Top 1% Pay More (Income) Taxes Than Bottom 95%

High income earners pay almost all of our taxes.

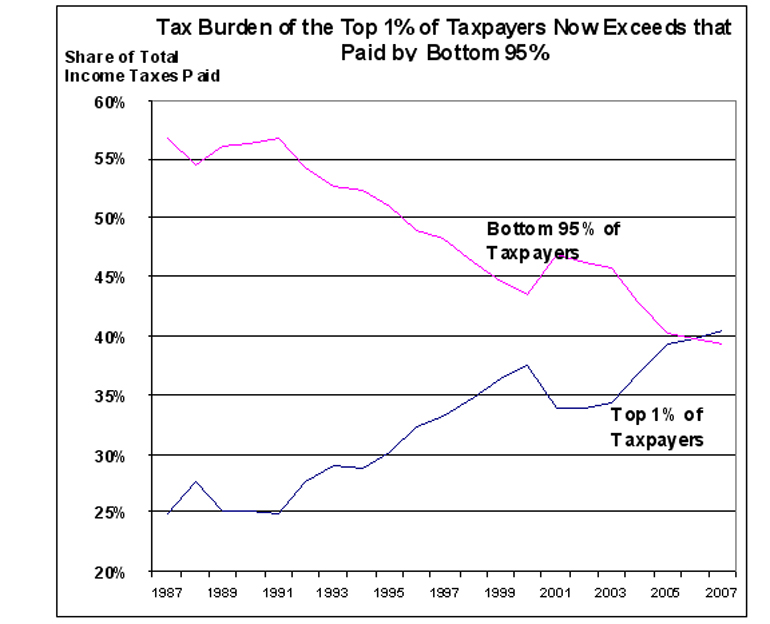

A chart from Scott Hodge of the Tax Foundation, titled “Tax Burden of Top 1% Now Exceeds That of Bottom 95%,” is making the rounds:

Newly released data from the IRS clearly debunks the conventional Beltway rhetoric that the “rich” are not paying their fair share of taxes.

Indeed, the IRS data shows that in 2007—the most recent data available—the top 1 percent of taxpayers paid 40.4 percent of the total income taxes collected by the federal government. This is the highest percentage in modern history. By contrast, the top 1 percent paid 24.8 percent of the income tax burden in 1987, the year following the 1986 tax reform act.

Remarkably, the share of the tax burden borne by the top 1 percent now exceeds the share paid by the bottom 95 percent of taxpayers combined. In 2007, the bottom 95 percent paid 39.4 percent of the income tax burden. This is down from the 58 percent of the total income tax burden they paid twenty years ago.

To put this in perspective, the top 1 percent is comprised of just 1.4 million taxpayers and they pay a larger share of the income tax burden now than the bottom 134 million taxpayers combined.

Some in Washington say the tax system is still not progressive enough. However, the recent IRS data bolsters the findings of an OECD study released last year showing that the U.S.—not France or Sweden—has the most progressive income tax system among OECD nations. We rely more heavily on the top 10 percent of taxpayers than does any nation and our poor people have the lowest tax burden of those in any nation.

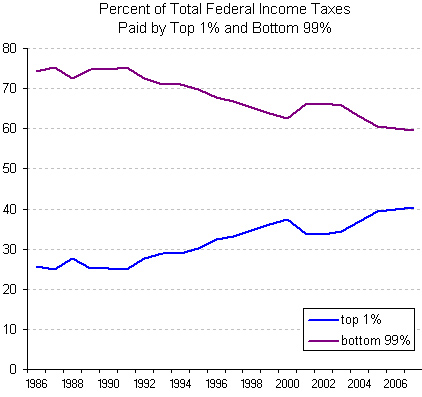

Paul Caron passes it along without comment but a more accurate title: “The Top 1% Pays More Income Tax Than the Bottom 95%.” Catherine Rampell notes that “This represents the second year in a row that the richest 1 percent paid more in federal income taxes than the bottom 95 percent (not, however, the bottom 99 percent)” and provides more charts.

Andrew Gelman observes,

It’s an interesting question what to make of this sort of statistic: the income distribution is more skewed than it used to be, so there are some super-rich people paying a lot of taxes. But what I wanted to focus on here was the shift from “income taxes” to “the tax burden.” This could be misleading.

He doesn’t elaborate. Presumably, though, he’s referring to the fact that there are other taxes aside from Federal income taxes. Most notably, there’s FICA (aka, “the payroll tax” or “the Social Security tax”), state and local income taxes, and various sales and excise taxes. (Of course, factoring corporate income taxes in would be useful, too. For that matter, so would the cost of various unfunded mandates on business owners.)

FICA is most often cited in these discussions for two reasons. First, as MSNBC’s Tom Curry points out, “for more than four out of five tax filers, employment taxes are a bigger burden than income taxes.” Second, it is capped at $106,800. That is, workers pay 7.65% of their income into the system (6.2% for Social Security and 1.45% for Medicare) up to the cap, at which point no more is collected. So, someone earning $106,800 and someone earning $1,068,000,000 will pay the identical amount into FICA.

This isn’t regressive in the traditional sense because benefits are capped at $2323 a month regardless of how much one pays into the system. Still, throwing it into the mix changes the ratios considerably and calculating a “tax burden” while excluding mention of other taxes borders on dishonest. But not as much as progressives would have you believe.

As Bruce Bartlett noted two years ago,”Looking at all federal taxes, including payroll taxes, those in the lowest quintile paid 4.5 percent of their income to the federal government in 2004, the second quintile paid 10 percent, the third paid 13.9 percent, the fourth paid 17.2 percent, and the top quintile paid 25.1 percent.” Curry provides this chart, which includes both income and payroll taxes:

What’s interesting is that, even with FICA factored in, the percentage of the federal tax burden falling on the upper quintiles has grown over the last thirty years. Then again, so has the disparity in income. Regardless, however, the top twenty percent pays more than two-thirds of federal income and payroll taxes whereas the bottom forty percent pays essentially nothing.

What’s interesting is that, even with FICA factored in, the percentage of the federal tax burden falling on the upper quintiles has grown over the last thirty years. Then again, so has the disparity in income. Regardless, however, the top twenty percent pays more than two-thirds of federal income and payroll taxes whereas the bottom forty percent pays essentially nothing.

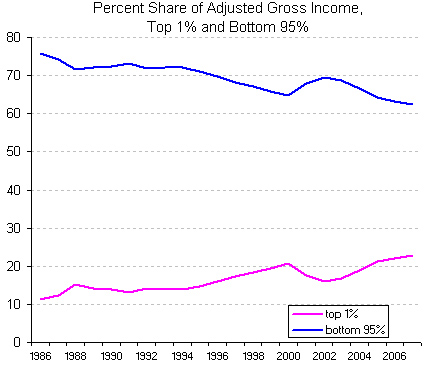

So let me get this straight: the top 1% makes more money than the entire bottom 95% put together?

Yes, I’m sure those folks in the top 1% cry themselves to sleep at night on their piles and piles of money.

Nope, they make a lot of money — about 21 percent of the money — but pay hugely more taxes because of progressivity built into the system. Even the FICA cap doesn’t stop them from paying a much greater percentage of what they earn in taxes.

I’m not sure what that has to do with anything. Few argue that the rich and poor should be taxed equally. But there’s a persistent myth that the rich don’t pay a lot of taxes because of “loopholes” whereas “the middle class” shoulders most of the burden. It just ain’t so.

And so?

James, I note from your second set of graphs that the explanation for this is pretty simple: the rich are making more money and have a greater share of wealth. The AGI graph syncs up with the tax burden graph for a reason.

I think this has to do with the fact that the effective tax rates of the highest quintile are lower than that of the middle quintiles. The top quintile pays a higher amount, but a lower percentage.

Gas tax in 2005/2006 looks way too low.

Populism. We’d rather have big cars and trucks than sense (see the newer thread on traffic deaths helping to pull down American life expectancy.)

I believe Time magazine did a great string of stories on corporate welfare (too lazy to google, but I think it won some sort of journalism award)…I thought that was the biggest gripe people have when it comes to ‘teh rich’ not paying their fair share of taxes.

It appears that wealthy individuals pony up a decent enough chunk of their income that gets put into government coffers, rather the problem is the public largesse showered on corporations because we are afraid they will go overseas, or something like that.

Corporations not putting enough into the public’s (i.e. government) coffers seem to be the issue, why else does the issue of taxing the mega profits of oil companies, etc., seem to rear its head in congress on a regular basis (at least once a year for the past few years, and yes, I am aware this is a crusade some congress-critters decided to take up not coincidentally when oil prices shot up through-the-roof).

We should be pressing for more mega-corps (and yes, aware that technically these mega-corps are composed of clusters of wealthy individuals with their own incentives to see that their company parts with as little cash as possible when it comes time to pay the piper, be it providing sharholder wealth, etc.) that make buckets of money from U.S. consumers to put more into the public’s piggy bank, not trying to put the burden entirely on the back of wealthy individuals.

Anyway, hope some of the above made sense.

That relates to my gas tax comment, and other news that the “cash for clunkers” money went fast.

What a classic example, right? We don’t have the balls for a gas tax, but happily bribe ourselves to buy slightly more efficient cars.

I love it what they use “adjusted gross income” which distorts the % in huge way since the higher up thin income stack you go the more you are likely to receive in capital gains. It also leaves out the payroll tax and excises which burdens lower wage earners far more then the top 1%

But let’s assume that this graph isn’t the totally manipulated and distorted piece of crap it is. What is says to me is not that the top 1% are too overburdened with federal taxes, but that income distribution is an outrageous scandal in this country totally out of line with any concept of the meritocracy we allegedly are suppose to have.

Spoken like someone who has never been rich enough. The shear naivety of the statement is breathtaking. There are all kinds of games you can play around with if you have the cash not least among them is out right money laundering. the biggest loop hole is the capital gains tax, you start out paying close to the lowest rate and then you start deducting your “expenses”. God the games you can play with even business taxes boggle the mind (I guess you need to run a business or maybe you’re just not adept at the tax code).

.. and let’s not take our eye off the ball the disparity of income distribution is the problem and as long as we have a system that compensates some individuals disproportionately then I have on problem whatsoever in taking these people at a higher rate.

It not an income tax rate problem it’s that the vast majority of people are not reaping the benefits of their labor in a just and fair way while other are compensation far beyond their value.

Let’s also remember that people who are properly “rich” don’t need income. They can book small losses for the rest of their lives, and still maintain houses in three countries.

When you talk about people who have high income, and need to claim it, we’re talking upper-middle, or managerial, class.

I personally don’t think it’s a great tragedy when a managerial class worker books as much income in a year as a median worker does in a lifetime, and is therefore taxed heavily.

(It’s a minor tragedy that we don’t do better income averaging, so that folks with 1 or 2 good years are taxed differently that people who have good years every year.)

But what is the purpose of the ‘progressive tax’ at all? Look, guys…I pointed out in a column back in the late 80’s that even assuming you taxed the op 1% of earners at 100%, you’d not even make a dent in the comparatively minuscule deficits the government was then racking up. That situation hasn’t changed.

So spare me the ‘we could pay for all this if only those nasty eveil rich people would pa their fair share’ song and dance. The context of that claim can be found on any stable floor, in smaller amounts.

THe fact is that what we’re dealing with is a government who doesn’t want to give up it’s ability to manipulate society to it’s designs. The leftists currently in government want to eliminate the rich by taxing them out of existance. (Is Charlie Rangle Rich, I wonder? Oh, wait, he doesn’t pay taxes… never mind)

If we’re really about getting the rich to pay their fair share, we should all be pressing for the flat tax. You know how that’ll go over with the left, no don’t you, really? Their biggest constiuancy woldn’t fair nearly as well when everyone started paying their fair share, you see..

I worry that the point is that we think so many families are at “survival income” that we can’t tax them at a working flat rate.

There is maybe one congressman alive who is ready to give that up, in both parties combined.

Not at all, I pay exactly the same taxes as anybody else.

Actually only the social security portion of FICA is capped…..medicare taxes are paid on all wages, whether you earn $10 or $1-million you’ll pay your 1.45% on the total and your employer (even if you’re self-employed) pays a matching 1.45% on all wages.

Which is why it is so easy to get a mob who screams, “Raise taxes!”

This thread is what is known as a “target rich environment.”

So Brian Knapp and Plebian weigh in with vapid comments……..James slaps them down.

Alex tries to go to effective tax rates. This very site has published these stats. The facts stand.

Rick Dement weighs in with some demented comments about how the super rich avail themselves of exotic loopholes. Eric swoops in and points out the overall economic irrelevancy of that point. Rick goes on about small business loophople……….boring. Overstated.

And then Rick basically tells us he wants to be King, deciding what is the “correct” income for people he obviously thinks do not deserve what they are getting. Super.

Odo makes one of the best points of all: 2-3 fat years might not be the way to tax.

And then we conclude with a thud: Michael says he pays the exact same taxes as anyone. Well, it may play with the data challenged.

Details often are used by sophists. Here’s the big picture deal people:

Tax incidence has been more and more shifted to the rich over the last 25 years. The system has become more progressive.

Yes, in part it is due to “income incidence” but tax policy cannot affect this. If you have problems with income distribution, you do not solve it with tax policy. You deal with the causes. Unless you don’t really want to solve the problem.

And as for capital gains. This is pure sophistry. Money put at risk into capital investments has already been taxed as earned income. Its recycled money.

Now, “unearned income,” gets two treatments, as we all know. Both should be at the lower rate. This is the lifeblood of investment.

Weirdos abound. But even Bill Clinton understood this.

This thread is what is known as a “target rich environme

Bill Gates and I are both taxed at the same rate for the first $75k of our income. The guy flipping burgers at McDonalds and I get taxed at the same rate for the first $10k of our incomes.

A lot of this has to do with decisions made on welfare reform and programs over the past 30 years. The federal government moved away from direct subsidy (in the form of benefits, such as ADFC), to setting up tax-credits designed to promote welfare purposes (like the Earned Income Tax Credit).

It does the job, but it also means that a significant fraction of the population does not pay net income tax. I don’t know what these folks are complaining about – would they rather the poor pay taxes and we go back to the prior system, which they used to (and often still) condemn as “Tax-and-spend”?

Well, here are some figures for you to poor (sic) over direct from the CBO (excel file).

The reality is that despite the decrease in marginal tax rates for the rich, they pay essentially the same effective tax rate as they did in the late 1970’s. The lowest three quintiles all pay less effective rates and the bottom two quintiles actually pay negative tax today.

Whatever your personal thoughts on fairness or who deserves to pay more, consider the effects of the reality that most government revenue at the federal and, in many cases, the state and local levels, is tied to the income of rich people.

Think about that. When rich people are making a ton of money, government revenues soar. That is, in fact, what happened during the Clinton administration. President Clinton didn’t have any magical solution to balancing the budget – the government was making a killing because rich people were making so much money in the dot.com boom.

A lot of the problems with state budgets today are because they are similarly tied to the fortunes of rich people. California is a perfect example – they got hit by greatly reduced incomes, primarily from the rich, plus all the decreased revenue from sales taxes.

The point in all this is that our yearly budget is pretty much dependent on the rich doing well and having good income. People should therefore focus less on marginal tax rates because they simply don’t have that big of an effect and the income of the top quintile is a much better predictor of revenue. What we should be looking at, IMO, is raising the corporate income tax. It is at historically low levels. Raising it would not only provide some additional revenue, but it would also diversify our tax base.

Someone here mentioned something about the rich getting richer. That is true to an extent. The incomes of the bottom three quintiles is essentially the same (adjusted for inflation) as 1979,though their tax burden is lower. The rich have become substantially richer – the top 1% are about 3 times a rich today as they were in 1979.

Anyway, a lot of data to examine, have at it.

You are taxed at the same marginal rate, but comparing marginal rates is meaningless. That guy at McDonalds is going to get everything he pays back in his refund, plus some. Everyone gets deductions on their taxes which greatly reduces the theoretical marginal rate.

Consider my family – me, my wife and two kids. IIRC, we had about $74k in taxable income last year. I use Turbotax for my taxes and when you’re all done it calculates your effective tax rate. While we were technically in the 25% bracket when all was said and done our effective rate was 14%. We don’t have any special tax loopholes.

So in this case the top gets screwed more than the bottom.

Who “gets screwed” is a matter of opinion. Even with high taxes, the rich still do well. Even with virtually no taxes, the poor are still poor and more economically vulnerable. That is a disparity that I don’t think tax policy can fix.

How Drew ever excavated my wanting to be king out of what I wrote is a testament to his imagination. As for what people deserve I’m just pointing out that in a truly free, non-rigged economy no one could possibly command the kinds of income the top 1% can. It’s just that simple.

The fact is that if income distribution was flatter, tax distribution would be flatter and we would not be having this argument. But James and Co. doesn’t want to focus on that because that’s the real scandal not the phony “who pays income tax debate. If you start looking at net worth it’s beyond scandal. While Drew, Bit and the rest of the useful idiots all compete to see how low they can bow to the god kings so that they will offer them a few more scraps from the table then the rest of us. God you guy’s crack me up.