The BOLO List And The Question Of Optics VS Effectiveness

The TIGTA audit reveals the BOLO "Tea Party" list was right 81% of the time. But does that change anything?

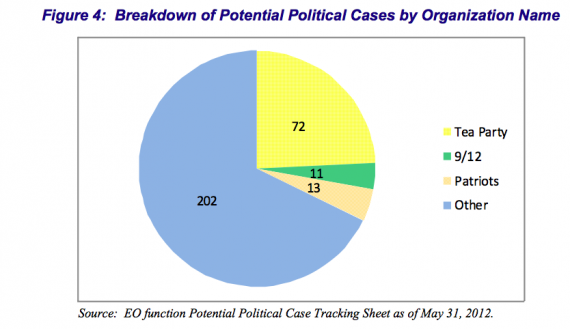

One of the key determinations of the TIGTA audit of the IRS’s was that initial reviewers used inappropriate criteria to select applications for review as “potentially political cases.” In particular, reviewers used a “Be On The Lookout [For]” or BOLO list, that contained, among things, phrases like “Tea Party”, “9/12”, and “Patriots.” We know from the audit that 100% of application containing these phrases in their names were held for review; ultimately 96 applications in total (see chart below).

What the audit fails to make clear, however, is that 78 of those 96 BOLO applications were found, upon review, to contain “indicators of significant amounts of political campaign intervention.” In other words, the names section of the BOLO list had an 81% success rate.

To put this into further context, the in-depth TIGTA review of all the flagged “potentially political cases” found that initial reviewers had a general success rate of 69% (of 296 cases reviewed, auditors determined 205 were correctly flagged). As it turns out, the BOLO list actually had a higher success rate than the standard review process.

But should that matter?

Audit interviewees noted that the BOLO list was intended to function as a “shorthand way of referring to the group of cases involving political campaign intervention rather than to target any particular group.” (TIGTA Audit 31/ PDF 37) These statistics seem to reinforce the effectiveness of the shorthand.

But, the question remains, is using a shorthand, regardless of effectiveness, the same as bias. On this topic the auditors wrote the following:

Whether the inappropriate criterion was shorthand for all potential political cases or not, developing and using criteria that focuses on organization names and policy positions instead of the activities permitted under the Treasury Regulations does not promote public confidence that tax-exempt laws are being adhered to impartially. (TIGTA Audit 7 / PDF 13)

The issue is ultimately one, not of actual effectiveness, but of optics. Regardless of whether or not the BOLO list was effective, in the opinion of the auditors, it was inappropriate because it gives the appearance of impropriety.

This attention to optics is, arguably reflected in the construction of the audit itself. The fact is that the very construction of the TIGTA report buries this finding. The critical information needed to calculate the success rate appears in the following paragraph and related footnotes:

Applications That the IRS Determined Should Be Processed by the Team of Specialists – We reviewed all 298 applications that had been identified as potential political cases as of May 31, 2012. In the majority of cases, we agreed that the applications submitted included indications of significant political campaign intervention. However, we did not identify any indications of significant political campaign intervention for 91 (31 percent) of the 296 applications27 that had complete documentation.28

27 – We could not complete our review of two cases due to inadequate documentation in the case files. See Appendix IV.

28 – Seventeen (19 percent) of the 91 applications involved Tea Party, Patriots, or 9/12 organizations.

(TIGTA Audit, 10/PDF 16)

This quote makes it clear that reviewers 69% general success rate — though rather than discussing this in terms of “success,” the phrasing focused on “failure.” But the real story, it turns out, is in footnote 28. From the footnote we learn the number of Tea Party BOLO List application that did not contain evidence of significant political campaign intervention. Using the total number of BOLO list cases previously given in Figure 4 (72 “Tea Party” + 11 “p/12” + 13 “Patriots”) one can quickly calculate the total percentage of correctly identified cases (again 81%).

I have to wonder if the Auditors chose to bury this lede because of optics. It’s hard to appear to be criticizing a practice while at the same time directly identifying how effective it turned out to be. (Likewise, one has to wonder if news outlets missed this because of how buried it was, or chose not to report it because it both complicates the story and leaves them open to questions of bias.)

There are some caveats here, the TIGTA audit only contained statistics on the BOLO list’s use of names. The audit also reveals that groups were also flagged based on policy positions. Unfortunately, the audit contains absolutely no data on how many groups were flagged based on policy or the number of those group whose applications were found not to contain indications of significant political campaign intervention.

Also, this finding most likely says more about the political nature of most Tea Party organizations than it does about the ultimate effectiveness of BOLO lists in general. As I discussed in previous posts, its hard not to see how groups like the Wetumpka Tea Party would not be initially flagged based on their activities. The thing to also remember is that even though a group was flagged for initial review, chances are that they will still be ultimately approved.

Also, conservative commenters might also suggest that all of this still remains a problem because many progressive applications could have been approved while these Tea Party applications languished. However, there are a number of indications that this simply wasn’t the case. First of all, its been found that a number of progressive organizations were flagged for specialist review and experienced the same delays and probing questions.

Further, we learned from the audit that, generally speaking, the initial reviewers didn’t let many “potential political cases” slip through the cracks. Auditors estimate that only 2% of all applications approved without specialist review contained indicators of significant political campaign intervention. Even if we were to accept for the moment that all of those cases were liberal organizations, that 2% — not surprisingly — translated to an incredibly small number (approximately 44 organizations out of the over 2000 that were approved without initial review during this period).

Looking at all this data, conservatives and liberals seem to find themselves suddenly defending positions typically held by the opposite side. For we could as easily be discussing this entire situation in terms of “profiling” versus “bias.” And the numbers suggest that profiling worked in this case. And if once groups were flagged they, by and large, received the same crappy treatment, wasn’t everyone treated more or less equally once they were “in” the system?

Ultimately, it increasingly seems like the real issue at the center of this “scandal” is what’s more important to us: Optics or results? Success or concerns about bias? But, before you answer, you should ask yourself: “which camp do I normally fall into when it comes to other issues of profiling?” Because, if you find that you’re suddenly switching sides, it might be a good idea to ask what makes this case so different.

—————

Full disclosure: In a previous post I got the BOLO list number reversed, mistakenly reading footnote 28 as saying that only 17 Tea Party BOLO list applications had been correctly flagged. I repeated this mistake in a number of comment threads. I have added a correction the original post an will be adding a correction to all of the comments I made. Apologies to anyone misled by my mistake and to the people who I thought I was “correcting.” Many thanks to a post by Martin A. Sullivan at Tax Analysts for helping me realize my mistake.

It’s interesting to me that the BOLO list sounds like profiling, which is (generally speaking) anathema to the left when applied for legal and security purposes, but (generally speaking) supported by the right in those same cases. This IRS case underlines for me how no one likes profiling when it’s applied to them. Classic human nature I suppose. It’s always the “other” who needs to be viewed with suspicion.

And yet, as much as I dislike profiling philosophically, it’s not just these BOLO list results that seems to indicate it’s simply more effective than random screening. I hate it when theory and reality don’t cooperate 🙂

Being right doesn’t make it right.

A broken watch is right twice a day.

Except for the broken clock in my ’72 tii…which is set to 4:20…and is thus always right.

Even Jenos is right once in a blue moon. That doesn’t make Jenos right by any stretch.

@Just Another Ex-Republican:

Completely agree.

In fact, this also gets to the point of how much work is expected to be done to ensure that profiling doesn’t look like profiling. One of the problems that Auditors found was that the IRS kept no records detailing the problems that were initially led reviewers to flag an application for “potential political intervention.” Without that paper trail, the assumption was always bias/profiling.

That said, it was much easier for me to say that the BOLO list/profiling was a bad thing when I incorrectly though it was wrong 81% of the time.

@Just Another Ex-Republican:

To be clear, the general screening wasn’t random. Each application was read by an initial reviewer. Based on the applications contents the reviewer made one of the following determinations:

a. Approve it on the spot (found to be correct 98% of the time)

b. Flag it as needing additional information

c. Flag it as requiring specialist review for one reason or another, including “indicators of significant amounts of political campaign intervention.” (again, on average, correct 69% of the time)

(there might be some cases where both b AND c were found)

Clearly, when in doubt the application was flagged for specialist review. And this makes sense, if the assumption is that it’s better to prevent illegal political activity from happening rather than trying to catch it once it happens.

BTW, the simplest answer for the success of the BOLO list in this case is that, in general, Tea Party groups engage in a LOT of political activity. This shouldn’t be taken as proof that BOLO lists or profiling in general works.

These days empirical evidence does not seem to matter when it comes to partisan political matters. What matters more is the source of the evidence – although to be fair, even this does not matter to Republicans.

@Just Another Ex-Republican:

There is a big difference between having to jump through some hoops to gain tax exempt status and having to hire a lawyer to keep you out of jail or worse Gitmo.

@Matt Bernius: Sorry to be confusing. I switched gears there when I was talking about random (or total) screening vs profiling, from the IRS scandal to things like US airport security vs Israeli airport security. Not to hijack the thread but it’s an interesting difference, and does speak to the optics vs effectiveness issue you mention. The Israeli’s have lived with the fear of terrorism a lot longer than we have, and their system doesn’t have a problem explaining that they pay a lot more attention to the backpack of a 22 yr old Arab male than they do an 80+ year old American female. The result is that airport security for the overwhelming majority of people is much LESS intrusive (not to mention massively quicker, much less of a hassle and much less expensive for all concerned) by the government than the US system. So is the profiling they engage in so wrong?

According to my uncle (who travels about 8 months of the year worldwide for his job), the US system is easily the most intrusive and worst to deal with. The irony he has noted is that he gets around much of the time-delay because his company pays for the various “fast-track” screening options available at US airports (which are easy to get–all you need is money and to not currently be on the no-fly list; they are hardly comprehensive background checks at all). So, in a VERY American approach, we bend over backwards to not give any hint of profiling for most of us (even though 99% of the effort is a complete waste of money and time), while allowing people with money to get through quicker. Seems kind of stupid to me, and a rather obvious hole to exploit. And you don’t even want to know how little security private flights deal with (pretty much none, as if those planes can’t be used to crash into buildings, smuggle arms, drugs, or people, etc…), but again, private flights are the domain of wealth.

I’m not arguing that profiling doesn’t have a looooong history of being abused around the world, including in this country, which is why everyone gets so sensitive when it’s applied to them, and yet….doesn’t every business engage in “profiling” when it does consumer research and targeting? Isn’t the key to doing pretty much anything efficiently (in government, the private sector, or even your personal life) is to first prioritize where you’ll get the most bang for your buck (“profiling” where the most easily addressed problems and/or biggest opportunities exist)? So if we want things to be efficiently run, shouldn’t we be encouraging effective profiling, whether it’s at the IRS looking into political activity or the police looking at drugs (that’s a good example of lousy profiling at the moment, to judge by black vs white arrest rates vs actual usage rates, and an example of how you can make profiling illegal or pretend it doesn’t exist, but it won’t stop people from instinctively doing it anyway, so maybe we should be encouraging SMART profiling instead?).

It almost seems to me that we’ve turned the word “profiling” into an automatic negative (like “liberal” or “conservative” depending on your point of view), without actually thinking about what the behavior actually involves, and I’m not sure I see how you can be efficient as any sort of oversight group without engaging in profiling, so arguably we should either accept and encourage it (and monitor it, of course), or not do it all all (for example, I happen to think the whole 501(c) section of the law should simply be abolished–there are way too many charity options available in our laws now, and again most of them benefit no one but the obscenely wealthy).

Citizen’s United opened up a can of worms as regards campaign contributions. All in favour of Republicans of course. This IRS issue is another reason that the tax law needs changing. None of these groups should get tax exemptions, knowing full well they are politically affilitated.

@Caj:

But what about some of the left leaning groups who were initially held and eventually were awarded their status (here’s a list of some 48 of these non-conservative groups). Clearly some were as directly political as most Tea Party groups… should they not have gotten Tax Exemptions as well*?

* – Again, the issue here really isn’t Tax Exemption. 527’s are tax exempt as well. The more important aspect of this — and what makes the 501(c)(4) form so prized is the anonymous donor thing.

Where can one find a COMPLETE list of what terms the IRS reviewers were flagging? The TIGTA report says a DU specialist “was asked to search for applications with Tea Party, Patriots, or 9/12 in the organization’s name as well as other ‘political-sounding’ names.”

I’d like to know what those other political-sounding names were.

I can think of several terms I’d look closer at if I was trying to locate all “potential political cases” — Democratic, Republican, Libertarian, Green Party, Progressive, Congressional/Congress, Senatorial/Senate, Representative, …

What else did THEY look for?

@Matt Bernius:

Absolutely, I don’t like dark money coming in from any quarter for any politicians.

@L.C. Richter:

Unfortunately, like a lot of things referenced in the TIGTA audit, a complete list has not been released.

Correct. At this time we do not know if all of the ‘political-sounding’ names were related to conservative groups.

And yes, like you, I’d love for the complete list to be released.

@Grewgills:

Then the thing you want to contact your senators and congressperson about is eliminating the 501(c)(4) form all together.

@Matt Bernius:

Done, now I will begin holding my breath while waiting for that change.