Secret to Wealth Discovered!

Americans who earn a lot of money disproportionately live in a tiny number of states and are married to other high-earners.

Dylan Matthews pulls these data from the Census Bureau:

Dylan Matthews pulls these data from the Census Bureau:

About 3.96 percent of American households make over $200,000 a year. Thirty-eight states have lower percentages than that, and twelve and the District of Columbia have higher ones. Seven states have a percentage of less than 2 percent (West Virginia is lowest with 1.36 percent), 21 have a percentage between 2 and 3 percent, 11 have one between 3 and 4 percent, and four have one between 4 and 5 percent. New York and Virginia are both at about 5.6 percent, and California and Massachusetts are around 6.2 percent. Maryland is at 6.8 percent, New Jersey at 7.46 percent, Connecticut at 7.95 percent, and D.C. tops the list with 8.37 percent.

The map atop the post illustrates this graphically.

My first instinct was to notice that, not only was the tiny city that houses the seat of government easily the place with the highest concentration of high earners but that its suburbs and exurbs managed to bring Virginia and Maryland up nicely as well.

But Reihan Salam notes that looking at “households” obscures some important demographic trends. He cites a three-year-old piece from Scott Hodge at the Tax Foundation:

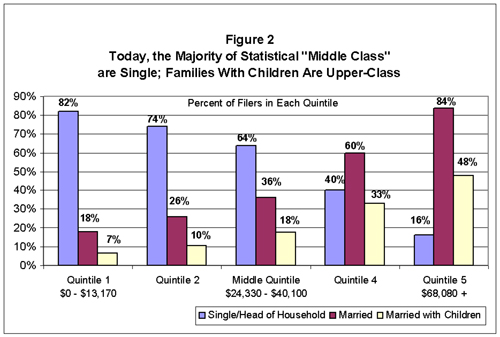

(1) There are vastly more single taxpayers than ever before and they comprise the majority of the populations of the first three quintiles.

(2) Because of the rise in dual-earner families, married couples are mostly found in the two highest quintiles.

(3) A greater percentage of taxpayers in the top two quintiles are married couples without dependents; no doubt many are “empty-nest” Baby Boomers nearing their peak earning years.

Today, the composition of taxpayers in the statistical “middle class” is completely reversed from what it was in 1960. More than two-thirds of modern middle-income taxpayers are single, or single-headed households, while just 36 percent are married. More dramatically, while half of the middle-income taxpayers in 1960 were couples with children, today only 18 percent of these taxpayers are couples with children. The majority of couples with children are now clustered in the top two quintiles.

These demographic shifts have no doubt contributed to the perception of rising income inequality. When the so-called rich are increasingly couples with two incomes, they will naturally look wealthier than the vast number of single taxpayers who now populate the statistical middle.

Putting two and two together, Reihan observes,

The $200,000 plus set is disproportionately composed of dual-earner families living in high cost metropolitan areas. Assortative mating plays a crucial role as well: in the age of consumption complementarity, high-earners are more likely to marry other high-earners.

That’s doubtless correct. The bulk of the highest paying jobs are in a handful of metropolitan areas, those who have them are likely to be married, and they’re likely to be be partnered with other high-earners.

Alas, he points to a posting by Gothamist‘s Jen Carlson (“Think You’re Making $250K In Manhattan? Think Again“) which notes that a “lifestyle that would cost $250,000 in Salt Lake City would cost $545,000 in Manhattan, $261,750 in Miami-Dade, and $405,250 in San Francisco.” That’s true if by “lifestyle” you mean “house size and model of car.” Otherwise, I’d posit that a Manhattan, San Francisco, or even DC “lifestyle” isn’t available in Salt Lake City at any price.

Regardless, all of this shows how complicated gauging relative wealth is when dealing with a diverse, continental country. We have not only very different costs of living and rates of taxation but also very different economies and cultures. And compounding this by looking at “households,” and thus comparing dual earners with single earners, only further obscures the issue.

Eyballing it, it seems to correlate with population density.

“These demographic shifts have no doubt contributed to the perception of rising income inequality.”

Is Mr Reihan claiming rising income inequality is purely a matter of perception and that in fact income inequality has not been on the rise for the past three decades. And secondly do you agree with him Jim?

It Look to me like were most of the millionaire/communists live.

He’s claiming that the degree has been wildly distorted, both by the rise of dual-earner households and the divergence of earnings in a handful of metro areas. That’s true. And, I’d add, a tiny class of ultra-rich, mostly in the tech sector.

“He’s claiming that the degree has been wildly distorted, both by the rise of dual-earner households and the divergence of earnings in a handful of metro areas.”

It hasn’t been wildly distorted. He’s bs’ing to confuse the gullible. If you compare real family incomes or individual incomes today with those in the mid seveties there has been a substantial increase in inequality in both groups for whatever reasons (high tech certainly but just as important the growth of the financial industry). And neither has there been a change in the divergence between metro and rural areas. It’s always been there as I would have thought was obvious. Sustaining a NYC lifestyle in the sixties always cost a ton more than sustaining the same lifestyle in Palookasville as I can attest personally. In 2007 the top 1% of income earners took 22% of national income, the largest share since the late 20’s. In the seventies the same group was taking about 10% of income. The size of families was irrelevant. A five second google turned up this and all you have to do is dig a little deeper any you’ll soon find Mr Salan is full of it.

http://www.nytimes.com/2007/03/29/business/29tax.html

Some more data from 2010 which tells exactly the same story. The reasons for the increase in income inequality are many and various but to claim it’s all “perception” or it’s being “distorted” by families or divergent incomes in major cities is total bs I’m afraid Jim. Just because two lawyers in the financial industry happen to be married doesn’t mean that as individuals they aren’t earning a lot more in real terms than their counterparts in the sixties and seventies and that relative to say a clerk in a shoe factory the gap is wider.

http://www.scribd.com/doc/33648738/INCOME-GAPS-BETWEEN-VERY-RICH-AND-EVERYONE-ELSE-MORE-THAN-TRIPLED-IN-LAST-THREE-DECADES-NEW-DATA-SHOW

@GA

“It Look to me like were most of the millionaire/communists live.”

Heh, right. Upper-income folks, including really upper-income folks vote Democratic. Observing this, Christopher Caldwell, writing the the Weekly Standard, said:

“Heh, right. Upper-income folks, including really upper-income folks vote Democratic.”

The 2008 election was actually the first presidential election since they’ve been capturing this data where a majority of grads voted Democratic so it’s a fairly new phenomena. The wealthy have traditionally tended to vote Republican. However, the wealthy also have a deep aversion to incompetence and denial of reality. This largely accounts for the shift along with the increased number of younger voters. Does anyone really think that outside of college educated doctrinaires, anyone with grad degree let alone a masters thought Palin a credible candidate for vp.

Wow, I could live like a God in Mississippi. Of course in Mississippi the God in question would be Hades.

But, in the seventies, most women married to men making a decent living stayed home with the kids. Now, they’re mostly making a decent living themselves. That alone markedly increases the disparity.

I didn’t quite catch that this was an attempt to reduce concerns about income disparity. As such, I don’t buy the logic. It borders on innumeracy.

Particularly because what you want to know is “how we doin’?”

For that you want to know real net worth, after debts are deducted. The national figures on that aren’t pretty at all right now. And I see no reason to think the lower quintiles would be fairing better the upper.

Getting back to top earners and population density, I think it is an outcome of big numbers in population that big numbers in wealth occur. That and connectivity. Henry Ford made money selling to “everybody” when everybody was measured in the millions. Now Bill Gates makes money to “everybody” approaches the billions. That matters, and stretches the high end. When you are just a joe, not leveraging to that population size, you do about as well as you always did.

More than my usual one or two missing words in this sentence:

Now Bill Gates makes money selling to “everybody” as everybody approaches the billions.

@joe:

RE: “If you compare real family incomes or individual incomes today with those in the mid seveties there has been a substantial increase in inequality in both groups for whatever reasons (high tech certainly but just as important the growth of the financial industry). And neither has there been a change in the divergence between metro and rural areas. It’s always been there as I would have thought was obvious. ”

Are we supposed to take your statement ‘real family incomes’ as a definition of something? Define ‘real family incomes’. Define it well enought that it is not open to the ‘error of aggregates.’

Show us how this statistical difference is not:

A) The seventies as a horrid time for everyone partly because of the oil crisis, partly because of hte impact of great society programs, partly because of external factors. The seventies were horrid to live in. Poverty creates equality and there is only equality in poverty. Why is the seventies a benchmark? College graduates could not find jobs. We were waiting in lines for gasoline. Is upper middle class and upper middle class deprivation what we should seek as equality?

B) The changes in family structure, and household trends as the author states, and many other analysts have shown as well – and the increase in individualism (that we sought as a polity) and the increasing costs, paid by individuals.

C) The effect of government sponsored debt working it’s way through the system, particularly in law, finance, education, construction. Despite the fact that the people who pay taxes are the people who are profiting from the debt creation. Why is that unfair?

D) the effect of the technology revolution which was very much a middle and upper middle class phenomenon that is now largely exhausted. (Technology has become a commodity – except in rare circumstances where there is investment in innovation, it has become one of the ‘trades’.) it was unavailable to the less talented, and they missed out on that rise.

E) the shift in labor from industrial production to housing construction (as well as into high tech manufacture). Caused by ridiculous trade policies which you might have right to criticize, only if you agree also that the reason was our education systems concern about equality rather than excellence.

F) The unprecedented increase in immigration among the lower classes and their lower education base.

Just how would the government have been constructive in this environment? By punishing people who made money during the tech boom, and married other people in it? By increasing the tax burden on families? By discouraging two income earners to marry? Or by redistributing the proceeds of profits from the financial sector? What is your solution? Have you noticed the decline in salaries for lawyers, and the decline in income in the financial sector now that the debt-feeding-frenzy has ended? Leveling for the difference in housing prices caused by population density, have you noticed how the disposable income stays constant? Or, that NY and DC are the financial redistribution centers, and the California is both a port for cheap imports, the recipient of the tech boom shift from the northeast, a radical immigration sector, and an unprecedented land-grab?

Or, more likely, did you fail to notice that people choose residential freedom over disposable income, and fail to equate the cost of that choice into your model? (Yes you did)

The difference between the seventies and today is the rise of “spatial independence” or, the number of households per person (the number of people per household), and the rapid manufacture of households (independence), combined with the tendency of high income earners to marry each other.

Furthermore, assuming there is a disparity, people will NOT SUBSIDIZE others who are culturally competitive. They will not. Ever. Period. Homogenous cultures are charitable, and heterogenous cultures are not. The economics of this is well understood. The opportunity costs in cultural conflict are very high. So policy wil not change in this American Empire unless we fragment it. (We should.)

But as far as I’m able to tell, the work has been done. the primary difference has been the increase in individualism over the famlly, and the choice of spacial independence by increasing numbers of people.

Any reference to household income without accounting for these factors, these choices, is a de facto misrepresentation of the data.

“It Look to me like were most of the millionaire/communists live.”

Yea, kinda interesting how the California commies are the actual capitalists who create wealth and opportunity…

“Now, they’re mostly making a decent living themselves. That alone markedly increases the disparity.”

Disparity between whom? Jim, the debate about growing income disparity is not about the disparity between the top 20 percentile and the rest of the country as illustrated in Salan’s chart which is bogus (unless you think an income of $68,000 makes you wealthy) it is the disparity between the incomes of the top 1% of country who are now taking 2.5-3.0 times the share of national income they were in the sixties and seventies and the rest of the country whose incomes have risen either modestly (if you’re in the next 10-15 percentiles) or only very slightly if you’re in the next 80 percentile. This, as the attachments I provided point out, almost certainly understates it because the percentage of salary income captured by the IRS is effectively 100% while in the case of business and investment income which is concentrated principally among the wealthiest economic classes the capture rate is around 70%. You probably didn’t read the info I provided because Res Ipsa Loquitur.

Curt Doolittle says:

Thursday, August 26, 2010 at 22:17

“Why is the seventies a benchmark?”

The seventies aren’t the benchmark, it just happens to be the year when the CBO started capturing all this data so you can do a very accurate and incontestable comparison. The top 1% of income earners were taking a roughly similar share of the national income (high single figures) in the sixties and fifties as other data shows.

So as Newt Gingrich attempts to employ Saudi Arabia as the basis for proper and correct U.S. Constitutional policies on the First Amendment and religion, are you and yours asserting that U.S. financial, regulatory, and tax policies should be based on the ability of a family of four to survive on $250,000 a year in Manhattan?

Perhaps we should use the 12 states and the District of Columbia where more than 3.96 percent of the households annually make over $200,000 a year as the basis for U.S. financial, regulatory, and tax policies – and leave the remaining 38 states of fend for themselves?