Tax Resentments: A Nation of Freeloaders?

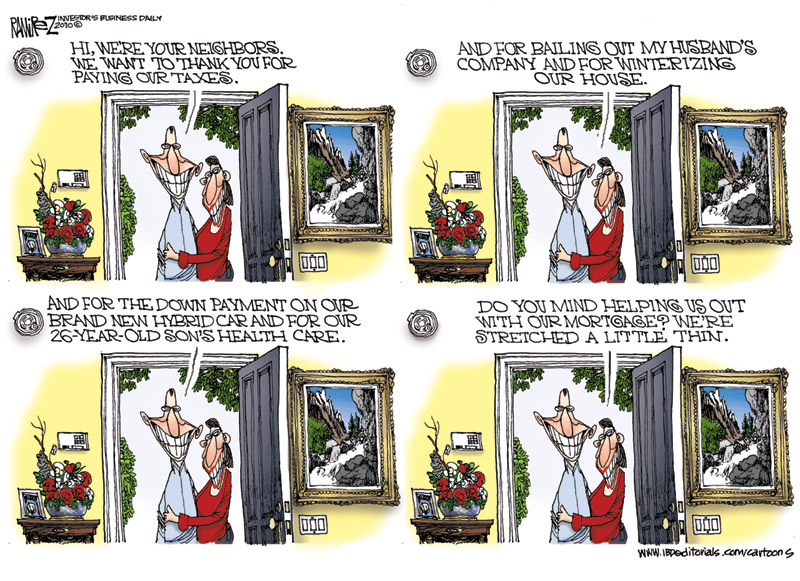

John Hinderacker pronounces this the “Greatest. Cartoon. Ever.”

Is the US turning into a nation of freeloaders? One certainly hates to think so, but there are powerful forces pushing us–lots of us–in that direction. Michael Ramirez captures the phenomenon of the 21st-century freeloader brilliantly. If you’re not outraged, you haven’t been paying attention.

Ramirez certainly captures the resentments caused by our political financing system. The fact that 47% of Americans pay zero Federal income tax. There’s an argument to be made that we’ve reversed the cause of the American Revolution and have representation without taxation for a large swath of society.

But the cartoon’s implicit argument is wrong in at least four ways.

First, nobody thinks they’re free riding on their neighbors. Politicians have so successfully waged class warfare that everyone’s confused and resents everyone else, since they invariably think “people like me” pay most of the taxes. Thus, we’ve carefully crafted a system where those paying the least taxes resent those paying the most for not paying their fair share. And politicians, including our current president, promise to remedy this by enacting more programs and paying for it by taxing the rich. But it’s not a one-way street, either. Even the Tea Party protestors, who care enough about taxes and spending to take time to rally, are ignorant on taxes and wildly overestimate their own burden. But that shouldn’t be surprising, since our tax code is so complex it’s a tax itself.

Second, in the truest sense, the successful neighbor isn’t paying for these programs, either. At best, they’re helping pay the interest on the loan that’s paying for these programs.

Third, it’s incredibly unlikely that the neighbors have wildly disparate tax burdens, given the way we economically segregate.

Fourth, assuming that the pictured neighbors are young and employed, they’re certainly paying taxes to the federal government. Most notably, they’re paying Social Security and Medicare taxes which, while theoretically insurance programs from which they directly benefit, are simply thrown into the general revenue pile with the hope that future generations will keep paying in. Indeed, if, for some reason, the unseen neighbor is indeed much more financially successful, the less-well-off neighbors are likely paying a much higher portion of their income into those programs, since we (quite reasonably) cap payments into FICA since payouts are capped.

I reiterate: The Fair Tax! You pay when you consume. That includes criminals, black market, underground economy, tourists. Just as George Will wrote regarding the VAT, the 16th amendment must be repealed or the Fair Tax will not be fair. It is not regressive because people at or below the poverty level do not pay the Fair Tax. It is rebated to them. Sure, people with lower incomes pay a higher percentage of their income, but they do that now with FICA. Even FICA goes away under the Fair Tax, but SS and Medicare/Medicaid are funded at the same levels as they are today.

Gone are all the Federal taxes on income, dividends, capital gains, estate, FICA. All this talk about a VAT? The Fair Tax expands the tax base, collects just as much as the income tax in a far more efficient manner, is transparent, reduces the number of transaction points to a more controllable number for compliance purposes, rewards saving and investment versus punishing achievement, AND makes investment in this economy much more attractive to foreign capital. For you doubters, go to http://www.fairtax.org.

Or another way to say this is that 47% of Americans are un-, or severely under, employed. This 47% stat is so narrowly caste as to make it useless. In addition to the un/underemployed it would include Seniors working part time under the SS cap by choice. Teenagers at part time jobs. Hobby businesses and a whole host of people who, by choice or not by choice, are not making the kind of money they would like to be making. Some of the 47% are also super rich who mange to pay no taxes because of tax shelter schemes or retirees who have little taxable income.

Anyone with a full time job, who is not tragically underpaid is paying income taxes. Further since the payroll taxes are not being “invested” in any sense of the word it’s dishonest not to count then as contributing to tax revenues. Until those funds are off the books they are revenue pure and simple.

Also, even if we were to assume that the 47% were all working age adults what kind of third world economy do we have where people who are ready, able and willing to work can’t make enough to pay federal taxes? Or to look at it another way isn’t this a triumph of the aggressive tax cutting advocacy from conservatives? Getting more and more people off the tax rolls.

finally talking about skiving off the backs of the tax payers no one is as good as that as corporations. They used to account for a full 505 of federal revenues now they account for less the 15%. The share holders are the beneficiaries of these “tax cuts” so if they have to pay a bit more in income tax then that’s the trade off.

This whole attempt to inspire resentment on the part of those of us who pay taxes is shameless pandering. People are paying less taxes then ever as a % of AGI and still they want to whoop up a holy war against those who are sucking wind. If you don’t like paying taxes stop making money, it’s simple.

Rick, stand back and ask yourself why all this unfairness exists regarding taxation. Could it be because the Fed tax code is used by special interests to reward and punish? Rather than get indignant at this obvious poke in the eye of the average taxpayer, why not consider an alternative method of tax collection that is far more fair? Read up on the Fair Tax and get motivated rather than depressed.

I notice that this cartoon pointedly ignores the counterproductive, harmful, destructive defense spending that dominates the discretionary budget. John Hinderaker has no problem with wasteful spending if the money goes to defense contractors and military bases in over 100 countries…

I think there are way too many credits in the current tax code, and there is a lot of pure spending I would cut, but hanging this off “the fact that 47% of Americans pay zero Federal income tax” brings the argument down, in my opinion(*).

Total tax burden is what matters on that end, and total benefits on the other.

Sure, the welfare mom pays no income tax and receives whatever. On the other hand that couple at the door probably does pay “Federal income tax” even while receiving the benefits described.

* – of course maybe that line was only there as “red meat” for the comments.

James… just last week, you went out of your way to defend the Tea Partiers by noting that their tax burden is actually much higher. Now, you’re back to this misleading “factoid.” It is making me question your commitment to honest discourse.

Either this income tax fact is relevant — in which case the Tea Partiers are ignorant. Or it isn’t because it does not capture the real tax burden on people.

Also, please explain why being able to keep MY children on MY health insurance until 26 means that my neighbors are paying for it?

This is an idiotic cartoon. We’re all dumber for having been exposed to it.

BTW, now that I know there is a “Paul, not Palin” wing to the Tea Partiers, I can feel a little more commonality … but this really ties back to their blind spots. They want “less government” but no less Medicare and no less NASA. They are the couple at the door.

For goodness sakes, James, we can’t let the facts get in the way of a good story.

Fixed that for you.

Well, we need to divide that 47% into those who pay no taxes due to poverty and those like the cartoon depicts.

The cartoon depicts that portion of non-taxpayers who have yielded to the whip and eagerly eat the carrots held before them, never seeking to raise their head or pull to the side. It is only natural that such “good” citizens would be rewarded while the free and independent minded are burdened not only with fending for themselves but also providing for those who dare not challenge the drover. Cattle are watched over, fed, watered and protected. Well until the drover can’t find water or good grazing then it’s the cattle who suffer but ultimately the cattle are being driven to slaughter anyway.

Go against the social engineering in the tax code and you must pay, sometime dearly. Unfortunately, the code has grown such that there is little chance of a maverick being able to find good water and green pastures regardless of the price they’d pay even as the drover is heading the herd into the desert.

There’s no question about the “factoid.” But, as I note in both the linked post discussing it in detail and in point four in this post, it doesn’t tell the whole story.

I don’t question that the Tea Partiers are ignorant. I’ve argued that in several posts, including this one. My only “defense” of them is that it’s unfair to single them out for the charge, when in fact most everyone is ignorant about this issue. For reasons I outline, again, in this very post.

Agree that this is a weak point of the cartoon. One could, I guess, argue that it’ll indirectly mean higher premiums for others — the insurance company has to make up the difference somewhere — but it’s not a tax issue.

I called it a troll, but I am actually enjoying this thread, somewhat ;-).

I know some don’t appreciate the Social Security to annuity comparison, but note that Social Security loans to the general fund. This is exactly analogous to a private annuity buying treasury notes at the same rate and term.

Perhaps. But who is foaming at the mouth and trumpeting their ignorance with the volume turned up to “11”?

The brilliance of this cartoon is being missed. JJ points out most Americans don’t think they are freeloading and that’s true but the cartoon points out how many are freeloading through various government programs and subsidies. It’s become so complicated those receiving a form of welfare don’t even recognize it.

Neighbors these days can have widely varying incomes and tax burdens. Age can make a huge difference as younger people move into neighborhoods with higher mortgages than the older couple that has lived there for 30 years. That higher mortgage requires higher income. Child tax credits, mortgage interest deductions, retirement plans, and many other differences can exist to create wide discrepancies in income and taxes.

Ramirez is pointing out how complex and misunderstood out tax system is. He is showing us even our next door neighbors can be on the dole.

Don’t forget about the DEA.

You’ll probably hear a lot about marijuana legalization today, but a new poll shows most Americans are against it.

Key points:

Who’s that sound like? (Hint: She’s all that and a bag of starbursts.)

I’m guessing libertarians were mostly in favor of legalization, but since they mostly vote Republican anyway, that doesn’t count for –what’s the word, Haley?– diddly.

I’m getting an impression of mixed messages from this post. It acknowledges that everyone pays something and no one is well informed, while still giving an undercurrent of the ‘damn-the- freeloaders-and-those-that-empower-them’ idiom (philosophy?) that seems to be fairly prevalent in the Republican party for pretty much my entire life.

I guess my question would be, do you really believe this is a serious problem and how would you deal with it?

“”But who is foaming at the mouth and trumpeting their ignorance with the volume turned up to “11”?””

“”””””””””””””””””””””””””””””””””””””””””

The left controlled media, Acorn, the Democrat Party, the list goes on.

Floyd.

Thanks for providing me with proof of concept so quickly.

Hint: Don’t mention Acorn, even if you hate it. It is such a bit player in real politics that even noticing it tips your hand as a winger, bordering on conspiracy theorist.

I don’t like the idea of over-reliance on a single type of taxation, particularly one such as sales taxes (the revenue of which fluctuates up and down considerably with the economic situation). That’s a recipe for having to borrow a ton of money in downturns just for the government to keep basic functions going.

@Steve P

Tell me, do you take the mortgage interest deduction?

You know, I wonder if you could change the wording on that cartoon:

Sam, Of course I do. I’m as guilty as the next guy of not turning down government benefits. That’s the point of the cartoon (which is the subject, not me) we all get some of these benefits without realizing it. Ramirez is generally a conservative voice but in this case his issue is neither conservative nor liberal. I guess we can all take a little something from it and that’s why it is a good one.

For me the problem is one of the size of government (that includes state and local) and the complexity of the tax system. It’s hard to be a well informed citizen given that complexity. To some extent I see the cartoon showing us how we are robbing Peter to pay Paul and robbing Paul to pay Peter. What the government is not robbing it’s borrowing. The Ramirez cartoon is like a mirror, those are not just neighbors they are us.

This is a real problem as deficits mount and endanger our economic prosperity. If we do not start addressing the spending as well as looking in the mirror about where it’s going we can never fix things. There’s always someone asking ‘how will you deal with it?’ but isn’t recognition of the problem the first step? Let’s identify what’s going on before we start advocating fixes.

It’s always interesting to observe the outrage an editorial cartoon can create. Of course, the cartoonist simplifies issues in order to lampoon it. That’s the job description.

I generally agree with Steve Plunk’s take, but one of the jokes is that the neighbors appear to be spending a lot in order to not pay taxes. (BTW/ I believe keeping your children on your health insurance is going to be a tax dodge) Is the neighbor’s spending wise, or is the more staid, non-green, mortgage-paying viewer a schmuck for missing opportunities?

Also, Triumph’s.

Hint: Don’t mention Acorn, even if you hate it. It is such a bit player in real politics that even noticing it tips your hand as a winger, bordering on conspiracy theorist.

This is a joke, right? How convenient that you get to declare out of bounds any discussion of a criminal conspiracy that engages in voter fraud on behalf of your favored candidates.

They used to use these tactics in the Soviet Union in order to silence critics who opposed the corruption inherent in the ruling class. They even sent them for psychiatric evaluation.

I’m a long time reader, but don’t remember ever commenting before. Last year, my sister and I were talking about just this – the number of workers that don’t pay Federal Income taxes. Just for the hack of it, we took our tax forms and booklets and tried to see how much a fictional person could make and still avoid paying any federal income taxes. We wanted to make sure we took advantage of as many loopholes and credits as possible, so our fictional taxpayer was a single parent with two children, making 36K, and a renter, because dealing with a fictional mortgage interest deduction was just too complicated.

Under our scenario, filing as head of household, taking all allowable exemptions, using a standard deduction, taking the allowable child tax credit and qualifying for the EITC resulted in our fictional worker not only not owing a penny in federal income taxes, but actually getting a check from the Treasury for a little over 3K.

At that point, we were so depressed that we decided to drink rather than see how much higher up the income scale we could go before our worker would actually owe money.

And yes, I am one of those people that doesn’t count Social Security and Medicare as “federal income tax”. It’s not – Medicare is an insurance premium to cover your health care in your old age and Social Security is nothing but payments toward retirement benefits.

Re. “Acorn”

Hey, I’m just telling you how not to look silly to me. To the extent that I’m representative of moderates or centrists, that might help. If you think I’m not representative, then I guess you can keep hitting that note.

Part of me now can say, with wry amusement, “tear it up.”

Hi, I’m your neighbor. I’d like to thank you for cutting taxes on those of us with the intelligence and foresight to have well off parents. My accountant tells me George Bush’s tax cuts have saved me $50,000 on capital gains alone, and more on dividends. Since the cuts passed Congress my wife and I have been to Paris, Rome (twice), Berlin, Istanbul, and four cities in Spain, all on Uncle Sam’s dime. Thanks, Joe the Plumber and Tito the Builder, I really appreciate it.

You are right, in a sense, of course. But here’s the thing that tips it for me: your contributions are not “firewalled” from mine. If I die quickly and young, and you live longer with medicine, you get “my” money.

(For the record, I’m OK with that.)

Oh, for goodness sake, Alex, a little balance, please. There are at least four things that are wrong or misleading in that sentence and for something that’s just 18 words long that’s pretty extreme.

First, defense spending isn’t discretionary spending. Indeed, it’s arguably one of the few things that isn’t. The budget is usually divided into four broad categories: defense, entitlements (the largest of which are Social Security and Medicare), interest on the debt, and discretionary (=everything else). There are others but those are the broad outlines. Who refers to defense as “discretionary spending”? Besides you, I mean.

Second, not all defense spending is “counterproductive, harmful, destructive”, which your statement clearly implies.

Third, the implication of the statement is that we can make major inroads on the deficit by cutting defense spending. If we were to cut defense spending entirely, it would make a relatively small dent in the deficit. Entitlements are bigger and they’re growing much faster.

Fourth, the implication of the statement is that it’s politically possible to make major cuts in defense spending at all. Prove it. I think it’s an outlandish claim.

As you know I’m in favor of making substantial cuts in defense spending, reducing our troop strength and our commitments commensurately. But I don’t kid myself into believing that it’s politically possible, that we can balance the budget by doing it, or that it won’t have serious implications.

If we are to live within our means the bulk of the cuts will come in entitlement spending. That isn’t merely politics, it’s mathematics.

your contributions are not “firewalled” from mine. If I die quickly and young, and you live longer with medicine, you get “my” money.

You do realize, do you not, that this is the basis upon which the entire insurance industry is built.

Tango, I’m the one who reminds that Social Security is like an annuity. It is like that as long as it does not receive permanent subsidy from the general fund.

On Medicare, I guess I’m influenced by Dave S. and others at OTB who remind us of looming problems. Here’s a summary showing the difference in solvency between Social Security and Medicare.

Right now I’d guess that Medicare will receive a subsidy.

“criminal conspiracy that engages in voter fraud on behalf of your favored candidates.”

I am always looking for confirmed cases of voter fraud. To my knowledge ACORN has none. Please link if you have some. (Voter fraud, not registration.)

Steve

John, you are absolutely correct that your contributions are not firewalled from mine. And, as TangoMan pointed out, this is how the insurance industry works. I believe it’s commonly referred to as a risk pool.

It’s like medical insurance. My premiums are not firewalled from the others in our group. My family pays over 18K per year in premiums, and it is rare for any of us to be sick, which means the insurance company makes a profit on us. However, others on our company plan have huge health problems and their medical costs exceed their individual premiums year in and year out. And, like you, I don’t have a problem with that.

I do, however, have a problem with other citizens, living above the poverty level, not having to pay anything in federal income taxes. We all are protected by the same armed forces, we all use the same roads, we all have the right to enter the same National Parks, etc. I just believe that everyone should have to contribute to our common good. It is easy to always want more when you’re not paying for what you get in the first place, which is part of what is driving up government spending.

I think the problem there, SoFedUp, is that “poverty level” is a culturally determined boundary.

I sense contradiction in it, and think that is why the US both taxes and funds people near that band, in kind of a mixed bag.

Part of the problem could be that our “poverty” is world-scale “middle class.”

Thanks for the hat tip, jp. Unfortunately, Medicare’s problems are probably even worse than we might have thought. The revenue shortfall of the last year or so may hasten the point of actuarial insolvency to within the next couple of years.

We’ll know when the trustees report comes out next month. Or when the report is delayed, whichever comes first.

Funny, the people who complain endlessly about taxes don’t seem to want to give up the goodies they get from the government. They just don’t like paying for them.

I think the

teafree party needs to think through it’s core philosophy a bit more carefully.