The Economy is Better Than it Feels

Why public attitudes are lagging real world performane.

Monday, I started but ultimately abandoned a longish response to Atlantic staff writer Rogé Karma‘s essay “The U.S. Economy Is Absolutely Fantastic” (since renamed “The U.S. Economy Reaches Superstar Status“). The hyperbolic title was actually exceeded by the lede paragraph:

If the United States’ economy were an athlete, right now it would be peak LeBron James. If it were a pop star, it would be peak Taylor Swift. Four years ago, the pandemic temporarily brought much of the world economy to a halt. Since then, America’s economic performance has left other countries in the dust and even broken some of its own records. The growth rate is high, the unemployment rate is at historic lows, household wealth is surging, and wages are rising faster than costs, especially for the working class. There are many ways to define a good economy. America is in tremendous shape according to just about any of them.

I spent quite a while attempting to Fisk the piece but gave up because it seemed, for reasons I couldn’t quite put my finger on, pointless. Driving in to the office yesterday morning, though, I listened to the latest episode of the Ezra Klein Show, “The Economic Theory That Explains Why Americans Are So Mad” and it clarified things for me.

His opening monologue begins:

Back in September, the economist put out this interesting model that pulled in a bunch of different bits of economic data, so things like the unemployment rate, inflation, gas prices, the S&P 500. And they used all that to predict how people would feel about the economy. And they showed that from 1980 to 2019. All these bits of data, they do predict how people feel about the economy.

And then the pandemic hits and the model completely falls apart.

By late 2023, the model is looking at low unemployment, it’s looking at falling inflation, it’s looking at a great stock market, and it predicts consumer sentiment. It’s going to be 98 out of 100, 98 out of 100. That is Joe Biden gets his face on a coin territory. Here, in reality, the actual consumer sentiment was 69. That is Joe Biden might lose re-election territory.

There’s been this debate for a year or two now about whether the economy is good or it is bad. And the language of that, the binariness bothers me. It’s like asking if the 19th century was good or bad. I mean, good or bad for whom? Compared to what? The economy is like this vast, multidimensional hyperobject. It’s a little too big for good or bad. I think we need to be more precise.

This debate is not about whether the economy is good or bad. The debate is about our expectations. Given what we’ve seen before, we would expect — we did expect people to be happier with the economy than they are right now, a lot happier.

I think that’s exactly right. While I quite agree with Khan (and the Biden team) that the U.S. economy is doing remarkably well by post-pandemic global standards, that’s not the metric most of us use. Further, debating whether something as complex as the American economy is either “absolutely fantastic”/in “superstar status” on the one hand or absolutely terrible on the other is just a dumb approach for the sort of people who read The Atlantic or OTB.

Later in the monologue, Klein continues,

So I’ve been working around this big theory of the economy right now. And it’s based on something that got published in The Atlantic in February of 2020, that cursed month right before everything shuts down.

In February of 2020, there’s this big piece on what they call “the great affordability crisis.” And the point the piece makes is that a lot is looking good in the economy — unemployment is down, wages are rising, people are feeling good. But if you look at the things people really need, housing, health care, education, child care, costs have just exploded. Quote, “The spiraling cost of living has become a central facet of American economic life.”

That piece read a little counterintuitively at the time. People felt the economy was great. How could you say there’s a crisis? And people hadn’t been paying much attention to costs for a while. The big problems after the Great Recession had been unemployment, consumer demand, financial fragility. This affordability problem, it was building in the background, but it wasn’t the thing we were looking at.

But then the pandemic hit, and then came inflation. And it was like this portal of salience for prices. Suddenly, all anybody was focused on was prices. The monthly inflation report got the attention that the monthly jobs report used to get — gas prices, food prices, car prices. Then the Federal Reserve begins raising interest rates, that makes it much harder to borrow money, much harder to finance buying a home.

And so the economy reorders itself to piss you off about how expensive everything is all of the time. The price of a cup of coffee is a reminder of the cost of a house, of child care, of a car, of a movie ticket. Maybe you can pay it. Maybe your financial situation is even OK after you pay it. But it doesn’t mean you like it and you’re reminded of it constantly.

What happened is not that the economy is terrible now and it was great in 2019, it’s at an affordability problem was building in 2019, a cost of living problem. Then inflation hit, and it made prices much worse, and it made the cost of living problem much worse. And now, prices and affordability are the part of the economy that people are seeing, and they hate it.

Now, it happens that said essay was written by Annie Lowrey, a star journalist who happens to be (since 2011) married to one Ezra Klein. And they have a very insightful back-and-forth that I encourage you to listen to or read in its entirety.

I will hit some of the points that particularly struck me below.

First, Lowrey contends that, during the Bush and Obama administrations, “the economy is defined by low growth, low interest rates, low inflation, high inequality. And the primary problem that policymakers are trying and failing to solve has to do with consumer demand, with demand in the economy.” While people mostly perceive the economy as doing well, there is an underlying cost crisis related to five sectors: health care, child care, higher education, housing, and elder care.

Ezra Klein: So one of the ways you would frame that piece, that was part of why it struck me at the time, was that everybody was really happy about the economy in early 2020. You have this line up top where it’s like, some of the best years the economy has ever recorded, people are getting bled dry on all these dimensions. If all of that was as bad as you’re saying, and it was, why aren’t people more upset in February of 2020?

Annie Lowrey: There’s a few things. So one is that directionality matters quite a bit. If things are rapidly improving or are falling apart, deteriorating really quickly, that’s going to matter more than a steady state. And here, I think that you are seeing a reversal of some of the trends in wage and inequality that we’ve had for a long time. That’s changing. And I think that people react to that.

The other thing is that the cost of living crisis that I had laid out, it built very slowly over decades. It’s a boiling the frog thing where just extremely, extremely slowly, you start to see all of these things ratchet up. And again, it’s a crisis not of inflation, not of change, it’s a crisis of level at that point.

And so I think that people, it’s less front of mind. The salient things about the economy are the wage gains. These kind of long standing problems are not quite front of mind for people. And things are getting better in a really noticeable way for folks.

Ezra Klein: I want to pick up on a word you just used, which is “salient,” because this has been — my motivation in this conversation a bit is trying to think about the economy and the politics of it this year, which we’ll get to. And the thing that keeps coming to mind is this question of salience, which is, we can’t hold the whole economy in our head, even in periods when we say there’s a really good economy, it’s bad for a lot of people. Millions of people are in poverty. Millions of people are losing their jobs. Periods where there’s a bad economy, lots of people are starting businesses, people are still getting rich. In a very complicated way, we have to choose what to pay attention to.

[…]

And then the pandemic hits and everything scrambles for a while. And then inflation comes. And inflation makes prices salient. And even now, as inflation eases, that doesn’t stop.

This concept frames the rest of the conversation. There are anchoring effects at work, so that public perception of the economy is based on what they’re used to, not some absolute standard. And the metrics economists and economics reporters use aren’t necessarily related to public perception.

Annie Lowrey: So to give a little bit of a historical perspective on inflation, inflation is really high when Ronald Reagan comes into office. It’s like 13 and 1/2 percent. Then it goes on this long, slow whoosh down through the George H.W. Bush administration. And it’s in a 2 percent to 4 percent range from George W. Bush, Obama, it’s really low, it’s less than 2 percent.

So you have this long period of quietude in which consumer prices, overall, are not changing that much. And the cost of some really important consumer goods, things that people are transacting for on a day to day basis actually go down. Electronics are the most notable example of this. But as a general point, you have this extremely long period of time in which stuff and basic services, things like haircuts or whatever, it’s all really cheap. It’s really, really cheap.

And what happens is in the first half of 2021, we see price increases concentrated among a relatively small set of items in the basket of things that the government looks at to determine the Inflation rate. So energy and car prices go up. You start to see really spiking commodity prices. Then you have this two-year period in which there’s giant spikes in almost everything. Food at home spikes. Food away from home, it spikes. Gas prices go up, natural gas prices, electricity prices. Shelter prices don’t increase in the way that food prices do, but they increase a lot, and they’re so expensive that that really matters. Commodities outside of food and energy go up. So it’s really, really unbelievably broad-based.

And so now, we’ve seen inflation, overall, come down from a 9 percent annual rate to a 3 percent annual rate. But basically, what it did, it was big enough to create this phase shift in prices. And prices don’t really go down.

So, a double shock. Not only are prices going up on things where people are really price-aware, but it’s happening against a backdrop of decades of stable prices. You have to be pretty old to remember anything like this. (Hell, I’m 58 and, while I remember it, I was still a kid, not an adult responsible for paying the bills.)

After some back-and-forth about how useful the standard metrics the government uses to assess various aspects of the economy and how little control the government (and thus the Biden administration) has over prices, they get to this:

Annie Lowrey: Inflation affects literally everybody. In an economy, and when I talk to people, inflation is much more pernicious for lower income folks because they’re really spending every dollar that they have on basic necessities, and for higher income folks, that’s not true. But you can talk to really rich people and they will be mad about inflation. They are mad about how much they are paying for things. It’s just universally enraging to people.

And there’s this perceptual problem. So the economist, Stefanie Stantcheva, who is at Harvard, who has found that Americans believe that their purchasing power is falling in a world in which there’s a lot of inflation. About four in five respondents to this survey that she conducted said that prices systematically increase faster than wages. That means nobody’s really getting ahead. This is not true, but this is what people think, real consumption and real wages are up.

[…]

Ezra Klein: I want to hold on that. How does somebody experience a wage gain? Your boss calls you into the office and says, we’re giving you a 6 percent, a 5 percent, a 7 percent raise. You’ve done great work. Thank you for everything you’ve done. Or you go look for a job and are able to bargain a higher salary than you were able to do before. That feels like something you did. I got a good raise.

And inflation feels like something happening to you. I got this raise. I’m making $2 more an hour than I was. And inflation is eating 80 percent of that. Inflation is a bad thing happening to you. And wage gains are a good thing you did. And the fact, frankly, that any of your wage gain is getting eaten by faster than normal inflation or prices that you have not in any way adjusted to, it’s really maddening.

Annie Lowrey: Absolutely. And look, the reason that interest rates are so high right now is to get inflation down because inflation is economically destabilizing when it’s too high, and it’s socially destabilizing. This is really well known. And again, you can tell people over and over and over again that they’re better off, but if you have inflation rates at 9 percent, people aren’t going to listen to you. They don’t like it. They don’t want to have to do mental math every time they go to the grocery store.

And when I talk to people about why they think the economy is bad, the first thing that people say to me, often, is, lunch at Chick-fil-A is $15. And lunch at Chick-fil-A being $15 is neither here nor there in the grand universe of what people are earning and paying for, but it’s a price that people notice, and it really ticks them off. The other thing is inflation has come down. It’s going to take a while for people to believe that. And one thing that I do think is changing now is that you are starting to see companies really start to compete for consumers on price. So both Burger King and McDonald’s have set out these $5 value meals. And Target said that it’s cutting prices for 5,000 frequently purchased items — things like diapers, and cat food, and dog food.

[…]

Ezra Klein: How much do you think the high prices of the small things act as a constant reminder of the high prices of the big things, which is to say, in a world where you know that health care, and housing, and education are incredibly expensive, how much does the fact that Chick-fil-A is $15, that a cup of coffee is $7 act as this constant salience portal to keep you thinking about this thing that is making you mad all through the economy?

Annie Lowrey: I think this is really important. So let’s say, as an example, the average American adult makes a purchase two or three times a day. And some people make purchases way more frequently than that. And a lot of families make purchases less often. They get gas once a week. They get groceries once a week and maybe a few other little things.

And so if two or three times a day, you are being reminded of the fact that your money is going less far than it used to be, I think that you’re going to be pretty angry about that. So one in three Americans eats something from a fast food restaurant every day. And about two in three Americans eat something from a fast food place once a week. It’s just really, really, really common. And the prices for fast food went up a lot. And I think that that contributed quite a lot also. Americans are currently spending more than 11 percent of their income on meals. That’s the largest share since the 1990s. So I think a lot of this is about food and restaurant costs going up quite sharply.

Between the summer of 2021 and the summer of 2022, grocery store prices go up nearly 14. And the cost of some grocery store staples — so dairy products, things like sugar and oil, cereals, it’s more than percent. And so I think that for high frequency items, all of a sudden, you just get this blasted in your face again and again and again. And even if you’re not spending that much overall on these things, I think it’s basically just tapping your shoulder over and over and over again and saying your money is going less far.

Whereas, even something like rent, which people complain about and talk about all the time, but it usually gets set once a year and you pay it monthly, so you’re reminded of it less frequently, even though that’s a much bigger line item on the budgets and fundamentally, I think a much more problematic part of the economy. And notably, rent goes up a tremendous amount during the pandemic. It’s a nightmare. It was really expensive. It’s even more expensive now.

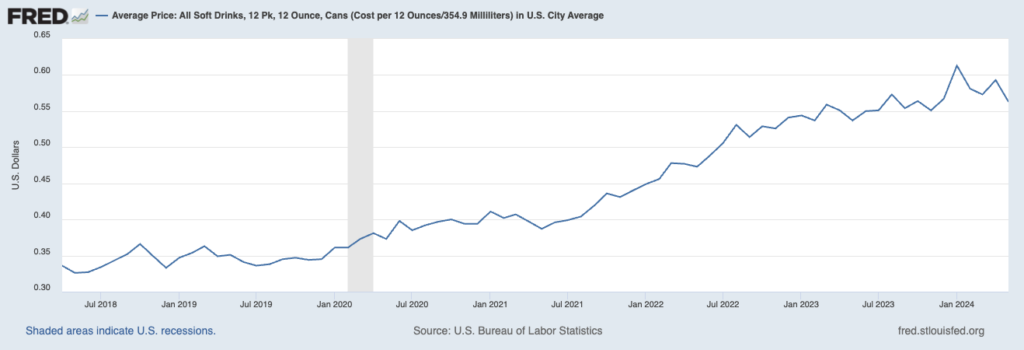

So, I don’t buy a lot of fast food. But I have certainly noticed the increases in prices, which have seemed massive. Getting a regular hamburger, fries, and a fountain drink at Five Guys is now over $20 where I live; it’s nuts. Or, to take a particularly annoying example, the price of canned soft drinks skyrocketed during the pandemic (ostensibly because of aluminum shortages) and have remained sky-high.

I seldom drink more than one 12-ounce can a day, but my wife and kids drink considerably more. Mostly out pf principle, we wait for it to go on a “sale” wherein buying in bulk gets the price of a 12-pack to $5 or less. But it’s a perfect example of what Lowrey is talking about: a consumable that has relatively minimal impact on the family budget but is nonetheless extremely noticeable because of the frequency in which it’s purchased.

After a bit of discussion of the Partisan Economic Expectations Gap, in which those of the President’s party tend to view the economy more favorably than those in the out-party, which partially explains why traditional metrics aren’t as predictive of people’s economic sentiments as they once were, we get this:

Ezra Klein: There’s something weird happening among the Democrats. They’re not giving Joe Biden the economic pass that you might expect from what we’ve seen in that data before. Why do you think that is?

Annie Lowrey: There’s two answers, and I don’t know which one it is. One is that they don’t really like him. Joe Biden is a somewhat less compelling politician for Democratic partisans than some other folks are in terms of his ability to stir the electorate and increase things like turnout. I think he’s a somewhat less vigorous campaigner than we’ve seen. And I think that he has somewhat lower favorability ratings and higher unfavorability ratings among his own partisans than we’ve seen in the past.

The second is that inflation is hitting them, and they’re just subject to the same forces that everybody else is in the economy. So Democrats are somewhat clustered more in the Northeast than on the Western coast, where you’ve seen really large increases in specifically, housing costs. But then you’ve seen urban housing costs go up everywhere. And so to the extent that we have all of these blue islands, that’s exactly where the prices have gone up, and it’s been really, really, really pretty bad.

That said, I do think that over the past, call it 10 years, you’ve started to see the housing crisis spread to communities that we would never think of as having won before. Rural areas, you’ve seen really dramatic increases in housing costs. Ex-urban areas, you’ve seen dramatic increases in housing costs. It’s everywhere now.

As to a theory favored by many OTB commenters, that blame public perceptions on the mass media (particularly the NYT):

Annie Lowrey: I would note that the mediating influence of the news media probably matters here quite a bit. So we know that holding economic conditions constant, media coverage of the economy has gotten more negative. And it’s especially more negative in social media where a lot of folks are now getting their news.

And I don’t think that that’s entirely the fault of journalists. People seek out bad stories, that’s what people want to read. So these are all headlines that have come out recently about household financial health and consumer spending — Americans keep on spending, but big retailers doubt it’ll last, Slump in big purchases clashes with government’s strong consumer data, Americans are still spending like there’s no tomorrow, Americans plan vacations even as they sour on the economy. These are all great stories. I’m not picking. These are all great. They’re really, really sensitive and really well-reported.

Ezra Klein: Does this media explanation actually feel true to you? Because here’s what I have experienced, as a person who writes about the economy, is married to a person who writes about the economy, and works in a place full of people who write about the economy, what I noticed happening was there was all this very sunny coverage of the economy, and everybody doing it was getting yelled at.

[…]

You write something about how the economy is actually looking really strong or we’re avoiding that recession or something. And people just got slammed by their audiences. They got slammed as out of touch. I don’t want to blow up your spot here, but you’ve written some pieces saying like, this economy’s actually pretty good. My sense is the reader feedback on that can be spicy, sometimes.

[…]

And I feel like the media got whipped by its audience a little bit into taking at least, some portion of the audience’s economic experience more seriously, which I’m not saying is a good or a bad thing, I think it’s a complicated thing. But it isn’t my impression that the economics reporting profession wanted to be negative on the economy. It’s that when they started covering the economy positively, what they heard from their readers or viewers or whatever, and then what they saw in the polling data, how people actually felt about the economy, was that people were not experiencing the economy positively at all.

I’ve seen the media in periods when we want to cover the economy negatively because the data is really negative. And that has not been what I’ve noticed happening here. In fact, I see a lot of stories about why aren’t people happier, given all this good economic data? And then all these people yelling at the author of those stories, explaining why it is that they’re not happy.

Lowrey agrees with all that and adds:

I think that people’s understanding of inflation is not economists’ understanding of inflation, which is something you were just trying to. I think it is real that people feel extraordinarily taxed by high prices. And the fact that the prices have only gone up 3 percent, they just went up 10 percent. I really credit that because I think that people are experts in their own experience. And I think what people are experiencing is really, really important.

Nevertheless, it feels to me important to point out that inequality dropping, that’s amazing. Declines in child poverty, that’s amazing. This is going to sound, perhaps, simplistic, but we have a gigantic economy. We’re not like Germany, where the entirety of the E.U. And so there’s just always a lot happening. And it can be hard when you’re doing these big gestural stories about the big headline statistics. You’re constantly missing things that are happening in this really vast, really, really, really diverse, really politically diverse, racially diverse, ethnically diverse country in which there’s really, really big problems.

People are allowed to be mad at stories. And I think you just have to hew to the complicated economic truth of any situation. It’s why I actually think that a lot of those headlines are correct. But I think that that leaves a lot of space for people to read in their partisan priors or read in their view of things.

There’s a whole lot more but I’ll stop there.

As I posted on another thread today, gas has come down more than 28% from it’s high two years ago, yet I’ve not read many articles about it.

So I went to google gas prices coming down to see what has been written, and in fairness, several stories popped up about falling gas prices. Yet the narrative remains that gas prices are high currently. They’re not, at all, by historical standards and trends.

So gas prices are down. Inflation is down. Crime is WAY down. Unemployment is down. The stock market is near it’s all time highs, reached a few weeks ago.

Yet Trump and his allies are badmouthing the country at every turn. I don’t get it.

I’d add that there are lag times on public perception. It takes people a while to realize the economy is pretty good. They don’t read Econ statistics. They pay for stuff, they get raises, they hear their nephew got a good job, the neighbors buy an RV. It’s feelz. And that takes time.

Also, too, the headline inflation rate is year over year, a measure that lags reality.

Polling started immediately on Trump’s conviction. I wonder if a polling company has ever tried to measure the time lag between event and public reaction.

@EddIeInCA: But they’re still radically higher in nominal dollars than when Biden took office. The FRED national average for Regular is $3.30. It was $2.30 in January 2021. That’s huge.

I’m always surprised that household debt load isn’t a bigger factor in these discussions, particularly credit card debt. Household debt is at $17.69 trillion:

Even when interest rates are low, credit card interest rates matter. When interest rates rise, accumulated debt is more expensive. So, if a household carries considerable debt, interest rates + inflation is going to feel like you’re slipping.

I think part of the problem shows up in one tiny comment:

That’s from Ezra. This means that the people he is talking to are, often, Republicans. Chick-fil-A is well known for gay-hating, and Republicans make it a point of (uh) pride to patronize them. Liberals stay away. Once again, the New York Times seeks out places where Republicans are happy to share their opinions.

And the Republicans never stop badmouthing all aspects of the country, particularly the economy.

@James Joyner:

…and there’s your explanation: people are innumerate, in this specific way. Even trained professionals can’t really adjust for inflation in their heads*, and the deep-rooted but irrational conviction that a dollar is a dollar drives the psychology of the situation. Even if a movie ticket today costs me 20 minutes’ wages, and in the past it cost me 25 minutes’ wages, my brain still wants to scream “$22 for a freaking movie ticket!?”

*Even professional cost estimators sometimes screw up in converting between nominal dollars, constant-price dollars, and constant-year dollars — and in knowing which one they should be using at the moment…

@James Joyner:

What you say is true, but it obfuscates the larger point and the fact that Americans are morons.

Gas prices, in real dollars (not adjusted for inflation), are less now than they were in 2008, 2011, 2012, 2014 – a decade ago – and 2022.

A chart that shows gas prices back to 1990

@EddIeInCA:

@James Joyner:

Furthermore, when looking at prices since 2000, the national inflation adjusted price of gas should be $3.90, much higher than the current $3.54 price.

In other words, Americans are morons, and ill-informed.

If you go back to 1970 and run the calculator, the variance is even worse, in that gas prices should be much higher than they are.

Even running the calculator from 2020 to today, the inflation adjusted price is $3.71, still less than the current $3.54.

Morons.

Gasoline Prices Adjusted for Inflation

@Cheryl Rofer: That’s Annie. And I doubt 99% of people make decisions on their fast food patronage on the politics of the ownership.

@DrDaveT: @EddIeInCA: Sure. It’s a point I make repeatedly when talking about gas prices. But it’s not unreasonable to answer “Am I better off than I was four years ago?” in nominal dollars. Because, as Ezra rightly notes, we tend to think of wage increases as something we earned and price hikes as something being done to us.

@James Joyner: Considering the number of people I’ve heard say they won’t eat at C-fA because of the politics of the owners, concluding that people who are using it as their example are Republicans isn’t that much of a leap.

But I would guess that part of the disconnect between what the numbers show and how people perceive their situation may be more of disconnection reflecting the rift between what makes a “median” income and other measures of economic stability. If a person only makes a median income, particularly in cities, that person is effectively poor, as in may not be making ends meet.

Don’t miss that not only have prices gone up but Biden decided to highlight the one way producers tried to dull the impact of inflation by reducing the size. And worst of all, Biden goes on about candy bars and potato chips which are things the busybodies harass people about eating to much anyway.

@JKB:

So you just glossed over the fact that, adjusted for inflation, gas prices are cheaper now then they were in 2008 to take a shot a Biden.

You’re a hack.

@JKB:

THIS is your take on shrinkflation? That reducing the amount of product but charging the same amount was a way to “dull the impact,” rather than the more obvious explanation of “businesses lying by omission to consumers”? And, that somehow, this is Biden’s fault, rather than the businesses that chose to take this route?

Your hot takes are unbelievable, and that is not a compliment.

It’s not just Republicans keeping the Chick-fil-A outposts here in Los Angeles busy at all hours. Plenty of liberals eat at Chick-fil-A.

And nobody Democrat, indie, or MAGA is being forced to spend $15-20 at Chick-fil-A.

Sticker shock over gasoline and housing costs is fair; these are staples. But those who can’t make ends meet whining over their own poor budgetary choices in spending $20 for a sandwich and some fries are not gettable for Biden. The criminally irresponsible are not a key part of his coalition.

It took a while, but smarter people realized the reason greedy corporate executives kept price gouging is because we kept spending money — sign of a hot economy, not a bad one. “Persistent inflation” (i.e. the businessesowners who rake in record profits actively deciding raise prices) is easing in part because there’s more people now looking at price tags and saying, “Yeah, right. I’m not paying that.”

To wit, AP — McDonald’s plans $5 US meal deal next month to counter customer frustration over high prices (May 16)

And, CNN Business — Retailers jacked up prices and squeezed consumers. They might have just blinked (May 5):

@DK:

Agree with pretty much all of that. Funny though, even though my wife and I can afford the price increases, we’ve cut back just out of principle. $18 for a Chipotle Bowl and a Lemonade? F-That! I can go home, make that exact same meal, for less than $5. I will still pay for sushi, and date nights, but every day eating out has been curtailed just for the sake of rationality based on corporate greed. Interestingly though, weed, beer, and alcohol haven’t seemed to have had any price increases.

And for the people complaining about Five Guys burger, coke, and fries costing $20, go to In N Out. You’ll get the same, with a better burger, for under $10. A double-double combo, with fries and a drink, will run you less than $12. I know because I did it yesterday in North Hollywood.

Shall we start with employment?

A. All economies recover from downturns. So Joe takes credit for what is just a rebound, as if he created it. I understand. Any politician would lie and take credit. OK. But as analysts, and not rank partisans or morons, we should acknowledge that its bullshit. Second, as to the unemployment rate, we should acknowledge that the job seeking population is down. Uh, er, that means the unemployment rate will fall. Arithmetic. Let’s also note that, numerically, the new jobs are largely part time, low wage, and that the number of jobs going to migrants is the same as all jobs. That doesn’t mean that every job was taken by a migrant. It means that net, US workers are no better off. Lastly, wages simply have not kept pace with inflation. Spin away, people. People are less well off. They aren’t stupid. You and your partisan “analyses” era.

B. Inflation. The Inflation Reduction Act. Green New Deal. Massive pork laden spending bills. An incredible injection of money into the economy. God knows where the money has really gone. Just pork. With no commensurate increase in productive output. Inflation is still at 3.5%. Wages haven’t kept up over the past 3 years. Stupid consumers. Idiots. They just don’t know how good they have it…………..except they go to the grocery store.

C. The Stock Market. Driven by interest rates. The most obvious example of income inequality. I guess that doesn’t matter if you can spin it to political advantage!

You guys can spin and spin all you want. The notion that everything is grand but people’s real world experience is just off base is just plain dumb. As is ‘corporate greed” and all the usual juvenile excuses.

This is Jimmy Carter Part 2. Knock yourselves out. Consumer – stupid. OTB commenter and Biden sycophants – economic gurus. (Gene Sperling anyone!!)

It plays on blogs. It fails real world. Please keep it up.

https://fred.stlouisfed.org/series/CE16OV

@Jack: A. There’s millions more American jobs now than pre-Covid, crime near 50-year lows, longest sub-4% unemployment streak in forever. The US now has one of the developed world’s lowest post-Covid inflation rates.

That rebound was not inevitable. We needed a president to take Covid mitigation seriously, and to invest in the America — like with Biden’s historic infrastructure bill Convicted Felon Trump repeatedly promised but failed at, since he was too busy cutting taxes for billionaires and telling us to inject disinfectant.

B. US job gains surge past expectations, wage growth quickens

US hiring and wage growth picked up last month in sign of sustained economic health

Surge in US wage growth surpasses forecasts, may impact federal reserve rate cut decisions

Workers win as wage growth outpaces inflation

We know MAGA will lie and lie and lie and lie: they attacked the Capitol based on sore loser lies after Drama Queen Donnie lost by 8 million votes. The rest of us will keep disseminating the facts.

C. Does the “it” in “It fails in the real world” refer to the GQP? Because:

Ohio Election Shock as Republican District Shifts 20 Points to Democrats

Democrat wins election in Alabama after focus on abortion and IVF

Democrats romp, Youngkin flops: 4 takeaways from Tuesday’s election

Michigan special elections flip control of lower chamber in Democrats’ favor

Florida Democrats flip Republican House seat in Special Election

Conservatives are knocking themselves out with their negatively, doom, gloom, and hate. The right has nothing positive to say about America, nothing inspiring to offer Americans — just racism, homophobia, anti-immigrant fearmongering, Putinism, extreme forced birth abortion bans, book bans, Hunter Biden’s dic pics, climate science denial, opposition to IVF and contraception, and an unlikeable rapist and convicted felon as standard bearer.

Plays well on talk radio, not in the ballot box. But just keep doing what you’re doing.

@James Joyner:

Of course it’s unreasonable. Today’s dollars are not the same as 4-years-ago dollars, any more than quarts are the same as liters. They are different units, utterly regardless of whether you think you earned your raises. It’s like thinking you got a raise because you’re now being paid in Canadian dollars…

@Jack:

Dude, you can’t have it both ways. If Joe isn’t responsible for the better-than-the-rest-of-the-world rebound, then he wasn’t responsible for needing a rebound in the first place.

@EddieInCA:

I’m not in the weed market by the price of both Scotch and bourbon has skyrocketed over the last 15 or so years. Beer has gone up steadily over time, with a modest spike since 2020, but probably not at a rate much higher than inflation.

In N Out is regional to the western part of the country. I don’t find them comparable to Five Guys, though. In N Out is a fast food burger and probably the best of them (their fries are among the worst, though). Five Guys has bigger burgers and more toppings (and fantastic fries) but they’re slow to arrive and much pricier.

@James Joyner: Gotta get In-n-Out fries well done (they will do this if you ask). It improves them dramatically.

@Jack:

Look at the inflation rate Nixon inherited from LBJ. Then look at the inflation rate Carter inherited from Ford. Then get back to us on how Carter was to blame for inflation.

@James Joyner:

both Scotch and bourbon has skyrocketed over the last 15 or so years

I wonder if TV advertising has played a role in rising prices.

@anjin-san: I don’t know that I’ve ever seen a liquor ad on television. I gather a couple of things have happened: there’s been an explosion in demand from the Asian market as their populations have gotten wealthier and, at least with bourbon, there’s been a substantial change in consumer tastes domestically back in that direction after decades of people drinking vodka, rum, and other spirits. Unlike other spirits, it takes a long time to adjust to increased demand because of aging requirements (most single malt Scotch is at least 12 years old) and the vast space it takes (bourbon is aged in “rickhouses” that are fairly massive).