About that Tyrannical Escrow Fund…

The escrow fund was a big negative for BP, yes?

As James Joyner notes this morning, some commentators are objecting rather strenuously to the $20 billion escrow fund that was established to help pay claims made on BP in regards to the effects of the oil spill.

As James Joyner notes this morning, some commentators are objecting rather strenuously to the $20 billion escrow fund that was established to help pay claims made on BP in regards to the effects of the oil spill.

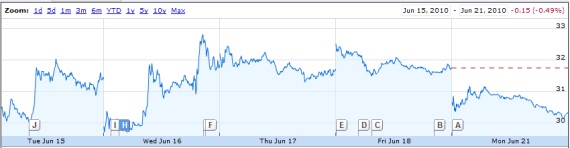

However, something that I have only heard once in passing that ought to be noted in regards to the fund in question and used to evaluate it (especially in regards to tyranny) is that the market response to the fund was for BP’s stock to climb rather precipitously. If one looks at the charge above (source) and one notes the “H” down in the stock price’s post-spill valley, that marks when the escrow account was announced. One will further note that the stock price climbs rather substantially soon after that announcement.

Now, it is rather clear that Wall Street didn’t see the fund as the thin edge of the tyranny wedge. Rather, the market saw the fund as a sign of BP’s financial stability in the face of the challenges associated with the cleanup costs.

Certainly the fact that the market responded positively to the fund does not make it good, but it does suggest that many who understand the economic implication the fund considered it to be a positive in an otherwise very difficult situation.

Why BP doesn’t mind the fund:

http://blogs.reuters.com/felix-salmon/2010/06/22/ken-feinbergs-other-job/

So what seems to be happening here is that Obama’s action here manages to make things substantially better both for the affected citizens of the Gulf states, who won’t need to spend years in court to get redress, and for BP, which has managed to instill confidence in the markets.

Of course, right-wingers are screaming about how evil, anti-constitutional and corrupt this is.

When was the last time a Republican was right about anything?

The fund is the first step in BP spinning the costs of the cleanup and any damages into a distinct trust the way Johns-Manville did twenty-five years ago.

The big questions will come when the courts start disaggregating the damages to income attributable to the blowout from to damages to income from other causes including natural variation and government actions.

john personna, that’s a good link, though I had to hunt around for the actual article.

http://blogs.reuters.com/felix-salmon/

Felix Salmon’s concerns would have been addressed by using the existing Oil Spill Liability Trust Fund. The government would have administered the fund and made payments and then the government would have had the right to seek reimbursement from BP for legitimate claims and take BP into court if BP refused.

That would have put the government in the position of advocate for the claimants who might not be sophisticated enough to document losses; it would have allowed the disputes to be aggregated for categorical treatment and it would have allowed the courts to provide independent supervision of the process.

Feinberg appears to be installed as the benign dictator, which might be OK if he’s benign and his judgments are indisputable.

“Feinberg appears to be installed as the benign dictator, which might be OK if he’s benign and his judgments are indisputable.”

I someone doesn’t like Feinberg’s decision, said decision is appealable to a three-judge panel. Here’s the Whitehouse fact sheet on the fund (http://www.whitehouse.gov/the-press-office/fact-sheet-claims-and-escrow):

FACT SHEET: Claims and Escrow

INDEPENDENT CLAIMS FACILITY

A new, independent claims process will be created with the mandate to be fairer, faster, and more transparent in paying damage claims by individuals and businesses.To assure independence, Kenneth Feinberg, who previously administered the September 11th Victim Compensation Fund, will serve as the independent claims administrator.The facility will develop standards for recoverable claims that will be published.A panel of three judges will be available to hear appeals of the administrator’s decisions.The facility is designed for claims of individuals and businesses who have been harmed by the oil spill; local, state, tribal, and federal government claims will continue to be handled directly by BP.The facility will decide all claims as expeditiously as possible, and in any event within the existing statutory timeframe.Dissatisfied claimants maintain all current rights under law, including the right to go to court or to the Oil Spill Liability Trust Fund.Decisions under current law by the independent claims facility shall be binding on BP. All claims adjudicated under this facility have access to the escrow account for payment.

ESCROW ACCOUNT

BP has agreed to contribute $20 billion over a four-year period at a rate of $5 billion per year, including $5 billion within 2010. BP will provide assurance for these commitments by setting aside $20 billion in U.S. assets.BP has reaffirmed its commitment to pay all removal costs and damages that it owes as a responsible party. It will not assert any liability cap under OPA to avoid liability.The creation of the escrow account will provide assurance to the public that funds will be available to compensate the injured. This account is neither a floor nor a ceiling on liability.The escrow account is to be used to pay claims adjudicated by the independent claims facility, as well as judgments and settlements, natural resource damage costs, and state and local response costs.

VOLUNTARY CONTRIBUTION FOR RIG WORKERS

BP will contribute to a foundation $100 million to support unemployed oil rig workers.The Administration’s May legislative proposal would create a new program of unemployment assistance, modeled after the Disaster Unemployment Assistance Program, to provide benefits to workers who lose their jobs as a result of a spill of national significance.

ENVIRONMENTAL AND HEALTH MONITORING

BP has previously committed $500 million for the ten-year Gulf of Mexico Research Initiative to improve understanding of the impacts of and ways to mitigate oil and gas pollution.As a part of this initiative, BP will work with governors, and state and local environmental and health authorities to design the long-term monitoring program to assure the environmental and public health of the Gulf Region.

It does put an implied cap (albeit and arbitrary and maybe imaginary one) on what BP deems to be the limit of their liability. At least from this view other company resources can be used for more normal operations.

It will be interesting to see how difficult it is to make claims against the escrow. I’m also waiting for all the false claims that will be made against this fund.

Can you imagine trying to find a neutral jury in Louisiana? Given the size of jury awards, liability could have been out of sight.

Steve

Dr. Taylor,

Wouldn’t it be wise to look at the market long term rather than short term regarding how it views this? And if we use the market to justify this isn’t it just another case of the ends justify the means?

Laws are in place specifically for this type of thing. Why must the President dictate actions instead of relying on those laws?

@Steve: I am not saying that spike in stock prices justifies the escrow account. However, what I am saying is that a positive response from the market would appear to undercut the argument that the escrow account is the thin edge of the totalitarian wedge. More importantly, I am of the opinion that BP knew that the account was in its best interest (good PR, some stability for investor in terms of knowing that the money was set aside for cleanup, etc.). As such it seems like BP was a more than willing participant in the process and not the victims of a shakedown (whether of the Putin, Stalin, Hitler or Chicago mob variety, depending on the critic of the moment).

BPs stock is up because investors are relieved to see that the government is not, apparently , going to take such draconian measures as nationalizing BP North America( as some prominent Democrats and liberal talking heads were suggesting). Your stock would go up too if your investors went from possible “Venezuela-style puppet-company” to “Oh, Good. The Obama administration’s not going to act like children again” relief.

My understanding is that this is definitely not an escrow fund, which would have third party control and asset release authority. My understanding is that calling it an escrow fund when it has no such controls is the problem that many people have with the situation. Is my understanding incorrect?

You would probably send a student back to high school if they served up this kind of cheese, you seem to do it on a regular basis. Why don’t you tell us once again how the “Obama administration” granted the deepwater horizon waivers? You kinda ducked out on that one last time…

Time to fire up the wayback machine…

Gosh I miss the days when adults were in charge. The torture, the gulags, the domestic spying. It was great.

The really bitchin’ “shock & awe” bombings that killed God knows how many innocents in a country that did not attack or threaten us… Adults rock!