Welcome To The Era Of Trump’s Trillion Dollar Budget Deficits

We're set to return to the era of trillion dollar budget deficits, and Republicans won't do a thing about it.

Later this week, the Congressional Budget Office is expected to release a report confirming that we will see Federal Budget Deficits exceeding one trillion dollars for the remainder of the Trump Presidency:

The new U.S. normal of $1 trillion or more annual federal budget deficits will officially begin this week when the Congressional Budget Office releases its economic and budget outlook report showing that the deficit will be at least that high every year Donald Trump is president.

Although there have been private sector projections for months (including my post from last October) that the government’s red ink will hit and exceed a trillion dollars for years to come, this will be the first report by Congress’s official budget watchdog since last year’s big tax cut and this year’s spending deal were enacted that will show the deficit rising precipitously and staying at that very high level through the next 10 years.

The official CBO projections are likely to be lower than the budget deficits that actually occur. CBO’s report is based on current law and makes no political judgements about what Congress and the president will do in the future. That means the deficit projections will be based on the presumption that the tax cuts enacted last year that currently phase out will in fact end. That means the CBO forecast will assume that future revenues will be higher and the deficit lower compared to what is likely to occur.

The same is true for spending. For this report, the Congressional Budget Office doesn’t presume that any of the reductions proposed in the Trump 2019 budget will be enacted. That will increase the deficit outlook compared to what the White House will say it will be.

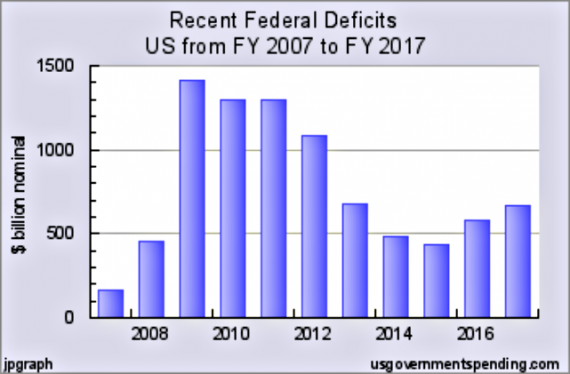

As conservatives and other supporters of President Trump will no doubt point out, this won’t be the first time that the Federal Government will run budget deficits in excess of a trillion dollars. The early years of the Obama Administration saw a similar phenomenon, and of course it became a point of criticism on the part of Republicans both when they were in the Congressional minority and when they took control of Congress in the 2010 midterm elections. Indeed, those deficits formed much of the basis for the numerous confrontations between the White House and Democratic Senate on one side and the Republicans on Capitol Hill on the other. As Forbes magazine’s Stan Collander notes in the article linked above notes, though, those deficits came in the wake of the Great Recession and, while they were at least partly attributable to increased spending in the early years of the Obama Administration such as the stimulus package that was passed when President Obama first took office, one of the main reasons for the size of those deficits was the fact that the Great Recession had a serious impact on Federal Government revenues that lasted for several years after the recession ended. Over time, though, that deficit gradually shrank, as this chart shows:

As you can see, the trillion dollar deficits ended with Fiscal Year 2012. After that, the budget gap gradually fell to the point where it was even under $500 billion in Fiscal Years 2014 and 2015. Credit for that decrease does lie, in part, with the budget deals that were reached between the Democrats and Republicans that resulted in at least some constraints on spending such as the sequestration deal that was reached to resolve the 2011 standoff over raising the debt ceiling. At the same time, though, a great deal of the credit for the decline in deficits lies in the simple fact that revenues returned to more “normal” levels after several years of being lower due to the impact of the recession.

The difference between those Obama Era deficits and the ones we’re likely to see under the Trump Administration is that these deficits will be taking place during a period of economic growth, Indeed, the Administration’s own budget projections assume rising deficits notwithstanding the fact that they believe, without any real evidence, that economic growth in the coming years will be stronger than it has been in the recent past. If it turns out to be the case, as it most likely will, that actual economic growth is slower than what the Administration and Republicans on Capitol Hill are forecasting, then the deficits will be even higher than they are currently projected to be unless Congress and the White House move to act by either cutting spending or finding a way to increase revenues. Even more ideal would be an effort to address the structural issues in the Federal Budget that are making these deficits possible, including addressing the controversial issues surrounding so-called “entitlement” spending. The odds of that happening in an election year are, of course, non-existent, and the odds of them happening in a non-election year aren’t much better.

Former Republican Senator Judd Gregg hits upon the problem quite well in The Hill:

One might assume that the president, who has railed against the inequity of sending American dollars to China in the form of our trade deficit, would be equally outraged at sending them all these American tax dollars to support payments on our debt.

This is not the case, however.

He and the Republican Congress are now on a path that is well trodden by their liberal counterparts in the Democratic Party: running up the debt to pay for the baubles of today at the expense of our children’s future.

It should be called by its actual name: inexcusable, irresponsible liberal spending.

But it is not.

According to the president and his abettors in the Republican Congress, it is called “deal making.”

The Art of the Deal has never been so misdirected and destructive.

Ralph Waldo Emerson famously observed, “consistency is the hobgoblin of small minds.” Certainly this philosophy has been put on steroids for most of this president’s time in office.

There is one exception.

The president has been unceasingly consistent in his lack of concern for, interest in or, one suspects, awareness of the deficits that his government is running up or their dire implications for coming generations of Americans.

As to the Republican Congress, someone asked if there are no “deficit hawks” left in the Congress? The answer is that there are not even any “deficit pigeons” in this Congress.

One can understand why the president is so oblivious to the results of his actions in exponentially increasing the federal debt.

He does not care.

As a businessman, running up debt that could not be repaid became one of his most successful tactics. Not paying his debts in full or filing for bankruptcy worked for him in his prior role as a hotel builder. It can be assumed that he sees it working in his present role.

Trillion-dollar deficits as far as the eye can see, along with $1 trillion interest payments? It is unsustainable, to put it kindly.

Bankruptcy for a nation, however, is not a viable option.

The bill passed by the Congress and signed by the president sets a fundamentally new tone for the Republican Party.

As Collender notes in his Forbes column yet another proposal for a Constitutional Amendment requiring a balanced budget, this week’s news about the beginning of a new era a trillion dollar budget deficits isn’t likely to cause either the President or the Republicans on Capitol Hill to actually do anything year. As it stands, it seems fairly clear that neither the House or the Senate even intends to comply with the law requiring the passage of a Budget resolution setting forth their budget plan. Instead, they’ll just put together another massive Omnibus spending bill that will not address any long-term issues, and there certainly won’t be any discussion about rolling back the tax cuts that passed in December which are projected to add $1.5 trillion to the budget deficit over the next ten years. Instead, we will likely see mostly symbolic and meaningless move such a the vote scheduled for later this week on something that won’t actually pass Congress never mind the state ratification process and which will do nothing to address the issues actually causing these new record deficits. So much for the party of fiscal responsibility.

Whyat’re you talking about Doug? They’re gonna make them even worse! Then they will say “Seee!! We need a balanced budget amendment because Democrats make us do these things!!!!”

ETA: now i’m gonna go read your post.

All’s I can figure is this is Democrat Party’s fault because DACA.

@OzarkHillbilly: Doug already covered the point I was going to mention, which is that the revenues in 2017 are presumably a hell of a lot higher than they were during the Great Recession. One can claim (like MBunge probably will) that “nobody” minded when Obama had these types of deficits, but there was a significant difference as to the reason why.

@Franklin:

I think the proper answer for the Trumpian whataboutism is “If you’re going to run things like Hillary and Obama did, we may as well replace you with Hillary or Obama.”

Such Holy horsesh!t. Not that DEMs are perfect but who was the majority in Congress when Pay-Go was first enacted in 1990?

Who was the majority in Congress when Pay-Go was suspended in 2003?

Who was the majority in Congress when Pay-Go was reinstituted in 2006?

And who is in the majority now, when it is just being flat ignored with magical math?

And just exactly who do we expect to bring it back?

Please, let us cut the fantasy about Republicans and fiscal restraint.

ETA and just to be clear I am aiming this rant at Gregg who uttered this inanity, not at Doug who is just quoting him.

@Franklin: Yep.

U.S. Tax Revenue

FY2009: $2.10 trillion

FY2017: $3.32 trillion

@OzarkHillbilly:

This times a hundred. The GOP makes noises about deficits and then invariably makes things worse. And it’s not just Washington. Kansas followed the GOP economic ‘theory’ and promptly went broke. California – you remember California, we were an irretrievable mess because libruls and brown people? We have a six billion dollar surplus.

One of the most effective implementations of the Big Lie in human history is the assertion the GOP has at any point been the party of fiscal responsibility.

Republicans want the same benefits of big government anyone else does. They just don’t want to pay the bill.

@OzarkHillbilly:

Take a look at the historic budget tables. The Democrats massively increased spending after they took Congress in 2006. The only real spending restraint we have seen in the last 30 years have been when we had a Democratic President and a Republican Congress. Just to run the numbers for you, here are the average spending increases over the last thirty years (the * is counting the stimulus as Dem spending; it was technically in Bush’s budget but retroactively):

Bush and Democrats – 5.4% annual increases

Clinton and Dems – 3.7%

Clinton and GOP – 3.5%

Bush and GOP – 6.6%

Bush and Dem – 8.6% (*)

Obama and Dems – 6.3% (*)

Obama and GOP – 2.1%

Trump and GOP – not clear yet, but high.

Neither party is one of fiscal responsibility. I have that table because I’m usually responding to Republicans saying, “BUT OBAAAAMA!” about the deficit. Dems spend; Republicans spend. The Dem occasionally talk tax hikes but unless they are going to hike taxes on the middle class, which they won’t, it’s not enough. Neither side wants to reign in entitlements. Dem pundits say that deficit spending is good because Keynesianism; GOP pundits say “SQUIRREL!” whenever they’re in charge. This is a fiscal trainwreck created by both parties and one of those rare times where you really can say … all together now … both sides do it.

(Addendum: I don’t do that table for revenues because revenues depend more on the economy than the tax law. In general, however, they’ve hovered around 18% of GDP, no matter who is President or who has Congress and grown about 4-7% a year with a lot variation. They’ve become a bit more volatile in recent years because that tax system has become more top-heavy and more prone to wild swings depending on the state of the economy. We probably need to go above the historic norm of 18% — which we are currently at — if we’re going to pay for Medicare and Social Security. That will mean a much broader tax hikes, such as a VAT.)

At least Democrats actually adhere to some kind of economic policy, unlike their Republican counterparts who magically think that tax cuts pay for themselves…

Reagan blew up the deficit.

GHW Bush blew up the deficit.

Clinton decreased it.

GWB blew up the deficit.

Obama decreased it.

Trump is blowing up the deficit.

How dumb do you have to be to imagine Republicans are “fiscally conservative” at this point?

@Hal_10000:

Those numbers, as presented here, are, to put it mildly, completely meaningless.

In order to say anything useful, they need – at the very least – be corrected for GDP growth and inflation.

For instance, if GDP grows 2% in a given year, in effect nothing changes if government spending is also increased by 2% (assuming tax income keeps pace with GDP growth). Same thing with inflation.

Of course, interest rates are important, too. If net interest rates are close to zero, additional borrowing isn’t much of a burden.

Then there is the question where the borrowed money is being spent on. Some expenditures, such as education, social security (especially for families), fundamental research, etc., are useful investments. Other expenditures (tax cuts, the military) far less so.

And then there’s the question when the borrowed money is being spent. Under certain conditions, running a government deficit may make a lot of sense and could actually save a lot of money in the medium term. At other times, it’s extremely unwise.

More specifically, one could say (as you do) “Dems spend; Republicans spend.” But, of course, what actually matters is this:

I strongly recommend Dean Baker’s blog Beat the Press. Read him for a couple of months and you will learn how to recognise economic know-nothings like Judd Gregg (countries that print their currency cannot go bankrupt); why to distrust all big scary numbers (they lack the context needed to put them in perspective); how to think about the deficit (look at productivity trends and the costs of borrowing); and much much else.

@Hal_10000: Please stop the false equivalence. Since Reagan was president, the Republicans are far more fiscally irresponsible than the Democrats.

1. With the exception for Bush the elder, all Republican presidents double down on the discredited Laffer Curve, lowering taxes and claiming they will pay for themselves.

2. Under Clinton we had a balanced budget. Bush came in, put in a huge tax cut while raising spending, and all of a sudden we had a $400 billion in pretty good economic times. Then we had the meltdown in 2008, and we suddenly had a $1 trillion deficit. Obama comes in, and with the exception of the year of the stimulus package (which was too small because the GOP opposed it completely despite stimulus being SOP) Obama was pretty effective at lowering the deficit.

3. Enter Trump. He comes in, pushes a massive tax cut and now we have a $1 trillion deficit again, only now it is occurring in excellent economic times, with low interest rates and basically full employment. Wait till we have a few interest rate hikes and a slowdown in either the general economy or the housing market. If we are lucky we’ll end up with a $1.5 trillion deficit.

I’m a financial analyst and work with budgets. My boss and his team was responsible for pulling together the budget for a $5 billion dollar company. We would be laughed at and then fired if we were one tenth as fiscally irresponsible as the modern GOP.

@teve tory:

Donnie Dennison Dumb?

Unless we redefine things.

Fiscally Conservative: Spend like a drunken sailor while decreasing government revenues, but blame it on the Democrats.

If republicans feel free to give the Trump family et al. millions in tax cuts without paying for it, I’m all for the dems acting similarly–pass Single Payer, straight up. How to pay for it? Who cares? It’ll pay for itself, we’ll close unspecified loopholes later, PAUL RYAN MAGICK ASTERITSK! etc. What are the Republicans gonna say? The Dems are big spenders? Oh, that’ll change things.

@Hal_10000: We could easily afford Medicare and Social Security if we raised the ceiling on the amount of income that is taxed for those programs. It would be nice if I paid a rate close to what the multi-millionaire lawyers I used to work for paid. Instead I paid 6.2% on virtually all of my income, whereas they paid 6.2% on less than a tenth of theirs, an effective tax rate of .62%.

@Hal_10000:

You said: “all together now … both sides do it.” Okay, I get the point you are trying to make but the last time I checked only one party created the Tea Party and had them loudly proclaim that overspending by Democrats was an existential threat to the future of this country.

@drj:

Yes, because none of those Presidents had a Congress. Check out the budget projections that Clinton had in 1994 or that Obama had in 2010. Both had massive deficits for the foreseeable future. The only reason it didn’t work out that way is that both had Republican Congress that forced spending restraint (over the screaming objections of much of the Left Wing commentariat). When they both had Democratic Congresses, they increased the deficit. And until the Democrats talk about entitlement reform or a broad-based tax increase or spending cuts, their complaining about the deficit now means nothing. They don’t have any fix; just “tax hikes on the rich” which will not nearly cover our current obligation, least of all “free” college, “free” healthcare and “free” daycare.

I’m not disputing Bush’s (or Trump’s) fiscal idiocy. What I’m disputing is the notion that Democrats, sans Republican opposition, show any degree of fiscal responsibility. They don’t.

I don’t see how one can say Republicans don’t intend to do anything about the deficit when they are already using the deficit as an excuse to push to cut, and probably privatize, SS, Medicare and Medicaid. Which was the whole point all along.

@drj:

This isn’t very helpful when looking at spending trends. Inflation has been more or less stable since 1980. And government spending has a weird connection with GDP, since automatic stabilizers increase spending when GDP falls. You can look at spending as a percent of GDP but that’s also a bit tricky. It fell under Clinton and GOP Congress, rose under Bush, spiked sharply in Obama’s first year (mostly because of the financial crisis), fell under Obama and Republicans and is now spiking up again.

People need to watch the video “History of Banking” for an education. Many people assume that banks have enough cash to cover a sudden widespread withdrawal, which almost happened in 2008.

The Federal Reserve loaned out trillions of dollars in 2008 that went outside the US. I wonder if that has been repaid. See Senator Sanders questioning Bernanke about it – video.

At some time the bill will come due. It always does.

@Hal_10000:

Let’s talk. Fund it fully. Period. Paragraph. Europeans can do it. Why can’t we? While we are at it, health care for everyone. Somehow, public? Someway, private? Public/private? These things can be done. Other countries have. Are we stupid? (rhetorical question: we are f’n idiots)

@OzarkHillbilly: Just what should people be entitled to? And why? I can understand and support a lot of benefits and help for our soldiers and veterans.

Where is the line drawn on entitlements? Everyone feels they are entitled to something – a nice, open highway, a short line at the rides, and a great meal at a restaurant for a low price. How about cell phones? Big screen tv’s? The top surgeon? Or any surgeon? A college education?

“Ask not what your country can do for you. Ask what you can do for your country” Kennedy

“If an idea is worth thinking about, it is worth doing”

“If it is easy, it is not worth doing” Theodore Roosevelt

@Tyrell:

Have you heard any news – now or in the past – that our federal government has plans to plans to default on its securities?

Except for Republicans (during the Obama years, were attempting to leverage their desire to repeal Obamacare against a shutdown) who told us that a default would not be serious, that Democrats were overstating the consequences, nobody has entertained or countenanced the possibility of default.

@OzarkHillbilly:

Then you will need massive tax hikes on the middle class, which the Democrats shun. We just had a bunch of Democrats sign on to a “single payer” proposal that 1) funds everything first dollar, which no system does; 2) has no cost controls and 3) has no taxes to pay for it. The latter is not surprising because Bernie’s proposal envisions gigantic tax hikes and, even then, can’t cover all the costs.

So as long as you’re at it, let’s all have a pony, too.

@Tyrell: The Federal Reserve loans on a secured basis. Banks borrowing must provide collateral.

@Hal_10000:

Everything is prefunded in a sovereign currrency system, and the evidence a $700 billion increase in military spending with no taxes or borrowing to pay for it. And a $1.3 trillion omnibus bill with no taxes or borrowing to pay for it.

Taxation and debt-issuance are ex-post. They happen after the money is spent. Hence they cannot fund spending.

Large deficits should be looked on as a huge opportunity for early retirement, rather than a time of mourning for conservatoids.

@OzarkHillbilly: Yes, since 1981, the Republican Party, Republican Presidents, and the Conservative Movement have been the creators of deficit spending through tax cuts for the wealthy and defense spending, and then cry “starve the beast” when comes to spending on domestic infrastructure, education, and health care for its citizens. The only exception was G.H.W. Bush and he was primaried and then 3rd partied into losing reelection. Then Bill Clinton and the Democratic Congress of 1993-94 raised taxes and cut spending, resulting in the deficit decline and surpluses in 1998, 99, and 2000, and if revenues and spending and stayed place, there would have been no more debt by 2010 (probably no housing boom causing a financial crisis). The Balance Budget Amendment should be called “Terminating Social Security and Medicare programs (while keeping the regressive taxes)” Amendment, because that is the only way to balance the budget in one year.” And removing 1 trillion dollars of demand all at once from the U.S. economy will have an interesting effect on that economy as well as reducing millions of elderly to poverty, misery, and early death.

Finally, a government that borrows in its own currency does not have a particular limit on debt. These figures should be taken on context (the U.S. has a 20 Trillion dollar annual economy, which is growing at a nominal rate of 3.5% to 4% (real GDP growth rate trend of 2% plus inflation of of 1.5% to 2%). So in about 10 years, even with a recession thrown in, the economy in nominal terms will be around $30 Trillion Dollars. If Judd Gregg really cared about his grandkids and great grandkids, he would take what CO2 and other greenhouse gases we are emitting will do to change the planet. That is the real debt bomb out there.