Stupid Chart of the Day

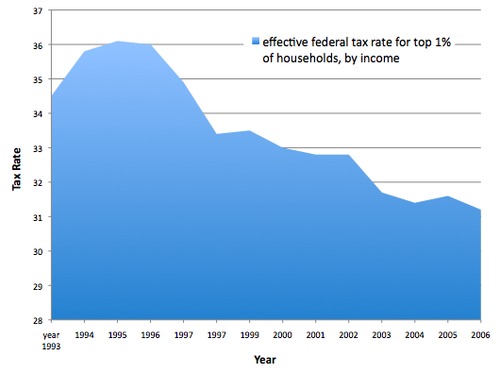

Conor Clarke has devised the following chart of the federal effective tax rate paid by the wealthiest 1% over the last 15 years:

While he doesn’t “love the idea,” he think it justifies paying for health care for the poor by taxing the rich. Kevin Drum agrees, adding,

The basic story is simple: As their incomes have gotten ever higher, their tax rates have gotten ever lower. So if tax rates on the rich are raised to help pay for healthcare reform, as some Democrats are proposing, it would just return us to the rates of the early 90s, not some hellish confiscatory dystopia.

I’d note that the curve is wildly exaggerated because the Y axis starts at 28 percent. All the variation is between 31.5 percent and 36.1 percent or so; the drop has hardly been precipitous. In addition to the Bush tax cuts, most of the difference is lowered capital gains taxes.

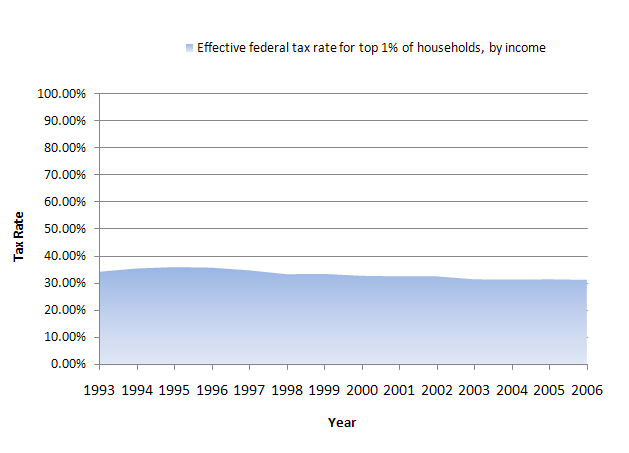

E.D. Kain agrees and actually took the time to replot it:

Quite the difference, no?

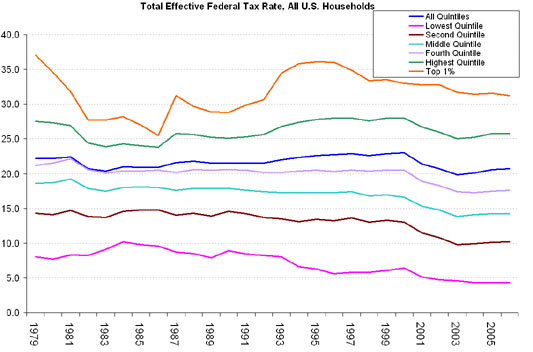

Via Catherine Campbell, here are the effective rates by quintile over time as calculated by CBO and plotted using a more conventional starting point of zero:

Not only are those in the top 1% paying more than twice the effective rate of the middle quintile but they’re paying substantially more than those in the top quintile. And, of course, they’d get zero benefit from the new health care plan whereas those in the bottom quintile.

UPDATE: To be clear, I don’t think that a return to Clinton-level rates wreck the economy or that doing so would be tantamount to socialism. (See, “Class Warfare: Framing the Debate” for a much longer distillation of my views on that.) I’m just pointing out that the top 1% has had only a modest cut and still pays a disproportionate share. It’s one thing to argue that the rich have an ability to pay more and another entirely to argue they have a duty.

In a sidebar discussion via email, Bernard Finel reminds me of a quotation from the fictional Sam on “West Wing” that I’ve used before (See, “Tax Burdens by Quintile” and “Middle Class Tax Cuts“):

Henry, last fall, every time your boss got on the stump, and said, ‘It’s time for the rich to pay their fair share,’ I hid under a couch and changed my name. I left Gage Whitney making $400,000 a year, which means I paid twenty-seven times the national average in income tax. I paid my fair share, and the fair share of twenty-six other people. And, I’m happy to, ’cause that’s the only way it’s gonna work, and it’s in my best interest that everybody be able to go to schools and drive on roads, but I don’t get twenty-seven votes on election day. The fire department doesn’t come to my house twenty-seven times faster and the water doesn’t come out of my faucet twenty-seven times hotter. The top one percent of wage earners in this country pay for twenty-two percent of this country. Let’s not call them names while they’re doing it, is all I’m saying.

While the fictional Sam is more liberal than the actual James, that’s pretty close to where I am as well. I’d demur on the “happy to” but concede “that’s the only way it’s gonna work, and it’s in my best interest that everybody be able to go to schools and drive on roads.”

Willie Sutton famously remarked that he robbed banks because “that’s where the money is.” I much prefer that rationale to one dressed up in moral obligation.

NOTE: The addition of E.D. Kain’s chart was momentarily UPDATE 2 but I thought it made better sense to insert it directly into the narrative.

Two things, first your second graph is what you should have put up back when you were arguing that half of all Americans paid no Federal Income tax.

You played the same “look at this, not this” game.

Second, I think you were the one who did a good post on historic tax levels, going back to Kennedy.

Points off for “look at this, not this” with respect to truly historic tax rates, add a few decades to the left there.

Odo,

Well, no. The “effective tax rate” includes all taxes, not just federal income taxes. Excise taxes, sales taxes, FICA, etc. are included. If we’re only having a discussion about where the income tax rates should be, however, those aren’t relevant.

And I added an addendum (before reading your comment) referring back to that other post and clarifying my view of the subject at the larger level.

I do not personally make $250,000 per year nor will I ever so I’m not in the group affected by the tax. However, I think we should think long and hard about whether the tax makes any sense from an economic policy standpoint. The $500 billion over ten years they’re talking about is $500 billion that won’t be spent on non-healthcare consumption, won’t be saved, and won’t be spent on non-healthcare investment. At least to me that sounds like a sizeable chunk of just the kind of stuff we’re going to need to get our economy back on track.

To be fair, if we plotted a Gini coefficient graph for the same time period, we’d see that the percentage of tax burden on the top quintile goes up as the percentage of GDP owned by them increases, something Campbell hints at. The graph here reveals another point, however, which is that because we have reduced non-payroll taxes on the lower quintiles so much, if there are going to be income tax cuts at all, then those tax cuts will have to be for “the rich” and other higher income quintiles.

But, in the grand scheme of health care financing, basing policy on the percentage of income controlled and tax paid by the rich at this point is a dubious proposition. Why? Because the cumulative goal of Obama’s policy programs before health care is to redistribute wealth from the top down, and that, plus the collapse of finance, means we have a shrinking income pool in the top quintile. How exactly are we to pay for a health care plan, which is destined to grow and grow over time, above and beyond White House estimates, by raising taxes on the upper income earners without simultaneously creating a plan to ensure that the rich get richer so as to pay for health care reform?

To simplify things, if we’re going to raid the piggy bank to pay for social programs, we’ll need that piggy bank to get bigger over time — and since the piggy bank in question is “the rich,” that’s anathema to most in Obama’s party.

P.S. Odograph, the graph James shows above illustrates total federal tax burden, which include payroll taxes minus EITC benefits for the lower quintiles. His earlier point stands.

Dave, to address your point, could we calculate the economic benefit of health care as services sector spending plus work hours gained (otherwise lost to untreated health care problems by those who gain coverage under health care reform) and then compare the impact on the economy to investing the same amount in education, infrastructure, etc., or simply leaving it in the hands of the wealthy to use as they see fit?

Look, I’m not trying to tell anyone what the total effective, or Federal effective, tax rate should be. I don’t really have a dog in that fight.

I do listen though when people look back at the go-go years of real productivity and wealth creation (the 60’s) and see higher tax rates than today. I’d like to understand that, rather than say simply encapsulate that entire history as “the Clinton years.”

I suspect that ideologues are wrong, both those who think government should be driving the economy, and those who think unrestricted free markets cure all ills.

This is a good point in history for my moderate view because of course Communism and Capitalism have both fallen when pushed to their extremes.

BTW, in case it wasn’t obvious:

Exactly, the “look at this” was “income tax” and the “not this” was “all taxes.”

A good quote. And on the other side of the coin, I don’t think people should insinuate that the rich are the only productive members of society. The guy who builds my deck is creating wealth, too.

There, fixed that for you.

Just curious, but what exactly will the Obama plan be once we’ve eaten all the rich people? Where will the money come from then?

There’s a fly in that ointment. At that time the US accounted for nearly half of the world’s GDP and was a “factory to the world.” Today we’re less than a quarter of the world’s GDP and we’ve abdicated the role of “factory to the world” to China and other LDCs and NICS.

What happened since the 1960s was that politicians of both parties were desperate to keep the economy growing at levels resembling the 1950s and 1960s, which, because productivity growth tanked from 1970-96*, meant shifting to deficit financing in the beginning and then, in the 1980s and 1990s, growing the finance pool on Wall Street to increase the money supply for small businesses at the cost of even higher deficits because we cut the top marginal rates in the 1980s.

If you’d like to return to 1960s tax rates, you’ll need to prepare the public for recession-level growth all the time, plus higher unemployment. The high growth rates and low unemployment of the 1960s will never be possible again because the US can no longer be responsible for half of the world’s economy.

* Please note that productivity growth, after reaching an average of around 2.75% in the 1960s and sinking to as low as 1.25% in the 1980s, rebounded to an average of around 2.5% during the 1996-2006 expansion thanks to growth in international trade and the availability of seed money to startups of various kind — something that would’ve been impossible if we had kept tax rates at the 1970s levels.

I understand that, and it actually cuts another way … with the expectation that globalized free markets will create wealth for … well, red state voters.

Sam’s quote made me think of another quote, this one from Gordon Gecko:

The problem with focusing on quintiles, and even the top 1%, is that it obscures one particularly outrageous aspect of the tax system: that the top 400 taxpayers, which had an average AGI of $277M in 2006 (in 2008 dollars) paid an average effective tax rate of 17%.

@Odograph: You may be missing the paradox, Republicans support tax cuts for financiers and bankers not because they think these people will change their votes — they always lean Dem — but because they will invest more money in small entrepreneurs — who are tax-conscious and vote GOP and whose business are responsible for most US productivity growth.

And, on a different note, Republicans support free trade because they (used to) feel protectionism is immoral, much as Dems feel inequality is immoral. It’s not necessarily because we think it’ll create more red state jobs or give higher incomes to GOP voters, it’s that we (used to) think free trade is the right thing to do.

(Parentheticals added because the Bush-Rove GOP abandoned this principle along with many other traditional tenets of conservatism.)

One has to compare what they pay and what they purchase from government. In other words, economists who do not break out the services received and paid for are dumb.

I do know that government engages in fraudulent accounting and the services rendered vs services paid are hard to identify.

the top 400 earners in 2006, with an average $277M in AGI (in 2008 dollars), paid an average effective tax rate of 17.2%, down from 26.4% in 1992. That puts them at about the fourth quintile, despite earning more than 3,000 times as much as that quintile (based on rough numbers from wikipedia).

http://taxprof.typepad.com/taxprof_blog/2009/01/the-irs-400.html

What I can’t even post non-html links anymore without being caught in the spam-filter, bah.

If you want to be intellectually honest here, you need to show what the top 1% makes in income and also what the top 1% have as a percentage of total wealth. If, eg, the top 1% made 80% of our income, they should pay more than 22% of the taxes. These charts are easy to find as we have posted them several times on my dinky blog. Also, remember to look at taxes actually paid, not just the rates.

Steve

Rescued. Quite weird: It went to spam rather than moderation, which never happens.

For two days, it was letting obvious spam through and now this. Don’t get it.

Amplifications:

Dave correctly points us toward economic impacts. The tax the rich crowd never wants to acknowledge this, but levels are reached where, in the aggregate, income and investment fall.

In particular, individuals and small business owners react. When you’ve got your wad, working on your handicap becomes a viable alternative. These people are not stupid mules.

Matthew – From post #1. I would say amount of GDP produced, not owned. It may seem a small point, but there are those who believe “the rich” are a perpetual money tree on auto-pilot, to be plucked. Not so.

Several – If you looked at the available deduction structure in place in the 60’s you would see that the top rate comparisons have no economic meaning.

Ugh – that statistic exists only because most of the income is investment income, previously taxed at the statutory earned income rate, and now a second time at the div rate. BTW – even if you changed the rates on those you cite you’d only run the government for about 3 hours. And you’d destroy the capital formation process. That would be really stupid.

Herb – The number of “rich” people and amount received through inheritance is actually quite low.

Matthew, we have had increasingly “jobless recoveries” in recent decades. I get that a “jobs creation” is asserted for tax cuts targeting the rich, but can we really find evidence? Especially among blue-collar workers?

(The only thing worse than a jobless recovery is a jobless non-recovery. We teetered on that distinction through the 90’s and into the 00’s. We certainly risk it again, IMO regardless of small differences in marginal tax rates.)

The interesting thing for me is that I’d see protectionism as a mechanism, and not an abstract goal. I favor free-ish trade because I think associated outcomes include many public goods. I wouldn’t treat the mechanism as a goal (or a morality) though, because there are public costs.

Drew, So you’re telling me that Gordon Gecko was wrong?? Nooooooo, I’ll have to rethink my entire life’s philosophy. Ha!

I mentioned the Gecko quote not as an endorsement, but only because the Sam quote brought it to mind.

And yes, this is a confession that I really have nothing intelligent to say on the subject.

This is good, though. I agree with this:

“It’s one thing to argue that the rich have an ability to pay more and another entirely to argue they have a duty.”

Another static analysis which makes no account of two factors, 1.) taxes distort behavior, 2.) marginal revenue raised or lost by increasing takes rates.

On the margin, an investor faced with a capital gains tax rate of X% will decide to realize the gain and thus create a tax obligation. At a rate of X+5% the investor will decide to forgo the realization of gain, or forgo the opportunity to rebalance the investment portfolio, thus depriving the State of capital gains tax revenue.

Ummm, that has been studied. It has a temporary effect. In the long run people go back to investing. Will look for citations later. Think it was cited at Thoma’s, Cowen’s or DeLong’s sites.

Steve

Gordon Gekko was a wall street caricature created by Oliver Stone. I don’t think Mr. Stone made him out to be a sympathetic character and I doubt any true believer in free markets would want to have their thoughts and ideas filtered through Mr. Stone’s jaundiced perspective. Seriously, if you want to attack the ideology of free markets why not attack the ideology of someone who actually believes in free markets rather than a strawman created by someone who was more comfortable around Fidel Castro than Milton Friedman.

It has a temporary effect. In the long run people go back to investing.

No one is arguing that investors stop investing. The point is that, at the margin, investors account for the effect of tax. Taxes distort decisions. Consider two extreme examples to model the behavior that results from tax presence. There are no capital gains taxes at all. In this case, investors will be allocating capital with fewer incumberances, thus, in the aggregate, investment capital will flow to the most efficient investments. Now consider a situation where the capital gains tax is 90%. The churn in the market will be reduced because 90% of any gain will be owed as tax. Rather than investment capital seeking the most efficient vehicle to generate returns the investment capital is more likely to stay parked in suboptimal investments because the investor is able to use compounding effects on what would be the money he would owe as tax. To put this in numerical terms, if the investment yield amounted to $1,000, the investor, after paying tax, would have a gain of $100 to invest in a new investment vehicle, however by not liquidating the investor can compound the $1,000 gain and hope for better future tax treatment.

Taxes distort decisions. Tax rates need to be investigated with dynamic, rather than static, modeling.

Tango, haven’t IRAs and 401Ks provided a vast pool of funds which trade without capital gains tax?

The average American under-contributes to those, and has “room” for tax free trading (though they might be better off with a good slug of broad index bond funds and index stock funds to provide a diversified base).

Sure, a couple years ago. Now, not so much.

And anyway, the taxes are just deferred until you withdraw the money at President Obama’s new higher rates! What a deal!

Charles, I thought Tango was talking about the balance available for investment, and shielded from capital gains. From my quick surf, it looks like $11 Trillion is the best guess. That is a lot of money, with less tax considerations per-trade than old pre-ira, pre-401k, investment accounts.