Timing is Everything

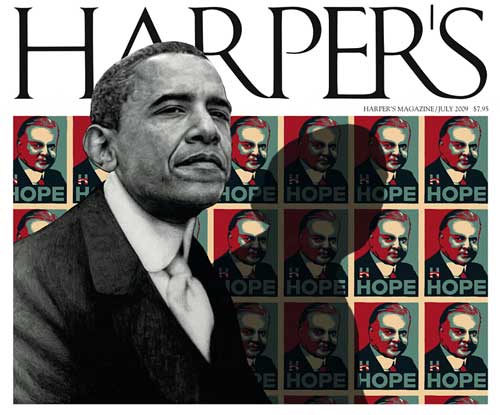

It's not a given that we'll have a massive recovery during the next presidential term but it's a pretty decent bet. And the party in power will get too much credit for it if it happens.

Ezra Klein makes a very salient point about the potential impact of the 2012 election on America’s two political parties.

Obama didn’t enter office at the right time to be FDR or Hoover. FDR was inaugurated in 1933 — more than three years into the Great Depression. The year before he took office, the country’s economy contracted by more than 13 percent and unemployment reached 23.6 percent. The suffering was pinned on his predecessor, and it had gone on long enough that a boom was in the offing — a boom that came, right on schedule, in 1934, when the economy grew by more than 10 percent. No wonder FDR was grinning.

Obama, by contrast, entered office as the crisis was peaking. The worst period of the crisis would prove to be the fourth quarter of 2008 and the first quarter of 2009, which mostly passed before Obama assumed the presidency, but which only showed up in the unemployment numbers months later. By the end of 2009, the Obama administration and the Federal Reserve had the economy growing again. But the damage done in 2008 and early 2009, which shot unemployment to 10 percent, nevertheless manifested on his watch.

[…]

Larry Bartels, a political scientist at Vanderbilt University, has written, globally, the pattern is clear: Whichever party was in power when the Great Depression hit was booted out of office, and whichever party was in power when the global recovery took hold reaped huge political benefits.

“In the U.S.,” wrote Bartels (pdf), “voters replaced Republicans with Democrats and the economy improved. In Britain and Australia, voters replaced Labor governments with conservatives and the economy improved. In Sweden, voters replaced Conservatives with Liberals, then with Social Democrats, and the economy improved.

[…]

And because a recovery is likely within five years — if it doesn’t happen, we’re sunk — whichever party wins the White House in 2012 is likely to get the credit, and so too will its policy agenda.

“Imagine someone like Rick Perry gets in and makes very dramatic changes in policy, like repealing health-care reform,” says Seth Masket, a political scientist at the University of Denver, “and then the next year the economy improves for reasons not related to the policies. Those policy shifts will nevertheless get the credit. And Obama’s approach will be discredited for a very long time.”

It’s not a given that we’ll have a massive recovery during the next presidential term but it’s a pretty decent bet. And Klein’s right: the party in power will get too much credit for it if it happens.

The worrying thing is that in the 2000s we coined “jobless recoveries.” That begs the question “massive” in what sense?

Sorry to be a wet blanket but the chances of a “massive recovery” between 2013-2017 are somewhere between zero and none.

The primary things which have kept us from outright collapse are FASB’s decision to suspend mark-to-market rules for U.S. banks and continuing bailouts of banks in Europe. The reality is the entire world banking sector is insolvent. The shell game won’t last too much longer. When it unravels it will unravel hard.

Then the Fed has leveraged itself by an unprecedented ratio. It’s painted itself into a death trap. Even the slightest uptick in short-term interest rates will be inflationary. Add serious inflation to the current economic mix and we’ve gone the way of Japan.

Then there’s the unemployment crisis. The only way to solve that would be a comprehensive rollback of various regulatory schemes. That’s not doable, however, regardless of who prevails next November, for the simple reason there still would be far too many Democrats in Congress. Harry Reid’s Senate caucus would block any meaningful attempt at regulatory reform, even if unemployment rates spike towards 1931 levels. Sad but true.

High unemployment + a poison banking sector + an overleveraged Fed = edge of the cliff.

Ultimately we’re headed for a painful debt restructuring, of an involuntary nature. It won’t be pretty.

I agree with Tsar Nickolas’s topline conclusion — where does the recovery come from as there is sufficient inventory in the housing market to keep that depressed for another three or four years, and there is still massive deleveraging in the household sector. However the rest of his analysis, I have massive issues with.

My take is that everyone in the elite political spectrum is embracing austerity now and surprisingly, austerity leads to contraction. Austerity in a liquidity trap is a positive feedback loop that won’t be broken until the debt overhang is dealt with either through inflation, principal writedowns or actual real wage gains. And none of those things are on the policy platter.