High Taxes and Egalitarianism

Matt Yglesias argues that "Northern Europe is Egalitarian Because of High Taxes." I would argue that he has his causality backwards.

Matt Yglesias argues that “Northern Europe is Egalitarian Because of High Taxes.” I would argue that he has his causality backwards.

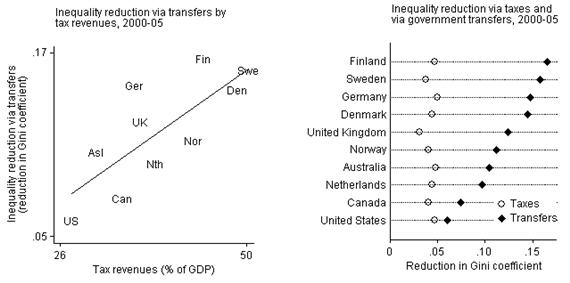

He presents these charts from Lane Kenworthy demonstrating that Europe taxed more and reduced inequality via taxes and government transfers than we did:

I use past tense because the figures are dated but have no reason to think anything significant has changed since 2005. Kenworthy, writing in 2008, observed:

None of these countries achieves much inequality reduction via taxes. Instead, to the extent inequality is reduced, it is mainly transfers that do the work.

The chief contribution of taxes to inequality reduction is indirect. Taxes provide the money to fund the transfers that reduce inequality.

Well, yeah. Punishing the successful by taking away their money achieves some flattening but the goal is (or, at least, should be) to raise those at the bottom, not lower those at the top.

Matt adds,

The US has lower taxes. And we spend much more money on non-redistributive military endeavors. And we do a lot of social programs through the regressive method of tax deductions. And on top of that, Medicare is only weakly redistributive programs. Higher taxes to finance more and better public services are the way to curb inequality.

The fact that we spend a lot more on defense than our European counterparts — indeed, some would argue, they intentionally free ride from membership in NATO while underspending on defense (more on that in another post later) — does reduce our ability to provide welfare payments. And Americans seem willing to pay taxes to support doing so. But they’re generally not willing to pay more to subsidize any but the most severely disadvantaged poor.

Further, as Dave Schuler argues at his own place, all manner of factors have conspired to depress the wages of the “working class” while at the same time reducing public sympathy for the same group. That is, public resentment at the high wages and outsized benefits being provided by low skill unionized workers created policy backlashes precisely as that perception was becoming less of a reality.

While Americans are more egalitarian than our European counterparts in terms of social deference, we’re less so in terms of income redistribution and a sense of commonality with our fellow citizen. Americans by and large view financial success as as product of their own efforts, while Europeans tend to think they’re all in it together.

“Well, yeah. Punishing the successful by taking away their money achieves some flattening but the goal is (or, at least, should be) to raise those at the bottom, not lower those at the top”

Jim, the London season is full swing for another three weeks. Unfortunately, you’ve missed the birthday parade, the Chelsea flower show, Royal Ascot, Wimbledon and Henley but if you get moving you’ll be able to get over there for Glorious Goodwood at the end of July (I might even see you there). Alternatively you could pop over to Paris in early October for the Arc at Longchamp. Punishment of the successful you’ll find is strictly limited.

You’re arguing that, because some Europeans manage to enjoy lavish lifestyles despite confiscatory taxation, that it’s not harder to succeed in their system than ours?

“does reduce our ability to provide welfare payments. And Americans seem willing to pay taxes to support doing so.”

Jim, the max effective rate in this country is in the twenties and is amongst the lowest in the western world

The Scandinavian countries (those on the far upper right on the first graph) are all small countries with, until quite recently, extremely homogeneous populations.

That builds national identity and makes consensus much easier.

“that it’s not harder to succeed in their system than ours?’

Actually Jim there are plenty of studies suggesting that there is greater class mobility in Britain and France than in the US. But even if we assume they are the same that indicates that “confiscatory” tax levels have had no negative effect on achieving success.

I like the Nordic system. Since I’m at least 75% Nordic, its possible that it is a hereditary preference.

From my blond perspective, America would be better off with a little more Northern European outlook … just a little more.

there are plenty of studies suggesting that there is greater class mobility in Britain and France than in the US.

There are a variety of reasons for that, not least of which is a flatter class structure.

But even if we assume they are the same that indicates that “confiscatory” tax levels have had no negative effect on achieving success.

Uh, no. Not unless you can show that people are getting rich at similar rates and to similar extents.

Prior to 2008, wide swaths of the US were experiencing concurrent growth in net worth. This matters much more than income.

The problem is that debt (generously called leverage) increased at the same time. The 2008 crash in housing and stocks was a triple whammy. It reduced assets while not reducing debt (if you didn’t walk away).

James Joyner says:

Wednesday, July 14, 2010 at 12:16

“Uh, no. Not unless you can show that people are getting rich at similar rates and to similar extents.”

If you have greater class mobility by definition more people are getting relatively richer than in a society that has lower mobility. As to the absolute wealth being generated that’s much more a factor of the size of our economy relative to others than anything to do with taxation or motivation. Although not mega rich I’ve paid top marginal rates and I can assure you it had zero effect on either my motivation or lifestyle. In my experience most people making a lot of money set out to minimize their tax liability and then forget about it. As you’ve acknowledged on another thread, top marginal rates in the high thirties or low forties don’t have much effect one way or the other and they certainly don’t dissuade people from weath creation.

(Prior to 2008, if we were going to be compassionate we’d worry about the bottom quintile, as a possible “permanent underclass.” Sadly, we don’t have to worry about just them any more. It isn’t just them anymore.)

James Joyner says:

Wednesday, July 14, 2010 at 12:16

One other thing you might want to think about Jim is the US economic business model. It relies for 70% of it’s growth on consumer spending. Now how do you sustain this against a long term trend since the early 80’s of shrinking or at best flat real earnings for 80% of the country with modest increase for the next 15-18% and huge increases for the top 1-2%. In the business I used to be in our stats people used to do modelling of this and it’s basically unsustainable. We were able to paper over the problem during the during the earlier part of the decade with borrowings and we’ve seen the consequences. Ultimately we’re going to have even out income distribution, a bit and taxation followed by transfers is really the only way to do it.

“Well, yeah. Punishing the successful by taking away their money achieves some flattening but the goal is (or, at least, should be) to raise those at the bottom, not lower those at the top.”

Well, yeah. And how is that working out for us? Are we raising those at the bottom? And related to that, where would you rather be poor?

This is like people who justify Wall Street excesses by claiming they are providing liquidity or some such, but then are unable to show any economic benefits from all this financial wizardry.

The reality is, the working poor in this country is getting screwed left and right. Stagnating wages, skyrocketing healthcare costs, job insecurity. The rich are doing just fine. The rising tide is not lifting all boats, and from the 1990s there is solid evidence that higher taxes are not inconsistent with economic growth (even if you stop the measure short of the tech bubble). I respect your philosophical positions, but don’t they need to be tested against actual facts on occasion? Under Clinton (and the GOP Congress) the tide rose faster and lifted all boats better. Maybe the 1990s are a better model (and more European for that matter) than either the 1980s or the 2000s?

Are we raising those at the bottom? And related to that, where would you rather be poor?

I don’t think raising those a the bottom is the goal of economic policy, just that it should be the goal of redistribution policy. Would I rather be poor somewhere with more subsidies for the poor? Sure! I’d rather not be poor, though.

The reality is, the working poor in this country is getting screwed left and right. Stagnating wages, skyrocketing healthcare costs, job insecurity.

But that’s not “getting screwed,” merely a sad lot in life. “Getting screwed” requires agency.

I respect your philosophical positions, but don’t they need to be tested against actual facts on occasion?

That people deserve to keep most of their earnings and that only those truly unable to help themselves should get benefits forcibly taken from the earnings of others isn’t falsifiable.

Under Clinton (and the GOP Congress) the tide rose faster and lifted all boats better. Maybe the 1990s are a better model (and more European for that matter) than either the 1980s or the 2000s?

More likely, it was a perfect storm: A brief respite from major war footing coinciding with a huge tech bubble. Which, as I recall, burst shortly before Clinton left office through no fault of his.

Taxes were raised in 1990 and 1993. The tech bubble did not start until 1998. You still have this 5 year gap before the tech bubble where the economy was nice and strong, deficits were falling, income inequality was lower. Everyone, essentially, was better off.

The issue is not redistribution. It is allocation of the burden of the various government program we have voted into being. If, somehow, money were being taken from people at the top at handed to people at the bottom, it would be one thing. But that isn’t where most of the money goes. Instead, the majority of our spending ignores income restrictions — social security, Medicare, defense, at the federal level — education, police, fire, etc at the state/local level. Yes, Medicaid is a program where the better off pay directly to the poor, but that is the exception, not the rule.

I think income inequality and tax rates are not related in this country. If we had a redistributive system they would be, but as it stands, there’s no direct causation between increased government revenue (due to tax increases or whatever) and increased opportunities/greater income for the poor. So I find the notion that we should increase taxes to help the poor is not likely to actually help the poor.

James,

“The reality is, the working poor in this country is getting screwed left and right. Stagnating wages, skyrocketing healthcare costs, job insecurity.

But that’s not “getting screwed,” merely a sad lot in life. “Getting screwed” requires agency.”

There has been an agency, in the sense that the working poor getting screwed was deliberate on the part of the well-off. As Warren Buffett said, “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

“More likely, it was a perfect storm: A brief respite from major war footing coinciding with a huge tech bubble.”

There was a dot com bubble but that was largely a stock market phenomenon which is why real economic recovery was so swift but the Nasdaq has never returned to 2000 levels. Underlying the bubble was genuine and substantial economic growth and a huge increase in productivity which was largely tech driven. This increased real wages for all during the latter part of Clinton’s presidency, the only time they went up from 1980 to now. The roughly 22 million jobs created on Clinton’s watch are mainly still there, while the 6.5 million created in 2001 -2008 which were based on the credit bubble have all essentially gone.

“Not unless you can show that people are getting rich at similar rates and to similar extents.”

I was reading a thing on how China has more billionaires this year than last year. They’re up to 103 now, I think.

In 2003, they had zero.

China’s entrepreneurs are paying a tax rate of 45% for anything over 100,000 yuan, but it doesn’t seem to be making them pucker up. (100,000 yuan isn’t very much…less than $15K.)

For what it’s worth…..none of these newly minted billionaires inherited their wealth. They earned it. On the other hand, around 35% of the wealthy people in the States inherited their wealth.

Implication: 35% of the super-rich in the United States are not “successful.” They’re lucky.

100% of the super-rich in China, however….successful! Not whining about their actually communist government. Not complaining about “confiscatory” taxes. Nope, they’re just kicking ass and taking names.

That people deserve to keep most of their earnings and that only those truly unable to help themselves should get benefits forcibly taken from the earnings of others isn’t falsifiable.

The notion that any American political party supports such a philosophy is, however, easily falsifiable.

Every presidential primary season the Republicans descend on Iowa and swear dedication to farm and ethanol subsidies.

Every presidential primary season the Republicans descend on Iowa and swear dedication to farm and ethanol subsidies.

True dat. This is mooted somewhat by the fact that the Democrats do the same. Having no alternative rather takes the issue out of play.

McCain didn’t descend on Iowa and swear dedication to farm and ethanol subsidies.

I respect your philosophical positions, but don’t they need to be tested against actual facts on occasion? Under Clinton (and the GOP Congress) the tide rose faster and lifted all boats better. Maybe the 1990s are a better model (and more European for that matter) than either the 1980s or the 2000s?

I also respect your position and I too would urge you to test your model. Pointing to the Clinton era is simply assuming a model of causality based on mere correlation. There were many structural changes occurring in the economy which were raising productivity and these factors, along with labor scarcity, were the primary drivers of economic growth in that era. If you contend that these factors arose due to specific Clinton policies which were not maintained by subsequent Administrations, please do me the favor of listing the specific Clinton policies which underlie your causal model. Further, you can strengthen your causal model by pointing to other historical instances where Democrats invoked the same, or similar, policies and those instances also resulted in a tightening labor market, increased labor productivity and robust economic growth.

The Scandinavian countries (those on the far upper right on the first graph) are all small countries with, until quite recently, extremely homogeneous populations.

That builds national identity and makes consensus much easier.

Dave speaks sense. This is exactly right. Here in the US we know that income inequality is greater WITHIN racial groups than BETWEEN racial groups. So, when an aggregate national figure is calculated by summing ALL data, the higher minority gini figures will skew upward the national figure.

Although not mega rich I’ve paid top marginal rates and I can assure you it had zero effect on either my motivation or lifestyle.

Yeah, so? Are you trying to argue that your response is representative for all people who are required to pay the top marginal rate? You’ve probably heard the joke about the man who offers a woman a $1,000,000 to sleep with him and she readily agrees and then he revises his offer to $100. She retorts “What do you think I am?” To which he responds, “We already know what you are, we’re just dickering on price.” If top marginal rates were 98% I’d guess that they would create a disincentive for you. All that you’re saying with your statement is that your marginal utility is not yet affected by the top marginal rate that you faced. Your experience says nothing at all about how other people respond to marginal change.

Matt Yglesias argues that “Northern Europe is Egalitarian Because of High Taxes.” I would argue that he has his causality backwards.

I think that James has this exactly right. The key to understanding the causality, in my opinion, lies in Dave’s observation of “extremely homogeneous populations” and I would add the nature of those societies apart from their taxation schemes, such as community standards, work ethic, etc.

Well, McCain flipped on ethanol, PD:

and

TangoMan says:

Wednesday, July 14, 2010 at 16:41

“I also respect your position and I too would urge you to test your model. Pointing to the Clinton era is simply assuming a model of causality based on mere correlation. ”

So Carter had no responsibility of the malaise of the late seventies or Hoover the great depression. Sorry buddy that’s not how it works.

“Yeah, so? Are you trying to argue that your response is representative for all people who are required to pay the top marginal rate?”

Yep, most people I know who make large sums (and I know quite a few quite well) don’t spend a lot of time agonizing over their tax bills they just get their accountant to take advantage of every opportunity to minimize them. It certainly doesn’t make them start at 10.00 and quit at 5.00

“The key to understanding the causality, in my opinion, ”

And Britain?

“If top marginal rates were 98% I’d guess that they would create a disincentive for you…… Your experience says nothing at all about how other people respond to marginal change.”

But they’re not 98%, they are 35%. And even Jim Joyner admits moves to the low forties aren’t going to make much difference. And what experience of paying top marginal rates do you have on which to base this statement?

So Carter had no responsibility of the malaise of the late seventies or Hoover the great depression. Sorry buddy that’s not how it works.

When there is a causal relationship at work that has been launched by specific legislation or policy, then responsibility can be allocated. When factors are baked into the cake, then the President is along merely for the ride. Sure, they get to claim being the father of the success and they get the stinking carcass of failure hanging around their neck but in neither case does this imply that there is always a CAUSAL relationship at work. I’m not claiming that Clinton should be held to a different standard – he governed during a prosperous period. What I’m objecting to is this portion of Bernard’s statement:

Bernard is actually claiming a governance model is responsible for the economic outcome of the 1990s.

Yep, most people I know who make large sums (and I know quite a few quite well) don’t spend a lot of time agonizing over their tax bills they just get their accountant to take advantage of every opportunity to minimize them. It certainly doesn’t make them start at 10.00 and quit at 5.00

Look, it’s pretty much a truism that there is always SOMEONE who is sitting on the margin. I’ve observed that there seem to be two mental models at work when dealing with projecting responses to policy changes, one being the “me model” and the other being the “margin model.” Here’s an example: back when the debate on giving welfare to unmarried women with children was starting critics were arguing that such aid would incentivize women to have children out of wedlock. The supporters of the measure argued that they would never, ever, in a million years consider having children out of wedlock and that none of their friends would ever consider doing so either. They asked all people in their church groups and at their committee meetings and at their protest rallies the same question and the response was always that no one would consider having a child out of wedlock in order to be eligible for welfare payments. That’s the “me model” – the questioner imagine what they would do in face of the policy and then conclude that their view is representative of the human condition. The “Margin Model” though looks at what happens with people who aren’t like you. Clearly there were women who did find the prospect of a welfare payment enough of an inducement to get pregnant. These early “pioneers” were on the extreme margin. When they crossed over and had their kid and collected welfare, they marginally moved the line of social acceptance and marginally legitimized the option, thus disproving the notion that no one would ever consider doing so simply because all of the campaigners thought that everyone responded to incentives in the same fashion.

We already see physicians curtailing their Medicare patient load in response to Obama policies. We see some physicians responding to ObamaCare by curtailing their working hours. These physicians are on the margins by responding so early and so drastically to changing conditions. Their actions will move the margins inward. People respond to events, they just don’t respond in an identical manner.

People respond to marginal tax rates. This is the basis for the empirical observation in Hauser’s Law.

And Britain?

And Britain, what? Your question is incomplete and I can’t guess at what exception you think you’ve discovered. Please elaborate.

Or it might just help me maintain my cynicism at 11.

“People respond to marginal tax rates.”

Not when they move from 35% to 39.6% they don’t. And the margins aren’t material. In the 90’s GDP increased strongly but it was outpaced by tax receipts although taxes were increased in both 1990(during the Bush presidency) and 1993(during Clinton’s) Sorry you’re full of it

It’s an “all else being equal” claim. All else being equal, you might be able to tease some difference resulting from the 4.6% marginal tax increase.

Of course, nothing is ever equal, and “all else being equal” claims really rot the brain.

Economists reliant on “all else being equal” claims have rotten brains 😉

“We already see physicians curtailing their Medicare patient load in response to Obama policies. We see some physicians responding to ObamaCare by curtailing their working hours.”

Where do we see this? Do you have any evidence to back up this claim?

I will say that I did see a new report back during the health debate about a doctor refusing to see patients who voted for Obama. But that wasn’t a business decision. That was a political decision the doctor made in protest.

How many of these physicians are cutting their hours and seeing fewer patients in protest of Obama’s policies? It doesn’t make sense that they’re cutting hours and seeing fewer patients because of Obama’s policies. They haven’t even kicked in yet.

“you might be able to tease some difference resulting from the 4.6% marginal tax increase.”

Tease being the operative word. It’s going to make zero difference in the work patterns of those earning over 200k given the top marginal rates are only going to cut in on a fraction of your income. For someone earning around half a million it’s going to push his effective rate from the high 20’s to the low thirties. Here’s a 101

http://taxes.about.com/od/preparingyourtaxes/a/tax-rates.htm

Not when they move from 35% to 39.6% they don’t

Do you understand the concept of margin? You may not find the 4.6% differential enough to change your behavior but someone certainly does.

And the margins aren’t material.

To YOU the margins aren’t material. Behavior on the margins matters quite a lot because it sets processes into motion.

In the 90′s GDP increased strongly but it was outpaced by tax receipts although taxes were increased in both 1990(during the Bush presidency) and 1993(during Clinton’s)

You mean like this:

Hold up a second. Didn’t you just write that a 4.6 percentage point increase wouldn’t affect taxpayer behavior? Yet we see a 5 percentage point decrease (From 20% to 15%) in tax rate spurred on the recording of more capital gains and this resulted in a surge of revenue to the IRS. Come on, get your model of reality aligned with the facts.

TangoMan says:

Wednesday, July 14, 2010 at 18:52

“Hold up a second. Didn’t you just write that a 4.6 percentage point increase wouldn’t affect taxpayer behavior? Yet we see a 5 percentage point decrease (From 20% to 15%) in tax rate spurred on the recording of more capital gains and this resulted in a surge of revenue to the IRS. Come on, get your model of reality aligned with the facts.”

When you don’t understand the difference between 25% move in capital gains taxes(5over20) and three or four percent moves in top marginal rates on earnings which will likely result in relatively minor shifts in most high earners tax bills it says it all about your level of understanding I’m afraid.

When you don’t understand the difference between 25% move in capital gains taxes(5over20) and three or four percent moves in top marginal rates on earnings which will likely result in relatively minor shifts in most high earners tax bills it says it all about your level of understanding I’m afraid.

OK, so you now concede that people respond to changes in marginal tax rates, you concede that the changes do occur at low tax levels, and now you’re resting your claim on the degree of change.

5% drop from 20% = 25% decrease in tax rate and at a 25% decrease we will see changes in behavior.

4.6% increase on 35% = 13% increase on previous tax levels. Your claim is that people will not respond to a 13% increase in tax levels.

Where in your world is the dividing line between behavior being responsive to tax load and not being responsive. It has to be somewhere above 13% and below 25%, right? In this binary world that you’ve constructed, does everyone respond at the same point, like a light switch being flipped, so tax increases can nudge right up below the point where everyone responds and people will won’t react until the magic line is crossed?

I don’t get why you think that people will respond to a 25% increase in their tax load but no one will respond to a 13% increase in their tax load. Why wouldn’t some people respond to a 13% tax increase? You know, those “some people” being out there on the margin.

America has been running massive trade deficits for decades

Northern Europe has huge trade surpluses.

We export decent blue collar jobs, Northern Europe doesn’t.

James,

Have you ever gone by Jim? It sounds odd to me.

“OK, so you now concede that people respond to changes in marginal tax rates,”

Er no. A 25% shift in capital gains rates is not a small adjustment whereas a shift in top marginal rates on earnings from 33 to 35 and 35 to 39.6 is relatively insignificant! They are not getting a 13% tax increase because you only pay the increase on income over 250k for joint filers. This probably means for a typical couple with gross income of around 500k and maxing on deductions that their tax bill is going up by 10-12k max. This is not going to make an iota of difference to their behavior or lifestyle.

Uhh, the capital gains thing has been looked at many times. The effects of changes in capital gains on tax revenue are temporary. You see a big change when they are instituted or going to be started, then go back to a more average amount. However, on marginal tax rates, I agree that there is some effect. Most of the time events in the broader economy are just as or more important.

Steve

A 25% shift in capital gains rates is not a small adjustment whereas a shift in top marginal rates on earnings from 33 to 35 and 35 to 39.6 is relatively insignificant!

Just because you put an exclamation mark at the end of your statement doesn’t make it any truer.

You claim that a 25% decrease in a tax rate is not a small adjustment but you claim that the following is insignificant:

39.6% – 35.0% = 4.6%

4.6% / 35% = 13.14% tax rate increase.

13.4% is greater than half of the 25% rate increase you thought was “not a small adjustment” so why isn’t this tax rate increase at least “greater than half of a small adjustment?” Why is a 13.14% rate increase “insignificant?” I don’t understand your world. Could you please tell me where you put the dividing line between “insignificant” and “not a small adjustment.”

Have you ever gone by Jim? It sounds odd to me.

My did was Jim, so I defaulted to “James” by grade school. The Army was the only place where I was “Jim,” for whatever reason, although I never introduced myself that way.

I thought so. Jim just doesn’t seem to fit you.

As I’ve said before, higher taxes just translate into my doing more work. Not less, more.

As a result of relocating from NC (via Italy) to CA my taxes went up. So I do more work. I just took on a book I’d never have done if my taxes were lower and my net income higher.

Let’s say we sell 100,000 copies at $18 a pop. That’s 1.8 million. Sadly I don’t get all of that. About 1.5 million of that goes to pay editors and printers and truckers and store clerks. (And of course stockholders in the godless multinational for which I slave.)

Figure, what for the average job? 50k a year? That 1.5 million is thirty jobs for a year. So high taxes forced me to agree to create 30 full-time jobs. Oh, and of course I’m guaranteed to piss away my piece of it on hotels, restaurants and iPads. So that’s a few more jobs.

Of course in order to do the extra work I have to become more productive, get more out of my work day.

Jobs and productivity, brought to you by higher taxes.

@Michael : That’s because you’re a godless liberal commufascist. Everyone knows that good hardworking real American heros like Tangoman would rather work less and lower their quality of life in protest of the draconian tax rate of the 80s then work a little more to maintain their current social life.

I”m going to say something obvious, but bear with me:

People who talk about lowering the tax rate now, or preserving the temporary tax cuts, forget that income is way down. Tax receipts at local, state, and federal levels, are way down. Business men are paying much less tax than they were a few years ago. Put another way, all else is not equal.

You’d think they’d notice that the driver on their reduced income was not a change in tax, it was a change in the economy.

If you hear someone suggest that business isn’t hiring because they are worried about future taxes, you can be pretty sure that person is a shill, or an idiot.

TangoMan says:

Wednesday, July 14, 2010 at 22:32

“I don’t understand your world. Could you please tell me where you put the dividing line between “insignificant” and “not a small adjustment.”

In my world a roughly 2.5% reduction in the after tax income of a couple with gross earnings of $500,000, which would be the consequence of these band adjustments, is relatively insignificant versus a 25% reduction in capital gains taxes. If you can’t comprehend this then I’m afraid I can’t help you. Here again is a 101 on how a progressive taxation system works. If this doesn’t help try a remedial class.

http://taxes.about.com/od/preparingyourtaxes/a/tax-rates.htm

Michael! Why do you hate America??

Damned liberal slackers…

I hesitate to get into an economic discussion and hasten to say that I’m only really talking about my situation. However. For me taxes are just one more cost of doing business. Like rent, or car payments, or food or utilities.

In a perfect world they’d all be lower. That would be swell.

But since they exist, and exist at these levels, I have a choice: try heroically to maintain my degenerate lifestyle by working hard and finding ways to be more productive, or throw up my hands, surrender to the forces of evil by getting a smaller car, fewer cable channels, slower download speeds, and spend less time traveling, etc…

I make the choice I suspect most people make if they can: I react to high costs by becoming more productive. (See: New Yorkers, San Franciscans, etc….)

So, I know it violates various economic theories that no doubt seem very impressive on paper, but in my own world higher taxes force me to increase productivity and create jobs. It seems to have the same effect in most of the world’s developed economies where both taxes and productivity are high.

Anjin:

Considering a move in a couple of years to San Francisco. At which point America will actually hate me.

Michael R — Only Real America will hate you.

I’m thinking of moving to Oregon. I’d prefer that they have lower taxes, but I’ll pay the tax to live in the place. I mean, Nevada has lower taxes, but then I’d be in Nevada.

If there are Bend equivalents in southwestern low-tax states, let me know. Mountain biking, fly fishing, skiing, cheap houses.

My current theory is that nice places have higher taxes, because they can.

I’m thinking of moving to Oregon. I’d prefer that they have lower taxes, but I’ll pay the tax to live in the place. I mean, Nevada has lower taxes, but then I’d be in Nevada.

Why would you choose to move to a state that has such low diversity? I thought liberals luvved diversity? LA and New Orleans and NYC have lots of diversity.

TangoBrimelow:

I think since we aren’t racist morons like you we don’t look first at the racial composition of a place.

John mentioned biking, fishing, etc… People who enjoy those things are his tribe, not white people. I’m in SoCal for weather and proximity to Hollywood weasels. I’m in the tribe of “People who really hate cold and clouds.” If I move to SF it’ll be so that my son can be with his tribe: computer geeks.

I do sometimes think of the diversity of a place like New York, but to me that translates as “interesting ethnic restaurants.”

See, you just don’t really get what a weary, out-of-it relic you are with your laughable apartheid mentality. You belong in a museum. Normal people don’t look first at skin color. Normal people look at good schools for their kids, reasonable home prices, entertainment opportunities, climate, proximity to extended family, work. . . You know: things that aren’t about the amount of melanin in your skin.

We are members of various tribes — in my case the sun-loving tribe, the interesting restaurants tribe, the parent tribe, the need-a-decent-airport-hub tribe — none of which are about skin tone.

Well that’s what you get for “thinking”…

I think since we aren’t racist morons like you we don’t look first at the racial composition of a place.

You mean like university administrators, EEOC analysts, President Obama (police acted stupidly) etc.

Hey, I’m just taking the signals that liberals like you telegraph about the things that you love and I’m asking why liberals don’t live by those rules. Diversity is supposed to be like manna from heaven, so moving to Oregon should be something to be dreaded.

Oregon is a higher tax environment but it also has a highly homogeneous population and this high degree of homogeneity supports higher levels of social cooperativeness, which is the bedrock for many of the things that liberals hold dear. Oregon is almost as undiverse as Vermont, another liberal haven.

Brimelow:

Know another hotbed of diversity? West Hollywood. Diverse and ass-deep in liberalism. New York City? Likewise. Berkeley? Same.

In fact, I could go on naming place after place that is both diverse and liberal.

Which leaves you once again, making no point, making no sense, an out-of-touch, washed-up old relic preaching ideas that no one with an IQ over room temperature finds relevant to the year 2010.

I am a moderate, but I will miss the food.

Went to an awesome Schezwan place today. Probably wouldn’t have the authentic options we do in the OC. I think the nearest noodle shop is 20 miles away, and I’m sure not real Pho. Korean spicy beef an leek soup? Don’t get me started.

… so it’s a trade for the mountains and the trees. An escape from 12 lane freeways.

BTW, it is a mistake to generalize about the diversity of a state. Portland is not the same as John Day. No more than Dallas is the same as Austin.

BTW, Michael is right about Bend being “bike tribe”, but it’s got some old school western mentality as well. When they had too many geese in the park they killed some … and fed the homeless.

That’s awesome john..