Rising Gas Prices And The 2012 Elections

Rising prices at the pump could lead to problems at the voting booth.

There’s yet more evidence today for something that I noted a month ago, an imminent rise in the price of gasoline to levels we haven’t seen in a year which could end up having a serious impact on the economy and the 2012 elections:

Gasoline prices could soon hit $4 a gallon, a threshold they haven’t flirted with since last spring.

The average price paid by U.S. drivers for a gallon of regular now stands at $3.52, according to the U.S. Energy Information Administration, which released its latest figures this afternoon. That price represents an increase of 0.04 percent from a week ago and 0.38 percent from a year ago.

Experts expect prices to spike another 60 cents or more, with the $4 mark being touched—or exceeded—sometime this summer, probably by Memorial Day weekend, the peak of the summer driving season. The last time the U.S. saw $4 gasoline was back in the summer of 2008.

“I think it’s going to be a chaotic spring,” says Tom Kloza of the Oil Price Information Service. He expects average prices to peak at $4.05, though he and other industry trackers say prices could be sharply higher in some markets.

Historically, $4 a gallon has been the upper limit of what consumers have been willing to pay. Last April, national prices peaked at about $3.98 a gallon before receding. “It’s going to be tough to sustain that level,” thinks Brian Milne of energy tracker Televent DTN. “People will drive less.”

There are several factors driving up prices in the short term, none of which is really within anyone’s control, although there’s one thing we could do to help the situation:

U.S. inventories have been rising. Demand has fallen as U.S. consumers have adjusted to driving less. The reason prices aren’t falling comes down to increased uncertainty.

Prices, he says, are being buoyed by home-grown uncertainties as well. The market is waiting to see if Sunoco will shut down its Philadelphia refinery, which, if it happens, would be the third refinery closure in Pennsylvania in the last six months. “If you’re in the northeast,” he says, “You need to be concerned, especially if you’re in the Philadelphia region.”

(…)

What would lower U.S. gas prices, he says, is the ability to pipe crude from newly discovered fields in North Dakota to refineries on the Gulf of Mexico, home to 40 percent of U.S. refining capacity. That increase in domestic gasoline production would lessen U.S. dependency on more expensive imported fuel. By the end of this year, North Dakota will be producing more oil than Alaska. But the pipeline, for now, remains, he says, “a political football.”

The pipeline referred to, of course, is Keystone XL, currently the subject of a dispute between the White House and Republicans in Congress. Of course, even if that dispute is resolved it will take several years for the pipeline to be completed, meaning that any real impact on prices will be in the long-term, not the immediate term, and that rising gas prices are likely to become a political football in the coming months.

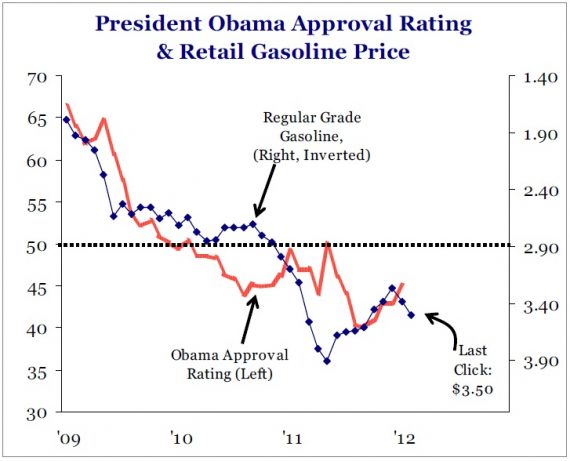

Not surprisingly, there seems to be some correlation between the price of gas and Presidential job approval, as this chart posted by James Pethokoukis shows rather clearly:

Larry Sabato discussed the relationship in a post last year:

On the one hand, it is clearly true that high gas prices often coincide with lower presidential approval ratings. As political scientists have long demonstrated, these approval ratings are a strong indicator of a president’s reelection chances. As we have seen, though, gas prices alone certainly are not a perfect predictor of approval ratings or, indirectly, reelection. While continually rising gas prices would likely weaken Obama’s reelection standing, it would be just one of many factors voters consider when evaluating his first term.

Of course, gas prices by themselves are only one economic indicator. As we’ve seen before, higher energy prices tend to have an impact on the economy as a whole as businesses and consumers cut back spending in one area to cover the cost of rising fuel prices, which are a necessary expense for most business and largely non-discretionary for consumers. So, if rising energy prices this spring lead to slower economic growth and job growth, those are also factors that are likely to have an impact on the election. At the very least, though, we can expect rising energy prices to mean that issues like oil drilling and Keystone XL will play a larger role in the election than they might have otherwise. We might even see a return of such silly ideas as the gas tax holiday that John McCain and Hillary Clinton were both pushing during the 2008 election.

More importantly, though, even if gas prices by themselves aren’t directly responsible for election outcomes, it seems quite apparent that voters paying between $4 and $5 per gallon at the pump aren’t going to be in a very good mood when they get to the voting booth. Which is why it’s still a good idea for the White House to be nervous about all the events beyond their control that could occur between now and Election Day.

You have to be pretty stupid to have a gas-price = vote motivation.

And so you are saying incumbents might loose the stupid vote? Did they have it to start with?

@john personna: Really? If I can’t afford to put gas in my tank, however am I going to go and get my photo ID that I’ll need for voting? I can walk to my polling place, but the place where I get an ID? That’s too many miles to walk. Is it worth $4.00 just to get there? I don’t think so…

Your assumption about Keystone taking years is wrong

From the TransCanada Keystone Pipeline website.

So delays in bringing it online now rest with the White House. Also, such a project would impact oil prices even before it came online as investments depending on that feedstock would the be underway.

BTW, the chart doesn’t actually show much correlation. From Spring 2010 to Fall 2011 approval moved contra gas prices, and again at the beginning of 2012 they are diverging.

When a “predictor” is off for a year at a time, it’s not much of a predictor.

@john personna:

Perhaps but historically, energy prices, and fuel prices will dominate until next winter, are a stressor on households and directly impact their feelings about the economy.

More cash going into the gas tank with a President and administration on record for high energy prices and its not just politicians talking anymore.

@JKB:

Of course if you make it a broader economic argument, one which both includes conditions and policy positions, you can make something work.

But that’s not the argument Doug went for. He just went for “higher gas prices a problem for the President.”

I’m saying “Gas prices are too high, we have to get rid of Obama” is a stupid person’s argument.

You could post a list of things that the President has little control over that could influence the election. The Eurozone, Israel/Iran, Asteroids.

Other than Asteroids, Fuel costs are probably the least under his control.

I can’t imagine letting something totally outside of the President’s control influence my vote for President…However, as JP points out, there is the stupid vote to consider…they have already decided though…so what’s the concern?

It does make sense to me that the stupid vote would go to someone who will be a puppet for the establishment. Norquist: “…We don’t need someone to think it up or design it. The leadership now for the modern conservative movement for the next 20 years will be coming out of the House and the Senate…”

Me? I’d just as soon see $5.80 gas (current price in France) than elect someone like Romney to be a Congressional butt-boy. That’s just me though….

It goes without saying that high and rising gas prices typically would amount to bad news for an incumbent president, but given the peculiarities of this year’s contest I can’t see how they could have a material impact on the ultimate outcome.

The people most negatively affected by higher gas prices — working class white adults — of course will be voting majority Republican, and high gas prices presumably will boost that margin, but it’s nearly impossible for any GOP nominee to garner more than 65% of that demographic, regardless of circumstances. Too many of them are following the leads of their shop stewards or what they’re seeing and hearing on the networks. Generation Y is too stupid to vote in large numbers and for those of them who do manage to make it to the polls the margin will be around 75-25 in favor of Obama, regardless of gas prices or anything else. Of course the black demographic will vote 98-2 for Obama, or thereabouts, regardless of gas prices or anything else. The fossilized demographic is not materially affected by high gas prices. Evangelicals either vote or don’t vote solely based upon religious issues.

Team Obama won’t be happy to see $4.00 / gallon gas prices, but in the final analysis I don’t believe they’ll need to lose too much sleep over it.

Actually no JKB…they rest with a Congress that is more interested in playing politics than actually governing. Congress issued the ultimatum even after the State Department said it couldn’t do it under those terms. By their actions their agenda is made crystal clear.

I’ve got nothing against the Keystone Pipeline…assuming it is given proper regulatory review. We need to get off fossil fuels but it won’t happen overnight and we need oil in the interim. Unfortunately Republicans, especially those like Santorum who gets scads of cash from the fossil fuel industry, will give away anything to their overlords. History shows when you do that you get agencies like the Minerals Management Service and events like the BP Oil Spill. Or poisoned water like in Northern PA. Or miners trapped underground.

If higher gas prices stymie a recovery, yeah, that would be a problem for Obama. As it would be for us all.

Keystone is a distraction, really (though in that particular instance, I’m happy to pin blame on both sides, as I think opposing the pipeline b/c of AGW is really really stupid and a chunk of the opposition seems to focus on precisely that), but it might be a politically useful one.

We may be seeing the new normal. If we have little or no surplus oil production capacity and no new major discoveries, every time there is economic growth, oil prices will rise, and growth will be curtailed.

Seems folks are forgetting the Strategic Oil Reserve which could ease things for an incumbent.

de stijl: The entity behind the curtain is not to be mentioned. Nor is the price increase for petrochemical origin plastics like medical supplies, car interiors, clothes, toys, etc.

You know, one of the prizes you get when you’re President is that you get blamed for a lot of things you didn’t actually do, couldn’t have done if you tried, and whatever you did wouldn’t have made any difference. Some see that as a downside, others as just part of the job.

If voters hate their economic situation and blame you, then that’s what happens. It’s part of the ambient heat of the kitchen. I think Truman had some quip about that, in fact.

@Hey Norm:

I remember the early – mid 2000s when Rush Limbaugh, Larry Elder, et al, were decrying the Congressional investigations into spiking gas prices and defending the “the President doesn’t control gas prices” mantra. Let’s see what tune they sing this summer, when, typically, gas prices rise due to increased travel demand.

@dennis:

And it would be a good argument that the President doesn’t control gas prices if…

Obama wasn’t on record for wanting higher gas prices

His Sec of Energy wasn’t on record for wanting to jack up gas prices

His EPA administrator wasn’t pursuing an agenda that is forcing the closure of refineries

His administration hadn’t sought to delay then cancel the Keystone Pipeline

His administration hadn’t been delaying new pipeline from the Shale oil areas coming under development

His administration hadn’t shut down deep water drilling in the GOMEX

His administration wasn’t slow walking new oil leases and permits in Western federal lands

It is true the President can’t reduce gas prices but he can sure make things uncertain so that they rise.

In any case, higher gas prices, strain household budgets, reduce business expansion and lead to at least the perception of a down economy. A down economy usually causes voters to think perhaps they should let someone else have a crack at the running of the country. And this time, the guy whose had his chance is Obama, so voter might just vote for not-Obama.

Last big price spike we had was fueled by rampant speculation among investors at NYMEX. Far more than supply and demand factors. They tried it again recently, Obama partially snuffed it by threatening to open the reserve, but there have been some rule changes in there, or so I have been led to believe.

My point is that these predictions of higher oil prices can be self-fulfilling prophecies, there are people who know it, and are in a position to profit from it. Not as easily as before, perhaps, but still….

@ JKB…

OMG…the uncertainty meme rears it’s ugly head.

In spite of all the propoganda you ranted off the price of gas is at a relatively low level.

In other words…you’re spouting horse$hit.

I blame gay marriage!

@Tsar Nicholas: I enjoy how I agree with your conclusion, but can’t endorse how you got to it. Lovely thing, diversity.

@John Burgess:

So, round-trip, your polling place is ~18 miles of travel?

Also, if it’s between $4 and being able to vote, I take the latter. Condemn the former, sure, but it’s not going to stop me. Saying $4 would stop you from voting reminds me of Peter Schiff’s BS argument that raising taxes on rich people will cause them to stop making and running businesses.

@John Burgess:

Again, “economic situation” is a more advanced argument than “gas prices.”

@JKB:

There is a simple relation which holds pretty well in practice. That is, the more energy a country produces, the more it tends to subsidize prices. The more a country has to import foreign energy, the more it tends to discourage, and tax, it.

For years we had low cost domestic supplies and benefited greatly. Interstates. Family vacations. We did reach a pinch-point though, were we started importing more, and sending trillions of dollars overseas. At that point you did actually want to start discouraging consumption.

The shale thing is a surprising twist, for many of us:

Perhaps the liberal position (that there were not sufficient domestic resources for this to happen) was wrong, but so also this complaint against Obama seems out of sync (ie. dumb).

How the heck do you complain about such a positive shift?

If it is because you don’t want to pay the world price for energy … you might not have an Obama problem. You might have a free markets problem.

The shorter answer to JKB is, “explain how a US president sets the world oil price?”

Actually gas prices going up is a sign of recovering demand (aka a recovering economy). They also go up in spring because of a switch to different mixes. So Obama has a choice… a strong economic recovery and somewhat higher gas prices or the economy remains flat and so do gas prices. This is what is called a no brainer. And please don’t put up stuff from that ass Pethokoukis, it immediately devalues any comment.

$4 a gallon gas in November – I vote Republican

$3 or less: I vote Democrat

@Lomax:

Okay so you’d rather the economy be in the tank which is the only thing that would take gas below 3 bucks….somehow I think Obama will manage without your vote.

@JKB:

As if you’d ever vote any other way. There’s no doubt in my mind that you would put a someone clinically insane in the WH if he had R after his name. Your views are the product of tribalism not rationalism.

Don’t be fooled keystone resources will not necessary be sold and consumed here at home, they will be sold to the highest bidder and overseas it goes. Also the US imports less than 40% oil consumed here. You want someone to blame ? Look at the speculators and understand why gas prices are so high.

Many are choosing to invest in energy by investing in their own ingenuity. There are countless inventors, tinkerers, engineers, mechanics, and small business owners who are out there planning, developing, testing, and building energy saving, clean, non-polluting devices. This is where the future is, not with some government or corporate project. One energy breakthrough is the amazing Johnson motor/generator. This is so simple that you will think “why didn’t I think of that?” This is now patented and was developed by an independent engineer. Many people are building their own. It is clean, safe, and generates more energy than it uses. It uses the energy of permanent magnets to do this. Many people are now using these to save 50-75% on residential electricity bills. There is a prototype being developed that will be tried in cars. This is the future!

http://freeenergynews.com/Directory/Howard_Johnson_Motor/

see numerous examples on you tube.

@Lomax: So at $3.50 do you stay home?

@John Burgess:

I know you meant to be snarky but if you are driving anywhere you have the ID that should be used to vote.

The real question is how are there adults in the U.S. without picture ID. How do they function in the economy or are the minorities claiming to not be able to get an ID just hiding from creditors or using stolen identities.

Of course, the people who cheat of identifies are very faithful Democratic voters and will vote for the Democratic candidates no matter how bad the economy is.

You never let the opportunity pass to show yourself to be a racist pig…well done…

@An Interested Party:

Well, if you could point to the media story where middle class whites are claiming that they do not have a government issued picture ID and will be denied their voting rights, then we can discuss whites and Voter ID laws. But as long as very example that the progressive Democrats put in front of the media is black or Hispanic, then those are the demographics that have to be discussed.

Maybe you should look at the rates of bad debts and bankruptcy among various demographic groups. But then again, progressives do not allow themselves to think about demographics.

You have to love this level of stupidity. Bush bequeathed an economy on the brink of depression to Obama. Today even the Murdoch owned WSJ admits we are in a recovery. I wonder which condition creates “uncertainty?”

Coming in three years or sooner to car showrooms: hydrogen powered cars! The big three and other car companies are already testing prototypes. But you don’t have to wait. Thousands of people have built their own hydrogen producing cells and are cutting their gas consumption by 50% or more. These devices can be built for less than $200 with parts that are available at local auto parts stores and home supply stores. They are safe and will have no effect on warranties or emissions (cars will actually run cleaner.) You don’t have to worry about overbearing government regulators or rules. A factory in SC is already using forklifts powered by hydrogen. See for your self by searching “hydrogen powered cars” and:

http://waterpoweredcar.com/herman.html#herman

Well, they probably don’t obsess over/attribute negative stereotypes to minorities like you do…

@Guthrum:

A Rip van Winkle from the 2000s?

The hydrogen vehicle died on the difficulty of producing hydrogen. Most is now made from natural gas, which is easier to use directly. See CNG powered taxis and buses.

The dream was cheap hydrogen from renewable resources, but no one ever figured out how to do the cheap part.

Big Oil will raise gas prices this year because they want a Republican in the White House.

George Bush, a Texas oilman let them charge what ever they wanted during his administration.

Why do you think Big Oil lowered the prices right around the 2008 elections. One thing Americans have learned since Bush…you never elect an oilman or a Republican president if you want to control the price of gas. When Obama is re-elected you’ll see gas prices drop like never before. Big Oil had Bush in their pocket….Big Oil will cave to Barack!

@john personna:

I agree…we have MORE than enough reasons already!!