Wage Stagnation and Total Compensation

Total compensation has been going up and the non-wage portion of said compensation is basically "eating up all" of the past increases since approximately 1974 resulting in a stagnant hourly wage.

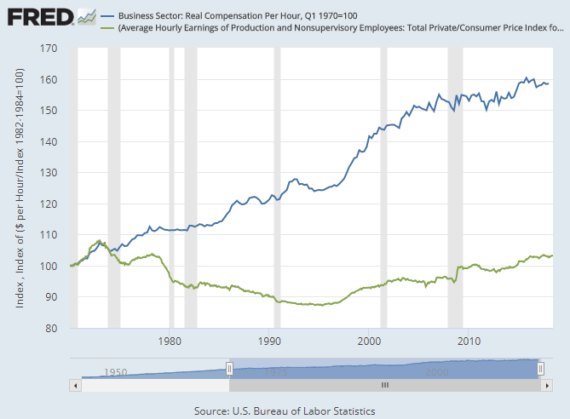

This post is somewhat related to Doug’s post about the recent jobs report. In that post Doug mentions that wage growth has been stagnant. And indeed has been the case for quite sometime. However, part of the problem is that people look at hourly wages which is only part of the picture when looking at compensation. A FRED blog post from quite awhile ago shows that what has been happening is that total compensation has been going up and the non-wage portion of said compensation is basically “eating up all” of the past increases since approximately 1974.

Now, I am not saying that there is no issue with the stagnant hourly wages or anything like that. In fact, this actually presents an actual problem and a source for growing wage income in equality.

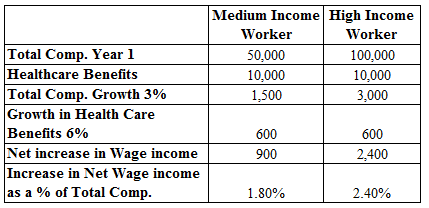

Consider the table below. The numbers are illustrative and are not to be reflective of actual wages. So we have a “medium income worker” and a “high income worker”. The benefits consists only of health care. It is assumed that total compensation will grow by 3% and that health care grow’s at a rate of 6%. In the end this results in a wage growth for the medium income worker of 1.8% vs. 2.4% for the high income worker. This is a substantial difference especially when compounded over time. After 20 years the medium income worker’s wage income will be almost 43% higher whereas the high income worker will have a wage income that is 61% higher. Another way to think of it is to use the “Rule of 72”. Using this rule you can approximate the doubling time for a given growth rate. Divide 72 by 1.8 and 2.4 and we get doubling times of 40 and 30 years respectively. Which would you rather have, the 30 year time span to double your take home wage or the 40 years? I know which one I’d rather have.

And to be clear this is simply baked into the compensation process by policy. The policy of moving healthcare expenditures as an untaxed non-wage benefit is what is driving the above numbers. Absent any other effects such a policy will lead to growing wage income inequality over time. I would also suggest that there is quite possibly a perverse feedback effect here. The separation of healthcare benefits may very well be part of the reason why healthcare expenditures have often grown faster than the over all economy.

How do we fix this? I have no idea. This policy has created a number of special interest groups that will resist changing such a policy such as the workers themselves. Right now healthcare benefits are untaxed. Convert that benefit into wage income and it will be taxed which will leave all workers strictly worse off. The healthcare industry also probably likes this policy in that many workers likely consider this benefit as a “gift” from the company and one they should “make the most of”–i.e. over utilize healthcare services and products.

I agree that the tying of health insurance with compensation-for-work results in increased wages that never actually occur secondary to medical inflation. As to your plea ‘(h)ow do we fix this? I have no idea.’

Single payer. Remove the connection between ‘pay’ for work and health care access.

Duh.

Is there some data to back it up, or is it just speculation? It runs counter to my experience and speculation — when I am paying for my health insurance directly, I see the money go out, and make a greater effort to actually use it.

For instance, I’m looking for a physical therapist for my long suffering knee. Partly I have time between jobs, and partly I see the money go out the door and that I am getting “nothing” for it.

Any solution that splits health care from employment is going to require that health insurance be tax deductible — on top of the standard deduction, or increasing the standard deduction — just to ensure that 99% of working Americans don’t immediately end up worse off. And that’s going to have to be worked into the tax withholding, so it doesn’t clobber everyone’s paycheck.

There would still be winners and losers from any change, but at least it wouldn’t be all losers.

Any such calculation should take into account that Americans pay somewhere between 60% and 250% for the same outcomes as every other advanced nation. The biggest difference? They cover every single person 100% of the time.

Steve,

Just wanted to say it’s nice to see you posting again.

” many workers likely consider this benefit as a “gift” from the company and one they should “make the most of”–i.e. over utilize healthcare services and products.”

While I broadly agree with your article, I don’t really know if there is good evidence for the above claim. There would be a lot of confounders to sort out to see if having a company buy your health insurance or buying it yourself, lead to more use of the insurance. The data is better for stuff like deductibles, but even there we still have the issue of short term vs long term spending.

Steve

@JohnMcC:

Single payer will likely be a disaster. We need more competition not less.

@Steve Verdon: Single payer doesn’t seem to be a disaster in he countries that have it. Are we uniquely special in some way, which makes us different from Canada, England or France?

Competition creates some poor incentives — insurers want to get the members with the lowest health care utilization, and that will affect profitability as much as (if not more than) any efficiencies they bring to processing health claims. The competition becomes an effort to cherry pick the healthiest and avoid the unhealthy. That doesn’t really help.

Small employers that offer health insurance see their rates climb dramatically when ne of their employees gets expensively sick, and that becomes an incentive for the employer to get rid of that employee.

So, any revamping of the health insurance system needs to somehow mitigate that incentive. ObamaCare uses risk corridors on the individual insurance market, which the Trump administration has been attacking. An alternative might be a free for all with those left behind covered by a public program funded by taxes on private insurance companies.

Someone has to pay for the guy with weird blood disorders in Iowa who costs $1.3M a month to keep alive and who messes up the entire community rating system. Or we let him die. And, there’s going to be someone like him in enough of the markets that you have to build a system resilient to it.

@Steve Verdon: Also, I am not sold on single payer, but I’m pragmatic — I want private industry where private industry serves a public good.

There might be a way to get a voucher program and a lot of regulation to create the right incentives where we have universal coverage (government supplies the vouchers) with private insurance.

But, competition isn’t a goal in itself. Our competitive health insurance market has been a complete failure at keeping costs down, while being quite profitable.

@Gustopher:

An important nitpick: France’s system isn’t “single-payer” but (like most countries) a hybrid public-private system.

A lot of Americans these days seem to use the term “single-payer” as a catch-all phrase referring to any health-care system that’s universal and has a major public component to it.

@Steve Verdon:

Except that the comparative policy experience does not suggest that this is the case.

Also: the problem with health care is that the competitive model has significant limits. When my kid falls off his bike and breaks his arm, I can’t price compare for services, nor can I defer the purchase until I can make adjustments to my budget to accommodate the new expense, likewise when I have severe chest pain at 3am.

@Kylopod:

That is a fair statement. There is a great deal of variation in systems across cases.

“Single payer will likely be a disaster. We need more competition not less.”

The states that had more insurers prior to the ACA adoption did not have lower prices, so there isnt much evidence to support this assertion. What has been shown everywhere else in the world that has quality care is that having everyone in a single system seems to lead to lower costs. That can be a true single payer, or a variety of public systems. However, market based systems are not working anywhere.

Steve

@Steve Verdon:

“We need more competition not less” is something of an undergrad econ kneejerk sloganeering. That’s unfortunate.

You need a system that responds to the market pecularities, and harnesses market mechanisms within that context. Organizing the health care mechanism such that price mechanisms can work is not a trivial task in the face of the behavioural aspects of health-care consumption and the well-demonstrated ‘bounded rationality’ in personal decisioning for medical care on anything where the sensation of life-threat is in play.

@Kylopod:

Yes the French sysstem (which I am myself partly covered under via my dear wife) works via the “Mutuals” (les mutuelles) which are as the name suggests, “Mutual” (as in Insured owned w caveats) insurers but are obligatory in one fashion or another. There is also private top-up insurance from above-bog-standard.

It’s not perfect, but by outcomes and by pricing it’s a reasonable model – one that would seem to have some applicability to the American context insofar as the Mutuals model is itself something not unknown in the USA, and could be perhaps adapted and sold.

Certainly with comparative health consumption experience between USA, UK and French systems, I can only observe that the French performance personally was excellent – of course no touchy feeliness like in USA, but that’s more cultural I should think.

I don’t quite get that.

After giving it some more thought, I’m assuming you mean people seek medical treatment for things that don’t require it, like the common cold or minor cuts and bruises(*), and/or request or are provided with more diagnostic tests “just to make sure.”

This may be the case, but the above quote sounds like people are visiting doctors and/or emergency rooms just to get something out of their insurance, whether they’re sick or not. It just sounds odd.

Now a brief description of healthcare in mexico:

It’s a mixed system, with both private providers and government ones. Government does not pay insurance, but provides care directly through clinics and hospitals. these are not concentrated in one agency, but divided among many. Some are federal level, others state, and a few are local. Some require payments withheld from payroll, others are free or ridiculously cheap (like $5 for setting a broken arm, say). And there are also charitable institutions.

Now, how good these government providers are, I can’t say for sure. You hear a lot about shortages of medications, but the people I know who use them tend to have good results.

They are incredibly bureaucratic, though. The company I work for sells food and food services to the government, among other things, and government hospitals are big clients. So I have this story:

Two coworkers were attending a meeting with a client. This client is in a big complex of 4 hospitals and some clinics, situated next to another big general hospital of another government agency, and a block away from yet another government hospital. So in the vicinity there must have been like literally hundreds of doctors.

One coworker, who has diabetes, started feeling poorly. So the other did the one thing he could: get him in a cab so he could go to his assigned clinic, about 10 miles away.

@Kathy:

That’s not where the medical expenses are. People with chronic conditions or people in the end of their lives that are the biggest expenses for medical systems, not healthy people going to the doctor due to colds or bruises.

You can’t have total free market on healthcare for obvious reasons. Unless you have some kind of public healthcare and then private healthcare to complement.

@Steve Verdon: Please explain how I can tell when you speak in vernacular and when ‘ex cathedra’, Your Infallibleness.

Or lacking that, perhaps you can explain how every other economically advanced nation has solved that problem that you — embarrassingly — cannot imagine a solution for.

Make employer provided insurance taxable comp. Reap a 100B a year in rev and people actually start to see the cost of their health insurance and shop accordingly.

Making sure that hospitals make their pricing obvious, simple, and the same for each similar operation would also help.

I just received a “bill” covering some necessary surgery–supposedly $15k, all of which is covered by insurance, even though I haven’t hit my deductible yet. So what’s the actual price? The quoted $15k? The price the insurance company will pay, which is probably less? Or the $0.00 + monthly insurance cost I and my employer end up paying?

@Steven L. Taylor:

Sure if you just go by accounting metrics. But have you factored in externalizing various costs. Extending wait times imposes absolutely zero accounting costs, but imposes tremendous human costs. Even better if the people die while waiting for treatment…no accounting costs there.

I find it amusing that people run to simple accounting when it is well known not to account for all the effects of a policy.

Do you do this with bread, cheese or most other items? The idea of competition is that it will reduce costs overall. Not that you need to engage in price comparisons. Competition means that entrepreneurs will constantly look for cost saving innovations and when they can’t find such innovations they’ll copy the innovations of those who do find them.

Food is absolutely essential to life. Yet we do not treat food like we treat healthcare. In fact, in places where healthcare is scarce food is abundant. And look at other expensive items we purchase. Cars have gotten progressively cheaper. An economy, entry level car will have power steering, AM/FM radio, CD player, power windows, ABS breaks, cruise control, AC, and Blue Tooth. At various times these were all luxury car items…yet we find them on relative low end models these days. Look at computers. Now you can get 1 terabyte of storage, 16 gig of ram, and i5 or i7 processor, and a flat screen monitor (maybe two depending on where you are shopping) for about the same price as a much less powerful computer 5 years ago.

Competition drives down the cost curve. Competition also drives up the quality. These are obviously trade offs, but over time we see things getting better not worse. The idea of competition driving down costs and quality just does not square with reality. Your television is a vast improvement over what you had 10 or 15 years ago…and it doesn’t cost all that much more. Thanks to competition.

When was the last time there was competition in the health care market? Hint: your grand mother was probably 10 years old at the time. We have not had a competitive system in the U.S. since around 1920…almost 100 years ago. Neither you nor I know what a competitive health care system would look like….because the U.S. never gave it a shot.

http://www.econtalk.org/christy-ford-chapin-on-the-evolution-of-the-american-health-care-system/

@grumpy realist:

http://faculty.chicagobooth.edu/john.cochrane/research/papers/after_aca.pdf

Give that a read…it is pretty illuminating.

Or try this podcast while you are stuck in traffic…

http://www.econtalk.org/cochrane-on-health-care/

@Steve Verdon:

The context for food production and acquisition are quite different than that of health care acquisition.

One does not typically go grocery shopping when literally starving to death.

But, you are making a lot of claims about how such a system would work. We do, however, have an awful lot of comparative information about what state-sponsored, universal healthcare looks like globally and it would suggest that it works pretty well.

@Steve Verdon:

I get all of that (and the previous examples). I agree that competition is good for consumer goods, and for a lot of things. I am not, however, fully convinced of the unvarnished good that unfettered competition can create.

Again: televisions aren’t healthcare. I don’t need a TV, and there are ways, in fact, to watch that football game that I really want to see for free. I can’t go to my neighbor’s house on a Sunday afternoon to get chemo, however.