Earnings Plummet Over Last 30 Years

A picture is more misleading than a thousand words.

Catherine Rampell of the NYT has some fun with charts, attempting to answer the question “who had it tougher, father or son (or, mother or daughter)?”

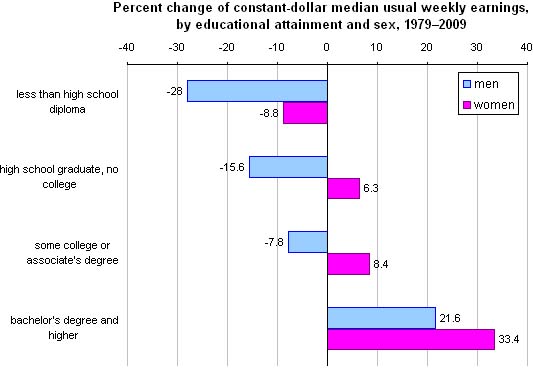

The chart above, adapted from a recent Bureau of Labor Statistics report, shows the difference in weekly pay between people with a given education level today and their counterparts from a generation ago.

As you can see, most men today earn less than equally educated men in 1979, with the exception of the most highly educated. The opposite is true for women: Most women today earn more than their equally educated counterparts from 1979, with the exception of the least educated.

But, as she admits in the closing paragraphs, this doesn’t mean what it would seem to mean:

There are a few forces behind these trends. One is that generally speaking, it’s harder to make it in today’s job market than it was a few decades ago if you don’t have at least a high school degree, since the expectations for what educational credentials workers should possess have risen. This is in part because the economy is less dependent on lower-skilled, manual-labor-intensive industries like manufacturing, and more reliant on industries that require formally credentialed education and training, like health care. Thus, in general, the earnings potential for the most educated has risen, and that for the least educated has fallen.

Another consideration is that the gap between men’s and women’s pay has narrowed over the years. One effect of this is that women’s wages, at most levels of education, have grown.

Of course, we knew that!

In 1979, most married women stayed at home with the kids or simply tended house; that almost immediately changed. And, while being a high-school dropout wasn’t exactly a road to riches even then, there were still entry level jobs that would take you and allow you to work yourself up if you were good enough. Why, “self-service” was still a necessary descriptors for gas stations that didn’t have attendants to pump it for you. The personal computer was a novelty item and the Internet as we know it was nearly 15 years into the future.

Good thing that our levels of education have changed to keep up with the trend:

Americans are more educated than ever before, with a greater percentage graduating from high school and college than a decade ago, U.S. Census data released Tuesday show. Eighty percent of Americans are graduates of high school or higher, compared with 75.2% in 1990, the 2000 figures show. That change came about in part because of a decline in the rate of students dropping out before ninth grade: 7.5% in 2000, compared with 10.4% in 1990.

That report, based on the 2000 Census, came out in 2002. It’s almost surely even more stark now, at least for native-born Americans.

That’s not to say that these trends are sustainable. We can’t keep increasing our level of meaningful education. Everyone isn’t college material or capable of doing intellectual work. But the nature of modernity is that more skills are necessary to do median level jobs.

I think your interpretation is a little off. Certainly three things are happening: First, manufacturing jobs are disappearing. Second, inflation in number of degrees sets an expectation. Third, there are higher tech jobs, which do require indeed advanced training.

That isn’t all gravy. Certainly we can advise kids to get even pointless degrees because the bar is higher now, and it’s expected. If you don’t want to get hit by the whammy on the lowest segment, at least try to hide out in the middle.

I guess what I’m saying is that you shouldn’t have the expectation that everyone will go for solid marketable degrees, and that if they do there will be enough slots in those fields.

I don’t doubt that some of it is simply expectations creep. But more and more people are moving from unskilled and semi-skilled jobs to those requiring solid written communication skills, basic data analysis, and the like. Those skills are presumed not to exist in those without a college degree, much less in high school drop-outs.

Right. It’s about how much we emphasize the mfg jobs now in China, and how much we emphasize the skills needed to drive a million dollar cnc machine still in the US.

It’s about how much we emphasize the labor-intensity of the two domains. Maybe foxconn has 1000 girls with nimble fingers doing pick and place. Maybe the US company needs 1 guy to run a pick and place machine.

There must be a fair number of (lower skilled) guys who read this and weep, in that laws are still written to take care of women over men, as if women did not have the economic advantages that have actually developed for them. Should such laws remain the same, it can only be more difficult for men in the near future, as jobs increase which are especially sought after by women as a growing part of the workplace.

It’s a little strange to me that people never seem to talk about the elephant in the room that this statement highlights: The huge increase in the size of the labour pool and consequent downward pressure on wage growth.

Part of the problem is that as the number of college graduates with useless humanities and studies degrees enter the workforce, they displace those with AA and no college in the on-the-job skilled jobs. Those displaced then displace the dropouts.

We also had a long period where skilled workers thrown out of factories in the ’80s held the trade jobs with little hope for those entering the workforce in the ’80s and ’90s training into the trades due to saturation. That is changing as retirements happen and the trades such as plumbing, building system tech are now recruiting and training replacements.

The data are skewed by a number of factors. It is post hoc, propter hoc.

Income increases have been so large among a subset of “college graduates” that it skews the entire group. The first group to split out would be doctors of medicine who’ve seen substantial real income increases over the last 30 years. There’s some argument about shorter recent periods but not about the longer period.

Second, remove the top 1% of income earners (those who aren’t medical doctors) from the data. Income gains have been concentrated in the top 1%.

Once you’ve done those things a somewhat different picture emerges in which the determining factor isn’t education.

Let me give one example: Bill Gates. He’s in the “some college” subgroup but his income is large enough to skew the results for the entire subgroup.

Obviously the nature of the economy and the skills it requires has changed substantially over the last thirty years. In particular the decline in manufacturing industry has eliminated millions of well paid blue collar jobs. None of this changes the fact that real incomes for most American men have declined over the last thirty years. I’m a bit sceptical about the jump in college educated male earnings because I suspect they are being skewed by those with post grad degrees of one sort and another who tend to be very highly rewarded in the fields of finance, medicine, technology, law etc. where higher ed is a pre-requisite. There has also been a decline in the value of a undergrad degree both as a negotiable asset in securing a job and as a measure of its holder’s intellectual quality. The relative ignorance of many undergrads these days is quite startling, perhaps not surprisingly when remedial classes are a not uncommon feature of today’s universities.

I was looking a while back for net-worth impacts. Unfortunately the studies lag, and data produced in 2006 includes both stocks and house price run-ups.

We only need to work to the extent that we don’t have money. If real net worth were higher now, across the spectrum, than it was 20 years ago, then some unemployment would be acceptable. You really are better off (for a short time) with $200K in home equity and no job, as opposed to with a $50K job and no house.

Of course, if households are losing net worth, while suffering unemployment, it is that much worse.

john personna says:

” Of course, if households are losing net worth, while suffering unemployment, it is that much worse.”

They obviously were in the period 2008-2009 (it even affected Warren Buffett) but American net worth has started to recover but it’s principally concentrated amongst those with substantial liquid assets which is only about 10% of the population. I was reading a piece about this only a couple of weeks ago when the market was undergoing a bit of a correction.

Zillow Blog has a good round-up of conditions in housing, and finishes:

But, many of those without jobs had their wealth concentrated in housing.

http://www.zillow.com/blog/home-values-decline-in-may-home-sales-falter-ahead-of-tax-credit-expiration-get-ready-for-a-bumpy-summer-of-real-estate-numbers/2010/07/07/

john personna says:

“But, many of those without jobs had their wealth concentrated in housing.”

Given that in round terms the net worth top 10% own 90% of all liquid assets excluding real estae (stocks, bonds, mutual funds, 401ks etc) that’s not too surprising. If you include real estate the number moves in round terms to 20% owning 80% of assets so the measure boadens considerably..

I would also point out that the disparity is going to increase greatly in the future. At present, there is an immense over-representation of women in college – further pushing men down the income ladder.