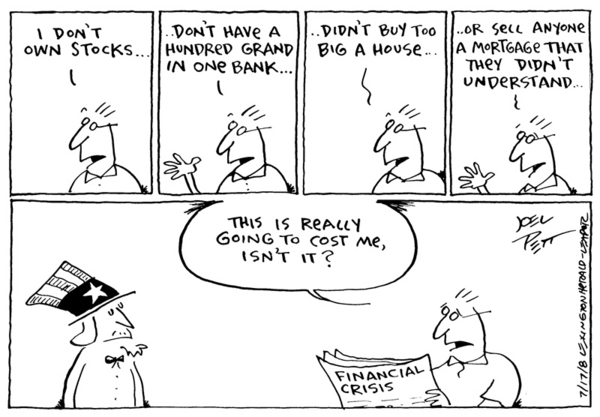

Financial Crisis and Moral Hazard

Lance Paddock, in his best Mr. Rogers imitation, asks, “Can you say moral hazard?”

Unfortunately, the notion of “too big to fail” means that those who behave badly often keep the benefits when things go well but pass off the negative consequences of failure.

UPDATE: Via Greg Ransom, I see that Cato’s Gerald Driscoll has a good analysis of the proposed Fannie Mae-Freddy Mac bailout.

Absent from Paulson’s plan is any protection for taxpayers. They’ll fund the downside if losses mount at the two mortgage giants. But if Fannie and Freddie recover, stockholders and management gain. Call it “casino capitalism” – taxpayers bankrolling management high rollers.

The plan doesn’t ask stockholders or management to suffer for their financial indiscretions. The players who put their companies in jeopardy get to stay in charge – Paulson says he isn’t looking for “scapegoats.” Someone should remind him that capitalism without failure is like religion without sin.

Indeed.

’bout sums it up

Fannie Mae and Freddie Mac desperately need to be de-privatized. Any bailout plan that doesn’t move in that direction is an error.

I think that’s being unduly cynical. But I repeat myself.

I think this oversimplifies the problem.

There are two parts to the corrective measures. One, examine what led to the problem and make sure it doesn’t happen again. Structural changes must be made to head off these problems in the future.

Two, minimize damage from the failure. This bailout may stick in everyone’s craw but it may be cheaper than the alternative. The negative consequences should be directed toward the management and board of directors. Letting the two entitites fail could send negative consequences to the entire country. Which is the better choice of the two even if they are both bad? I think the bailout is the lesser of evils.

Now let’s see some firings to show those jackasses there are consequences for running things into the ground.

But then again, if throwing money at the company will prevent an economic disaster, maybe throwing the same amount of money to their clients/creditors would offer the same economic buffer, while still letting the companies fail.

If a company is too big to fail, I say make it small enough to fail, not prevent it from failing.

But then the government is stuck with a bad business. If there isn’t any other player in the industry who can take over, maybe it would be better to create a _new_ government agency, along the lines of what Fannie Mae initially was, and use the bailout money to buy their assets during bankruptcy, without taking in all the overhead and debt too.

Yet another argument for smaller government.

Steve Plunk finds himself in exact agreement with Robert Reich in this week’s Newsweek. I hope this doesn’t give him cardiac arrest.