Redistribution: Where You Stand is Where You Sit

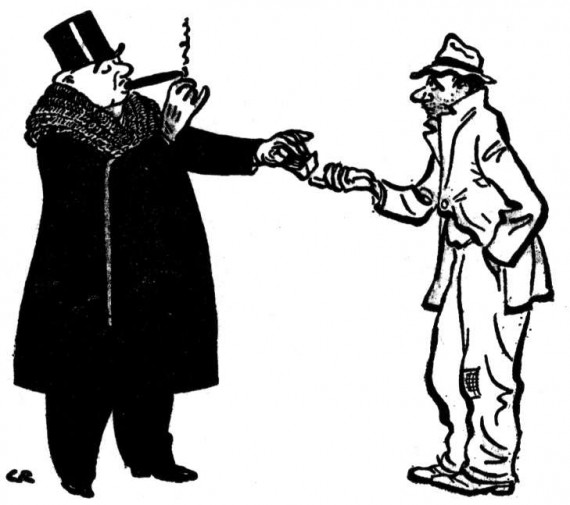

A government that robs Peter to pay Paul can always depend on the support of Paul.

Gallup asked Americans whether we should “redistribute wealth by heavy taxes on the rich.” As has been the steady pattern over the years, those surveyed roughly split:

Here’s how it breaks down by key subgroups:

Gallup’s Lydia Saad, a family friend, focuses on the partisan divide:

Republicans and Democrats have sharply different reactions to the government’s taking such an active role in equalizing economic outcomes. Seven in 10 Democrats believe the government should levy taxes on the rich to redistribute wealth, while an equal proportion of Republicans believe it should not. The slight majority of independents oppose this policy.

The question also provokes different reactions from men compared with women, whites vs. nonwhites, and upper-income vs. lower-income Americans. Consistent with their more Democratic political orientation, women, nonwhites, and lower-income adults are all more supportive than their counterparts of government redistribution of wealth via taxes.

[…]

While a solid majority of Americans, 57%, believe money and wealth in the U.S. should be more evenly distributed among the people, fewer than half favor using the federal tax code to do so. The fault line in these views is distinctly partisan, with most Democrats championing redistribution and most Republicans opposing it.

But, as Matt Yglesias notes, the underlying demographics are more telling:

The public is pretty evenly divided on this, but support for redistribution is concentrated in demographic categories (poor people, black people) who are disproportionately unlikely to vote. Then over and above actual voting, the $75,000 and over crowd has higher social capital and is the donor base for both parties. In general, this poll seems to support the Lupu and Pontussen thesis that middle class white Americans have an unusually low sense of solidarity with low-income Americans due to ethnic differences.

Actually, I think it’s more basic than that: High taxes on the rich to benefit the poor . . . hurts the rich and benefits the poor. That the rich would be again’ it and the poor for merely illustrates Dave Schuler’s favorite George Bernard Shaw quote: “A government that robs Peter to pay Paul can always depend on the support of Paul.”

UPDATE: A commenter correctly points out that I’ve managed to miss Matt’s point. I actually don’t think the data here sheds any light on the subject. The “middle class” here is represented by a very large swath, $34,000 to $75,000, and they’re almost evenly divided. I suspect that, if this were broken into three equal bands, you’d see the overall results replicated. That is, the lowest middle class group would mirror the poor, the middle would be even, and the highest would mirror the rich.

Redistribution is such a nice word, why not call it for what it is?

Communism.

” “A government that robs Peter to pay Paul can always depend on the support of Paul.””

Then why dont the poor vote? Al this concern about redistribution, and the end result is that the wealthy have more than they have ever had. We worry about theoretical votes by the poor and ignore the reality in front of us. The real redistribution is from the young to the old.

““There’s class warfare, all right,” Mr. Buffett said, “but it’s my class, the rich class, that’s making war, and we’re winning.”

Steve

SH – a typical and simplistic view, to be sure. To be consistent, you have to be willing to get rid of all government programs that benefit the rich disproportionately.

In reality, we have one completely corporatist party (Republicans) and one semi-corporatist party (Democrats). Republicans actively seek to redistribute money upwards. The essence of the Ryan Plan is to destroy Medicare so as to funnel all of that money to rich people. Likewise, that’s how our corporatist government protects incumbent business interests through tax breaks and subsidies. Tax the masses, then funnel as much money as possible to the top 1%. The entire purpose of movement conservatism has been to redistribute money from the middle class to the more deserving rich people. The thinking was the American people had it too good in the 60s and 70s, like how if you have a job that pays anywhere a living wage, you have it too good now.

That does not address the point Yglesias was making. He was referring to the unusually weak sense of solidarity between the middle class and the poor (relative to other societies, I infer), not the more mundane point that the rich oppose redistribution and the poor support it.

Well, first off, it isn’t redistributing wealth. It is redistributing income. If we’re going to redistribute wealth, then John Kerry needs to let some poor people take is boat out, Tom Friedman needs to open up some building sites on his estate and Bill Gates can take in a few boarders out in Seattle.

Should the government redistribute annual income via heavy taxes?

Ask that question, then report back the results. By the way, the median household income for 2009 was $49,777 so by definition if you make over that you’re rich and need high taxes down to that level.

this question is either designed to ellicit the response it got, or just poorly designed. redistribution is such a dog-whistle word that this shouldn’t even be considered seriously. look how fast souther hoosier’s ears perked up. take out the red-meat and you’ll see numbers at least ten points higher, or even more, in support of tax increases on higher incomes in order to reduce the debt.

then there is the vagueness of it:

oil subsidies are redistribution of wealth. so-called republicans are all for them.

aid to tornado victims is redistribution of wealth. should we stop it?

tax breaks to employers who provide health insurance is redistribution of wealth. will we stop subsidizing health care?

mortgage interest tax exemptions are redistribution of wealth. should we eliminate them from the tax code altogether? maybe just second homes? maybe just homes above a certain value?

MY may be correct but this survey neither supports nor contradicts the finding. The results aren’t reported in such a way that this determination could be reached.

I think the thing that is most unfair is the tax code.

That is why we need the Fair Tax. People on the lower end of the pay scale pay no taxes and people on the upper end get special exemptions written into the tax codes. It is the middle and the upper middle class that seems to be paying the bills.

Unfortunately, it’s borrowing that’s paying the bills.

Agreed with Tano. Joyner is looking at this through a binary lens (apropos of the literally and figuratively black-and-white picture he chose for the post).

Yglesias used the term “middle class” and Joyner answered him with only “rich” and “poor”. To me, that shows a lack of effort on Joyner’s part to understand Yglesias’ point.

can we all just agree to lose the “…47% pay no federal income taxes…” meme? please? i mean…can’t we at least elevate the discussion above that level?

Redistribution of income has been a part of every human society for as long as there have been human societies. In fact, one could argue that it starts far earlier than that. As long as we have been mammals we have been, to some extent at least, social animals, with a division of labor, and an unequal ability to “create wealth”. There has almost always also been an unequal distribution of wealth, but I suspect that the most productive members of society have always been net donators of wealth, and the weakest and least productive members of society have been net gainers.

OF course there is always the temptation of the young, strong, and most productive members of society to try to keep all the wealth that they create and ignore the rest of their society, whether it be an immediate family, a tribe or something larger. Its probably fair to say that the socialization of the young (especially males) into a societal ethos of service to the rest of their family / tribe / society has been one of the central tasks of all civilizations.

It is rather odd that modern American conservatives, who see themselves as guardians of the great traditions of our culture, and who have such great respect for this notion of service to ones society when it comes to military service, have also seemingly abandonded the notion of service in the economic realm, and embraced the “greedy individual” model that was championed by (classical) liberal philosophy.

Why? They are the ones that are benefiting from the redistribution of wealth.

I agree the phrase “redistribution” is a dogwhistle, intended to be synonymous with “welfare”.

To elaborate on other’s points, we have NEVER had a purely “free” marketplace. The government has always bent and distorted the laws, regulations and playing field to favor or punish those who were either in or out of favor at the moment.

For example, the Interstate Highway system was a godsend slice of welfare delivered to the auto companies and trucking outfits, but was a devastating blow to the passenger rail companies. Public financing of airports and the public creation of the FAA system of air traffic control was a huge benefit to the airline companies, but again, was a crushing blow to the passenger rail system

Was this called “redistribution”? No, but it had as much effect as if we simply wrote the auto, ailine, and trucking companies a ginormous check.

He didn’t get it nearly as right as Scorcese did in Gangs of New York: You can always hire half of the working class to kill the other half. That’s the problem.

Yeah, my God, they’re all just rolling in that welfare lucre. It’s a goddamn windfall.

Hunter societies had rules for division of the spoils. This goes back tens of thousands of years (at least). Tano’s right on that, and Southern Hoosier comes across pretty dopey for looking at everything through a 19th century lens.

Beyond that, I personally think you can’t do a reasonable survey with “redistribution” in there as red meat. Most voters don’t really know what it means, or how many of their benefits are re-distributive.

Do you like your mortgage interest rate deduction? Guess what, it’s re-distributive.

freddie, you picked up on that too.

I repeat: a society that can not take care of it’s aged, it’s children, it’s disabled… has some serious problems. And the problems do not start in it’s tax policies, they start in it’s very soul. We are going to hell and the Republicans are leading the way.

ps: No, I do not have the answers, but Europe seems able to do the above. Why can’t we? And don’t tell me “They are are going broke!” because we are too… twice as fast.

What do you call it, SH, when the redistribution is going upwards?

SH – because that 47% are paying other taxes, which tend to be regressive in nature (like the sales tax and payroll taxes)

Well, we don’t want communism. Does this mean that that California and New York can stop sending welfare to red states with dynamic, chicken-ranching based economies? Maybe Rick Perry will stop groveling for federal $$$ too.

“Does this mean that that California and New York can stop sending welfare to red states with dynamic, chicken-ranching based economies? ”

Hell, no. Are you crazy? Peckerwoodry is the unspoken governing theory of the Republican Party.

Every dime a government spends is redistributing income.

“What do you call it, SH, when the redistribution is going upwards?”

I’m pretty confident that SH calls that “the thing that makes ‘murka great.”

Now, on to a more serious idea. I have read the theory, heard the spoutings from the Limbaughs and Hannitys out there, and I still cannot understand where these guys think that there is a bottom line in their theories. There is, in the Western Hemisphere (and probably in the Eastern and Southern, too), a 500 or so year long anecdotal, ethnographic study available on the effects of policies such as the ones conservatives espouse–it’s called :LATIN AMERICA! So far, it’s hasn’t worked well.

The housing market has slumped again as the banks finally are trying to ditch their “inventory” of underwater houses, the dumping is reducing prices and a compound effect is that the lower prices are driving prices even lower–because most of the people who can actually afford houses on the income they earn already own one . In every one of the Forbes list of the “best cities” to do various things in a median-level income will not buy a median-priced house–it takes an income as much as 50% higher than median, or an equity position that will provide a down payment above 25%. Economic systems are always self correcting–there will either be some sort of “income redistribution” system that capital holders (I agree, the government can’t do this by fiat) put into place, or the system will devolve to an equiblibrium level that matches the distribution of wealth in the country. You pick.

Since I criticized Joyner earlier, I guess it’s only fair to tip the hat to his Update. Being willing to admit that you’re wrong and paying attention to feedback in the comments are important qualities in an opinionator.

the govt can only give to someone what they take from someone else namely we the taxpayers,you can never have equality of outcome as people are different from each other some have more drive to succeed than others and some people are just too lazy and stupid to ever make it,if someone wants to be sorry and trashy they have that right however they do not have the right to expect me to pay for it as this interferes whit my right to be free from them

Yeah because every rich person obviously works so much harder and has less drive than every poor person :eyeroll:

Since most of you believe in redistribution of wealth. why don’t you start with your own money instead of someone else’s?

How is the government redistributing money upward in what you posted?

As I said, it’s been happening for tens of thousands of years. I don’t have to believe in it to make it happen, nor do I have to somehow kick-start it with my own money.

The key thing to know is that we were all born into an America with redistributions in place, and not always sensible or uniform ones.

Do you put ethanol in your gas tank? Redistribution.

“How is the government redistributing money upward in what you posted?”

sam referred to President Bush’s reduction of taxes on capital gains and dividends. This was a giveaway to Bush’s well off supporters and had little or no economic value. If the President had wanted to spur investment, he could have made the tax reduction apply to future investments, say to equity purchases made after 2003. By making it retroactive, all he did was reward wealth. If this isn’t redistribution, what is?

A perfect example of redistribution upward is productivity growth. That growth has traditionally meant an increase in the wages of the employee responsible for it. In fact most economists agree that wage growth from productivity is inherently non-inflationary and therefore a valuable path to real economic growth.

But starting at the end of the 1970’s american workers stopped seeing wage growth despite very largr increases in productivity, particularly over the last two decades. The decline of labor has allowed corporations to redirect that increase in wealth to themselves and shareholders: note the incredible profitability of american corporations since our economy collapsed in 2008. Those profits have come exclusively from productivity growth as management has squeezed the employees they haven’t fired to take up the slack from downsizing. Rather than resulting in an increase in wages as those employees produce more for their employer, they’ve seen downward pressure on wages, i.e. wage cuts and “renegotiations” of salaries despite corporations accumulating the greatest cash surpluses in history.

There is no argument that can spin this as good.

sam, a certain segment of voters have been trained to think “tax cuts = jobs,” without really checking that logic. So I can already tell you the answer. That reward to the rich wasn’t for them, it was for the magic they might do.

(The magic fails though. The reason tax cuts haven’t equaled jobs is that business has less need to hire for expansion anymore. Part of that is technological, and part of that is globalization.)

How is letting people keep more of their wealth redistribution?

Don’t we have one of the highest corporate tax rates in the world?

http://www.cato.org/pubs/tbb/tbb-0204.html

Really? You actually don’t know what redistribution means then.

What it means is, when government taxes and spends, and you either take more tax from some, or spend more on some, the net result is a transfer.

Spending more on food stamps is a greater transfer to the poor.

Reducing the tax rate on the rich, especially giving them avenues to pay no tax, is a transfer to them.

Foxconn workers assemble iPhones for $2000 per year.

Think about that.

And then this idea that lower taxes will magic those jobs back to America.

SH,

The Treasury calculates the effective corporate tax rate at 27%. The effective rate is what they pay after all the loopholes and deductions are utilized, which puts the U.S. squarely in the average range on corporate taxation.

If the United States were to cut its corporate rate to, say, 20 percent, not only would real capital investment increase, but firms would financially restructure in order to shift more of their global tax base into this country.

Ireland’s corporate tax rate is 12.5%. It isn’t helping.

I’m sure many of us paid higher effective tax in 2006 than 17%, and so that was a net transfer from us to them.

I guess I don’t. I just never thought that being allowed to keep more of what I earned was redistribution. I always thought that redistribution was robbing Peter to pay Paul, not allowing Peter to keep more.

Right, it’s only when you have more people in the model. If you are “robbing” Peter to pay Paul, but robbing Ringo less, then there are two transfers going on. One to Paul, and one effectively to Fungi.

Fungi? Stupid phone. Ringo.

So none of you would have any trouble if the government sized your 401Ks for redistribution? I’m not saying they are going to, but it has been discussed.

http://goo.gl/1l9BZ

I’ve always wanted to have 401K over to someone that is bankrupt to manage it for me.

Boy, that will never happen. People love to think they can outsmart markets, and Wall Street love rapacious retirement account fees.

Robbing someone less is redistribution?

I guess I need to go back to school and take a class in economics. I need to find a professor that has never had a job outside of academia in his life, never had to make a payroll, has always lived of government grants and has never had his economic theories challenged . That way I can sit there and have my head filled full of mush.

The difference between market returns and investor returns is important for a number of reasons.

Its just math, SH.

Sorry, John, you lost me when you said that robbing someone less is redistribution. That is saying that money belongs to the government and not to the people that generate wealth. The government does not produce wealth, it only consumes it and redistribute it in a very wasteful way and to the advantage of those in power and their supporters.

Imagine that our Beatles are on a desert island. Peter has 101 coconuts, Ringo has 100, and Paul has none. Their rule is people with 100 or less pay a 5 coconut tax, people with more than 100 pay 10. Progressive tax.

After paying tax, Paul has 15, Peter has 91, Ringo has 95.

How did Ringo get to be richest? Redistribution.

Peter and Paul bust butt gathering coconuts while Ringo sits on the beach all day smoking dope. Then at the end of the day Ringo pulls a gun and forces Peter and Paul to share their coconuts. When the coconuts are all gone, Peter and Paul only collect enough coconuts to meet there needs. At which point Ringo pulls his gun and forces Peter and Paul to gather coconuts for him as well. Instead of communism, it now becomes slavery, since Peter ad Paul are forced to work for someone else against their will and with no benefit to themselves.

Maybe Ringo was sick that day, and that’s the deal the three of them made for such an eventuality.

You poor comic-book libertarians, everything is a gun to you.

OK robbing someone

lessis redistribution. So we are back to simply robbing Peter to pay Paul. By taking less from Peter, only one of his three children will starve to death.If Ringo was sick, I am sure that Perter and Paul would take care of him without being forced. And when Ringo got well he would pickup his share of the chores.

I love how “will pay no federal income taxes” becomes NO TAXES AT ALL to you. It’s like you’ve never heard of sales taxes or payroll taxes or property taxes or any number of taxes that exist outside of the federal income tax..

Do you simply not believe in a democracy’s ability to tax SH?

That would put you way out in left field, wouldn’t it?

I mean, can you name any democracy in the history of the world which has not set (redistributive) tax rates by majority rule?

The downside of redistribution is, people began to not only expect someone else’s wealth as entitlements, but to demand it.

http://goo.gl/YqBa3

What, you put that out there so that someone could call you a racist and you could escape by the back door?

What a goof.

Of course all governments need to tax, since the government does not produce wealth. The problem is what the government does with the wealth that it brings in. I do not trust the government to spend the money wisely. One of my favorite boondoggles is penis washing in Africa. http://goo.gl/2olhw That money was suppose to be for job stimulate not penis stimulate.

And I look at the crooks we elect to office, How much have they used their position to enrich themselves, their supporters and to maintain their position? It not just one party or the other, but the media does howl more when the Republicans do it.

It might be more proper to say far right field instead of left

Sorry John, the truth is not racist as unpleasant as it may be. The facts support what the author wrote. American Thinker is hardly a racist website, except to those that disagree. Even this site says that 64% of non-whites are in favor of redistribution. How is that any different than what I posted?

I asked specifically about democracy.

IMO your answer is typical of the far, far, right. You can’t really stand up and say “yeah, I support democratic taxation and spending.”

No wonder you call them “The Democrat Party” eh?

You are trying to open a rabbit hole that has nothing to do with the wider question.

In fact, far more homogeneous nations than ours have higher tax rates and more redistribution than ours. Interesting that.

Sure I agree with that statement. When I said all governments I was being inclusive of all governments whether the were a dictatorship, theocracy, or democracy.

and to forgive divine, which liberals are not, since they never forget or forgive any mistake a person makes.

But you don’t agree. You go on and on above about guns and confiscation, right?

(“The Democrat Party” is a widespread right wordplay, not recalling anything you said specifically.)

I don’t believe I’ve ever said anything about guns on here

I said the The Democrat Party once by mistake instead of the The Democratic Party and got jumped all over for making a simple mistake.

News to me, I must be hanging with the wrong crowd.

Democrat Party (phrase)

http://goo.gl/iXqKm

Indeed…it’s one thing when you think your tax dollars are going to support someone like you…it’s quite another when you think your tax dollars are going to support the lazy, shiftless “other”…

That would just make sense, that people are more willing to help others that are like them. Where as in heterogeneous nations there would be more racial strife

Interesting

Why Are Ethnically Divided Countries Poor?

http://goo.gl/wo9NW

And yet we live in an ethnically diverse country that is also the richest in the world…

Interesting

http://goo.gl/wo9NW

IF the author is correct, than as we become a more racially diverse nation, we will become a poor nation.

We do?

Read more: Ethnicity and Race by Countries — Infoplease.com http://www.infoplease.com/ipa/A0855617.html#ixzz1OKUqmj1W

It is that 75% that generates most of the wealth and controls the redistribution of it. In the next 30-40 years and that 75% is reduced to less than 50%, more ethnic groups will be fighting for control of wealth and redistribution of it.

http://goo.gl/dKpKN

wow, the group that composes 75% of the population produces the majority of the wealth?

shocking, that!

It is hardly surprising that a known racist would lament the demographic changes that are going to happen to this country in the next few decades….if it is any consolation, Grand Dragon Southern Hoosier, you could save up as much money as you can and then move to Norway or Finland…I’m sure those countries are white enough for you…

@ An Interested Party

If you like the up coming changes so well, why don’t you move to Mexico? That is our future.

SH said:

But he previously said:

I think we’ve been through it. We don’t need to repeat. But it’s pretty clear that while you assert support for demographic government and taxation, you like to be able to swing around and call it “pulling a gun.”

It’s funny how often this pattern shows up.

It hasn’t worked out too badly for California. 200 years of culture-blending.

Wait, and the highest GDP of any state? What’s up with that?

And one of the worst budgets crisis in the nation.

http://goo.gl/biq8X

http://goo.gl/jyQTT

http://goo.gl/dHk66

California is a shining example of multiculturalism that the rest of American has to look forward to.

Southern Hoosier is a shining example of monoculturalism.

@ john personna

You forgot to mention the great education system California has.

http://goo.gl/9kC61

SH, is there actually a state in the union where some shmuck couldn’t do that kind of news crawl?

Try not to be too obvious when you go for the cheap points.

It wasn’t a cheap shot, it was a reality check. Multiculturalism doesn’t work, It seems to work when the smaller ethnic groups are being absorbed into the dominant culture, but that isn’t happening anymore.

Yes, you can probably find similar stories in other states, but not the extent or as many as there are in California, simply because other states does not have the large Hispanic population that California has. As the Hispanic population increase across, the United States, more states will begin to have the same problems that Californian is having.

The future of our country will be in an ever increasing hands of illiterates.

Right now California has to build a school house a day to keep up with the increase population. Think what that is doing to the environment. And what happens when a state reaches the tipping point and votes itself a Spanish only language state? There is nothing to prevent a sate from doing that.

Let me share this video with you. This is the future that we are creating for our children and grandchildren. If you choose to ignore it, then that is your problem, not mine. http://goo.gl/zEBpX

“It wasn’t a cheap shot, it was a reality check. Multiculturalism doesn’t work, It seems to work when the smaller ethnic groups are being absorbed into the dominant culture, but that isn’t happening anymore.”

You have no idea of the history of California, do you?

The state has been multicultural for its entire growth cycle.

Looking at the population difference between the native and non-native population during that 4 years, I’d say the native population was totally overrun.

So in one year twice as many Chinese arrived as the entire original Mexican population.

Are you going to tell me that New York city, is Dutch, just because the original settlers there were Dutch? California is now more Mexican than it has ever been in its past and I’ve pointed out with my “cheap shots,” it isn’t working out to well.

No, no, no. Multiculturalism just does not work. Ask the Americans who live in San Francisco, Los Angeles, or San Diego. They just can’t compete with the dynamic cultures of Maine and Idaho.

I love how SH uses Chinese immigration to prove that California does not have a multicultural history 😉

@ anjin-san

I’ll not bother to repost what I said earlier, since you won’t read it anyway. But I’ll say this much.

@john personn

So how do you get no multiculturalism out of multiculturalism doesn’t work?

Be careful how you quote SH. The casual observer might think you are quoting me.

And I’m still waiting for one of your less diverse states to pass us in GDP. Basically you’ve been throwing up whatever you can to make failure out of that success. As, many point out, tax dollars from rich and multicultural California flow to the backwards Red States.

How about we rank California 12th in the nation? GDP per capita?

1 California 1,936,400 13.34 37.3 51,914 12

http://goo.gl/f3hgh

12th per capita is still a win, especially given the “special case” states above it (DC with low population and government, Alaska with low population and oil.)

(To make your messed-up monoculturalism claim work, you need California to be in the bottom, not the top.)

No. Actually I just have to point out all the conflicts between the different ethnic groups, the failing school system, the budget crisis, the failing infrastructure, the business leaving California, and the local government loosing control of parts of the state. Which I have and can do so again.

There you go again, Grand Dragon Southern Hoosier, hating on a state specifically because it has such a multicultural population…tell me, what lily-white states are doing well? Hmm?

Why would I hate California? I was just pointing it out a a shining example of the future. If you love what California is becoming, then you will like what the future holds in store for America, How I feel about California should be totally irrelevant to you.

I see you are clueless to the real world, there are no lily white states, just lily white communities, like the one you probably live it.

Tell me why are liberals so unhappy and hateful. You always seems to come across that way. Is calling me names the only joy you have in your life?

Poor poor Grand Dragon Southern Hoosier…you don’t even know sarcasm when you see it…and stop projecting so much…calling the president “Comrade” and telling us what hell holes minority communities are do seem to be the only joys you have in your life…

NYC’s birth as New Amsterdam is actually an interesting story. I liked “The Island at the Center of the World” which is all about that.

…

As for the post – I don’t buy it for the simple reason that, as Jay Gould apparently put it, you can always hire half the working class to shoot the other half. The rich have a *really* sweet deal here in the USA, and the trend is in their direction. The poor don’t vote and those who do don’t automatically vote themselves handouts.

So apparently Peter can bring in a ton of money, pay comparatively low taxes on it, crash the economy, get a bailout, whine and cry all the while, lay Paul off (because it’s cheaper to hire someone somewhere else or use a robot – neither of which, I should say, are morally wrong in and of themselves), and Paul won’t do a goddamned thing. That’s closer to reality.

I know clueless when I see it.

The happiest top ten countries are predominantly white and homogeneity. I think MSNBC must be more racist than Stormfront for running this story.

http://goo.gl/q5DyA

Redistribution of wealth in Sweden. When an entitlement becomes a demand. Our future in America.

http://www.youtube.com/watch?v=zN32eCzIv1U

Notice how easily anjin-san substitutes postmodern multiculturalism for a society with multiple cultures (melting pot, salad bowl, whatever) as though they are the same thing?

Good point. I missed it.