ago, I was briefly an instructor at a for profit private college, teaching aspiring paralegals. My fights with the college regarding the cost/benefit of the program led to my being given the usual ride out of town…on a rail.

@Stormy Dragon: That seems to be a possible market-based framework that could be quite useful if properly designed. Attention to design of course.

I remember years ago reading about some MBA getting busted for robbing banks or something- turns out he got his MBA from the prestigious Strayer U and probably thought it would be his ticket to something bigger…..unaware that a good chunk of college is actually networking.