How Much Student Loan Relief?

Now, we're just haggling over price.

During the 2020 Democratic primaries, Elizabeth Warren and Bernie Sanders championed the idea of student loan forgiveness. While Joe Biden opposed the idea at first, he gradually glommed on to it but in a smaller way. Last week, in his first town hall session since being sworn in as President, he shot down a questioner demanding that the government should write off $50,000 but championed a $10,000 amount.

Conservative friends on my Facebook feed have been circulating memes like this throughout the discussion:

It’s pretty intuitive. Especially if 1) you never went to college and resent the idea of being forced to subsidize someone else’s poor choices or 2) like me (and President Biden) you went to college a long time ago when it was much easier to graduate without debt.

Less often, I see memes more along these lines:

Again, it’s not wholly without merit. A lot of people do in fact borrow much more than necessary to get through school so they can maintain their parents’ upper-middle-class lifestyle, take beach vacations, and live the Greek lifestyle. I get why people who didn’t go to college or who were frugal while in school would be resentful of bailing out those who partied for four years. Or why people like Biden, who went to the local state university, would bristle at subsidizing those who went to fancy-pants Yale.

The “you should have worked a part-time job” argument is especially appealing for those of us who finished college more than thirty years ago. Between a $100/month ROTC stipend, $150/month from Army Reserve service (not counting extra pay for summer drills, for which I always volunteered for the advanced party for an extra week’s pay), and $135/month from the GI Bill, I did in fact finish not only my bachelor’s but my master’s debt-free. Most of my cohort who had loan debt were in fact living large during school.

But, again, it’s simply not possible to do what I did these days and it hasn’t been for 20 years or more. When I was at Jacksonville State, full-time undergraduate tuition was $400/semester, which is $954.68 in today’s dollars. Since “full-time” was 12 hours or more, I tended to take 18-20 hours at a time so that I could finish more quickly. Today, tuition is $324.00 per credit hour. Even at 15 credits, then, it’s $4860 a semester. It’s literally five times as expensive now as it was then. There’s also a $700 “general student fee” on top of tuition; if I paid one back in the 1980s, I don’t remember it—and I would remember $293 (the inflation-adjusted equivalent).

That, combined with two of the most massive economic catastrophes since the Great Depression—the Great Recession of 2008-9 and the COVID shutdown—means that a lot of people who did nothing wrong are in way over their head. They took out huge loans to get a college degree because everyone has been told for generations that it’s the only way to make a good living and yet states have quit subsidizing the cost. Meanwhile, the good-paying jobs never materialized.

Many economists therefore argue the $10,000 write-off is warranted:

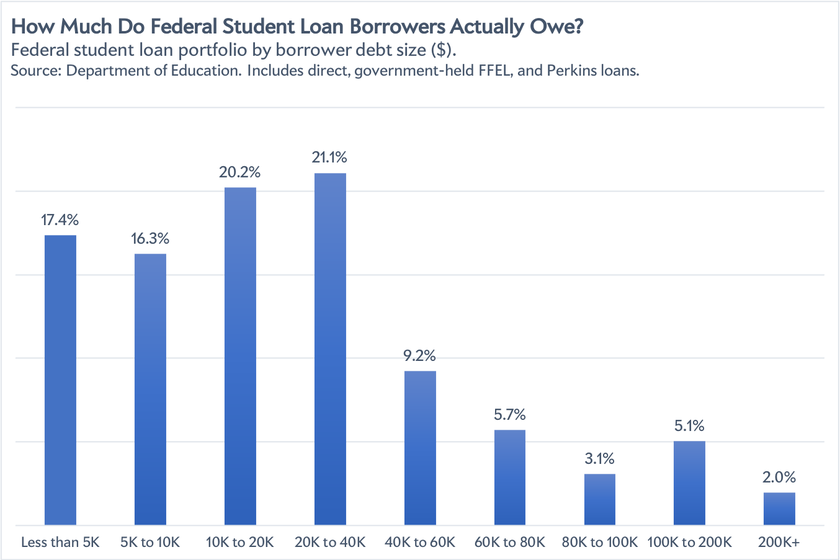

Some of the economists arguing for $10,000 forgiveness warn that anything higher runs the risk of rewarding borrowers who don’t need the help.

“Borrowers who have the lowest student debts are the ones who struggle the most,” explains Adam Looney, an economist at the University of Utah.

More than a third of borrowers owe less than $10,000 in federal student debt, according to federal data.

Often borrowers with low debt balances went to college for a semester or a year or two, and never completed a degree. Without a degree, those borrowers often earn less money, making it harder for them to pay their student loans, and making them more likely to default. Roughly 8 million federal student loan borrowers are currently in default, and most of them owe less than $10,000.

Certainly, this is the most sympathetic group. They’re likely first-generation college students who had poor prospects going in and either couldn’t survive academically, couldn’t make it financially even with the loans, or needed to enter the labor force full-time to meet family obligations. They’re already struggling to make ends meet and yet are obligated to pay off loans for a degree they never got. (And that’s to say nothing of those who fell prey to the ever-increasingly supply of for-profit degree mills.)

Those who complete their degrees, by contrast, tend to be able to pay back their loans:

Student debt is not a burden for everyone. Economist Looney points out that many borrowers who took out loans to get a bachelor’s degree are able to pay down that debt. And research shows that more than a third of student debt is owed by the top 20% of income holders in the U.S.

Slate’s Jordan Weissmann provides a handy-dandy chart illustrating the distribution of debt:

The $10,000 figure would wipe out the amount owed by more than a third of those with outstanding student loans and leave more than half of loan-holders with little-to-no debt. Further, limiting relief to the first $10,000 is

. . . decent way to target the most troubled borrowers while spending a somewhat limited amount of cash. One unintuitive wrinkle of the student debt crisis is that the ex-students who have the most difficulty paying back their loans are not, generally speaking, the ones who took out the most money. In fact, the opposite is generally true—borrowers who default tend to have some of the lowest balances, in part because a large share of them never finished their degrees. (A long-term study of students who began repaying their loans in the 2003-04 school year found that, of those who eventually defaulted on their loans over the next 12 years, 49 percent had dropped out of school.) The students who rack up the largest loan balances, meanwhile, have often earned advanced diplomas in fields like law and medicine that usually pay off fairly well, at least in the long term (obviously, being a hospital resident is not a financial picnic). Forgiving just $10,000 wouldn’t be cheap, per se—my quick Excel math says you’d probably be wiping away around $375 billion of the $1.5 trillion in outstanding federal student loans2—but it would keep costs down, while relieving a lot of financial pressure. Plus it would make the whole scheme a bit more progressive, since Washington wouldn’t be forgiving as much debt belonging to doctors and lawyers.

Most of the arguments for higher figure are about broader social justice issues:

Black families tend to have significantly less wealth than white families, according to the Federal Reserve, and Black households are more likely to have student debt — and more of it — than white or Latino families. They’re also more likely to default on their loans, even if they’ve earned a bachelor’s degree, thanks to discrimination in the labor market.

Proponents of the $50,000 proposal say a more generous policy would target those wealth gaps, especially among Black families. About 80% of borrowers have student debt under $50,000, according to federal data. Advocates of this proposal also argue this level of forgiveness is about racial justice — the dollar amount comes from research that found $50,000 would help grow the wealth of the highest number of Black households. (That research was later updated to reflect growing debt balances.)

“The student debt crisis is disproportionately impacting borrowers of color and communities of color, Black borrowers in particular,” explains Ashley Harrington, senior policy counsel at the Center for Responsible Lending. “When we talk about cancellation, we have to start there.”

Many Black and Latino families have missed out on ways to build wealth in the past — such as homeownership and job training programs — due to racist policies. Researchers who study and talk to student loan borrowers say student loan debt is a primary factor in holding them back now.

Weismann echoes that concern and argues that there’s no magic in the $10,000 number:

Once you set aside concerns about the debt, though—and in these days of trillion-dollar relief packages, it seems like a lot of Democrats have—it becomes pretty difficult to come up with a principled reason for keeping the limit at $10,000, especially once you start considering all the nuances of student debt that make it such a pernicious burden for many Americans, such as how Black Americans are particularly saddled by costly graduate school loans. I mean, once you’ve committed to doing any forgiveness at all, there just isn’t a clear philosophical dividing line between writing off 10 grand from everybody’s loans versus 20 or 30.

But that strikes me as a weak argument. Of course any cap is in some way arbitrary. But $10,000 seems to be 1) politically possible, 2) relatively targeted to those who need the most relief, and 3) minimizes poor people subsidizing the rich.

The Nation‘s Elie Mystal, however, isn’t buying it. For one thing, he correctly notes that graduates of fancy-pants Ivy League schools, like himself, tend not to have a lot of debt because those schools heavily subsidize low-income students with their generous endowments. Indeed, the list of colleges where students have the most debt is led by Philadelphia’s Drexel ($72,883) and nine schools with averages in the $50,000 range.

Further, he makes a more nuanced version of the social justice argument:

Moreover, to the extent that student debt forgiveness helps the Ivy League grads Biden apparently thinks are undeserving, that help will go disproportionately to graduates of color. That’s because student debt, like everything else in this country, hits Black and brown people harder. A 2016 Brookings Institute study found that Black students owe $7,400 more in debt than their white counterparts upon graduation, but that figure balloons to Black graduates owing $25,000 more debt than white graduates, tripling the gap between them, just four years after graduation.

Regardless, Weismann is right about how far the debate has come:

When you stop and consider it in the grand scheme of things, though, it’s somewhat remarkable that this plan is actually considered the moderate option at the moment, given that just a few years ago mass student debt forgiveness was still considered a relatively fringe idea mostly advocated by self-identified socialists. Now the president is striking a moderate pose by talking about merely freeing a third of borrowers from their education debt entirely while the Senate majority leader is urging him to go bigger. Times have changed in the Democratic Party—just a bit less than many would like.

While I still think the moral hazard issues that Pete Buttigieg and others raised have merit, some sort of forgiveness program seems reasonable under the extraordinary circumstances outlined above. Personally, I would prefer something like the $10,000 cap but to a program that’s targeted to those who actually need relief. If a younger me was coming out of Jacksonville State today with an officer’s commission and set to earn $40,629.60 a year (plus thousands more in non-taxed benefits) it would be perfectly reasonable to ask him to pay back $10-20,000 in student loans over time.

Further, Mystal’s argument actually points to an easier reform than simply wiping out massive numbers of loans: interest reform. For the last decade-plus, the Prime has been near zero. Most savings accounts and Treasury bills pay next to nothing. Why are we charging students usurious rates for their loans? Further, given that worthless degrees from online degree mills tend to be expensive, why shouldn’t those loans be dischargeable in bankruptcy?

This is a dumb idea. Even if I were going to go to college today…I have enough sense to know borrowing 100k plus for the prospect of securing a 40k job doesn’t make business sense. I personally went to Jr College for 2 years to minimize the amount of loans I would need to take the final 2 years. I ended taking around 20K which sucked to pay off…but I did.

Now, people that decided to borrow 200K to attend Southeastern Shaman Baptist University for an Herbal Basket Weaving Degree want a free pass for poor judgment?

This was neither an act of nature or fraud so there really is no reason for the Government to forgive the loans.

Shit….forgive my Mortgage payments then.

This doesn’t mean Im not sensitive to these people’s situations. Cap the payments as a percentage of income (which I think Obama did). Allow write downs for community, government, or Military Service. Move on to the next problem.

[Biden Staff Lurker—please get this up to POTUS. Thx]

I have difficulty understanding why folks like Warren and Sanders et.al. are so wrapped up with the $50K number for such a broad swath of students and want to do it by executive order. Frankly, Biden would need to spend a huge amount of political capital to accomplish that, likely at the expense of other priorities. What the proper dollar figure is I don’t know, but it should be targeted based on need.

Targeting the debt is only part of the problem, the true issue is the cost of college relative to ability to pay. Over the last 50 years most states have shirked their support of state college and university systems in order to keep taxes low and close deficits. Perhaps Congress should enact some sort of tuition challenge grant, the Feds will give grants to students for X dollars, but the state government would need to match those grants for residents to be eligible.

Or, I’ve always liked Milton Friedman’s solution, the student pays x% of their gross earnings for y years. It may result in the kid who goes to Wall St and is making a million/year, paying back a huge amount of money, but the kid who chooses a relatively low income, high social value career, could do so while having manageable student loans.

Given that student loan forgiveness is regressive (its giving money to relatively well off people), but that getting young people started in their careers is extremely useful, why not just give everyone say $10,000 (or $50,000 if you prefer a bigger amount) on say their 22nd birthday?

It’ll be cheaper than a year in prison and will help everyone (including the poor). And it might well get a lot more support than just forgiving student loans because it does help everyone.

@Jim Brown 32:

I’m basically with you on this. And I’d add that part of the reason college has gotten so expensive is that there’s an endless line of suckers willing to go into debt to pay whatever extortionate amount a college demands.

However, there has been a fraud committed, and it was committed by the education establishment itself with its irrational and monomaniacal insistence that everyone should go to college. Education’s a good thing in itself, but you can self-educate for free. Formal education is largely a matter of status and credentialing. College as cure-all panacea was never going to work for the obvious reason that status is by its nature relative. If everyone has a diploma, a diploma doesn’t mean much. Escalate that to a BA, and when everyone has a BA it doesn’t mean much.

We subsidize lots of things, and our tax policies are more favorable to some people or some forms of economic activity than others. For example, the gasohol mandate moved money from car drivers to farmers and enjoyed lots of support. Lots of tax relief goes to older people. I’m an old guy whose education was very cheap; I got some scholarship help and had summer jobs, and that was all I needed. Loan forgiveness would be a boost to young people. I think they would spend it on consumer goods which would help the economy, and it might even improve the birth rate. The federal government is financed via debt; the youngsters getting relief will inherit this debt. They won’t escape paying.

We should look at the cost of education. My education was subsidized, but the subsidies are lower now. I got my Covid vaccine this week. The vaccine was developed by Özlem Türeci who got her education without paying tuition. Großen Dank, Deutschland.

It would be better to restore bankruptcy protections. That way, people who truly have no chance of ever paying off their student loan debt can get relief that allows them to fully participate in society, which bad credit precludes.

We allow people to discharge medical debt, credit card debt, and even gambling debt, even though none of this debt is secured.

To prevent people from declaring bankruptcy the day they graduate, we can institute a waiting period. I don’t think 7 to 10 years post-graduation/leaving school is unreasonable. If the debtor returns to school, the clock restarts.

This isn’t without precedent. There are waiting periods for other types of debt. You can’t blow 50k in Vegas over the weekend, then liquidate it in bankruptcy on Monday. You can’t go to Europe and max out all of your credit cards, then liquidate it in bankruptcy as soon as you return to the states.

While I suppose there are people who will live like paupers for 7 to 10 years after graduation specifically for the purpose of declaring bankruptcy on their student loans, or who will suddenly quit their jobs just as their careers are taking off, I don’t think there will be that many of them. Additionally, bankruptcy has its own negative ramifications. It’s better than being saddled with bad credit for the rest of your life, but it’s definitely not “better” than never having declared it.

I hate that first meme. I could say the same damn thing about medical debt, credit card debt, and gambling debt, yet all of those debts are dischargeable in bankruptcy, even though none of them are secured. There’s nothing to “repossess.”

If we are to follow the logic of that meme, then we should abolish bankruptcy completely, for both individuals and businesses. You took out the loan or line of credit, you can’t pay it, tough. Your FICO will be 300 forever. Too bad, so sad. No excuses.

Odd how when our government decides to give huge amounts of money to the very rich in the form of tax breaks, no one ever stops to suggest we make sure that the tens of millions of dollars per year only go to the deserving billionaires. Because we have decided that shoveling money at people who already own more than half the nation’s wealth is an unambiguous good, while trying to help anyone else is just a path littered with moral hazard.

James: “Less often, I see memes more along these lines:”

It’s good propaganda, but nobody is working their way through (4 year) college these days.

This “idea” has the same problem that a path to citizenship for current illegal aliens has, namely, if you don’t address the underlying cause, you are right back where you started in 10, 20, 30 years, like we are after the 1980s amnesty and subsequent failure to secure the border as promised.

Any transfer of student debt to the non-college graduates should be prefaced with restrictions on college cost increases for colleges where student can get taxpayer money backed loans. It won’t happen, the professors like living off the backs of their debt slaves. The drive now is only because more and more young people are declining to sell their futures for some rambling vanity classes. The college degree is no longer a guarantee to a good job as it was 50 years ago. Now, the student must show they can solve problems instead of just repeat what they were taught.

–Econtalk podcast with economist Ed Leamer, April 13, 2020

There are a lot of employers out there who want employees with degrees. Indeed, many demand that higher ed provide job training and workforce development (so that the companies don’t have to).

This creates its own pressure.

It is also true that public colleges and universities are, in the main, get only a small percentage of their operating budgets from their states. I suspect that James’ alma mater, JSU, probably gets no more than 30% of its operating budget from the state of Alabama (I have seen the number, but I can’t remember for sure). Now, yes, it also gets indirect federal funding via Pell grants, which likely pay a significant portion of the expenses for a significant number of students.

Since most schools are tuition-driven, you get the inflation that James noted at JSU (and their cost of attendance is in line with those at my institution–JSU and Troy are very similar in many ways).

Also: as schools become tuition-driven, schools find themselves needing to compete harder for students. 18 year-olds are more convinced to come to your school if your dorms are nice than they are based on the quality of your chemistry faculty (and, of course, chemistry programs aren’t cheap to build for that matter).

And, yes, many schools have spent too much on the lazy rivers and climbing walls (and sports!), but this is a direct result of what incoming students value.

As a country, we need to figure out a better way to fund higher education.

A major problem, in my opinion, with US higher ed is that most schools across the country were built and predicated on unending population growth. But while some states are growing, others are not. Look into the plight of some schools in New England states, for example. Alabama is currently facing long-term declines in college-age kids.

A side note is that a lot of this debt problem, especially for those students with high debt and no job, are linked to for-profit schools that have low-to-no admissions standards, promise employment they cannot deliver, teach poorly, and in many cases lack accreditation so that students cannot transfer whatever credit they have earned to another school.

@JKB:

How did you know? It is as if you have been to faculty meetings!

@Michael Reynolds:

I think I have heard politicians say this.

It is rare for people in higher education to say this.

The cost of even community college is a lot higher today than what many Gen Xers and Boomers recall, at a time when the minimum wage is still $7.25. My semester bill for my AA was $1,200, and I left my BA with about $10,000 in debt in 1995. I left my MS with about $45,000 of additional debt in 2007, just a decade later.

In contrast, I took at a Spanish class at my community college in 2020, and the tuition plus fees plus the book was $900, for a single lower division course. That doesn’t include the parking fee, which I don’t have to pay because I am faculty. If I had, the course would have cost over $1,000. If I had taken it online, I would have had to pay an additional fee on top of that.

Funding a college education by “working your way through” is no longer the reasonable endeavor it once was. The gap between the expected entry-level wage and the cost of attendance widens every year, and it has widened at an increasing rate of change. Which means that folks who did it that way twenty or thirty years ago – or even TEN years ago – really need to check themselves.

If you’re a parent right now working with your high schoolers, the gap is going to be noticable wider for your youngest kid than it was for your oldest unless they are just a year or two apart in total. That’s how divergent the two lines have become. Even older Millenials who think they know don’t fully grasp it.

@Jim Brown 32: The Obama Administration may have capped payments as a percentage of income, but all that does is trap people into a lifelong situation of never being able to pay them off:

– The payments get capped, but the interest that accumulates does not.

– Which means that you can easily end up in a situation where the amount of monthly interest expense is greater than the required monthly payment

– As soon as that happens the first time, the excess interest gets capitalized and the monthly interest starts getting compounded into subsequent interest calculations

– That creates a situation where people who are following the rules and doing exactly what the Dept of Ed is telling them they are required to do to keep their loans in good status are trapped in student loans balances that are increasing an exponentially increasing rate of change

– Further, when borrowers sign up for these payment schemes, they are told not to worry about their account balance because after either 20 or 25 years will be forgiven

– But no one emphasizes at any point to them that the balance is a TAXABLE EVENT

– Which means that (and I’m not exaggerating – I am an accounting professor and I’ve built these models and show them to my students so that get a better understanding of the consequences of their borrowing) someone can borrow $50,000, end up making every regular payment they told that they are supposed to, and end up with an account balance greater than $100,000 (think of the what a normal mortgages Truth in Lending disclosure looks like regarding the total cost of borrowing), which is reported as TAXABLE ORDINARY INCOME to the IRS in the year of the forgiveness

– And now that person owes a marginal tax rate on money that is at least double their actual annual income to the IRS and has to come up with a payment plan to pay the taxes

– And if you don’t ever apply for forgiveness because you want to avoid that taxable event that you can’t afford, student loan balances can never be discharged through personal bankruptcy, unlike every other type of debt

– And if you end up with a student loan balance at retirement age, because you had a to do career change later in life, it gets garnished out of your Social Security payment, just like your Medicare premiums and any payment arrangements with the IRS

– So now you are a retiree with a funding level for your retirement below even what your Social Security payment should be because the money you should have been putting into a retirement fund went to the Department of Education for your entire working life

@no one in particular, again:

It is absolutely criminal that we can and do sign up 17 or 18 year olds for a lifetime of usorious debt all because we (the collective “we”) – the people who are supposed to be the responsible adults looking out for the best interests of the minors we love – convince them that their only pathway to success is to sit down in front of a computer for 30 minutes, watch a substandard video that “explains” a complex legal document (the Master Promissory Note) and all of it potential ramifications, and then sign a document that obligates them to repay debts without telling them exactly what the ultimate cost of those debts will be because both the total cost of borrowing and the applicable interest rates are unknowable at the time the document is signed.

@JKB: “It won’t happen, the professors like living off the backs of their debt slaves.”

You know, I’ve really tried to be more constructive and generous in my comments here after a time I was slipping into negativity sometimes verging on hostility. (Thank you, Trump era!) But honestly, there is no way to reply to this other than with a simple:

Fuck you.

I hate the concept of blanket student loan forgiveness, regardless of amount, but I don’t see another way to reach those individuals who actually need the forgiveness.

There are rampant abuses across the Student Loan system, and widespread bad faith. I worked the 2018 tax season for a major store front tax preparation chain (I was hired based on IRS certified training I had from many years of volunteering at military installation tax offices, a great way of getting out of real work!). Regardless of race, ethnicity, or socio-economic status, clients with student loans fell into three groups. The first (and largest) group were making on-time payments. The second group were not current on payments, but had hardships (under/un-employment, sickness, family tragedy). The third group just didn’t feel like paying, they usually had the means, and would often tell me of extensive efforts they would go to to request forbearance.

Based on the enormous number of loans involved, and the herculean task for Student Loan officials to determine who really needs help and who doesn’t, I don’t see another viable “Universal” solution.

@Steven L. Taylor:

In my kid’s high schools (both in Marin, so there’s that) it was college, college, college, and there was literally no other track contemplated. You went to college or you were a failure. Annoying enough for the non-conformist genius kid, brutal to the artistic worker kid. And that elitism pervades society.

Incidentally the genius is living off mom and dad, the ‘special needs’ kid is up for a supervisorial position at the grocery store where she works.

@Michael Reynolds: In full agreement on this. I would add this is what made Bernies “Free College” proposal ridiculous. Lets not kid ourselves, this isn’t about education, degrees are sorting tools to ration the supply of middle class jobs. If there become more BA degree applicants than middle class jobs–the discriminator then moves to graduate degrees.

Much of the problem we have today is that the barrier of entry for young adults to responsibly start and raise a family has become too high. We are now defacto requiring a minimum of 16 years of education, and, in many cases professional certifications as well in order to *Maybe* get an entry-level middle-class job. There are obviously exceptions with the Trades–but not enough to make it feasible for the average 20yo to pull in enough coin to buy a house/car with a partner, have a kid, and take a couple of staycations a year.

I don’t have the answer on how to de-escalate credential inflation in the workplace but 30 year olds at home is going to continue to breed social unrest going forward in the future.

@JKB:

Hey, meant to ask you: who won the presidential election of 2020?

@Gromitt Gunn: Thanks for the in depth analysis. Definitely educational.

Now that I think about it–I really knocked out my original loan when I got my graduate degree–courtesy of Uncle Sam so no cost to me besides the initial GI Bill buy in. When you are in school–the payments are deferred. I kept paying however which really knocked the principle down.

Easy fix–cap payments and interest. Or mandate 98% of the payment be toward principle and have the taxpayers pic up the difference after the 2% interest is applied.

@wr:

ego te absolvo.

@Jim Brown 32: No problem. They way that they structured it *seems* like it really should be a good solution, but the hidden ramifications make it anything but that once all of the different ways folks get trapped in it come together.

I’d like to see it capped at something like “once you pay twice what you borrowed, you’re done,” or even to just allow them to be discharged in bankruptcy in a way that makes people need to work towards paying what they borrowed without keeping them on the hook for the rest of their lives. Even a interest rate lower than or equal to the rate on a standard mortgage would be a huge deal.

@Michael Reynolds: I think that the Marin variable looms large there for sure.

@Michael Reynolds: it is interesting that he decided to comment on this but nothing else that has been major topics here over the last three months…

@Jim Brown 32:

To add to the problem, the kid and his often overwhelmed parents are left to sort this out on their own. Yes, high schools provide resources, but how many would tell a kid or more likely the parents that the student was better off going into the trades than a BA program.

@Jim Brown 32: Don’t have any outstanding student loan debt–paid of the $10k or so that I borrowed to finish my masters–but I am still sick to fucking death of assholes who characterize people with burdensome student loan debt as

. Get a real example or STFU. Just sayin’.

@Just nutha ignint cracker: Forgot to note in the previous rant that I really have no dog in the fight. Don’t particularly care whether this problem gets solved or not. It’s the whole “can’t get blood from a turnip” thing. People who can’t pay off their student loans will not have heirs who can. Immutable laws of economics at work.

@Barry:

I’m not sure if “nobody” is doing that but, as noted in the post, it’s certainly much, much harder than it used to be. But I think a lot of people passing along the cartoon, and quite probably the illustrator, are just from older generations for whom it was possible and they haven’t internalized the new reality.

@Sleeping Dog:

The last few years have shown that if you flood the media, you can get away with all sorts of things, since the opposition cannot focus. Political capitol just isn’t a thing. Group it with three other things that are going to get pushback, do them in rapid succession, and just go with it.

Want to be clever? Add a fifth thing that you don’t care about and can be rolled back, to give the conservative Democrats a victory.

Want to be mean? Get a delayed cabinet appointment to say “Yeah, I would have advised against that, maybe you should get a move on confirming appointments.”

It’s not like the opposition is going to hold back if there’s nothing worth opposing. It will be tan suits, fancy mustard and Hunter Biden’s laptop, or “Joe Biden is doing things that help people, how dare he!”

@JKB: And once again, he turns to a grossly oversimplified explanation from a libertarian-leaning economist. But I’ll give him credit for leaving out the underwater basketweaving reference, so a least he’s TRYING to be serious.

@Just nutha ignint cracker: I’ve got no dog in this fight either, and would be mostly conflicted — I can see the moral hazard arguments, and the arguments in favor, and I just don’t know.

But the arguments people make against it are so shitty and mean spirited that now I want it to happen. Is there a word that encapsulates optimistic, generous spite?

@Michael Reynolds: “In my kid’s high schools (both in Marin, so there’s that) it was college, college, college, and there was literally no other track contemplated.”

It’s not significantly different in Cowlitz County, Washington, where the principle industries–other than the hospital and school district–are Keystone Industries, a manufacturer of kraftpaper bags and boxes, and Foster Farms, a chicken packing plant. We pay lip service to “vocational education” here, but students are beginning to see that “vocational education” is a dead end that leads to minimum wage jobs unless you can get hired by a county. Part of our problem with minimum wage is that we’re fast approaching the $15/hr ceiling enacted into law, but it doesn’t pay $1000/mo. rent.

@Steven L. Taylor:

A college degree has become a major part of the middle class identity. A plumber might make more, but they’re considered low class because they work with their hands rather than their brains.

And that class distinction creates an opportunity for grifters to exploit.

At the very least we need to make loans for for-profit college degrees dischargable through bankruptcy. (We could use a redaction at the standard too, but I have a distaste for providing a subsidy (loans cannot be discharged, and the state will enforce them indefinitely… that’s a subsidy) to for-profit businesses — aligning government power with corporate power is generally bad news)

@Jim Brown 32: “If there become more BA degree applicants than middle class jobs–the discriminator then moves to graduate degrees.” I’m sorry to tell you this, but we passed that stop several stops back. I read an article in the mid nineties where the author was illuminating the “problem with borrowing for college” being that Oregon state already at that time graduated 10 times the number of degree holders that the state could hire. It got so bad at one point that Oregon colleges stopped granting admission to teacher training programs unless the students had a promise from a school district that would provide a teaching candidate slot for the student’s final year. (An interesting idea I would add, but it proved unworkable as a social equity problems as minority students usually didn’t have the connections for that type of a proposal.) While I was in Korea, 2008-2015, I encountered an article claiming that the US alone graduates 100% of the Ph.Ds the world CAN (but not DOES) hire. I don’t know when the return route is scheduled, though, so I can’t tell you how soon you can get back.

@Gustopher: “. A plumber might make more, but they’re considered low class because they work with their hands rather than their brains.”

Can only speak for the situations that I have seen, but the plumber who is making more owns his own business, so he may not actually be making more–with overhead, paying both sides of Social Security, reserves, ratios of “billable” hours to total hours worked, cost of staff (to lower his non billable hour count, for example), and other expenses that I may not even understand. The plumber who works for a company or a contractor in my area is making the same $15/hour that the minimum wage guy will be making in another year or two. At least that’s what I see over and over.

The technician at the auto dealership that I take my car to makes good money–for Longview, Washington. In Seattle, the same money makes a person who has to pay $640,000 for the house I grew up in part of the working poor. And how many welder, plumber, and auto tech jobs are there in the market. I realize that employers are moaning about the scarcity of people, but so are educational administrators, and I KNOW they are full of it.

I went to a Tier 4 law school, graduated in 07. It was the best thing I ever did. It was also my biggest economic mistake of my life.

For me, it was hammered into me that I had to go to college and then beyond at a young age. I really only made it through college because of inertia and it was cheap. 3 years of community college paid for by parents and 3 years of undergrad paid off on credit cards. I ended up with a choice, continue being a truck mechanic and eventual suicide, join the Army or go to law school. I went to law school only because the recruiters were idiots. I told them I didn’t want any MOS that involved fixing anything. I told them I’d be a tank paratrooper or human mine sweeper, but not mechanic. Apparently I scored really high on the fixing stuff test cause that’s all they offered me. Fixing 4 wheel vehicles in South Korea, hell.

So, law school it was. I took out the full boat of loans at stupid interest rates. I was told that it was a bad idea, but, wink wink, nudge nudge, you’ll be a lawyer. Cause, you know, lawyers, amirite… I got lucky. I loved every moment of law school. Seemed like a dream. and well, you know, suicidal. I graduated right before hell opened up and wiped everyone out. I was lucky though. I got a job, making 6 dollars a billable hour. The interest on my Sallie loans was about 6%, the private loans were between 6-9%. I made no payments for the first 3 years. All that interest capitalized. We got by because my partner, who had a Masters in Library Science got on a track in executive search. For the majority of our relationship she made more money that me, by a lot and paid her loans off in no time. I got a couple of raises and managed to get moving, but only started making any real money when I left the firm I was at and went solo. My interest rates are all above 5.

Now, you’re like, what’s the point of this? I will never be able to pay off those loans. They are a millstone around my neck that I just laugh at. They effect my ability to provide for my kids and they will effect my ability to pay for their schooling. They effect my credit, because that one time they erroneously reported that I hadn’t made any payments for months (in forebearance) and my credit cards got hammered (limits went down, rates went up) instantly. Every time a sanctimonious boomer or drug addled nitwit just bleats out “just pay it back”, I want to take a chainsaw to them. The whole system is set up so that most of us can’t pay them back. The interest just gets recapitalized and we start over. I will eventually die and these loans well never be paid off. I will pay off my car, my house, my credit cards and these loans will never be paid off. I will just pay and pay and pay. All because a suicidal 27 year old did what she was supposed to do and took the opportunity presented to her.

You want us to pay back every penny we borrowed? You want these to be non-dischargeable? You want these loans to haunt our family members when we die (thanks co-signors)? Then federalize all student loans and re-issue them at low interest rates, like what whatever a Treasury Bill is paying.

@Just nutha ignint cracker: That IS representative of “Real Examples’ —-to say it isn’t is disingenuous. Sure, it isn’t ALL EXAMPLES–but no example is.

Bottom line is people voluntarily borrowed money–many of them for degrees that offers scare outlooks of employment–or employment that was a lesser value than what they borrowed from For-Profit or Private institutions.

Many other kids undoubtedly evaluated that same situation and said “No Thanks.” Not the Taxpayers job to save the ones that thought it was a good deal–it want. If they feel defrauded–they can get a lawyer and class-action sue the Institution.

The Federal Gov’t is not the righter of all wrongs of last resort.

@Just nutha ignint cracker: No question about that–I would say a BA became the new High School diploma about 15-20 years ago. Its the reason I went and got a Graduate Degree… I started seeing that desired education qualifications in my field went from BS to MS–which by default meant that pretty much people with BS’s wouldn’t get call backs. Especially people with ethnic names and BS’s

I graduated NC State in 2005 with 15k in student loans. 2 years later I was working I in a coffee shop with a girl who had a full-time job and that part-time job, and I asked her why she worked literally seven days a week, and she said she went to Wake Forest and had $80,000 in student loan debt. Was her education that much better than mine?

@Jim Brown 32:

How about when the broader culture and the Federal Government conspire to inflict actual harm on people. As pointed out above, by Gromitt and myself, there are people who are going to be paying these loans for the rest of our lives. Well past the the time that we’ve paid back the actual principal and are only paying capitalized interest (and fees) and new interest.

We are all told we are worthless losers if we don’t go to college and get degrees and then told we are deadbeats when we can’t payoff the juice loans.

@Beth: Wow–that’s horrible! And frankly is beneath the intent of why the Federal Gov’t should be offering the loans anyway. We *should* be doing this because we want a higher educated citizenry and a good supply of professionals to do 1st world stuff.

Of course, the *actual* American way is to turn everything into a money-making hustle. There is no way on God’s green earth that we could allowing Student Loans at that kind of interest. It’s criminal.

Whatever Biden does–I hope it helps with your situation.

I’ve done some painfully stupid things in my life, but one mistake I didn’t make was I realized that all my physics professors had degrees from Harvard and Cal-Tech and MIT etc. and if a professor from schools ranked #1, #2 etc were teaching at a school ranked #50, (which NCSU was in physics that year), a Ph.D from the #50 school might not be a good return on investment.

Imagine my chagrin when a postdoc from the same lab I worked in was hired by Exxon for a starting salary of $85.

@Teve:

Clearly. Your education only qualified you to work in a coffee shop, while hers qualified her to work in a coffee shop AND another job!

And let’s talk about the work ethic she learned at Wake Forest — nothing creates a better work ethic than crushing debt.

JKB makes it quicker to read this blog because I hit those quote marks and know I’m done with the comment.

@Teve: He puts idea in scare quotes because he is scared of ideas.

@Jim Brown 32:

Thanks. We’re in agreement there. Frankly, I doubt anything the administration does is really going to help. The 5ok forgiveness would, hell, I’d take the tax hit for that.

I also can’tunderstand how we can populate Mars with robots but we can’t figure out a way to pay for everyone to go to school (college or trade) without taking multiple pounds of flesh out of them.

@Gustopher: i’m actually proud of how I talked my way into college. When I was about to graduate high school my mom and I went to talk to a career counselor at UF. We brought my high school transcript. The guy took a look at the transcript with my 2.98 GPA and told us in very polite and bureaucratic words that there was no fucking way I was getting into the school. Several years later I had moved to Raleigh and I went and found the Director of undergraduate admissions for physics at NC State and said look if I just apply you’re not gonna let me in. i was a terrible student in High School but I’m not a dummy. I taught myself Trig and then Calculus in the last year. So here’s what I’m going to do. I can take up to 2 classes a semester as a Lifelong Education student. I’m going to take physics 101 and calculus 101 and get a great grade in it. Then I’m going to take physics 201 and calculus 201 and I’m gonna get great grades in those, and so on, and if I do that for two years will you let me in the program? And he took a few seconds and looked out the window and said, “if you can do that, I’ll let you in.”

I have a fond memory. The physics building at the time at NCSU was connected to the chemistry building and, working in a polymer physics lab I would need something or other chemical occasionally and I would cross the hall and walk into a random chemistry lab and look for an Asian person. Teve why an Asian person? Because caucasians would ask me questions about why I needed it and what was I doing, and who my PI was, and Asian people would just go get it out of the cabinet. They didn’t GAF.

@Jim Brown 32:

Take right and wrong off the table for a moment — is it good for our country to have a generation where so many people cannot start families, buy houses and do the rest of the “becoming an adult” stuff for many years because they are paying down crushing debts? And future generations?

The economic activity that these kids would be creating is being lost because of rent seeking.

We need to fix education in this country — so a high school degree is considered good enough for a middle class life, as it was when we had a larger manufacturing sector; and so those who do pursue a higher education aren’t crushed. Plus we have to do something about the people who are already screwed, to try to unscrew them a bit.

My main concern with loan forgiveness is that it does nothing to stop the problem going forward. But sometimes you have to just kick the can down the road while you deal with other problems.

Ultimately it comes down to income inequality and a tax system that promotes capitol creating wealth without creating jobs. Manufacturing might not be coming back, but there’s no reason why manufacturing was well-paid less-skilled work while service sector jobs were always poorly-paid less-skilled work (ok, better unions, and racism, and sexism, but no reason intrinsic to the work).

You get taxed more hiring someone to do something than you would be taxed if you bought a machine to do the job. We literally penalize job growth.

This might be good for the economy, but the economy doesn’t need to eat, have a house, and raise kids. The economy should serve people, not the other way around.

If you want to be death-spiral of the declining middle class, you have to be a knowledge worker, and really be upper middle class. And that requires college. And so, you borrow what you have to. And you listen to the people who are telling you that you can make it, even if they are lying to you.

It’s like illegal immigration. You do what you have to do, and if conditions were better, you wouldn’t need to do it. And sometimes people are desperate enough or unlucky enough to hire the wrong person to help them across the border and they get pressed into sex work. In this metaphor, Trump University would be running brothels and be pimping out it’s students to Johns, who are financial lenders.

To be fair, I was asking for things like toluene and chloroform, so I wasn’t insulted by the questions, it was just faster to avoid them.

@Teve: You had to do a lot of work to get good grades in a couple of hard classes — I’m not sure I would call that “talking your way into school”.

You earned that chance, you didn’t talk your way in. Don’t sell yourself short.

(Other, less white-male people may have had a harder time getting someone to listen and getting a chance to earn that chance, but that’s another problem.)

@Jim Brown 32: You’re gonna have to help me out on this. Try as I might, I couldn’t find either Southeastern Shaman Baptist University, or degree programs in Herbal Basket Weaving. If you want to hold that an imaginary institution offering a degree in an imaginary major is “REAL EXAMPLES,” I’m happy to keep discounting what you say as so much bullshit. Even as I am on record in this forum for several years as a critic of both emphasis on university education as a panacea and of what our system has done over the past 40 years to gut working class wages and prospects.

AOC raising millions of dollars to help Texans and Ted Cruz splitting for Cancun. That says it all.

@Teve: Clearly not. But then again by the time you had STARTED school, “barista” had already become a career field for people beyond those who got their degrees at Southeastern Shaman Baptist University in Herbal Basket Weaving. Close to 15 years before you started at NC State, I’d already been told that I didn’t meet the qualifications to unload trucks overnight at Target–with 16 years experience in warehousing and inventory control under my belt–because I didn’t have a BBA in Marketing.

@Michael Reynolds:

Apparently those suckers have a better grasp than you do of the extent to which having a college degree is being used as a filter on job applicants, even for jobs where the content of the degree is utterly irrelevant to the work required.

Stepping back to the broader picture, this is a perfect example of the conservative mindset. When faced with the question “Would you rather do what’s best for America’s future prosperity, or would you rather make sure that no undeserving poor people put one over on you?” the conservative answer is always the same: it’s better to stifle the economy and cripple the future workforce than to reward even one slacker.

As noted in James’s last paragraph, if this were really about moral hazard, why exclude it from bankruptcy? Let them take the Trump Out.

@Jim Brown 32: Now if you want to have a real example of a problem related to the education system, I can point you to the class of 25 technical writing students that I had in 1995 who were finishing 2-year degrees in Desktop Publishing just as Adobe released Dreamweaver and Microsoft was about to release the program that they eventually embedded onto Windows 10.

@DrDaveT: i remember an advertisement for a GAP store manager:

A whole lotta jobs use Bachelors Degrees as a filter of the Undesirable Class.

@Beth: “I also can’t understand how we can populate Mars with robots but we can’t figure out a way to pay for everyone to go to school (college or trade) without taking multiple pounds of flesh out of them.”

We can, there’s just no money for the *job creators* in the economy in the second choice. Populating Mars with robots at least has graft enough for everyone to get a chunk.

@Jim Brown 32:

Only conservatives (and asshats) want to make this about righting wrongs. It ought to be enough to make it about managing the country sensibly. We don’t rescue idiots who surf in hurricanes because they deserve it. We don’t bail out GM because they deserve it. We don’t send the fire department to fires started by drunks smoking in bed because they deserve it. We do it because everyone is better off in the end if we do those things. And that should be enough, shouldn’t it?

@DrDaveT: Thats not the point…who is deserving or not deserving. The point is there isnt an unlimited amount of resources to throw at every problem. Which means we have to prioritize.

We save the lives of stupid people doing stupid things because its impactful and actually life and death. Outside of life and death I would prioritize quality of life issues (of which this qualfies but not at the helm of pressing quality of life issues in this Country right now) For issues that dont hit high enough to “right”, there is room to evaluate the impact of reducing *some* harm.

It appears harm reduction strategies for this particular issue are only bounded by creativity.

@DrDaveT: BTW I am neither an asshat–nor a Conservative

@Jim Brown 32:

You’re doing it again — you’re accepting the zero-sum conservative framing of the problem without question.

Of course resources are limited. The point, then, is to get the highest return for America on the dollars you invest. The economic return on debt forgiveness (or mitigation) for the generation currently being crushed under student debt burden would be enormous — much better than many of the other things we could spend that money on. That’s where “we would all be better off” comes from — not just better off than if that debt were still there, but better off than if we’d spent that money on various other things we tend to spend it on. Better than if we’d simply failed to collect the taxes to pay for the forgiveness.

Frankly, the argument for bailing out the students is better — and the moral hazard is significantly less — than for bailing out GM or AIG or Wells Fargo or J.P. Morgan or Chrysler or…

My biggest problem with student loan forgiveness is that it doesn’t fix the underlying problem. We are sending too many people to college. College are charging enormous amounts of money and we have a federal system that will hand them giant sacks of money to go to college. Unless we address the underlying problem, we’ll just be back here in ten years with an even *bigger* problem.

@Hal_10000:

Say rather, we have two separate problems. Fixing the debt burden problem will not fix the problem of our skewed educational requirements — you’re absolutely right about that. On the other hand, fixing the educational mix won’t solve the existing debt burden problem at all, either.

More cogently, the fact that bailing out the existing debt cohort won’t solve this other problem is not a reason to not do it. We should absolutely also do something about the problem you cite — but it’s not an either/or, and you don’t have to solve one before you can solve the other.

@Michael Reynolds: That “college, college, college” theme is all over my grandkid’s *elementary* school here.

Every teacher has their alma-mater posted outside the classroom door. A big banner in the cafeteria states “We’re the Bobcats and we’re going to college!”

I have complained to the local school board about it, but it turns out all of them went to college too, so it’s the only form of success they understand and appreciate.

We need more non-college graduates teaching high school, at a minimum. Kids need to see that there are many pathways to a great life, and that they are not a failure simply because they can’t/won’t choose the one that all of their teachers chose.

@Tony W:

That was true, but starting to fail as a system feature, when graduated from high school 50 years ago. I wish it were true and think that the nation could make it true again if we wanted to, but the reason that your community is pushing “we’re going to college” is because the likelihood that their children will have good life not doing it is vanishingly small. Even Reynolds’ kid moving up to a supervisory position in the retail business in which he or she works is one promotion out of 30 or 40 in-store candidates and countless outside possibilities. Reynolds’ kid won the employment lottery.

@DrDaveT: “Frankly, the argument for bailing out the students is better — and the moral hazard is significantly less — than for bailing out GM or AIG or Wells Fargo or J.P. Morgan or Chrysler or…”

If these “students” were really worthy of a bailout, they’d do what other needy souls do — spend millions of dollars lobbying congress and give tens of millions in campaign contributions. The fact that they won’t do this simply proves they’re not really needy.

@Tony W:

Not to sound like a credentialist boosting his own industry, but what is going to be the criteria for qualification for teachers who only graduated from high school?

I ask realizing that yes, there are people in the broader society without degrees who are smart and capable of teaching.

But you still need a mechanism for them to demonstrate ability. And, further, people in the broader society who have been successful without a college degree are unlikely to want to teach high school.

I can see it in some vocational areas, but even then, just because you are a good mechanic doesn’t mean you can be unleashed in the classroom to teach auto repair.

@DrDaveT: Im doing no such thing. Recognizing that, at a certain point, things DO become zero sum…and that there is such a thing as opportunity cost has nothing to do with Conservatism or Liberalism. Its an environmental management factor.

You’re make argument akin to arguments made by some within the Black community that proper diction and devotion to studies is ‘acting white’

What Ive stated has nothing to do with Conservatives or their bad faith attempt to shirk governing responsibility by applying similar reasons to every problem.

Here’s were we are: Democrats have a hair majority for *likely 2 years. This is an audition. I do not believe that Democrats were put in charge because voters like the system and simply want relief from some inequities. Voters hate the system(s). Trump’s ‘The system is rigged’ resonates because its true from the standpoint of rent-seeking pervading every rung of the upward mobility ladder.

Therefore, in a system with limited political capital, constrained resources, a pandemic, and a 2 year audition…you gotta come with your best act. The opportunity cost don’t make this a must do after I apply all the variable weights I believe are important from a whole of nation standpoint.

And Im reasonably confident Biden has someone in his ear with your take, and one with mines…hes going to have to evaluate the practical pros and cons with the political realities of his coalition.

@Steven L. Taylor: I had some grade school nephews staying with me while my brother took some out of town employment to stay working during the pandemic. They did virtual school and I listened in daily. I could honestly say I would feel comfortable with someone with an AA and teaching certificate teaching that level of school. I would certainly want a college graduate teaching high school students in the hard sciences and literature but K-8 I believe could have relaxed credential qualifications.

@JKB:

My daughter was a college professor and I remember the tremendous stress, insane workload, and late-night calls to me in tears because it was crushing her.

[Deleted]

My four years of USAF service got me a very modest G.I. Bill subsidy, but I still had to go to night school to get my degree. All of that aside, I assume the debt forgiveness is for government loans, correct? If so, I would limit future federal aid to state-supported universities ONLY! Why should we taxpayers subsidize a sociology degree at Harvard for $200,000? Or an ethnic studies degree at Yale for $300K? The same degree at Univ. of Texas is $112K, and all three will still likely to be unemployed.

@Tony W: I think that “certificates” of technical skills will diminish the need for a “degree”. In my former IT world, I’ve seen men (and women) who could type UNIX commands at 50 words/minute but had no clue as to who Beowulf was and didn’t know where Ibiza was. They didn’t need to know in order to do the job.

@Steven L. Taylor: As a side note: I think that tapping college endowment funds should be an integral part of college cost reductions. Harvard is sitting on an Endowment Fund of more than $40 billion! Yale has $30B. Stanford-$27B and MIT has $17B.

@Barry: My granddaughter is, with small academic scholarships and working 30 hours per week. Will graduate with an accounting degree.