“Soaking the Rich” in Perspective

Some perspective on "soaking the rich."

Personally, I only have one issue with Obama’s “millionaire tax,” and that’s the way it structured. It would make more sense to simply add another marginal rate on a higher income level (say, a 45% marginal rate on $1,000,000+), or, as James suggested, lifting the FICA cap, or taxing capital gains as ordinary income. But that’s purely my preference only as a matter of making it easier to enforce. Personally, I don’t see the need to raise taxes right now, since we have a sluggish economy and we can borrow money at a negative interest rate. But if taxes are raised, taxing wealthy individuals’ income is the most harmless way to do it.

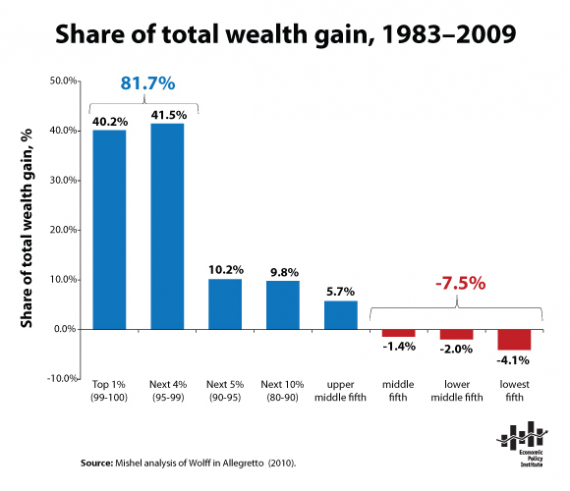

I also don’t mind a bit of class warfare here, considering how many of the wealthy in this country get that way through rent-seeking and speculation. It’s also worth putting in perspective just how bad wealth inequality in this country is. Not income inequality. Wealth inequality.

I’ve shown this image before. See that yellow sliver? That’s 80% of the population. They own 7% of the total wealth in this country. And things aren’t looking up.

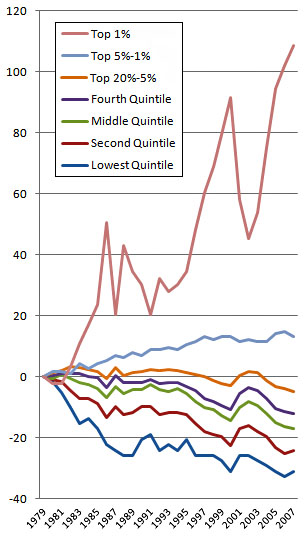

That’s the change in wealth in the United States since 1983. It’s tied to this:

Which is the change in income over the past few decades.

I’ve read too much history to believe that a society where the rich get richer, the middle class stagnates at best, and the poor get poorer is a healthy society. The United States has one of the lowest rates of class mobility in the OECD, meaning that people are more likely to be stuck in their parents socioeconomic system. The poor get stuck, while an awful lot of today’s wealthy had wealthy parents (see, e.g. the Kochs). We rank near dead last when it comes to numbers of people who are self-employed or own small businesses. There are profound economic and political structures dedicated to maintaining the economic status quo.

A tax on millionaires won’t change the underlying structural problems in American economics and society. But it’s where raising taxes will do the least amount of harm.

What taxing the wealthier will do is drain excess reserves and counter the speculation-fueled component of the inflation we’re experiencing now. The massive amount of capital which has accumulated in the hands of the wealthy over the last thirty years incentivized creation of increasingly risky financial products and greatly contributed to the economic bust of 2008.

@Ben Wolf:

Taking income does nothing about wealth. So unless you’re actually in favor of wealth confiscation, you’re not accomplishing anything except transferring a little bit of money from Peter to Paul.

Then there’s the entire question of whether wealth redistribution is even a legitimate function of government.

Maybe the Republicans should counter by proposing to only raise taxes in New York, Mass., New Jersey, Conn., Maryland, Illinoins, and California. Those are the states where most of the millionaires live and especially for people who earn taxable wages above $1 million. Since most millionaires are Democrats and most millionaires live in blue states, there should be a way to tax millionaires that Republicans will support.

I feel like this study is flawed as I think a good portion of why it appears like this is related to education. I’d like to also see how education level corresponds to wealth.

That said, I feel like corporate executive compensation and the payment amounts given to board members is often no longer at a level that is in shareholders best interests. They simply get paid too much. Everything appears skewed because nearly everyone is doing it. They do it because they can; no one stops them. I agree that an increase in tax for simple redistribution of wealth is unhealthy for a society. Our Federal and state government is already too large and too inefficient. Letting them take any additional tax money for redistribution will only create more problems for us all. If you tax these executives more, they will eventually just determine a way to move their company to another country that does not have this kind of tax, and where does that get us? I think the better solution is to break up large companies, making them form smaller companies with less political clout and more accountability to their shareholders in conjunction with deregulation. Small companies can’t afford to pay their execs ridiculous salaries. This creates more competition, allowing other smaller more efficient or “better product” companies the ability to compete with the split apart divisions of what was once a larger company who had teams of lawyers to lobby for regulations that hinder competition that only large companies can comply with, helping move us to a more deregulated business environment that would lower costs for products.

We could argue the actual effectiveness of a higher marginal tax rate (after all, $0.40 to $0.45 on every extra dollars certainly buys a lot of top notch accounting and tax law expertise).

I recommend looking at the effective tax rates by income category. Upper-income taxpayers STILL pay the most, even with the Bush Tax Cuts.

http://soquelbythecreek.blogspot.com/2011/08/chart-average-federal-income-tax-rate.html

As to income disparity since the 1980s, think about how the world has changed since then and how that change affected the current members of the Forbes’ 400 list of the wealthiest Americans.

http://www.forbes.com/wealth/forbes-400

These are some of the major changes since 1980:

* The personal computer (PC)

* Globalization

* The Internet

* Improved telecommunications

* The end of the Cold War and the liberation of Eastern/Central Europe

* China embraces free-market reforms

* India moves away from socialist economics

* European Union

Now, let’s look at a few players at the top of the Forbes 400 list:

#1. Bill Gates: PC, Globalization, Internet

#3. Larry Ellison: PC, Internet

#4, #7, #8, #9: Walmart heirs: Globalization, China’s emergence (and to some extent, the Internet, improved telecommunications)

#10: Michael Bloomberg: Internet

The others in the top ten are a bit unique.

#2. Warren Buffet has a long history of generally prudent investment. His fortunes rose along with the U.S. economy.

#5. Those vilified “evil” Koch brothers. Yep, you are right, they inherited their money, as did #4, #7, #8, and #9. As far as I know, all did it legally and paid taxes along the way.

I’m not a Koch supporter, but they are hardly passive, do-nothing, fun-loving heirs of the Paris Hilton variety. The Koch Brothers were significantly lower on the Forbes 400 list a decade ago.

Here’s another test of tax increases as the solution. Ask, what if you adopted a fully Marxist approach and outright confiscated ALL the wealth of those on the Top 400 Richest Americans list–not their income, their ENTIRE WEALTH? Now, how long could you fund the U.S. government with that additional money? Okay, you’d put a serious dent in THIS YEAR’S deficit. But, what do you do NEXT year?

Raising marginal tax rates on 0.03% or 0.00035% of the population is NOT the solution. The solutions lie elsewhere.

* We need fundamental reform of our antiquated, bloated, byzantine income tax system. I favor a consumption-based tax.

* We need to come to grasps of our actual reality and not live in a world of make believe. The U.S. lives in a much broader world than it did in the 1980s and we must be globally competitive. We are no longer the sole manufacturing power on the planet. We can no longer justify higher-than-average wages for low-skilled manufacturing.

* We need to get out of Afghanistan and Iraq.

@Doug Mataconis: @Doug Mataconis: It has nothing to do with giving money to someone else; wealth transfer is irrelevant to me. In fact I’d recommend the government destroy the additional funds from the tax rather than spend it back out.

Reducing the income of top earners will reduce the growth of their wealth relative to the rest of the population and retard their capacity for creating financial instability. The problem is not that the wealthy have a lot of wealth, but that too much capital has become too heavily concentrated. We have well over a hundred years of economic data that this does not play out well.

Ben

I’ve never quite understood the economic wisdom of taking capital from people who actually have experience investing it and giving it to people they don’t. I also have this little bugaboo about property rights but, hey, this is the 21st Century right?

We need to stop treating the symptom and talk about the actual problem, which is the way politically connected corporations use the government to prevent competition.

The problem is we have two parties, one of which is anti-business and one of which is pro-business. The problem is that both of these positions are anti-market. No one is really fighting for a vibrant economy. As an analogy, it’s like we trying to decide how to take care of a forest and the only two positions being presented are to clear cut it, or to do absolutely nothing to it. While “do nothing” will certainly have better results than “clear cut”, neither will result in a forest as healthy as it could have been with appropriate management.

@Doug Mataconis: The wisdom is, we don’t want the money invested (i.e., saved or used to speculate). We want it SPENT on normal goods and services (“normal” as in not weird financial instruments or houses we don’t intended to live in), in order to increase aggregate demand and get the economy going again.

This shouldn’t be so hard – a consumer economy the size of America’s cannot subsist on only the speculation and luxury purchases of the massively wealthy.

As for private property – how much of that wealth was acquired by collecting rents from the other 80% of the population? I’d wager most of it.

@Joe:

As for the problem with the Kochs – it’s always just been that they work hard to rig the system in their own favor while pretending to be against it, as is the case with most corporate titans who rail against government interference. They subsidize institutional libertarianism not to promote actual liberty, but personal profit & a lopsided, oligarchic pseudo-market.

@Doug Mataconis: Doug, here’s the thing: there are ultimately a limited number of healthy, productive investments in existence at any time. When available investment capital roughly corresponds with this we get (for the most part) real economic growth and an advancing standard of living.

On the other hand we have capitalism and what marxists call its “internal contradictions”. One of these is the tendency of a capital-based economy to create and concentrate so much capital it begins to strangle itself. Once healthy investment opportunities have been saturated, the excess investment capital will naturally look elsewhere for potential to generate additional returns. That’s how we got things like securitization, over the counter derivatives and credit default swaps, because there is enormous pressure to find something to do with the money. The wealthiest simply can’t spend it all because the math just doesn’t work out.

During the thirty years following World War II the incomes and wealth of the poor and middle class grew faster than those of the wealthy creating the longest, most stable period of economic growth in U.S. history. How did directing more capital at the non-wealthy help this happen? It helped because they used the capital (not debt) to build houses, pay for education and create small businesses, i.e. to spend the capital in ways which promoted solid economic growth.

It’s obvious you’re a smart man, Doug, but you’re taking an individual virtue (property rights) and assuming the same rules operate for the aggregate. This is called fallacy of composition, a term identified by the field of macro-economics which emerged from the Great Depression, and it means that what happens to the whole is often highly counterintuitive: observing sacrosanct property rights at a macro-economic level can have the effect of diminishing property rights for many more at the individual (or micro) level.

Here’s my question for you: for the sake of this discussion, if, and I am stressing if because it isn’t my intent to try and entrap you into agreeing with my greater argument, absolute property rights (meaning the wealthiest are entitled to all the wealth and income they are able to get) tend to generate economic instability resulting in busts such as the one we’re currently experiencing, would you agree that we should at least re-examine that absolute commitment?

@Ben Wolf:

There is no compromise when it comes to individual rights, Ben.

@Joe

It really doesn’t matter what you, or anyone else, wants me or some other person to do with our property. You don’t have to right to take it from us simply because you think it’s “fair” to give it someone else.

On the long, long list of weak-ass right wing canards, this is one of the weakest. Doug – why don’t you and Jan get together and discuss recent advances in cut & past technology?

Money is political power.

A redistribution of wealth is therefore also a redistribution of political power.

The rich use their political power to get richer — rent-seeking, tax breaks, the straightforward purchase of politicians like Eric Cantor, selective free trade, union-busting, predatory consumer practices buttressed by expensive lawyers, regulatory capture, the domination of media.

Money is power. Now, obviously Republicans like all the power concentrated in a small class of individuals with the rest of the population effectively dis-enfranchised. That’s how they roll. And Libertarians like Doug are just the wacky neighbors, the Kramers if you will, but all part of the same game: screw the poor, push the middle class down, all power to the rich.

By the way, this:

is the perfect example of that toady-the-rich mentality that dominates Republican thinking. The poor and middle-class will just waste that money on food and health care.

The rich — who are better than we regular people — will spend it wisely investing in Lehman stock, or building important companies like Enron, or shipping jobs to India.

We should worship them as gods.

@Doug Mataconis:

Either overstatement, or a cry for math tutoring.

This.

At the level they play consumption is all relative. Their houses should be more ridiculously lager, their cars should be more ridiculously faster … absolute level doesn’t matter. They can play the same high-end status games regardless.

I just saw a Talbot-Lago on PCH … that guy definitely wins.

@Doug Mataconis: Why not? Where does this “right” of property ownership come from? I’m not being snarky — I’m seriously curious. It seems to me that all “rights” any individual has are those that the society he lives in has chosen to prioritize. And in fact, I seem to recall that the word property was stricken from the list of rights in a certain founding document and replaced with “the pursuit of happiness.”

WR,

Go read some John Locke and Algernon Sidney, then you’ll understand

@michael reynolds:

And here’s why nothing ever changes. The AFL-CIO is just as much a corporation as General Electric is. The Democrats and Republicans both support the idea that things should be rigged in the favor of politically connected corporate interests, they just disagree on which corporations those should be. No one is actually fighting for a market place that doesn’t favor a handful of large concentrated interests over a multitude of smaller ones.

@anjin-san:

If you believe that this in fact a “right wing canard,” may I ask that you do the math yourself?

Here is the current list of the Forbes 400 Richest Americans, including their current estimated net worth (not this years income).

http://www.forbes.com/wealth/forbes-400

Add it all up and compare it against this year’s (or last years, or 2012’s) federal budget deficit. Download Table 1.1 directly from the White House servers.

http://www.whitehouse.gov/omb/budget/Historicals

All the confiscated wealth will not plug our current and project deficits. Federal spending is too high as a percent of the overall economic output of the country. If you have a different theory as to why, I’m open to your idea.

@WR: @Doug Mataconis:

Doug, that’s not much of an answer to WR’s question. Here’s a counter: go read some Jesus and you’ll understand the pitfalls of wealth.

It goes to your fundamentally religious way of thinking. You picked an ideology and you are unwilling to ever question it. And you don’t really seem either willing or perhaps able to debate it. It’s a set of assumptions you have, locked in as though they were never to be taken out and re-examined.

I’m sorry but “go read Locke” is meaningless as a defense of your point of view.

@Stormy Dragon:

The difference is one of constituencies. General Electric has to satisfy its stockholders. A Union has to satisfy its members. Without a union GE is free to ignore the interests of its workers and those interests suffer. That’s why we need both, not just one side.

@michael reynolds:

Do we really need either? They’re both primarily focussed with using their political advantage to enrich a small group of insiders, everything beyond that is just handwaving in both cases.

Just as we can have businesses without having to have GE, we can have unions without having to have the AFL-CIO.

Alex, if you compare the share of taxes paid by income group vs. their share of total income, you will find that top earners pay more in taxes than their equivalent share of total income, even under the Bush Tax Cuts. If effect, current tax law DOES essentially also tax a portion of wealth for upper-income taxpayers. Likewise, there is an effective wealth transfer to lower-income taxpayers. Essentially, on average, government services are subsidized by upper-income taxpayers for average- and low-income taxpayers.

My data sources are provided for your own analysis.

CHART: “Share of Federal Income Taxes Paid versus Share of Adjusted Gross Income (AGI) Earned”

http://3.bp.blogspot.com/-jJgdJlAiQAg/TlWesxPYGBI/AAAAAAAAAns/Hrb8umlKiio/s1600/federal_income_tax_shares_vs_income_shares.png

DATA TABLE: (Scroll to the last table tab, “Share of Taxes Paid vs. Share of Total Income”)

http://www.editgrid.com/user/soquel_by_the_creek/usa_federal_income_tax_data

The really terrible thing about today is that OTBers have decided to defend ridiculous wealth. $1M per year is 43 times “poverty level.” These people can live, not just large, but crazy-large. I mean think about the lifestyle you’d choose on $1M per year. Every year.

(If you wanted to save a million, that would take you what, 2 or 3 years? Oh, the humanity.)

And then come back to me and say that you need every penny of that, that loopholes are needed, that you can’t be happy with a penny less.

(As an aside, I do support income averaging, to give a break to the 1-time or 2-time million earners.)

Alex, can you point me to the data sources used to create this chart?

https://www.outsidethebeltway.com/wp-content/uploads/2010/09/income_shares_1979_2007_1.jpg

I’d like to understand see if there are other effects at work. For example:

* The chart covers the period 1979 to 2007. Do you see similar results with different starting points? Did the wealth of the Top 1% grow similarly during other periods? Why or why not?

* The chart shows the change in income growth as quintiles (the entire population split into five equal groups). However, it does not show the change in wealth for each group. After adjusting for inflation, did the wealth of all groups increase, but the Top 1% grew the fastest? Mathematically, you could see similar effects if you had a growing economy. The bottom quintile has a hard bottom bounded limit of $0. The top of the upper quintile is unbounded.

* Looking at the Top 1% curve, it is highly volatile and seems directly affected by the underlying economy. You can see large downward swings during recessions and large upward swings during booms. As the chart only continues until 2007, I would expect there to be a large downward swing beginning in 2008 and accelerating into 2009. There appear to be similar big upswings during the Reagan, Clinton, and Bush eras (all followed by stock market “crashes”, 1987, 2001, and I would expect 2008-2009).

* How has increased productivity, efficiency, and globalization helped or hurt different income groups? For example, thanks to the PC and the Internet, I am able to accomplish more by myself than I did in the 1980s with a support staff of two or three other workers. I no longer need a research staff, a typist, a document formatting group, a video production house, plus a fulfillment company to ship documents. Support functions like accounting and payroll are outsourced to local firms for a fraction of having permanent staff. Similarly, I now collaborate almost daily with colleagues on four different continents, instead of just the people within my own building.

Perhaps the USGov has too much concentration of wealth@Ben Wolf:

@Soquel by the Creek:

Lots of good charts here:

A Lost Decade Into The Great Middle Class Poverty?

I wouldn’t try to answer your questions specifically, because I don’t think they should be the real focus. The focus should be on how we pay the bills, or more correctly, how we split the bill.

@Soquel by the Creek:

Get back to us when you have some charts that include FICA.

@Doug Mataconis: I’m hearing you say that if a few people exercising their rights harms many others, then so be it.

Is this accurate?

@john personna: Net 1mil yr is one thing. but to gross 1mil, and save a few mil in a few yrs is another.

@Robert:

You are not taxed on gross. Surely you know that.

(“adjusted” gross income is a fair place to start, and yeah, I can save a lot with AGI north of $1M.)

@john personna: @michael reynolds:

I assume that you mean something like Matthew 19:16-26:

http://www.biblegateway.com/passage/?search=Matthew+19%3A16-26&version=NIV

Did I miss the part where it said to give your money to the government or the tax collectors? It specifically says “give to the poor” and not some group pretending to care for the poor. I’m not wealthy but I give relatively generously to various causes. I see plenty of examples where government policies are detrimental and counterproductive to the poor. I’d rather keep more of my taxes and spend the money where I see it being the most effective and doing the most good, without requiring an act of Congress in faraway Washington, D.C..

Plus, I thought it was the Left that wants a complete separation of Church and State. Or does the Left merely want the State to become the new Church?

@Robert: Your statement is nonsensical. The U.S. government has no wealth, not in any real sense. Wealth is tools and factories and intellectual property, money is not because it has no intrinsic value: it is only valuable as a medium for economic exchange. Furthermore I am aware of no correlation between higher government spending and economic depressions. There is, however, a significant correlation between balanced budgets and depressions because government deficits = private sector surpluses while government surpluses = private sector deficits.

@john personna: perhaps if you win the lottery. Factor in education expenses, continuing educational expenses, complying with gov reg expenses. How much do you need to save to throw off enough income to provide for living expenses? How about sending two kids to an ivy league college? John, you obvious are not livin it like i am

@Ben Wolf: Take less of my money and I’ll hire some people, take more vactions, perhaps buy a boat. Keep taking more money and I will make do with less employees, fire the gardner and the nanny.

@Ben Wolf: If I fire my nanny, I balance my budget, to her, it will be a depression.

Soqul – the canard lies in the inference that “Taking 100% from the rich” is somehow not the table. Yes folks, the scary Democrats/communists want to confiscate everything from the rich and end the American dream

Excuse me, posting from my phone. Should be “somehow on the table”

@Soquel by the Creek:

The churches would be the very first to tell you that they can’t replace government. Red Cross would agree. It’s a fantasy. It’s utter, complete and absolute nonsense.

Every time we have a disaster what happens? The Red Cross gets a rush of cash dedicated to that particular crisis. Charity follows the headlines, but people’s lives go on. We had lots of charities in eras when people regularly starved to death in the streets. That’s why we now have a safety net: because charity does not work.

@Robert:

Actually, logically, if we take your money and give it to someone else, they’ll hire a gardner and a nanny, right?

Or more to the point they’ll be able to afford sufficient day care to be able to work outside the home and contribute to the economy. Or get an education. Or get some help with a sick relative and be able to pick up an extra day.

Maybe instead of you socking money into a cash account because right now that seems safe, we’d get some of that money into the economy and people would buy things, which would spur the economy a whole lot more than you leaving your money idle because you’re nervous about your rate of return.

@Robert:

This is exactly my point. In your analogy you are in the role of government and your nanny is the private sector.

But your argument also contains a fallacy of composition. When you as an individual cut costs in hard times it’s a smart move, because you’re hedging against potential economic hardship in the future. When eveyone does it, however, it creates a positive feedback which reinforces the economic decline. Hence an individual virtue (the desire to save) becomes an aggregate vice.

Again the government isn’t “taking” money. Currently it is spending more money into the private sector than it is debiting through taxation. As I stated before, government spending (GS) = private sector surpluses (PS). I’m sure you’ve noticed the budget deficit of roughly $1 trillion matches the hole in private sector spending since the financial crisis in 2008. In this case GS is allowing the private sector to rebuild its balance sheets by transferring $1 trillion per year in financial assets to make up the shortfall.

@Scott O.:

First, you need to understand that INCOME TAX and FICA are two very different tax systems with different rules, roles, and purposes.

FICA has a fixed benefit cap, which is the same reason that Social Security taxes are also capped to the first $106,800 in income. Even with Warren Buffett’s mutli-million dollar income, he receives the same maximum FICA benefit that anybody else receives if their income is $106,800 or more. Lower-income people, in fact, receive relatively more benefit from Social Security than do upper-income individuals. There is no cap on Medicare taxes.

http://www.socialsecurity.gov/estimator/

Because of the income cap, it is also true that wealthier taxpayers pay less as a percentage of their income on Social Security than others, as shown in the following chart courtesy of the Tax Policy Center.

http://www.taxpolicycenter.org/taxtopics/images/currentlaw2_5.gif

Despite paying less as a percentage of income on payroll taxes, the top quintile pays more …

* Income tax

* Corporate Income tax

* Combined total of all federal taxes

You can find more in the following document from the Tax Policy Center.

Current-Law Distribution of Taxes

http://www.taxpolicycenter.org/taxtopics/currentdistribution.cfm

Personally, I would prefer a system based somewhat on the more modern Singaporean system.

* A small tax to pay for actual “social insurance” to help those that find themselves in unfortunate circumstance who cannot live without assistance or those who outlive PRUDENT retirement savings.

* A mandatory self-funded retirement program, where you are required to set aside a portion of your income for your retirement. This retirement savings account is the property of the individual and can be inherited by family or other designated parties.

“I also don’t mind a bit of class warfare here, considering how many of the wealthy in this country get that way through rent-seeking and speculation.”

Then you ought to do something about rent seeking (and BTW – Obama seems to be a master of catering to his campaign donating rent seekers) rather than tax away hard earned money; and those you cite as rent seekers are a vanishing small minority. Wake up.

And just how do you define “speculation?”

Any wonder we have no job creation? This is now bordering on self immolation.

@anjin-san: My purpose was simply to show that the President’s proposal is a partisan “class-warfare” sideshow. Even if we raised taxes on the wealthy to 100%, it does not fix our current budget situation. The President’s plan is a distraction from real solutions.

@Soquel by the Creek:

No one thing fixes it all. A bunch of smaller things do. Taxing people who can afford it is a start. Thus, not a side show.

@Drew:

We had zero net job creation through 8 years of George W. Bush giving you every last thing you wanted, Drew. Then the economy blew up.

Now you want more of that medicine. So that we can create jobs. Uh huh.

Are you in the “job creation” business? Or are you in the “line Drew’s pockets” business? I’ll be honest and tell you I’m in the “Line Michael’s pockets business.” So can we cut the crapola about so-called job creators? Job creation is an occasional result of what we both do while pursuing our own interests. So is job destruction.

There is absolutely no guarantee, none whatsoever, that either of us would use an extra dollar to create a job. Stop pretending there is. We’re just as likely to use that dollar to create a job in Bangalore and de-create one in Ohio.

@michael reynolds:

Michael, you are a well known author, and no doubt have an income far above many. Since I no doubt have less than you, I would sincerely appreciate it if you would please sign all of your assets, and future royalties over to me forthwith. It’s only fair. I promise to spend it on only those things you would approve of.

@michael reynolds:

We had net job creation under GWB because the economy blew up at the very end of his term in large part due to factors he had nothing to do with. For most of GWB’s two terms, job creation was actually very healthy.

You are making a less than honest cut in the data IMHO and a less than honest conclusion from it.

-Polaris

@Polaris:

Bullshit.

Wall Street Journal, Real Time Economics: Bush On Jobs: The Worst Track Record On Record . (See also, Jobs created during U.S. presidential terms)

@michael reynolds:

So many of your posts seem to follow the same theme: “I’m a self-centered guy, who is only out for my own interests. Therefore, I am perfectly correct in projecting that everyone else in the world thinks the way I do. Consequently, all rich people would act like complete SOB’s, especially those self-indulgent republicans!”

Wow! Talk about seeing oneself as God-like and superior in those assumptions! However, I do have a flash bulletin for you, Michael. God didn’t make man/woman out of your particular template. There are different kinds of folks out there from your ilk. It may depress you to think that. But, get over it!

@Doug Mataconis: “I’ve never quite understood the economic wisdom of taking capital from people who actually have experience investing it and giving it to people they don’t.”

Uh…if there’s one thing even the most out-there libertarian should have learned from the last few years is that “people who actually have experience” investing capital frequently don’t know what the hell they are doing.

Mike

@jan:

It’s not projection. It’s called capitalism. Once again, it’s reality. Or are you under the impression the impression that business is charity? Or even that it should be charity?

“Take less of my money and I’ll hire some people”

That theory got blown up in the 2000s. The wealthy use their money to increase wealth, not create jobs. Financialization has become the preferred method of increasing wealth.

” For most of GWB’s two terms, job creation was actually very healthy.”

Nope. It was the weakest recovery for jobs creation until the current one. 40% of our growth was in the financial sector which creates few jobs.

““I’ve never quite understood the economic wisdom of taking capital from people who actually have experience investing it and giving it to people they don’t.”

I have never understood the wisdom of concentrating all of our economic and political decision making into the hands of a few thousand people.

Steve

soquel:

Raising marginal rates on the top 1% can generate enough money to eliminate the deficit.

If we imposed a one-time wealth tax of 75% on the top 1%, that would be enough money to immediately pay off the entire national debt, and each man, woman and child in that group would still have $1.7 million, on average (link).

The numbers can work even if you look at just at a relatively small group (e.g., the top 1%). They just don’t work if you look at a tiny group (e.g., only 400 people, or only “0.03% or 0.00035% of the population”).

This statement is true only if you use an absurdly narrow definition of “wealthy.” You keep talking about “the Top 400 Richest Americans.” The people at the bottom of that list have net worth of $1B. You are essentially saying that anyone with less than that should not be called “wealthy.” Really?

michael:

Actually, high taxes on the rich (i.e., top 1%) can fix it all. I’m not suggesting this is the right solution, but I think it’s important to understand how the numbers work.

alex:

History shows that such a society doesn’t last. That wacky Marxist Alan Greenspan has said this:

Joseph E. Stiglitz (Nobelist and former Chief Economist of the World Bank) explains why:

The GOP and their patrons don’t understand that their strategy is ultimately self-destructive.

@michael reynolds: Sorry, but I disagree. President Obama’s “Buffett Test” tax plan will indeed be a distraction. Instead of focusing on real solutions, the electorate will again devolve in partisan bickering over yet another non-solution.

I noticed that your graph “Share of Total Wealth Gain (1983-2009)” came from the Economic Policy Institute, or EPI, who bills themselves as a “a non-profit, non-partisan think tank”, “created in 1986 to broaden discussions about economic policy to include the needs of low- and middle-income workers.”

If you peruse the EPI’s web site, one could argue that they have a particular polical slant. As always, “trust but verify” the data presented and its sources.

http://www.epi.org/about/board/

Here are the associations that some of the board members have.

Service Employees International Union (SEIU), #2 top spender in California politics, #5 donor nationally with 75% going to one political party. Said to have spent over $60M to elect President Obama. A major funder of 527 political committees. Top funder of a fake Tea Party group in the 2010 Nevada Senate race, managed by Senator Harry Reid’s former communication director.

American Federation of State, County, and Municipal Employees (AFSCME), #2 top donor on national campaigns with 94% going to one policial party

AFL-CIO

American Federation of Teachers (AFT)

United Auto Workers (UAW)

United Food and Commercial Workers (UFCW)

International Association of Machinists & Allied Workers (IAMAW)

Communications Workers of America (CWA)

Two Secretaries of Labor under Bill Clinton, Demcrat

Secretary of Labor under Jimmy Carter, Democrat

Senior Policy Staff for Richard Gephardt (former Democratic Party Congressman)

Involvement with Cesar Chavez and the farm worker’s movement

Green for All, “a national organization working to build an inclusive green economy strong enough to lift people out of poverty.”

AFL-CIO Labor Council

United Steelworkers of America (USWA)

Trustee for Union Auto Workers (UAW) retirees at GM, Ford, and Chrysler

Trustee for Steelworker retirees at Goodyear

Board member of the Democracy Alliance, “created to build progressive infrastructure that

could help counter the well-funded and sophisticated conservative apparatus in the areas of civic engagement, leadership, media, and ideas.”

And yet many people do want to place the blame for that blow up on the current President…

Oh, like a consumption tax, reducing wages for American manufacturing jobs, and getting out of Iraq and Afghanistan, eh?

@michael reynolds:

Claiming Drew got everything he wanted during the Bush administration is as silly as claiming you got everything you wanted 2008-2010. Regardless of who holds the majorities in government during a particular period, they’re still beholden to the broad will of the voters.

There’s been some minor swaying to one side or the other, but the course of the ship of state has been pretty steady regardless of who has been steering lately.

@jukeboxgrad:

So, do you actually advocate this position? If so, this is EXACTLY why most socialist and Marxist countries eventually erect border fences to imprison their citizens or nationalize businesses to steal wealth.

Such a policy may make some feel good–for awhile–but it will destroy the nation and eventually lead all of us into poverty. A government cannot seize 75% of a citizen’s wealth without eventual bloodshed. History is replete with examples.

@jukeboxgrad:

They might fix the acute situation, but they don’t fix the chronic situation. So long as Medicare costs keep climbing — and health care more broadly — we’ll outrun our ability to pay.

@Stormy Dragon:

True in theory, perhaps, but not true in practice. Right now the majority of Americans want to see the rich pay more. Is that going to happen? Probably not. Why? Because the rich now control the government.

“Because the rich now control the government.”

Just as important, they control the media and business. Given the importance of messaging today, I think that you can make a case that the wealthy have unprecedented power in the country, certainly for the modern era.

Steve

soquel:

No, but I notice that you’re moving the goalposts. You were trying to argue that the money simply isn’t there. I proved that it is. When are you going to admit that you were wrong?

Unless you “actually” want to stick with your implied claim that no one with net worth under $1B should be considered “wealthy.” Is that it?

@Moderate Mom:

I sign close to half my income over for the feds and the state and the various other taxes. And if we have to bump that up a few points so that you don’t die for lack of medical care, or so that your children don’t go hungry, I’m willing.

Why you think that is an occasion for derision escapes me.

It fascinates me that as a liberal atheist — and therefore expecting no reward for moral behavior — my willingness to help others exceeds that of so many conservative evangelical Christians who believe that they’ll be paid off in an eternity of joy.

Apparently even God can’t pay Republicans enough to behave like Christians.

@michael reynolds:

I meant “public will” in the Hamiltonian sense. People say they want a lot of things, many of them completely contradictory. While I’m sure if you asked people “do you want to raise taxes on the rich”, most will say yes. But on the other hand, I doubt congressmen are getting many angry calls or questions at town halls about why they haven’t repealed the high end Bush tax cuts, so I don’t think it has been the public’s will that they do so.

That seems to be beginning to change though, so I would be suprised if we see an increase in 2012-2013.

@michael reynolds:

Business is not about charity. It’s about exchanging work for income in order to make a living. If you want to make a good living, expand it, and stay in business for a substantial amount of time you cover all the bases the best you can, which includes having satisfied employees. Having satisfied employees is accomplished by paying them well, treating them as you would like to be treated, maintaining honest, viable relationships between all involved, including clients, employees and yourself.

Therefore, satisfying, sound business practices are not all about yourself. And, if they become that, then one usually loses sight of all the other elements it takes to be successful. It’s similar to the health model, where it isn’t all about the physical being. The evolving concept is a “wholistic” one, where mind, body and spirit are included in the equation of well being.

The same can be said of business operating under the one-dimensional meme of greed, as being the only tangible incentive behind the private sector putting any money into the economy. Certainly. business wants to make a profit to make their capital investments worthwhile. But, making a profit, does not mean being unnecessarily “greedy” and self-serving in the process.

Obviously, Michael, you either haven’t been a boss, essentially basing your assumptions regarding business through the intellectual eyes of a reader/writer, or, you have been one of those self-absorbed type of bosses who employees use as dart board targets, during their off hours.

@Soquel by the Creek:

I don’t know how I got roped in on the church thing. That wasn’t my argument. But for what it’s worth “give to Caesar” was actually in my bible.

@Robert:

I’m not going to talk about the actual size of my dot-com windfall, but yes I did bank a good part of it. Now, are you really asking me (us) to believe that because someone has let his lifestyle slip to consume an actual million every year (including ~100K in tuition which is tax sheltered somewhat) .. they are the new underclass?

Dude, if so you’ve forgotten how the world works. The median family is out there “livin it” on $50K per year. That is (I know you can do the math) 20 times less than you are talking about. It takes two families full incomes just to cover your tuition (though you do have 18 families worth left over, for other things).

Reviewing these 3 threads, do you know what is missing?

Any call or expectation for spending reduction.

No, we don’t even pretend anymore. We just whine that none of us (and for some reason especially the rich) should pay the bill.

And don’t think you can be a tax cutter and say the spending cuts are all on someone else. It’s on you. You are the ones telling us we need lower tax while … silence on the other end of the equation.

The deterioration of the discussion into the morals of taxation is unfortunate. It doesn’t matter how well Jan treats employees or how much money Michael spends (in his case he doesn’t benefit from the massive tax breaks for those who derive their income from capital gains and yet he’s still willing to contribute more). The empirical data show we have:

1) excess reserves accumulating at the top, made worse by QE and QE2.

2) insufficient monetary flow throughout the real (non-financial economy).

3) Draining those reserves will counter commodity price inflation and allow the government to increase transfers to the real economy; this has the added benefit of, as Michael touched on earlier, increasing the velocity of money and acting as a sort of economic multiplier.

4) Doug’s nonsensical point on absolute individual rights aside (there never has nor will ever be a right which does not have some limitation) the wealthiest Americans are pushing toward re-discovering an old check on their freedoms: a guillotine when the poverty-stricken revolt and drag their economic masters from their beds in the middle of the night. This is a possible future I’d like to avoid.

@jan:

Capitalism works because it is at base good anthropology. It gets humans about right, it doesn’t require them to be paragons. The same can be said for a regulated free market: it gets human nature. Ditto our Constitution which again, to repeat the theme, is based on a shrewd appraisal of homo sapiens.

I don’t think you understand much about business or human nature.

@Ben Wolf:

The two sides have devolved to:

– we have this deficit

– but I don’t want to pay taxes.

You can guess which I think is the adult position. I mean, if you can actually cut spending, and not make me another empty promise about next year or the year after, then sure, we can cut taxes. But to just whine and let the debt build … that’s not adult, moral, rational, take your pick.

@jukeboxgrad:

Really? Please re-read the original post and do the math. If you OUTRIGHT CONFISCATE the wealth of the Top 400 taxpayers, you barely pay of THIS YEAR’s budget deficit. That’s what I wrote and that’s what the math says.

Is there MORE money out there? Of course. So, once you’ve sacrificed the Top 400 taxpayers and their associated companies plus devastated the pensions of those invested in those firms, THEN WHAT ARE YOU GOING TO DO THE FOLLOWING YEAR?

Sure, the money is out there, but is it morally right to take it? I say no and I’ll fight against those that think it is.

Considering that the federal government owns some 650 million acres of land, I think we could find the money elsewhere if required. Perhaps we can eliminate some of the obvious wastes like the John Murtha Airport.

CNN

http://www.youtube.com/watch?v=JFUurITRjAk

ABC

http://www.youtube.com/watch?v=lvzNj0Vobss

Of course, we could decide to prioritize spending and limit the growth of government spending, but that would be heresy.

@Soquel by the Creek:

Isn’t that whole “outright confiscate” thing a silly argument? It’s used as a straw man to say that they can’t pay 1 or 2 percent more.

And of course actually fixing the deficit, if that was your goal, wouldn’t be all one thing. It wouldn’t just be a tax increase on the top 400. It would be closing those middle class credits, and it would be cutting a lot of spending.

How do you stop a train? Pull all levers.

@Soquel by the Creek:

I like federal lands. I hike, camp, and fish on them. Would we really sell off the High Sierras?

What you’re proposing isn’t akin to hitting the brakes, it’s more like dropping a steel wall over the tracks. If you’re really concerned about the deficit then your focus needs to be on a federal jobs policy to get the country back to work. As tax revenues increase, stabilizers will automatically reduce government outlays.

@michael reynolds:

It’s not a lack of understanding, but simply looking at business and human nature through different paradigms and considerations than you do.

In effect you are still on the same pedastal of self-indulgence or aggrandizement in thinking that your way is the way, similar to thinking you are the Tao without being the Tao.

So the plan is just to repeat this stupidity over, and over?

Have you ever worked in corporate America? Does not really sound like it…

soquel:

I already answered this question. You’re just ignoring the answer.

I already showed that the entire deficit can be eliminated by raising taxes just on the top 1%. You’re sticking your fingers in your ears and pretending that this fact doesn’t exist, but it still continues to exist.

This is what you said before:

This is what you’re saying now:

Here’s an idea: pick one story and stick with it. What you were saying before is that the money just isn’t out there. Now you’re saying it’s out there, but it’s wrong to take it. When you shift your arguments like this, you’re announcing that all your arguments are hackery and shouldn’t be trusted.

@john personna:

Because there’s no support for actual spending cuts right now. People support them in theory, but also are against cuts on anything the represents a significant amount of federal spending. Even the tea party has by and large been reduced to dancing around the “waste, fraud, and abuse” maypole.

Thing is, if they’d gone on a platform of “we’re here to balance the budget. We’d prefer to do it by cutting, but if not, we’ll do it through increased taxes”, they might have an easier time getting cuts because a fully financed government would at least make people face the cost of the spending they vote for.

Minor swaying? The message from the Bush administration to business was a clear one: “Do anything you want, just make money.”

If you every played pinball you know the difference between “minor swaying” and “tilt’.

@anjin-san:

Rhetorically, yes, but in terms of actual practice thing really weren’t that different during the Bush administration than during the Clinton and Obama administrations. The myth of Bush as having widely deregulated business is about as releastic as the myth of Obama having widely nationalized it.

@Soquel by the Creek: You know, Soquel, you should read a little further in your history books. It turns out that if a country transfers almost all its wealth to a select few and lets the vast majority die in poverty, that also leads to blood in the streets.

Actual deregulation at the legislative level? Perhaps. But the Bush admin actively decimated regulatory agencies, and it instilled a nod, nod, wink, wink culture amongst those that were left standing. There are plenty of examples, including the pass Enron got on its rather vast ripoff of California electrical utility customers.

@anjin-san:

Perfect example of the myth. The vast majority of Enron’s malfeasance accorded during the 90s, but since the thing blew up in 2001, it’s remembered as Bush’s fault. Also, Enron largely did it by taking advantage of the switch from historical cost accounting to mark-to-market accounting to hide debt. That change was originally initated by a desire to stop corporations from using historical cost accounting to hide capital gains (from taxation). While it certainly was a change in regulation, I don’t think it can be categorized as either regulation or deregulation.

I did not say the Enron ripoff was Bush’s fault. I live in California, I know the timeline. In the aftermath, they got a pass from the relevant regulatory agencies.

@jan:

No, I think gravity works whether I approve or not. Self-interest and greed are core facets of human behavior. That’s why capitalism works: because it takes humans as they are. The Marxist systems fail because they rely on a form of human — some mythical enlightened man — who does not exist.

It’s as if one were proposing to build a method of moving between floors of a building that did not take gravity into account. Those systems work best whose assumptions are most in line with reality. Capitalism doesn’t just expect humans to be self-interested, it only works if they are self-interested. Just like the stairs only work so long as gravity exists. If people suddenly stopped being self-interested and began, let’s say, behaving like Christians, capitalism would fail.

Our current regulated capitalism is a refinement on the core idea. It’s a political fix for a flaw in capitalist thinking. Capitalism relies on greed and self-interest, but it also relies on political stability. It only works so long as we aren’t all murdering each other. Right? And it works best when some outside force — government — controls the excesses of the worst practitioners of capitalism, the people who sell tainted food or commit fraud.

With me so far?

Now, how to organize a political system to both protect and restrain capitalism? Well, let’s go looking for a system that, again, relies on good anthropology. A system that takes humans as they are and does not rely on fantasy. That system is representative democracy, limited and defined by a system of laws.

Right?

Now we have the marriage of two anthropologically realistic systems: capitalism and constitutional democracy. You’ll notice that this modified version of capitalism is practiced in 100% of the wealthy, stable and successful countries on earth. (Setting aside quibbles that the UK is common law based rather than constitutional.) So capitalism, which recognizes human greed, is married to constitutional democracy, which recognizes the human lust for power and capacity for corruption.

One more element is needed: a moral system. Because there are gaps between capitalism and government. There are subtleties not covered by either of those systems. To cover those friction points we rely on a common sense of morality: right and wrong.

So, here’s why Libertarianism is bulls–it: It is bad anthropology. Same reason Marxism is bulls–t. Same reason sharia or so-called dominionism or Scientology or whatever are bulls–t: they are bad anthropology. They rely on bad data about homo sapiens.

The success of any human system relies on understanding the irreducible component: humans.

The best we’ve come up with so far is a mix of capitalism, constitutional democracy and basic morality. Not perfect, but the best we have. All three elements need to work. Republicans tend to devalue the second part. Democrats in the past devalued the first, but no longer. Now we are in a situation where Part One is eating Part Two and Part Three is impotent.

We need all three parts to work. Greed is a necessary but not sufficient value — a fact apparently lost on Republicans who are now wholly dominated by greed to the exclusion of any other consideration. You, Jan, seem to think you can solve the problem with Part Three alone. You’re wrong. Morality alone isn’t strong enough.

@Doug Mataconis: Civil society is governed by a social contract. The poor obey the laws governing private property because they think they’ll get a fair shot at having a decent life, and the rich, if they have any sense, agree on the necessity of a safety net designed to save the least among us from total destitution. I accept this arrangement. I think the dog eat dog society Doug wants would be the kind of horror envisioned by Thomas Hobbes. I also think the totalitarian nightmares of the 20th century – the perversion of socialism in the Soviet Union and Maoist China, the Hell of Nazi Germany, and the milder but still awful fascism of Mussolini, Franco, and Salazar, arose because the common people in Russia and the other countries I mentioned no longer felt they had a stake in society. That’s the practical reason I disagree with Libertarianism. The moral one is that it’s wrong in my book for people to live in misery in a country as wealthy as ours. If this makes me a socialist, so be it.

Throughout history when the state confiscated wealth and gave it to someone else…usually “the People” it turned into a bloodbath/reign of terror/killing fields/millions to the gulags sort of scenario. I have never seen this turn out well. The idea should be to make it possible for more people to create wealth of their own, rather than just take it away from someone else.

Wow, who knew that so many countries in Europe today have the scenario of bloodbaths/reigns of terror/killing fields/millions to the gulags…

This isn’t a question to people living in the 21’st century, Doug. Taxation equals the redistribution of wealth.

Governments exist precisely because individual rights are not absolute. Said system includes the Constitutionally prescribed power to confiscate your wealth, via taxation, and redistribute it.

If you have a problem with this, your options are literally to go and live in Somalia. Even there, you will have to pay some protection money to gangs (your ‘government’) Perhaps you’ll be given the freedom to delude yourself that this transaction will be a voluntary exchange at that time, but you will indeed be deluding yourself.

Every society on earth violates your principles. This should tell you something: your principles are badly nonfunctional.

John Locke was a fool, and philosophers don’t know literally the first thing about ensuring prosperity. And if the people in charge don’t ensure prosperity, they will be cast out and destroyed. And they will deserve it.

On planet earth, the historical record demonstrates very, very clearly that excessive wealth inequality leads to economic underperformance. Either we fix it, or we are steering a course to decades of economic pain for *everyone*, the wealthy included, not to mention global irrelevance. If your vision for America is the collapse of the Spanish empire, then by all means, stick to your principles.

@Ben Wolf:

Do you think that in our (political) world we have to worry about too-rapid action?

Changes to tax and spending should be ramped, over something like ten years.

@Terrye: There have been a handful of societies that confiscated wealth and gave it to “the people.” There have been innumerable societies that confiscated wealth and gave it to the ruling elite. Amusing, although not surprising, that you are so mightily troubled by the former and not at all by the latter.

@WR:

I’m quite a fan of history. I also traveled. I’ve seen firsthand when you run the experiment on state-controlled wealth redistribution versus free-market reforms. Examples include East/West Germany, North/South Korea, Communist China before and after market reforms.

There are two choices to closing the disparity gap.

1. Steal wealth from top earners, who acquired their wealth legally, and give it to those at the bottom. This approach never ends well.

2. Empower, educate, and lift up those on the bottom to help them become prosperous and globally competitive. This approach can be very powerful and long lasting. Look at Singapore and South Korea.

You don’t make a poor man rich by making a rich man poor. Unfortunately, many in Washington have completely abdicated option #2. We’ve literally spent over $1 TRILLION on the efforts but with little lasting results. We continue to spend a significant percentage of our GDP, beyond the current limits of the economy.

We don’t need to raise the top marginal tax rate on 0.03% of the taxpaying population. It’s a sideshow! To close just this YEAR’s budget deficit, you’d need to raise rates on the Top 1% to 75% or more. In my mind, we need to …

* Reduce spending and prioritize the remaining spending to those functions that can only be handled by the federal government. Much of the “Stimulus” in my area went to programs of local significance. Why not allow communities to keep and use their own money without first filtering it through Washington?

* Fundamentally reform the current tax code. The current system is antiquated, bloated, discourages investment and savings, is not internationally competitive, etc. Personally, I favor a consumption-based tax system.

@Soquel by the Creek: It’s nice to say that we should “empower, educate and lift up” those who are less well off. But in the same breath you say you want to slash government spending. How do you do that without elminating the programs that do the very things you’re talking about? The fastest way to empower Americans to become entrepeneurs? Guaranteed health coverage so they can leave dead end jobs and start business without the fear of condeming their families to bankruptcy or death should illness or accident befall them. Increased educational opportunities by fully funding public universities, instead of dumping more and more of the costs on students.

These things aren’t free. The money has to come from somewhere. And while you may have decided that taxation is theft, the constitution disagrees with you.

And speaking of straw men, the only two models in the world aren’t North Korea and Singapore. You might look at some of the northern social democracies, which have high taxation, strong safety nets, and happy citizens.

@michael reynolds:

Michael, I enjoyed your post — one of your best, IMO, because it was explaining your rationale without any barbed wire attached.

While I followed your “thinking” I don’t see the human species as you do. Your impeccable presentation was intellectually designed, like a good table setting. However, there are different paradigms of believing and seeing every person’s make-up, their essence or moral genome.

Ever since I was a kid, I saw people as basically ‘good’ beings. However, I believe they struggle to be this, frequently conflicted and often succumbing to the environmental pressures around them. Because, just like dormant cancer cells, that can be activated and run amuck in our lives, there are always present the components of greed and selfishness, which can also be activated, altering one’s perspective, hardening and blinding them to the virtues of others and themselves. But, the ‘core’ in most people begins as centered and basically good, which is 180 degrees away from your assumption of it being invested primarily with self-interest and greed.

I see flickers of what I’m saying in every day human behavior. Now, granted this isn’t focusing on big scale corporations, political parties, or countries. However, just like energy is comprised of atoms, the body with cells, so are populations bundles of cultures composed of individuals. I value and see promise in each and every unit (person), not burdening them with expectations that are presumed to be part and parcel the nature of mass behavior patterns, by putting them all in the massive vat of ‘good anthropology.’

Your discussion of capitalism, Marxism, and the intersection of capitalism, a constitutional democracy, and morality as the mix of elements needed for a human system to work is rational, and one I basically agree with. Consequently, the primary wedge in our disagreement remains how you see the human core versus how I see it.

To me the human code, has decency embedded in it, and if given the right away, can transcend the travails and obstacle courses presented to us in this life experience. Therefore, the ‘power of one’ is what I relish. And, that singular power can become contagious, spreading outward to others. There have been various episodes in world history of this happening, changing the course of mankind for a time.

However, if governmental higher powers are too rigorous and over-bearing in their man-made interventions, I see people never discovering reasons to go within themselves for the answers to their own lives, let alone finding or affirming any personal benevolence to help other people. Instead, there is created a mass dependency on government as being the perennial and benevolent parent. Therefore, while I don’t stand on morality alone to solve or render a country with the highest form of governance, it is indeed a component I treasure, wanting to cultivate and encourage, rather than diminish with an over-emphasis on a too highly regulated, centralized form of governance.

So, we will “Empower, educate, and lift up those on the bottom” by cutting government spending and switching to a consumption tax which, even if designed specifically to avoid screwing the poor, will almost assuredly further advantage the super rich who have already benefitted disporporationately over the past few decades (remember, wealth = power. It’s not just about being able to buy a Porshe or three). You have to work hard to create a consumption tax that isn’t regressive (particularly at the top end).

Yeah, I got a bridge to sell ya.

The purpose of taxing the rich more is that revenues are down and the government needs more revenue. The rich have the money – others do not. Their taxes have gone down in recent years (which we were told would result in good outcomes for all, and that simply did not happen). Their share of total income is way up, their taxes are down… this is not hard to figure out.

Pretty much everyone commenting here also agrees that government spending is on an unsustainable path and has to be trimmed in the medium-term, but some of us think it’s a bad idea to slash that spending *right now* given the economic situation.

The Democrats keep offering packages that are 2 to 1 or more (5-to-1 was on the table at one point) spending cuts to tax increases, and even if you adjust for the likelyhood that some of the “cuts” are going to happen anyway (winding down wars, for example) or are gimmicky in other ways, there’s still plenty to discuss on the cuts side of the ledger. But the GOP can’t get past the revenue side, where they in total opposition.

Each side has its political calculus. The GOP calculus is: why help him out? We’ll win in 2012 and do what we want. The Dems figure: let the GOP explain to the public why protecting the top 1% of the population from tax rates they used to pay quite recently is The Most Important Thing in The World.

And so it goes.

The United States has one of the lowest rates of class mobility in the OECD, meaning that people are more likely to be stuck in their parents socioeconomic system.

This isn’t necessarily a bad thing. Consider the hypothetical case of “perfect” income mobility, wherein the son of a man in the top income quintile has a 20% chance of ending up in any of the five income quintiles.

That would be great, right? Well…no. In fact, it would be a nightmare dystopia. The qualities that allow one to succeed in a market economy are partially heritable. The son of a man with high intelligence and conscientiousness is likely to have high intelligence and conscientiousness himself. If he’s as likely to end up in the bottom quintile as in the top quintile, then that means that income has no correlation with performance. A low measure of “social mobility” can actually mean that an economy is more, not less, meritocratic.

That said, I suspect that the United States’ low measured “social mobility” is largely a matter of ethnic diversity and regional differences in wages and cost of living. Specific US states would likely have measured “social mobility” closer to those of specific European states, and the EU as a whole would likely have measured “social mobility” closer to that of the US as a whole.

Why the scare quotes? Because we’re not really talking about social mobility at all. Social mobility means that a high-ability person born into the lower classes should be able to move up into the upper classes. But typical measures of “social mobility” don’t even consider that. They just ask whether people born into lower classes are moving into the upper classes, regardless of ability. Which is a pretty silly thing to expect, unless you completely ignore questions of genetic heritability.

We rank near dead last when it comes to numbers of people who are self-employed or own small businesses.

Also not necessarily a bad thing. An economy dominated by small businesses is an economy which is failing to take advantage of economies of scale. Do you really think that we need to be less like Denmark, Norway, and Luxembourg, and more like Greece, Italy, and Portugal? Or Turkey and Mexico?

soquel:

Where did you get “or more?” Aggregate household income of the top 1% is $2.2T. The projected deficit for FY2011 is $1.645T. That ratio is just under 75%. And this year is highly unusual. No one is projecting deficits this high for subsequent years.

But thanks for reminding us that higher taxes on the top 1% could eliminate the deficit. This is a simple fact that you previously tried to deny (“even if we raised taxes on the wealthy to 100%, it does not fix our current budget situation”). And thanks for making it so clear that you lack the intellectual integrity to admit that your claim was false.

@michael reynolds:

Again, the supposedly rationalist libertarian has a somewhat moralistic and Puritanical mindset when it comes to whose wealth is more “deserved.” The poor are wastrels and spendthrifts, undeserving of their labor, while the wealthy deserve absolute property rights and inheritances unto the End of Time. The wealthy create with their money, while the poor only destroy. Every dollar a poor person spends is wasted, while every dollar a wealthy man spends is a vital, integral part of our economy. When the government taxes it really steals, while when a wealthy man collects interest or rent he produces.

Modern economic conservatism is a collection of fallacies and tautologies, but it is mainly a disguise for an aristocratic loathing of the poor. And I think it’s amusing they don’t even notice their own Orwellian doublespeak.

@jan:

You believe humans are basically decent because you live in a wealthy, stable society that has been governed by law for more than two centuries. You’re seeing a slice of history, seeing it in very narrow terms, seeing only your local conditions, and therefore committing bad anthropology.

Humans do indeed have some aspects of decency encoded. But we don’t build systems or write laws around nice people being nice. We have to build systems that contain and channel people behaving selfishly. Having successfully created that sort of stable, prosperous society we see less of the unpleasant behavior. But humans don’t stop being humans.

Unfortunately: Lehman, Bear Stearns, Countrywide, etc… We have to build systems that control the behaviors of unbalanced greedheads. Just as we pass laws against pedophiles or wife beaters. Systems cannot be built on optimistic assumptions, they have to be built on honest anthropology, and honesty requires that we take notice of the fact that humans are capable of being rather not-nice.

We live in a country that we stole from the weak, or that we bought from those who stole it, or that we stole from those who stole it from someone else. We didn’t spread from Jamestown to Hawaii by being sweethearts. We did it by killing everyone who got in our way. We financed that expansion in part by enslaving our fellow humans, beating them, raping them, torturing them.

You’re seeing the later stage: when we are rich and stable. You’re chopping history into a tiny little segment of time and pronouncing a blessing on the human race. It’s inaccurate. It’s bad history and bad anthropology. To understand humans you can’t just look at the ones you see at a church social. You need to understand the ones who lie, cheat, steal, rape and murder to get what they want. Your wishful thinking about homo sapiens is no different than the wishful thinking indulged by Communists or anyone else who has difficulty seeing the human race for what it is.

@Brandon Berg: Denmark, Luxembourg and Norway have, to my knowledge, greater per capita numbers of small businesses and self-employed, so we’d actually be more like them if we structured our system in a way that doesn’t heavily pressure people to become wage slaves in the corporate machine.

Also, your argument on social mobility is rather bizzare. On what planet would you assume “perfect” social mobility (whatever that actually means) then conclude that because you think it would suck we don’t need to improve opportunities for the lower classes? This makes absolutely no sense.

@Lit3Bolt:

The confusion of material success and virtue is baked into the American mindset. It’s why people get angry when I say, “No, in my case it has nothing to do with any recognizable virtue. My DNA lined up a certain way, I had a marketable talent and good luck.”

I always argue that any life is a product of DNA, environment, free will and random chance. And that not only do those four circles overlap, they shift and intertwine to such a degree that no life can be shown in some philosophical autopsy to be all of this, or most of that.

Americans hate that. For Americans life is all clean living and right thinking and luck in life or in the big DNA lotto has no place.

@Ben Wolf:

Look at the lists linked from the original post and from my comment. Wealthy countries like the US, Denmark, Luxembourg, and Norway are at one end of the spectrum (low rates of self-employment), and relatively poor countries like Turkey, Mexico, Italy, and Portugal are at the other end (high rates of self-employment). Granted that the US has even lower rates of self-employment than the other countries on that list, but the correlation between prosperity and low rates of self-employment is pretty clear.

Which intuitively makes sense–most small businesses are small because they didn’t do a good enough job to get big.

My point regarding social mobility is that intergenerational interquintile movement (IIM), to coin a phrase, is a poor proxy for actual opportunity. Having acknowledged that, and that more IIM is not necessarily better, it becomes unclear whether the US’s low rate of IIM actually indicates any real problem with social mobility in the US.

@michael reynolds:

The temperance movement lives on.

@Doug Mataconis: Whats wrong with taking a little money from peter to pay paul. We all need a little help now and then. And when peter is down paul can pay. money is not the only thing that brings you down. Lack of access to necessities. can also bring you down. So maybe peter may have money but the beginning of alzheimers and then he is going to need paul to make sure he is not taken advantage of.