Chart Of The Day: We’re Doomed Edition

Via Henry Blodget:

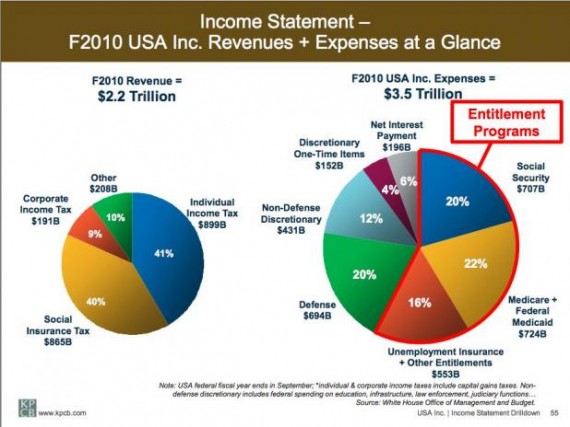

First, “Revenue” is tiny relative to “Expenses.”

Second, most of the expense is entitlement programs, not defense, education, or any of the other line items that most budget crusaders normally howl about.

Third, as horrifying as these charts are, they don’t even show the trends of these two pies: The “expense” pie is growing like gangbusters, driven by the explosive growth of the entitlement programs that no one in government even has the balls to talk about. “Revenue” is barely growing at all.

The take-away? If we’re going to fix this problem, most of the work is going to have to be done on the spending side of the ledger.

The solution, obviously, is to cut taxes.

The solution, as I said, is to cut spending. Drastically

Well, given that cutting taxes have been shown time and time again as a reliable method of increasing overall tax revenue, then yes, that is a very big part of the solution. You either confiscate more of what people have now or you create the environment for them to create more wealth by taking less of the bigger pie.

But by all means, let’s go with the attack against the Robber Barons which was the hue and cry for the income tax in the first place. Problem, no more robber barons. Problem, the great wealth accumulators and their heirs kept their wealth but those lower down on the tax chain gang, were the ones who saw a decrease in wealth and the ability to accumulate.

If by ‘drastically’, you mean lay waste to probably half of the government, I’m with you, Doug. If the top 10% of income earners were hit with 100% confiscatory taxes, it wouldn’t cover the debt.

Nonsense. Taxes, right now, are at the lowest point they’ve been since World War II. And revenues are lower than they’ve been since 1950.

Here’s how the CBO director puts it:

So a cuts-only approach requires cutting 25% of the total federal budget. Good luck with that.

Alex was (trying to) making a funny.

I assume “Social Insurance Tax” includes both SS and Medicare/Medicaid? I think most have us have known that Medicare/Medicaid is really the one blowing up in our face. Social Security pales in comparison, and unemployment insurance is (hopefully) a temporary problem.

Only if you don’t factor in payroll taxes and state and local taxes. When the average American thinks of their tax burden, they don’t tend to divide it up depending on which one of the several blood suckers happens to be taking it.

Under the current tax code, about half of income tax filers pay no income tax at all. Maybe you can explain how cutting effective tax rates to zero increases revenue? I just finished my own taxes and on a gross income of $85k, my effective tax rate was 3.7%.

While I agree that reducing taxes when tax levels are very high can increase revenues in some instances, we are way past that point today.

I would like to see some data that actually supports that assertion. Looking only at the federal side (see table 1a) the federal burden is lower for every quintile. Obviously the state and local tax burden is highly variable.

I was going to post on this one, too. Arithmetically you cannot balance the budget simply by cutting defense spending. Strategically it would be ill-advised. Arithmetically, you can balance the budget simply by cutting discretionary spending—barely (if you include military spending). Strategically it would be ill-advised and operationally nightmarish. Do we really want to eliminate funding for courts, the FBI, food inspections, and so on? That doesn’t mean that defense or discretionary spending must be absolved from cuts, merely that we can’t achieve fiscal sanity just by cutting defense and other discretionary spending.

Although arithmetically we can bring the budget into balance by increasing taxes practically I think the idea is suspect. Two reasons: deadweight loss and it does nothing to control the growth in spending. That doesn’t mean that tax increases must be off the table, merely that it’s pretty unlikely we’ll be able to balance the budget simply through tax increases.

Practically I don’t believe it’s possible to arrive at anything resembling fiscal sanity without cutting healthcare costs (particularly at the state and local level).

Politically arrving at anything resembling fiscal sanity will require tax increases, defense cuts, cuts to discretionary spending, and cuts in entitlements, particularly Medicare. The formula proposed by Simpson-Bowles was probably about right although I’m not as convinced about the details.

Today neither political party is convinced of that.

Doug,

Well, since we’re talking about the federal budget, I didn’t think that local taxes were germane to the discussion.

And while payroll tax rates are higher than they were immediately post-WWII, the effective federal tax burden, including all federal taxes, is lower for everyone at this point in time. And the result is the lowest federal revenues since 1950.

Blood suckers? Really? Where are you — Objectivist boot camp? Government is a necessary institution. Taxes are necessary to finance it. I don’t agree with everything the government does. In fact, I vehemently disagree with a lot of it. But I doubt you’d think we’d be better off without government.

Well, since we’re talking about the federal budget, I didn’t think that local taxes were germane to the discussion.

It’s about the federal budget until you mention how low federal taxes are, and then it’s suddenly about taxpayer feelings. Follow the Queen, keep your eye on the Queen. Follow the little lady….aww, sorry, you lose.

Perhaps you can think of a reason why revenue is barely growing at all, while expenditures are out of control.

Where are you — Objectivist boot camp?

Always.

But I doubt you’d think we’d be better off without government.

Somalia calling, Doug. Goddam libertarian paradise. Go make a billion!

Also, can somebody explain why the reducing the deficit is a more urgent issue right now than the unemployment rate or economic recovery? A pretty straightforward way of ensuring that revenues don’t remain flat is reducing the unemployment rate and GDP growth. Spending cuts are not the way to achieve that.

Aidan:

It doesn’t feel like one but we’re in an economic recovery. The present recovery has been going on for about a year and a half, since June 2009. It won’t go on forever. We’re starting to tempt fate relative to other post-war recoveries.

When the next recession comes it looks strongly as though we’ll have no monetary or fiscal tools to deploy to deal with it. The only solution at hand appears to be to reduce deadweight loss by reducing the size of the federal government and, as I noted above, reducing healthcare costs.

If you’ve got another suggestion, I’m all ears.

Dave Schuler — Raise taxes.

Somehow I don’t think your ears will be willing to hear that one.

The present recovery has been going on for about a year and a half, since June 2009. It won’t go on forever.

A jobless recovery that sends large profits to the top and shits on everyone else will not help much with revenue, especially after the top rate cuts were extended.

wr –

You’re wrong about Dave on the tax score. He’s been a consistent opponent of the current tax regime. Particularly, he was opposed to both the Bush tax cuts initially as well as their extension last year.

Aidan: That question always results in loud cricket sounds when I bring it up. The idea of instituting drastic budget cuts at this point in time sounds crazy to me, too. Modest, targeted reductions always makes sense, and letting the Bush tax cuts expire for the wealthy would have helped, too.

? I opposed the extension of the “Bush tax cuts” and I already mentioned in my comment above that I thought tax increases were necessarily part of the solution. I don’t know where your comment is coming from.

However, I’m unaware of any theoretical support for the idea that we can tax our way to economic growth. Deadweight loss practically insures the opposite. Also, to balance the budget on the basis of tax increases alone we’d need to increase them by $1.3 trillion per year. The Obama Administration couldn’t find it in its heart to increase taxes by a fraction of that amount. Sounds like a political non-starter to me.

Doug’s assertion is that you can look at taxation and spending without scaling them to GDP, and then tell which has to change.

What was 2010 GDP? It was $14 trillion in 2009. I don’t think the 2010 numbers are out yet.

Is there something magical about $2.2T as an upper limit on revenue from an economy of approximately $14T? Why?

It seems to me that the $2.2T tax and $3.5T spending are actually similar fractions of $14, and splitting the difference (making them both $3T say for tax and spend) would work.

Do we have spooky Laffer, or worse yet Norquist, math on that?

I thought the idea was to reduce debt. Preferably without affecting growth.

Come on now, is the Obama administration really the prime target when it comes to refusing to raise taxes? They could have fought harder, sure, but the main culprit here is the unflinching Republican position that taxes must always be reduced, much less raised.

BTW, Alex’s reminder that taxes are low historically is a good one. It scales to GDP and doesn’t just present abstract scary charts.

Dough, why do you make an argument which works best for the uncritical and uninformed reader? Really?

(I don’t know why my fingers like to add that “h” … though I do bake bread.)

We should begin referring to the Laugher curve, which is the Laffer curve shifted so that the peak revenue point is at 0 taxes.

My point was if the Democratic Obama Administration won’t support tax increases and Republicans won’t support tax increases who, exactly, is the standard-bearer for the policy shift?

They’re not as separable as you’re trying to make them. Increasing taxes will reduce growth; increasing federal spending will reduce growth.

Maybe I’m misremembering here, but I thought the Obama administration was in favor of raising taxes, at least on the top 2%. The fact that even that was a political non-starter can be placed right at the feet of the Republicans….

The president vetoed an extension of the tax cuts? I missed that.

I understand they’re related, but I’m not sure I believe that, at least not in all cases. You really think that letting the Bush tax cuts expire on the top 2% would have done much to stifle economic growth?

And did you really mean to say that increasing federal spending will reduce growth…?

Dave,

I don’t think that’s necessarily true. It all depends on how the taxes are structured. Bruce Bartlett has some interesting articles on this about growth-enhancing tax increases vs. growth-hindering tax increases.

Reid,

Ok, you let the tax cuts for the top 2% expire. That might get you a few tens of billions of dollars. What about the remaining trillion plus?

Did anyone else click through to the full analysis and note that corp. taxes at only 9% of revenue comprise a historical low and the average is something closer to 18%? That would suggest that actually enforcing corporation taxes might help by raising an additional $200 billion a year, instead of allowing loopholes and havens to proliferate so that, today, 83 out of the top 100 US companies pay exactly zero tax. It’s not a full fix but then again, no single action is.

Also, defense spending is at a 30 year high yet there’s no Cold War enemy to face. We could cut that by $100 billion a year simply be refusing to waste further resources on marginal outcomes in Afghanistan, bringing it back into line with spending in the early Bush2 years.

Finally, Dave Schuler is right about letting tax breaks for the ultra-wealthy expire. Again, the top 0.1% are paying a historically low rate of tax (including rates lowered by offshoring and other loopholes) and revenue from that source could easily be doubled with no ill efects. As a bonus, eliminating offshoring loopholes would encourage corporations and the very rich to put their money in investments which would create real wealth and profits inside the country, growing the economy.

None of these are on the Republican agenda, yet each has to be as much a part of any realistic fix as reforms to entitlement spending.

Regards, Steve

I agree that it’s not necessarily true. The question on the table is whether the tax increases under discussion will reduce economic activity, not other tax increases. I think they will.

As an example I’d support eliminating the corporate income tax and increasing the marginal personal tax rates. I think the increase in productivity of the former would more than make up for the reduction in economic activity caused by the latter.

I think we owe Doug a “thank you” for doing what he frequently does: demonstrate the threadbare nature of the libertarian ideology.

Another libertarian papier mache Galt comes apart in the rainstorm of reality.

Somewhere a little Objectivist cries.

The president vetoed an extension of the tax cuts? I missed that.

Aren’t you cute. And dishonest, too!

I’m not talking about balancing the budget based on tax increases alone, because I don’t think balancing the budget should be a top priority right now. Reports by both Goldman Sachs and Mark Zandi have concluded that the House GOP’s budget cuts would reduce GDP growth and employment (http://voices.washingtonpost.com/plum-line/2011/02/report_house_gop_budget_cuts_w.html).

I don’t think you can necessarily tax your way to economic growth, but I certainly don’t think that increasing unemployment and hurting economic growth is any kind of sane way to approach reducing the deficit. Part of the reason we have record deficits is because the financial crisis wiped out so much personal income, along with skyrocketing unemployment and negative growth. Our deficit problem is a result of the collapse of the housing bubble and the rate of growth of health care costs as a % of GDP.

Also, there is certainly historical precedent for both economic growth and increases in revenue per capita alongside tax increases: http://krugman.blogs.nytimes.com/2008/01/16/taxes-and-revenues-another-history-lesson/

While we are flapping our gums (fingers?) about taxes no one will do … we could note that this is only true (that any tax would retard growth) if current taxes are perfectly placed. It might be possible to remove some especially retarding taxes (payroll?) and replace them with some less bad (sin?)

(I was quick to post a thought that was shared by others.)

BTW, as I mention at Dave’s page, one aspect of free trade has been that tariffs have fallen as a revenue source.

Remember, they were never _just_ strategic. They allowed other taxes to be lower.

My preference for a uniform 3-5% tariff would reduce a number of politically motivated and higher ones. That might be a source of both revenue and growth.

Ugh. I already said the Obama and congressional democrats could have fought harder for that tax increase, but with the R’s uniformly against it and the sad politics of being smeared as a “tax increaser”, it’s somewhat understandable. Really, though, the blame mainly sits with the Republicans.

Aidan,

Regarding the Krugman piece, the reason revenues increased so dramatically in the late 1990’s was because we were in an economic bubble. We got out of the 2000-2001 recession and saw the second growth spike thanks to the housing bubble.

So yes, we could “grow” our way out of this problem for a few years with yet another economic bubble and such a bubble could easily cover any growth hits caused by tax increases. As always, correlation does not equal causation – this isn’t the mid-1990’s. What’s relevant today is that there doesn’t seem to be another bubble on the horizon even if another bubble were desirable.

I don’t claim to have a solution that will work, especially in the short term. I think doing relatively minor things like targeted budget cuts and small tax increases is safest for the economy, and they can be ramped up over time. This idea of slashing budgets right now seems as foolish as proposing a 50% tax increase, yet somehow the budget-slashers are seen as credible and upstanding.

(NB: I’m not an economist, obviously.)

It’s pretty simple, cut defense spending, control health care costs with single payer and immediately raise taxes to at least 18% GDP with a target of 20% GDP.

It’s pretty simple, cut defense spending, control health care costs with single payer and immediately raise taxes to at least 18% GDP with a target of 20% GDP.

Agreed, but with a raise in the SS retirement age to 70 and a lot more enforcement for corporate tax evasion.

Well, it’s a funny thing, not only must tax rates be low to spur growth but those who would invest in creating jobs must feel that the low rates will be in effect when the income from that investment starts flowing. Anybody want to bet on the consensus about taxes in 2-10 years right now?

Secondly, and this is new, we must look at the costs imposed on making new investments both current and projected. Like hiring new employees, we know unless Obamacare is repealed, that employee costs will rise. We know if Obama and the Dems are successful, energy costs will be raised by fiat but that may not matter since they are now rising by market. We know that opening a restaurant or other food service business is risky right now since the FLOTUS has a campaign to raise the costs of businesses that sell fast, tasty and non-Whitehouse approved items. In short the regulatory environment at all levels must be now and expected in the future to be accommodating to investments or investment will be limited in risky areas.

And, as for many not paying income taxes or as Andy posts, his effective rate being low. Well, are these people getting these tax breaks likely to make investments for future income that involves the development of small businesses that will require wage-employees? If not, then the tax break is not revenue enhancing.

Blodget said: “Second, most of the expense is entitlement programs, not defense, education, or any of the other line items that most budget crusaders normally howl about.”

Lumping defense in with education here is highly deceptive. Look at the chart – it’s clearly one of the big three items.

It’s hard to take Blodget seriously when he’s making a silly claim like this.

And I would support increasing taxes on individuals making above a moderate amount if we also gave a deduction or credit for any of that income that is plowed back into a business, invested in the start of businesses or invested in existing business to increase their ability to generate revenue. We could even put restrictions that require the businesses have non-related employees, i.e, no self employed and no hiring only your kin.

TG: I was going to point that out myself; minimizing defense spending at “only” 20% stood out like a sore thumb.

Alex,

Growth enhancing tax cuts are completely irrelevant. The reason is that we aren’t going to switch tax regimes no matter how much sense it makes. There are too many with a vested interest in our current system to let it go. So while the theory is nice, the practical aspects mean precisely nothing.

Have a cite for thae fact that most people don’t do thusor did you just make it up? If you file taxes it’s pretty simple to figure out which one goes to the state and which one goes to the federal government. They even come with completely different forms.

And if the math to figure out basic percentages is to complicated for someone, it’s fairly likely that that person is probably not in a high tax bracket.

If Americans can factor in life insurance and the minutia of specific dental plans into what a public employee makes, it seems to me that they can puzzle out the significance of the numbers on a w-2.

Dave S — I misunderstood you. Sorry.

Dave is right, as much as it pains my libertarian side to write that. We will likely need a complete overhaul of our entire fiscal system to solve this problem. However, as I noted in my comment to Alex, that simply is not in the set of feasible options.

Or the Too Long:Didn’t Read (TL:DR) version: there is no feasible solution we are pretty much screwed.

At this point, with our spending at 160% of our revenues, I view pronouncements like “the answer is to cut spending” or “the answer is to raise taxes” (particularly “raise taxes on the rich!” as a complete solution to our hole as mostly posturing. We’re being “or” and in to “and” territory. I think we’re beyond “and raise taxes a little” or “and cut spending a little” as well.

How high should taxes go? Going to Clinton levels may be a start, but it won’t get us there. Do we go to Pre-Reagan tax levels so that tax rates marginal rates hit over 50% for those making over $150k a year (in current dollars) and approaching 40% (including FICA) for those making over $60k? Do we take another 10% out of everybody’s paycheck and maybe a little more for the top 5% and top 1%? Do you soak those making over $150 a year so that they cut back hours and extra income? There are a number of possibilities here, but as with the “cut spending” crowd, I want to see specifics before “raise taxes” becomes a solution for a government spending 60% more than it is bringing in with future obligations that are only going to increase spending even further.

And the same goes, except moreso, for the “cut spending!” people. Where do you suppose we cut? Entitlements, of course. But where? How much do you take back from the old folks that have been paying into Social Security and Medicare their entire lives with the understanding that this meant that they would be getting money back on retirement? How willing are we, as a society, to let people forgo basic health care that they cannot afford (which would be required for Medicaid cuts)?

And in both cases, from where are we supposed to get the political will? Obama went on record as wanting to keep the tax cuts for those making under $250 a year. The Republicans went ballistic on any perceived cuts on Medicare that came with PPACA. The notion that all we are going to go entirely (or primarily) in one direction or the other with cuts or tax hikes strikes me as pretty unlikely. Expecting that the other side is going to take the hit in its entirety strikes me as a stance that gets us nowhere.

If we’re ever going to get serious about this, the notion that this can be comfortable (or only a little uncomfortable) for any of us is going to have to go. But right now far too many are more concerned with the discomfort falling on the people they don’t care for than any real solution.

As an example I’d support eliminating the corporate income tax and increasing the marginal personal tax rates.

Wouldn’t it make more sense to shift the corporate tax by increasing the capital gains? I say this not because I don’t think we should (or need to) raise the personal income tax rates, but rather because I think we’re going to have to do that anyway and the corporate income tax and capital gains tend to affect the same people – corporate investors (with the latter being, as I understand it, less costly to collect and more difficult to avoid).

I’m really rather convinced that income taxes are going to have to go up. Very likely by more than just a little (and not just on the wealthy). I would prefer that go as much as possible towards reducing the deficit rather than paying for a cut/elimination elsewhere.